Technology stocks led the market for much of this year, with AI euphoria in full effect. Recent cracks in the momentum have caused some investors to question whether the enthusiasm has been exhausted. Technology investors and active stock pickers Tony Kim and Reid Menge offer answers ― and an optimistic outlook.

The tech sector powered global equity markets higher in the first half of 2024, led by an elite group of mega-cap stocks leveraged to the advancement in artificial intelligence (AI). These leaders, dubbed the “Magnificent 7” in 2023, retained their luster through the first half of 2024 as AI momentum continued unabated. July introduced a speed bump that stirred consternation for some tech investors.

What next for tech?

We do observe greater differentiation across technology stocks, even among the Magnificent 7 as the market attempts to assign “winners” and “losers” in the race for AI development, enablement and adoption.

Today, monetization of AI resides primarily in the buildout of AI “factories.” Hyperscalers, private enterprises and government entities are pouring hundreds of billions of dollars into the construction of these data centers, namely by spending on clusters of GPUs in the race to support ever-larger AI models. GPUs, or graphic processing units, are the type of semiconductor that is critical for generative AI training and inference workflows.

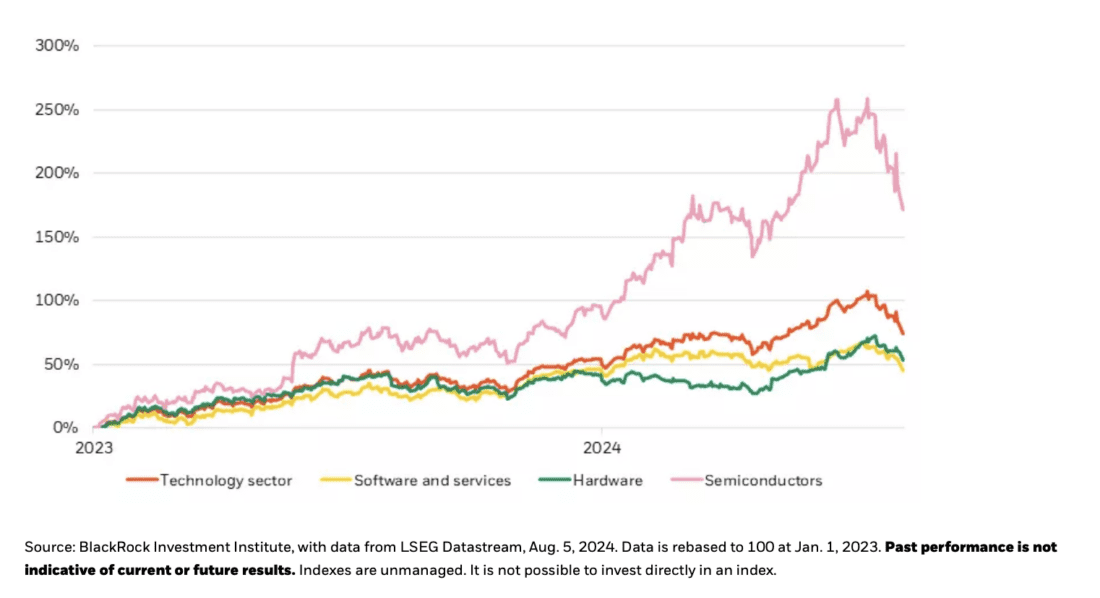

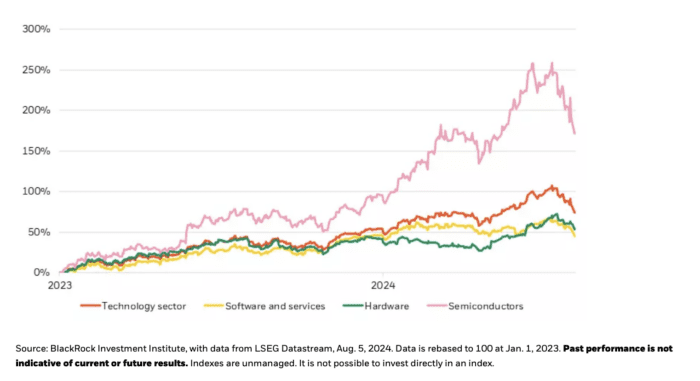

Meanwhile, use cases and real-world applications of AI are in much earlier stages, with significant impact from AI products not expected until 2025. This is leading to cautious spending on software development, while software customers are likewise delaying purchases in anticipation of AI advancements. The chart below illustrates how this divergence has manifested in returns across technology subsectors.

Shades of good fortune

Total returns across technology subsectors, 2023-2024

According to a Morgan Stanley survey of CIOs, 50% of AI spending is drawn from existing IT budgets, suggesting AI investment is supplanting other IT spend. Hyperscalers offering cloud services are consuming a large portion of enterprise IT budgets.

This type of bifurcation underscores the heavy influence that AI is having across the economy and markets, with its evolution driving the investment opportunity set. AI momentum reinforces our outlook for future returns, and the differentiation we’re seeing does nothing to dim that. Rather, it highlights the need for individual stock research and selection to capitalize on the opportunities as the AI evolution advances.

A market without precedent

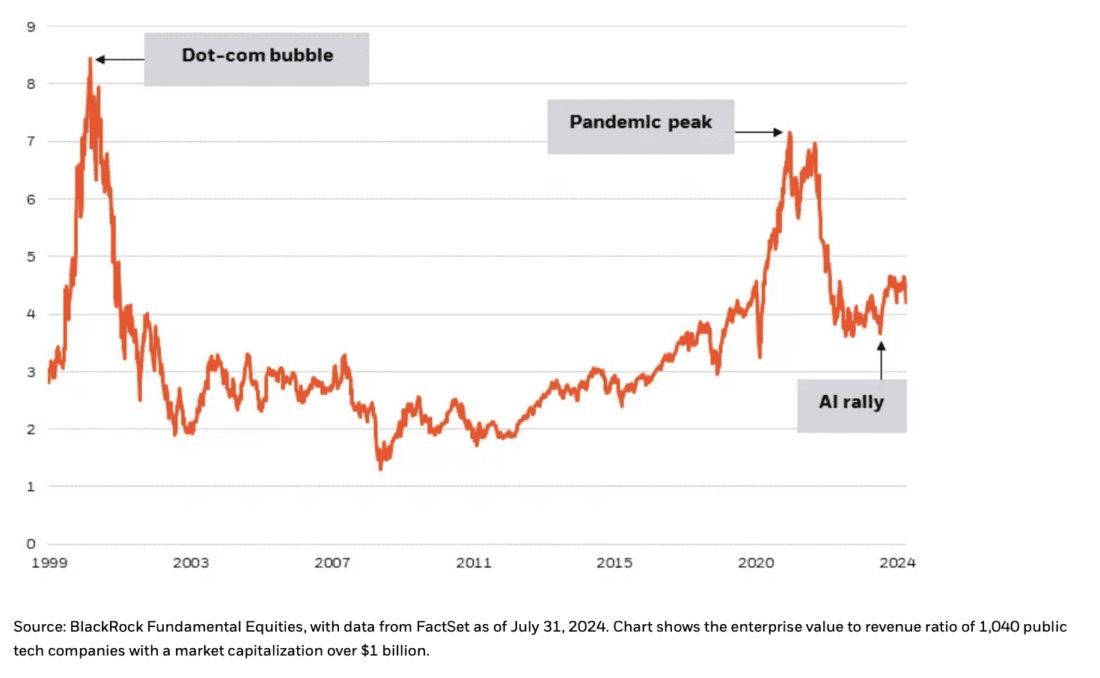

The technology sector’s strong performance last year and into 2024 has prompted questions as to whether technology stocks are overvalued. Some have made comparisons to the dot-com bubble of the late 1990s and the pandemic-era market where the “digitization of everything” led to heavy IT investment and historically low interest rates supercharged tech stocks. Both ended in busts.

We don’t think today’s market is akin to either of these periods. The chart below illustrates the valuation difference relative to the dot-com bubble and pandemic peak. Much of the skepticism on tech’s ability to power on is based on trailing sales and earnings estimates. Yet many tech stocks are cheaper today than they were before the rally began in 2023 when factoring in revisions to forward-looking earnings estimates. As of July, the average 2024 earnings growth forecast for the technology sector stood at 20%. This represents a notable increase from early-year estimates, while profit margins in the sector have also expanded.

No comparison

Technology sector equity valuation multiples, 1998-2024

Past performance is not indicative of future results

We believe earnings growth can remain healthy for the technology sector broadly, fueled by the build out of AI and a commitment to cost prudence on the part of tech firms.

That said, we evaluate company fundamentals on an individual basis with an emphasis on owning the right names at the right price. Our team of technology-focused, fundamentals-based stock researchers and selectors is looking to identify the next areas of opportunity while also assessing which business models may be at risk as AI becomes increasingly sophisticated.

In all, we believe the rapid evolution of AI and all of its ramifications makes investing in this space very much an active pursuit. Volatility such as that seen of late, while always unsettling, is not unexpected and could present buying opportunities in this exciting and, we believe, enduring theme.

—

Originally Posted August 13, 2024 – Can AI and technology stocks keep on keeping on? An expert take

Disclosure: BlackRock

©2022 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD). Multiple leg strategies, including spreads, will incur multiple transaction costs.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account