IntroductionCopy Location

Copy Location

The TWS API is a TCP Socket Protocol API based on connectivity to the Trader Workstation or IB Gateway. The API acts as an interface to retrieve and send data autonomously to Interactive Brokers. Interactive Brokers provides code systems in Python, Java, C++, C#, and VisualBasic.

The TWS API is a message protocol as its core, and any library that implements the TWS API, whether created by IB or someone else, is a tool to send and receive these messages over a TCP socket connection with the IB host platform (TWS or IB Gateway). As such the system can be tweaked and modified into any language of interest given the intention to translate the underlying decoder.

In short, a library written in any other languages must be sending and receiving the same data in the same format as any other conformant TWS API library, so users can look at the documentation for our libraries to see what a given request or response consists of (what it must include, in what form, etc.) and implement them in their own structure.

Our TWS API components are aimed at experienced professional developers willing to enhance the current TWS functionality. Before you use TWS API, please make sure you fully understand the concepts of OOP (https://www.geeksforgeeks.org/introduction-of-object-oriented-programming/) and other Computer Science Concepts. Regrettably, Interactive Brokers cannot offer any programming consulting. Before contacting our API support, please always refer to our available documentation, sample applications and Recorded Webinars

This guide references the Java, VB, C#, C++ and Python Testbed sample projects to demonstrate the TWS API functionality. Code snippets are extracted from these projects and we suggest all those users new to the TWS API to get familiar with them in order to quickly understand the fundamentals of our programming interface. The Testbed sample projects can be found within the samples folder of the TWS API’s installation directory.

Notes & LimitationsCopy Location

Copy Location

While Interactive Brokers does maintain a Python, Java, C#, and C++ offering for the TWS API, C# and our Excel offerings are exclusively available for Windows PC. As a result, these features are not available on Linux or Mac OS.

RequirementsCopy Location

Copy Location

- A funded and opened IBKR Pro account

- The current Stable or Latest release of the TWS or IB Gateway

- The current Stable or Latest release of the TWS API

- A working knowledge of the programming language our Testbed sample projects are developed in.

The minimum supported language version is documented on the right for each of our supported languages.

Please be sure to toggle the indicated language to the language of your choosing.

Minimum supported Python release is version 3.11.0.

The minimum supported Java version is Java 8 (JDK 8).

The minimum supported C++ version is C++ 14 Standard.

The C# implementation was built using:

- .NET Core 3.1

- .NET Framework 4.8

- .NET Standard 2.0

LimitationsCopy Location

Copy Location

Our programming interface is designed to automate some of the operations a user normally performs manually within the TWS Software such as placing orders, monitoring your account balance and positions, viewing an instrument’s live data… etc. There is no logic within the API other than to ensure the integrity of the exchanged messages. Most validations and checks occur in the backend of TWS and our servers. Because of this it is highly convenient to familiarize with the TWS itself, in order to gain a better understanding on how our platform works. Before spending precious development time troubleshooting on the API side, it is recommended to first experiment with the TWS directly.

Remember: If a certain feature or operation is not available in the TWS, it will not be available on the API side either!

C# for MacOSCopy Location

Copy Location

The TWS API C# source files are not available through the Mac and Unix distribution download as the language is built around Dynamic Link Library (DLL) files for execution. This is because DLL files are exclusively supported through Windows platforms.

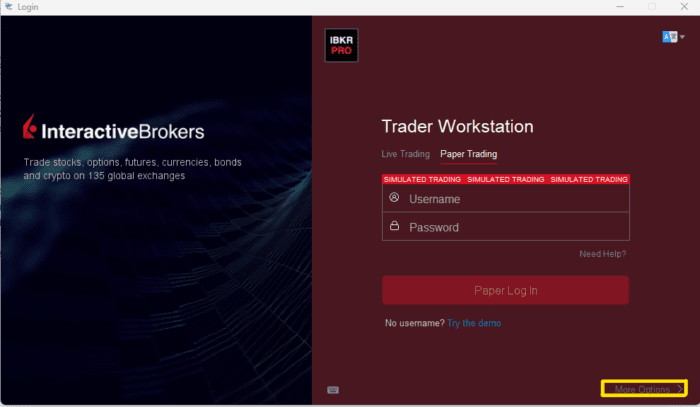

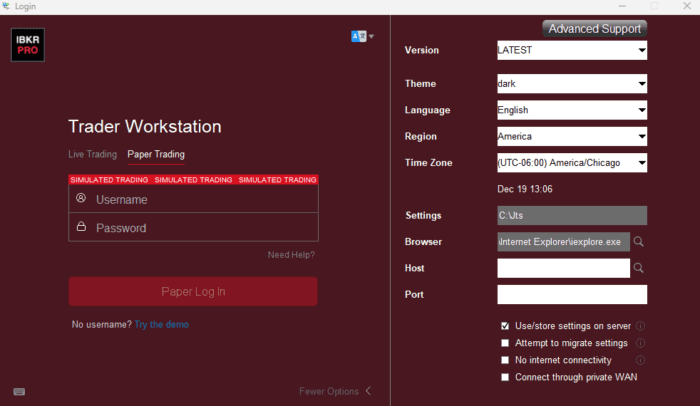

Paper TradingCopy Location

Copy Location

If your regular trading account has been approved and funded, you can use your Account Management page to open a Paper Trading Account which lets you use the full range of trading facilities in a simulated environment using real market conditions. Using a Paper Trading Account will allow you not only to get familiar with the TWS API but also to test your trading strategies without risking your capital. Note the paper trading environment has inherent limitations.

Download TWS or IB GatewayCopy Location

Copy Location

In order to use the TWS API, all customers must install either Trader Workstation or IB Gateway to connect the API to. Both downloads maintain the same level of usage and support; however, they both have equal benefits. For example, IB Gateway will be less resource intensive as there is no UI; however, the Trader Workstation has access all of the same information as the API, if users would like an interface to confirm data.

TWS Online or Offline Version?Copy Location

Copy Location

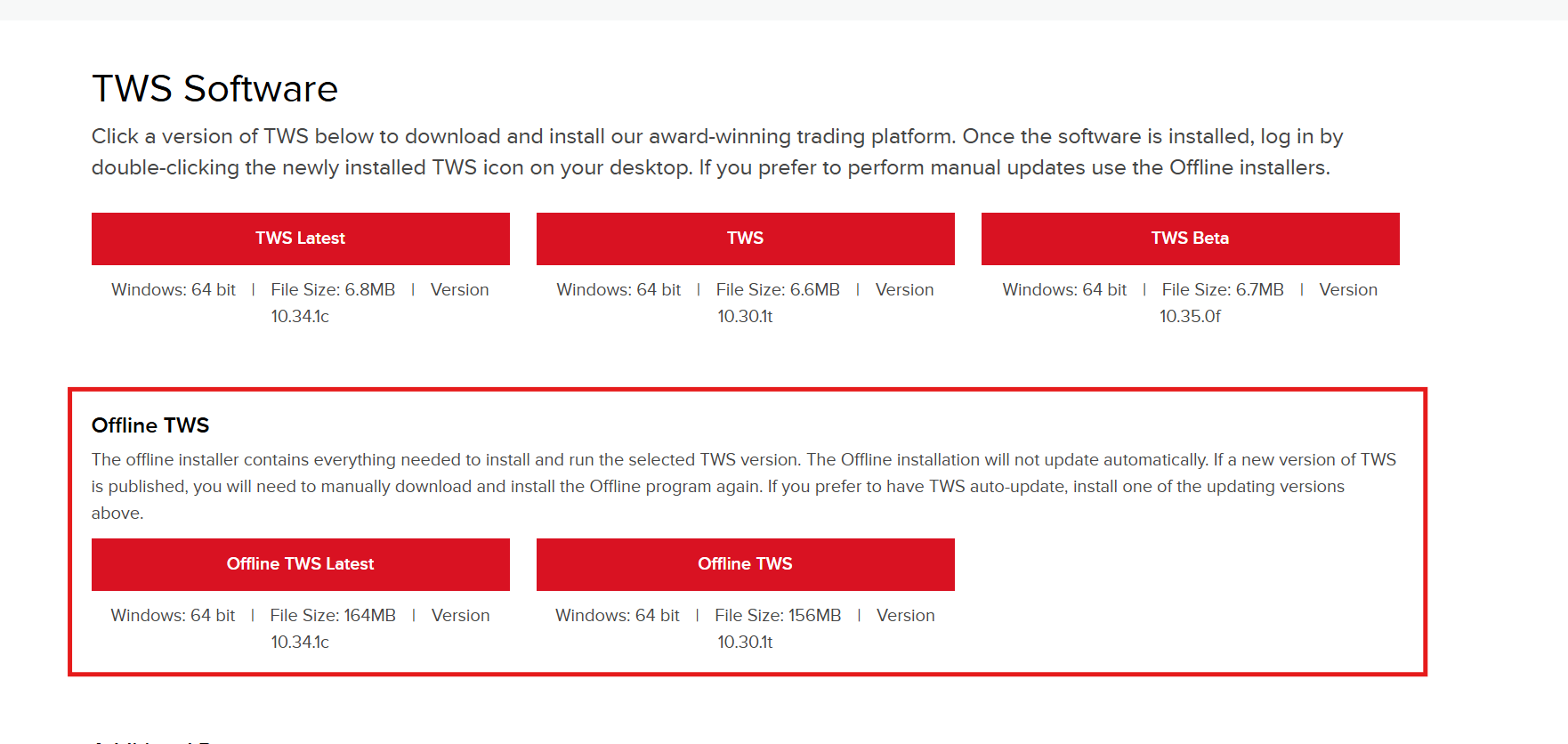

It is recommended for API users to use offline TWS because TWS online version has automatic update. Please use same TWS version to make sure the TWS version and TWS API version are synced. These will help preventing version conflict issue.

TWS SettingsCopy Location

Copy Location

Some TWS Settings affect API.

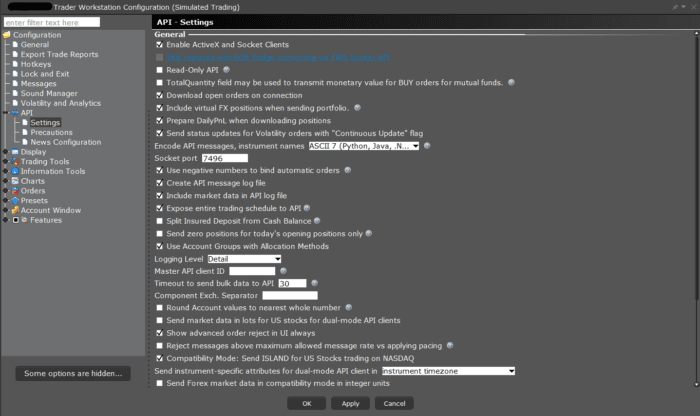

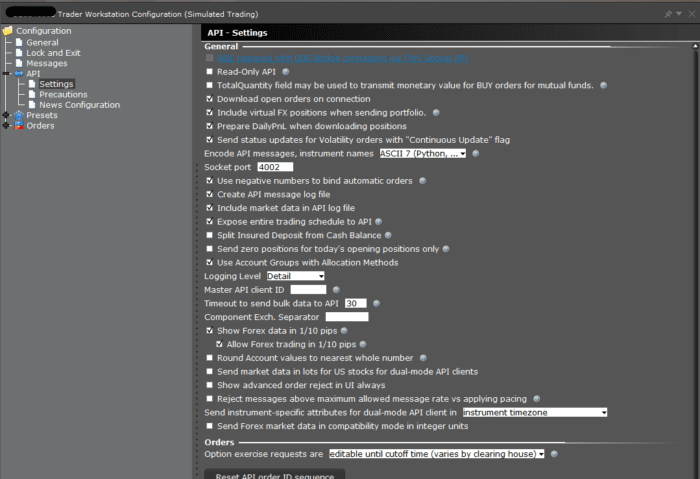

TWS Configuration For API UseCopy Location

Copy Location

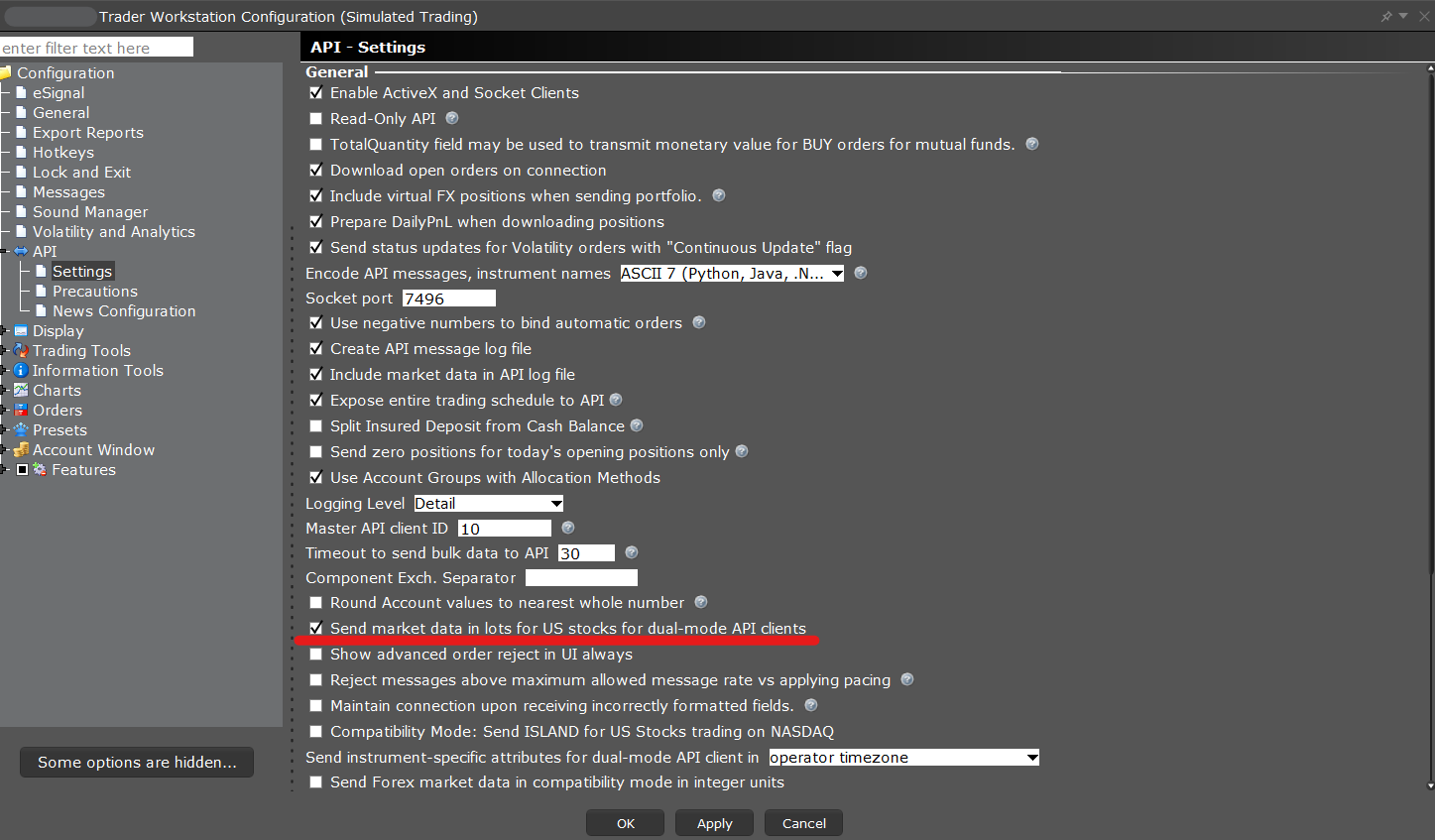

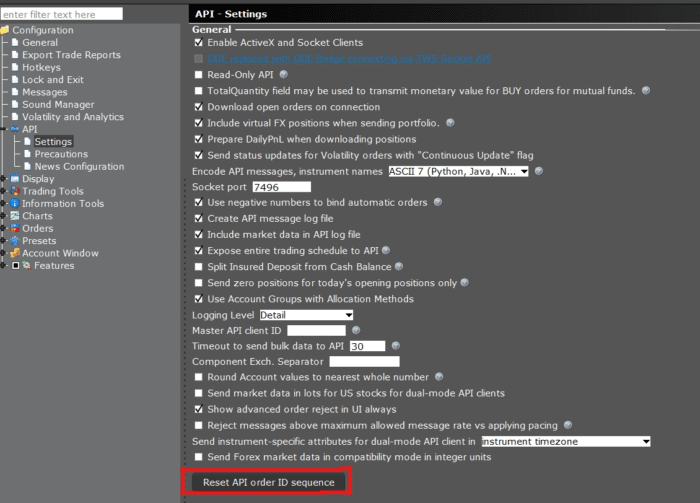

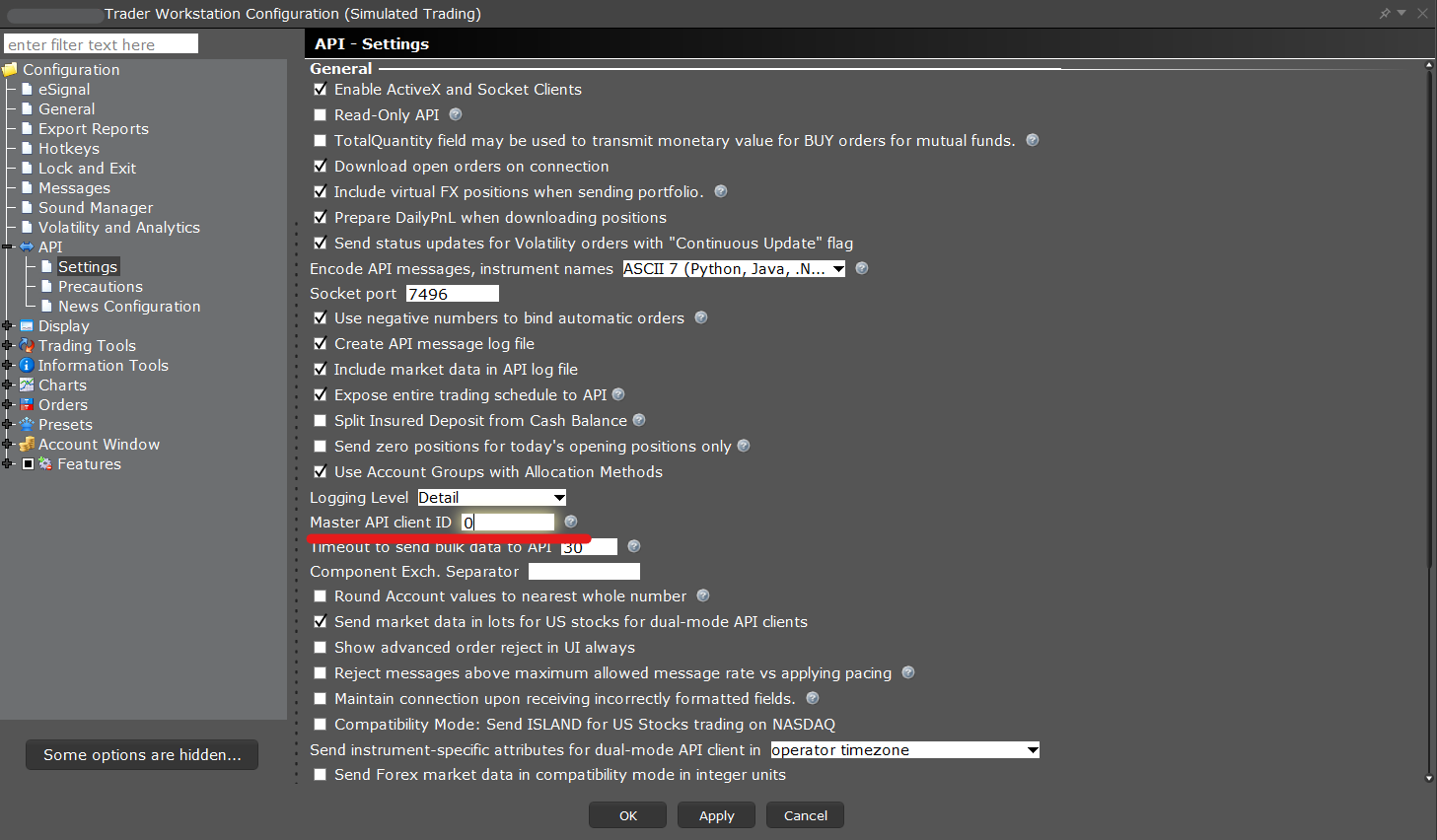

The settings required to use the TWS API with the Trader Workstation are managed in the Global Configuration under “API” -> “Settings”

In this section, only the most important API settings for API connection are covered.

Please:

- Enable “ActiveX and Socket Clients”

- Disable “Read-Only API”

- Verify the “Socket Port” value

Best Practice: Configure TWS / IB GatewayCopy Location

Copy Location

The information listed below are not required or necessary in order to operate the TWS API. However, these steps include many references which can help improve the day to day usage of the TWS API that is not explicitly offered as a callable method within the API itself.

"Never Lock Trader Workstation" SettingCopy Location

Copy Location

Note: For IBHK API users, it is commended to use IB Gateway instead of TWS. It is because all IBHK users cannot choose “Never Lock Trader Workstation” in TWS – Global Configuration – Lock and Exit. If there is inactivity, TWS will be locked and there will be API disconnection.

Memory AllocationCopy Location

Copy Location

In TWS/ IB Gateway – “Global Configuration” – “General”, you can adjust the Memory Allocation (in MB)*.

This feature is to control how much memory your computer can assign to the TWS/ IB Gateway application. Usually, higher value allows users to have faster data returning speed.

Normally, it is recommended for API users to set 4000. However, it depends on your computer memory size because setting too high may cause High Memory Usage and application not responding.

For details, please visit: https://www.ibkrguides.com/traderworkstation/increase-tws-memory-size.htm

Note:

- In IB Gateway Global Configuration – API – settings, there is no “Compatibility Mode: Send ISLAND for US stocks trading on NASDAQ”. Specifying NASDAQ exchange in contract details may cause error if connecting to IB Gateway. For this error, please specify ISLAND exchange.

Daily & Weekly ReauthenticationCopy Location

Copy Location

Daily Reauthentication

In TWS/ IB Gateway – “Global Configuration” – “Lock and Exit”, you can choose the time of your TWS being shut down.

For API users, it is recommended to choose “Never lock Trader Workstation” and “Auto restart”.

Note:

- IBHK users do not have “Never lock Trader Workstation” and “Auto restart” in TWS. It is suggested for IBHK users to use IB Gateway in order to have stable API connection because IB Gateway won’t be locked due to inactivity. Also, IBHK users can choose “Auto restart” in IB Gateway.

Weekly Reauthentication

The weekly authentication cycle starts on every Monday. If you receive Login failed = Soft token=0 received instead of expected permanent for zdc1.ibllc.com:4001 (SSL), this means you need to manually login again to complete the weekly reauthentication task.

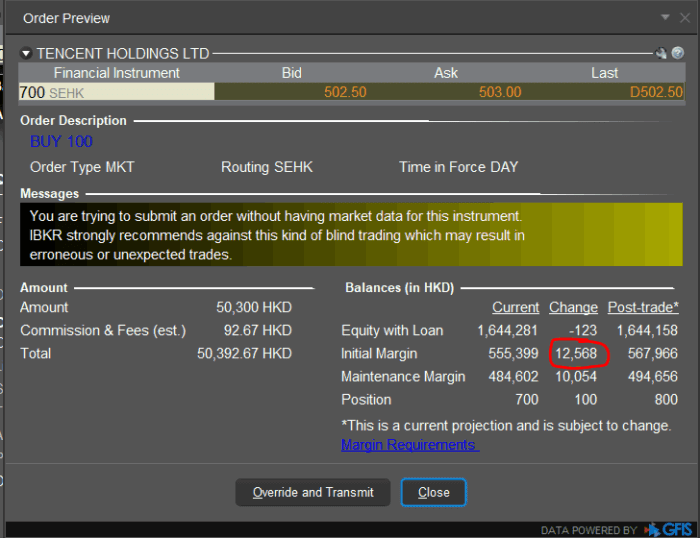

Order PrecautionsCopy Location

Copy Location

In TWS – “Global Configuration” – “API” – “Precautions”, you can enable the following items to stop receiving the order submission messages.

- Enable “Bypass Order Precautions for API orders”.

- Enable “Bypass Bond warning for API orders”.

- Enable “Bypass negative yield to worst confirmation for API orders”.

- Enable “Bypass Called Bond warning for API orders”.

- Enable “Bypass “same action pair trade” warning for API orders”.

- Enable “Bypass price-based volatility risk warning for API orders”.

- Enable “Bypass US Stocks market data in shares warning for API orders”.

- Enable “Bypass Redirect Order warning for Stock API orders”.

- Enable “Bypass No Overfill Protection precaution for destinations where implied natively”.

Connected IB Server Location in TWSCopy Location

Copy Location

Each IB account has a pre-decided IB server. You can visit this link to know our IB servers’ locations: https://www.interactivebrokers.com/download/IB-Host-and-Ports.pdf

Yet, all IB paper accounts are connected to US server by default and its location cannot be changed.

As IB servers in different regions have different scheduled server maintenance time ( https://www.interactivebrokers.com/en/software/systemStatus.php ), you may need to change the IB server location in order to avoid service downtime.

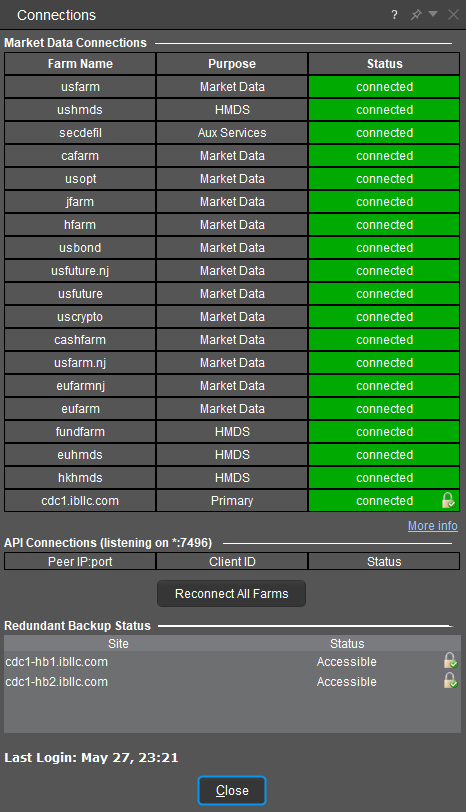

For checking your connected IB server location, you can go to TWS and click “Data” to see your Primary server. In the below image, the pre-decided IB server location is: cdc1.ibllc.com

If you want to change your live IB account server location in TWS, please submit a web ticket to “Technical Assistance” – “Connectivity” in order to request changing the IB server location.

In the web ticket, you need to provide:

- Which account do you want to have IB server location change?

- Which IB server location would you like to connect to?

- TWS AMERICA – EAST (New York)

- TWS AMERICA – CENTRAL (Chicago)

- TWS Europe (Zurich)

- TWS Asia (Hong Kong)

- TWS Asia – CHINA (For mainland China users, if the account server is hosted in Hong Kong, they will automatically connect with the Shenzhen Gateway mcgw1.ibllc.com.cn)

- Which IB scheduled maintenance time do you choose? (Recommended to choose the default schedule maintenance time of its own IB server location)

- North America

- Europe

- Asia

After you submit the ticket, you will receive a web ticket reply which require you to confirm and understand the migration request.

Note:

- For Internet users, as the connection between IB server and Exchange goes through a dedicated line, it is commonly recommended to choose a IB server location which is closer to your TWS location. For IB connection types, please visit: https://www.interactivebrokers.co.uk/en/software/connectionInterface.php

- The pre-decided IB server location connected from TWS is different from the IB Server location connected from IB Client Portal and IBKR Mobile.

- IB server location connected from TWS is pre-decided. You can submit a web ticket to request the IB server relocation for the TWS connection.

- IB server location connected from Client Portal or IBKR Mobile is based on your nearest IB server location. You cannot request the IB server relocation for Client Portal and IBKR Mobile connections. OAuth CP API users now cannot specify which server they want to connect to by themselves.

SMART AlgorithmCopy Location

Copy Location

In TWS Global Configuration – Orders – Smart Routing, you can set your SMART order routing algorithm. For available SMART Routing via TWS API, please visit: https://www.interactivebrokers.com/campus/ibkr-api-page/contracts/#smart-routing

Allocation Setup (For Financial Advisors)Copy Location

Copy Location

In TWS Global Configuration – Advisor Setup – Presets, you can need to choose Allocation Preference in order to avoid wrong allocation result.

Intelligent Order ResubmissionCopy Location

Copy Location

The TWS Setting listed in the Global Configuration under API -> Setting for Maintain and resubmit orders when connection is restored, is enabled by default in TWS 10.28 and above. When this setting is checked, all orders received while connectivity is lost will be saved and automatically resubmitted when connectivity is restored. Please note, if the Trader Workstation is closed during this time, the orders are deleted regardless of the setting.

Disconnect on Invalid FormatCopy Location

Copy Location

The TWS Setting listed in the Global Configuration under API -> Setting for Maintain connection upon receiving incorrectly formatted fields, is enabled by default in TWS 10.28 and above. For clients operating on Client Version 100 and above, users will not disconnect from fields with invalid value submissions when the setting is enabled.

Download the TWS APICopy Location

Copy Location

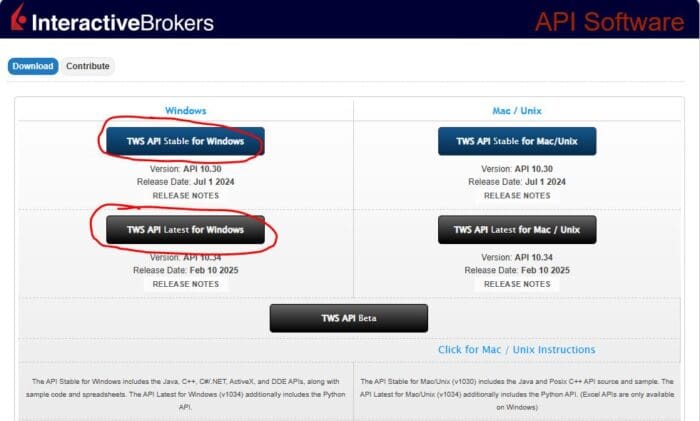

It is recommended for API users to use same TWS API version to make sure the TWS version and TWS API version are synced in order to prevent version conflict issue.

Running the Windows version of the API installer creates a directory “C:\TWS API” for the API source code in addition to automatically copying two files into the Windows directory for the DDE and C++ APIs. It is important that the API installs to the C: drive, as otherwise API applications may not be able to find the associated files. The Windows installer also copies compiled dynamic linked libraries (DLL) of the ActiveX control TWSLib.dll, C# API CSharpAPI.dll, and C++ API TwsSocketClient.dll. Starting in API version 973.07, running the API installer is designed to install an ActiveX control TWSLib.dll, and TwsRtdServer control TwsRTDServer.dll which are compatible with both 32 and 64 bit applications.

It is important to know that the TWS API is only available through the interactivebrokers.github.io MSI or ZIP file. Any other resource, including pip, NuGet, or any other online repository is not hosted, endorsed, supported, or connected to Interactive Brokers. As such, updates to the installation should always be downloaded from the github directly.

Install the TWS API on WindowsCopy Location

Copy Location

Windows:

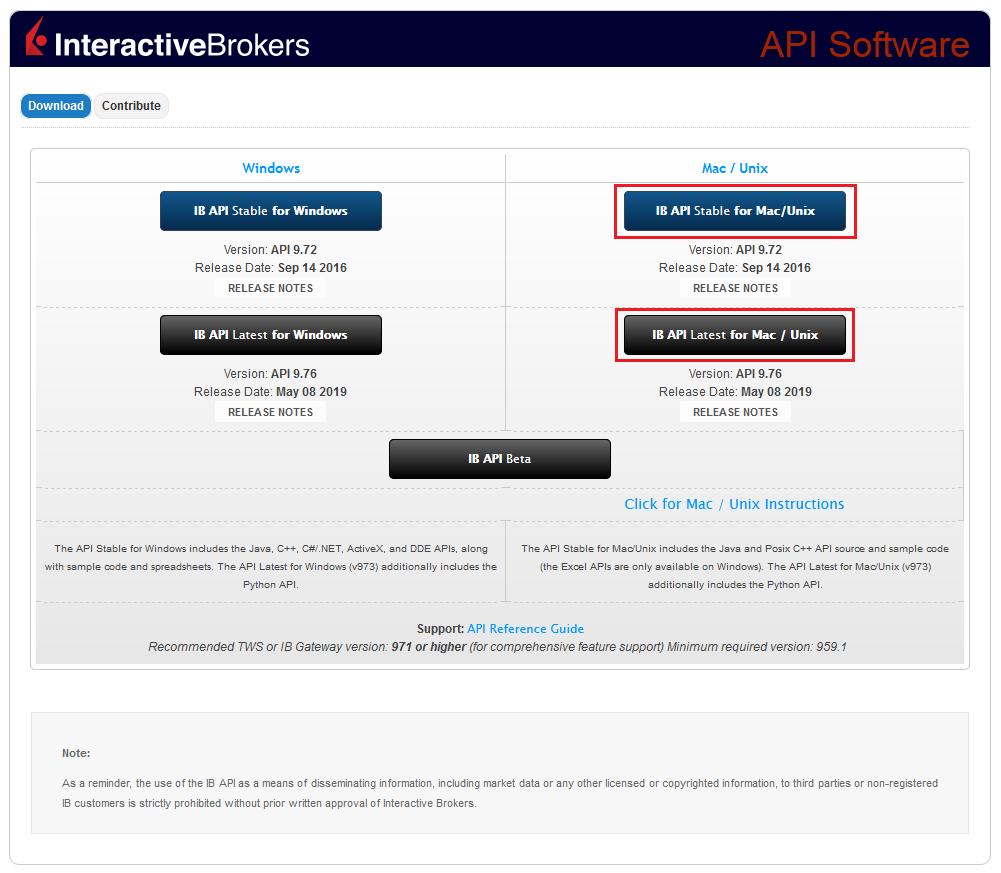

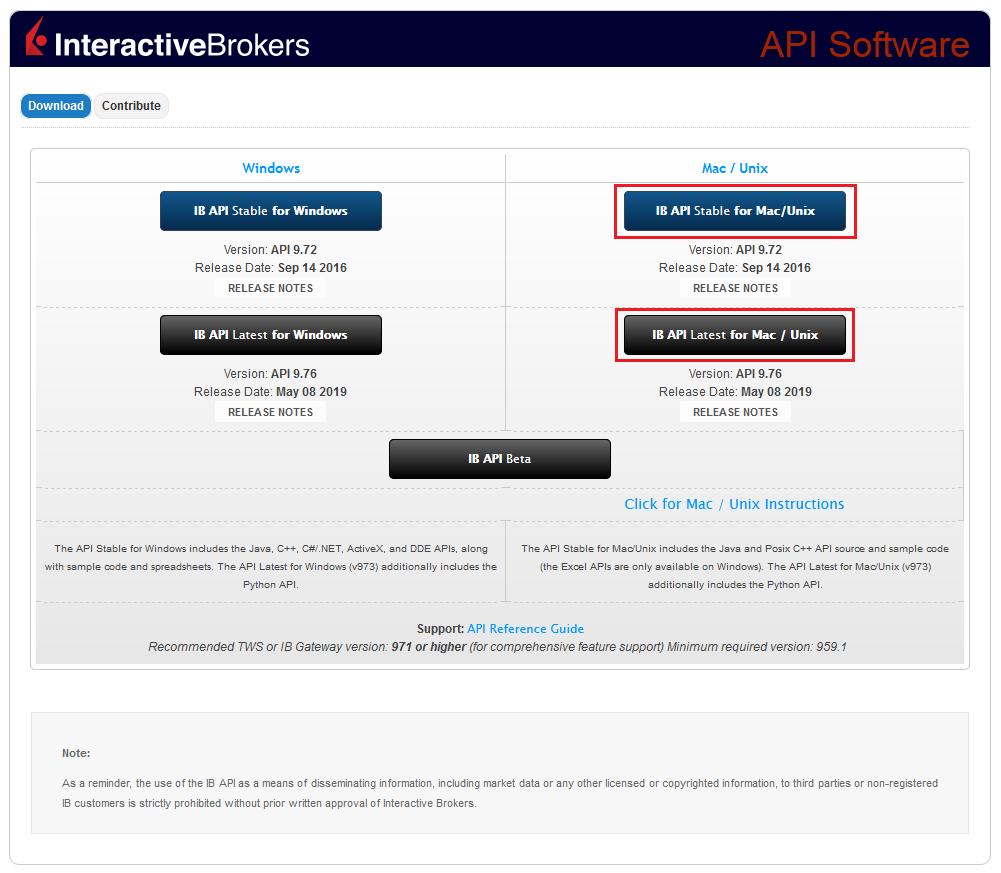

- Download the IB API for Windows to your local machine

- This will direct you to Interactive Brokers API License Agreement, please review it

- Once you have clicked “I Agree“, refer to the Windows section to download the API Software version of your preference

- This will download TWS API folder to your computer

- Go to your IDE and Open Terminal

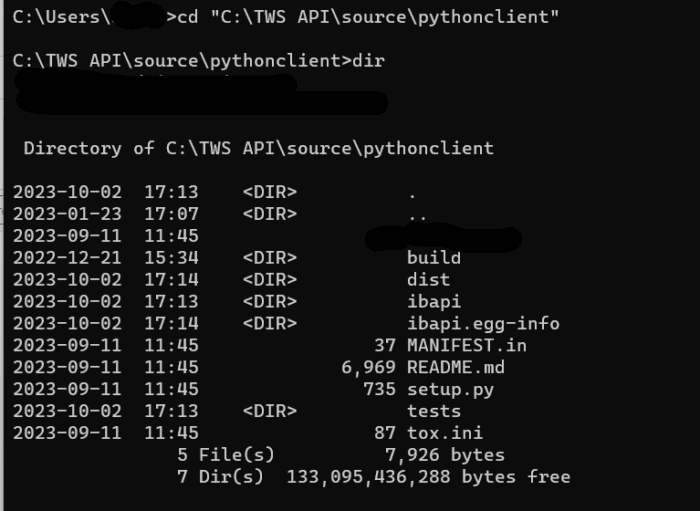

- Navigate to the directory where the installer has been downloaded (normally it should be your C: drive or D: drive) and confirm the file is present. Now, let’s take an example: install TWS API Python

$ cd ~/TWS API/source/pythonclient

$ python3 setup.py install

Install the TWS API on MacOs / LinuxCopy Location

Copy Location

Unix/ Linux:

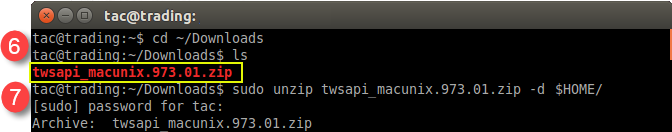

- Download the IB API for Mac/Unix zip file to your local machine

- This will direct you to Interactive Brokers API License Agreement, please review it

- Once you have clicked “I Agree“, refer to the Mac / Unix section to download the API Software version of your preference

- This will download twsapi_macunix.<Major Version>.<Minor Version>.zip to your computer

(where <Major Version> and <Minor Version> are the major and minor version numbers respectively) - Open Terminal (Ctrl+Alt+T on most distributions)

- Navigate to the directory where the installer has been downloaded (normally it should be the Download folder within your home folder) and confirm the file is present

$ cd ~/Downloads

$ ls

- Unzip the contents the installer into your home folder with the following command (if prompted, enter your password):

NOTE: replace the values ‘n.m’ with the name of your installed file.

$ sudo unzip twsapi_macunix.n.m.zip -d $HOME/

- To access the sample and source files, navigate to the IBJts directory and confirm the subfolders samples and source are present

$ cd ~/IBJts

$ ls

Note:

- When running “python3 setup.py install“, you may get “ModuleNotFoundError: No Module named ‘setuptools’“. As “setuptools” is deprecated, please grant the write permission on the target folder (e.g. source/pythonclient) using “sudo chmod -R 777” in order to avoid “error: could not create ‘ibapi.egg-info’: Permission denied“. After that, run “python3 -m pip install .“

MacOS:

- Download the IB API for Mac/Unix zip file to your local machine

- This will direct you to Interactive Brokers API License Agreement, please review it

- Once you have clicked “I Agree“, refer to the Mac / Unix section to download the API Software version of your preference

- This will download twsapi_macunix.<Major Version>.<Minor Version>.zip to your computer

(where <Major Version> and <Minor Version> are the major and minor version numbers respectively) - Open MacOS Terminal (Command+Space to launch Spotlight, then type terminal and press Return)

- Go to find the zipped TWS API file and Copy the zipped TWS API file path.

- Run the following command in MacOS Terminal.

- $ unzip twsapi_macunix.<Major Version>.<Minor Version>.zip

Note: On MacOS, if you directly open the twsapi_macunix.<Major Version>.<Minor Version>.zip file, you will get an error: “Unable to expand…… It is an unsupported format“. It is required for users to unzip the zipped TWS API file using the above MacOS Terminal command.

TWS API File Location & ToolsCopy Location

Copy Location

TWS API Folder Files Explanation:

- “API_VersionNum.txt”

File Path: ~TWS APIAPI_VersionNum.txt

You can check your API version in this file.

- “IBSampleApp.exe”

File Path: ~TWS APIsamplesCSharpIBSampleAppbinReleaseIBSampleApp.exe

You can manually use the IBSampleApp to test the API functions.

- “ApiDemo.jar”

File Path: ~TWS APIsamplesJavaApiDemo.jar

This is built with Java. Java users can use it to quickly test the IB TWS API functions.

TWSAPI Basics TutorialCopy Location

Copy Location

Many of our most common features, as well as instructions for installing and running the Trader Workstation API, are available in our TWS API Tutorial Series. The series uses Python to implement the TWS API functionality; however, the function calls are identical across languages, and will follow a similar patter regardless of language.

This tutorial covers:

- Downloading and running the Trader Workstation and IB Gateway

- How to install the TWS API and update the Python Interpreter

- Requesting Live and Historical Market Data

- Placing and Monitoring Orders

- Reviewing Individual Account Information

- Handling Market Scanners

Third Party API PlatformsCopy Location

Copy Location

Third party software vendors make use of the TWS’ programming interface (API) to integrate their platforms with Interactive Broker’s. Thanks to the TWS API, well known platforms such as Ninja Trader or Multicharts can interact with the TWS to fetch market data, place orders and/or manage account and portfolio information.

It is important to keep in mind that most third party API platforms are not compatible with all IBKR account structures. Always check first with the software vendor before opening a specific account type or converting an IBKR account type. For instance, many third party API platforms such as NinjaTrader and TradeNavigator are not compatible with IBKR linked account structures, so it is highly recommended to first check with the third party vendor before linking your IBKR accounts.

An ongoing list of common Third Party Connections are available within our documentation. This resource will also link out to connection guides detailing how a user can connect with a given platform.

A non-exhaustive list of third party platforms implementing our interface can be found in our Investor’s Marketplace. As stated in the marketplace, the vendors’ list is in no way a recommendation from Interactive Brokers. If you are interested in a given platform that is not listed, please contact the platform’s vendor directly for further information.

Non-Standard TWS API Languages and PackagesCopy Location

Copy Location

Noted in further depth through our Architecture section, the TWS API is built using standardized socket protocol. As a result, users may develop or access alternative third party modules and classes in place of Interactive Brokers default modules through the TWS API Download. While the API is adaptable for client implementations, please understand that Interactive Brokers API Support cannot provide support for non-standard implementations. While we can review your API logs to affirm what content is being submitted, any further assistance will need to take place with the module’s original developer.

This is neither an endorsement or admonishment of third party implementations. Interactive Brokers will always advise clients use our direct TWS API implementation whenever possible.

ib_insync and ib_asyncCopy Location

Copy Location

While Interactive Brokers’ API Support is aware of the ib_insync package, we cannot provide coding assistance for the package.

With that in mind, users should be aware that the original ib_insync package is built using a legacy release of the TWS API and is no longer updated. Users who wish to implement the ib_insync structure using supported releases of the Trader Workstation should migrate to the ib_async package, which is a modernized implementation of the package by one of its original developers.

This is neither an endorsement or admonishment of either the ib_insync or ib_async library. Interactive Brokers will always advise clients use our direct TWS API implementation whenever possible.

Unique ConfigurationsCopy Location

Copy Location

While all of the available Trader Workstation API default samples provide equivalent functionality, some languages have unique configurations that must be implemented in order to use our samples or program code with the underlying API.

Implementing the Intel Decimal Library for MacOS and LinuxCopy Location

Copy Location

Due to the malleability of the many Linux distributions including MacOS, Interactive Brokers is unable to provide a pre-built binary for the library. As such, users programming in C++ on a Linux machine must manually build the Intel® Decimal Floating-Point Math Library manually.

As described in the README file from the linked page, you can find the library’s build steps within the ~/IntelRDFPMathLib20U2/LIBRARY/README file.

Updating The Python InterpreterCopy Location

Copy Location

Python has a unique system for importing libraries into it’s IDEs. This extends even further when it comes to virtual environments. In order to utilize Python code with the TWS API, you must run our setup file in order to import the code.

1. Open Command Prompt or TerminalCopy Location

Copy Location

In order to update the Python IDE, these steps MUST be performed through Command Prompt or Terminal. This can not be done through an explorer interface.

As such, users should begin by launching their respective command line interface.

These samples will display Windows commands, though the procedure is identical on Windows, MacOS, and Linux.

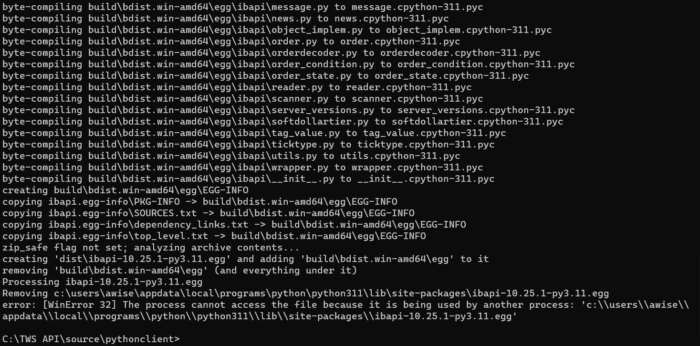

3. Run The setup.py FileCopy Location

Copy Location

Customers will now need to run the setup.py steps with the installation parameter. This can be done with the command: python setup.py install

4. Confirm UpdatesCopy Location

Copy Location

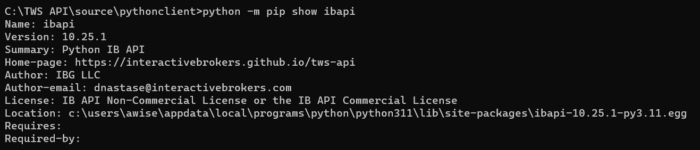

After running the prior command, users should see a large block of text describing various values being updated and added to their system. It is important to confirm that the version installed on your system mirrors the build version displayed. This example represents 10.25; however, you may have a different version.

5. Confirm your installationCopy Location

Copy Location

Finally, users should look to confirm their installation. The simplest way to do this is to confirm their version with pip. Typing this command should show the latest installed version on your system: python -m pip show ibapi

Protobuf UserWarning messagesCopy Location

Copy Location

After resolving the reference errors, using the TWSAPI may print a UserWarning upon connection. These warnings are predominantly cosmetic and can be ignored. These issues are caused by the Pypi release of protobuf running version 6.30.1 and above, while the TWS API is built with 5.29.3. The warning is simply notifying users that their version is 1 major version different. However, given protobuf is currently backgwards compatible, this should not present any issues with the implementation. Developers uncomfortable with the warning messages have a few options:

- Recompile Protobuf against their Github 5.29.3 version to maintain parity with the TWS API implementations.

- Users can also modify the code source, linked by the protobuf warning, and simply remove lines 94 and on from the runtime_version.py file.

Implementing Visual Basic .NETCopy Location

Copy Location

Our VB.NET code is provided for demonstration purposes only; there is no pure, standalone VB.NET-based TWS API library. Both our “VB_API_Sample” and the VB.NET “Testbed” projects included with our TWS API releases call the C# TWS API source. The provided VB.NET code only interfaces with the C# source. Please keep in mind that these samples are in VB.NET, not Visual Basic for Applications.

Troubleshooting & SupportCopy Location

Copy Location

If there are remaining questions about available API functionality after reviewing the content of this documentation, the API Support group is available to help.

-> It is important to keep in mind that IB cannot provide programming assistance or give suggestions on how to code custom applications. The API group can review log files which contain a record of communications between API applications and TWS, and give details about what the API can provide.

General suggestions on starting out with the IB system:

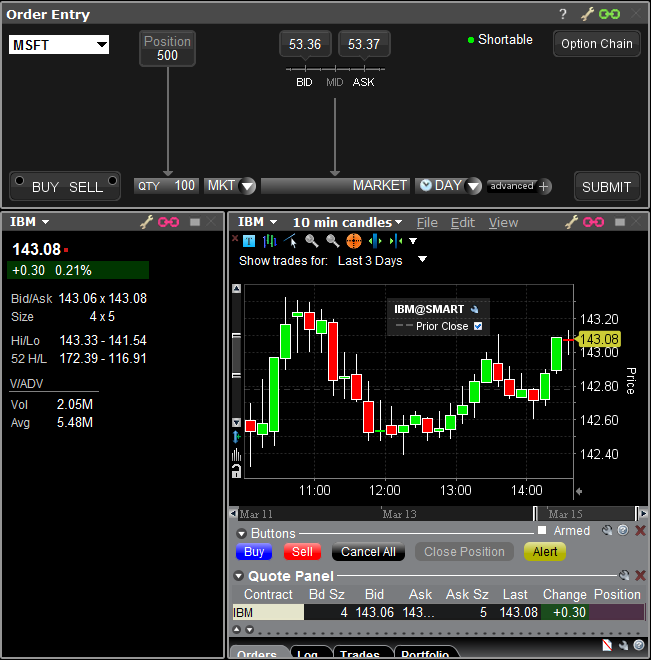

- Become familiar with the analogous functionality in TWS before using the API: the TWS API is nothing but a communication channel between your client application and TWS. Each API function has a corresponding tool in TWS. For instance, the market data tick types in the API correspond to watchlist columns in TWS. Any order which can be created in the API can first be created in TWS, and it is recommended to do so. Additionally, if information is not available in TWS, it will not be available in the API. Before using IB Gateway with the API, it is recommended to first become familiar with TWS.

- Make use of the sample API applications: the sample applications distributed with the API download have examples of essentially every API function in each of the available programming languages. If an issue does not occur in the corresponding sample application, that implies there is a problem with the custom implementation.

- Upgrade TWS or IB Gateway periodically: TWS and IB Gateway often have new software releases that have enhancements, and that can sometimes have bug fixes. Because of this, we strongly recommend our users to keep their software as up to date as possible. If you are experiencing a specific problem that is occurring in TWS or IB Gateway and not in the API program, it is likely resolved in the more recent software build.

Log FilesCopy Location

Copy Location

Log files are used by developers and support to unambiguously understand the behavior of a request.

These files are stored on the clients machine and are only sent to Interactive Brokers by client request.

These logs will recycle every 7 days. This would include the current day and the prior 6 days.

API LogsCopy Location

Copy Location

TWS and IB Gateway can be configured to create a separate log file which has a record of just communications with API applications. This log is not enabled by default; but needs to be enabled by the Global Configuration setting “Create API Message Log File”(picture below).

- API logs contain a record of exchanged messages between API applications and TWS/IB Gateway. Since only API messages are recorded, the API logs are more compact and easier to handle. However they do not contain general diagnostic information about TWS/IBG as the TWS/IBG logs. The TWS/IBG settings folder is by default C:Jts (or IBJts on Mac/Linux). The API logs are named api.[clientId].[day].log, where [clientId] corresponds to the Id the client application used to connect to the TWS and [day] to the week day (i.e. api.123.Thu.log).

- There is also a setting “Include Market Data in API Log” that will include streaming market data values in the API log file. Historical candlestick data is always recorded in the API log.

Note: Both the API and TWS logs are encrypted locally. The API logs can be decrypted for review from the associated TWS or IB Gateway session, just like the TWS logs, as shown in the section describing the Local location of logs.

Note: The TWS/IB Gateway log file setting has to be set to ‘Detail’ level before an issue occurs so that information recorded correctly when it manifests. However due to the high amount of information that will be generated under this level, the resulting logs can grow considerably in size.

Enabling creation of API logs

TWS:

- Navigate to File/Edit → Global Configuration → API → Settings

- Check the box Create API message log file

- Set Logging Level to Detail

- Click Apply and Ok

IB Gateway:

- Navigate to Configure → Settings → API → Settings

- Check the box Create API message log file

- Set Logging Level to Detail

- Click Apply and Ok

How To Enable Debug LoggingCopy Location

Copy Location

Enabling DEBUG-level logging for the host platform (TWS or IBG, this does not affect API logs):

- Navigate to the root TWS/IBG installation directory

- Find jts.ini and open in text editor

- Put debug=1 under the [Communication] section

- Reboot TWS/IBG

Setting debug=1 has added benefits in TWS.

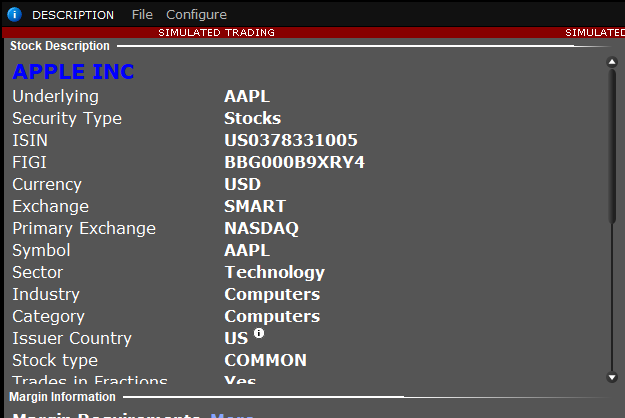

- Debug=1 also allows you to enter conIds into a watchlist to resolve them into symbols. Type/paste the conId in an empty watchlist row, add |C (vertical bar, capital C) at the end, and press Enter. Example: 265598|C will resolve immediately to AAPL (exchange will be SMART where available, primary otherwise).

- If the instrument is already present in the watchlist, nothing will happen.

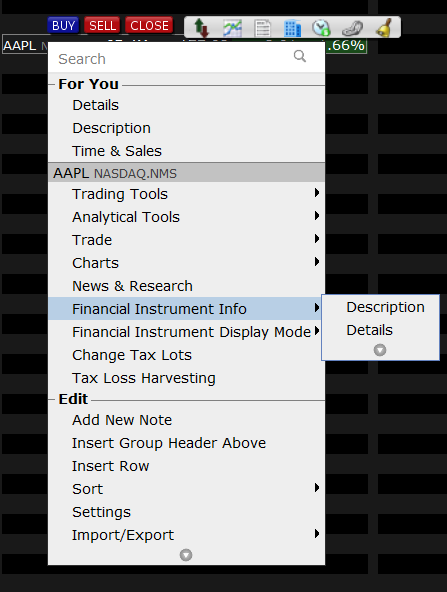

- Additional detail in the “Description” window for an instrument, normally available by right-clicking on an instrument in a watchlist and selecting Financial Instrument Info >> Description from the context menu. Debug=1 will add the conId, min order sizes, market rules (i.e., min price increments and thresholds), all available order types, and all available exchanges to this interface. Changing the behavior of TWS to bring up that Description window on double-click can make it easier to find.

- In TWS, go to Global Configuration >> Display >> Ticker Row

- Change “Double-click on Financial Instrument will” dropdown menu to “Open Contract Details”

Location of Interactive Brokers LogsCopy Location

Copy Location

Logs are stored in the TWS settings directory, C:Jts and then your user subdirectory by default on a Windows computer (the default can be configured differently on the login screen).

The path to the log file directory can be found from a TWS or IB Gateway session by using the combination Ctrl-Alt-U. This will reveal path such as C:Jtsdetcfsvirl (on Windows).

Due to privacy regulations, logs are encrypted before they are saved to disk. To review them on your machine, you may need to Export Your Logs from the associated TWS or IB Gateway session.

How To Delete LogsCopy Location

Copy Location

In some instances, your logs may be too large to export or upload for Client Services to review. In scenarios such as this, the Support team may request that you delete your existing API logs, and then replicate the error before attempting to upload them again.

To delete your logs:

- Locate your Logs.

- Exit TWS or IB Gateway session by clicking “File” and “Exit”.

- In your terminal or window explorer, navigate to your user subdirectory.

- Once in the directory, select the files labeled like “api.0.20250110.105733.ibgzenc”, “tws.20250110.105733.ibgzenc” or “ibgateway.20250110.105733.ibgzenc” and press the “Delete” key on your keyboard, or type ‘del {filename}’ into your terminal.

Uploading LogsCopy Location

Copy Location

If API logging has been enabled with the setting “Create API Message Log” during the time when an issue occurs, it can be uploaded to the API group.

Important: Please be aware that the process of uploading logs does not notify support, nor is a ticket logged. You will need to contact our representatives through a direct call, chat, or secure message center message for our representatives to be aware of the upload.

To upload logs as a Windows user:

- In TWS or IB Gateway, press CTRL+ALT+H to bring up the Upload Diagnostics window.

- In the “reason” text field, please type the reason for your upload.

- Alternatively, type “ATTENTION: ” and then the ticket number you are working with, or the name of your customer service representative.

- Find the small arrow in the upper right corner, click it and select “Advanced View”

- Make sure “Full internal state of the application” is checked

- Make sure “Include previous days logs and settings” is unchecked, unless the error happened on a prior day.

- Click Submit

To upload logs as a Mac and Linux user:

- In TWS or IB Gateway, press CMD+OPT+H to bring up the Upload Diagnostics window.

- In the “reason” text field, please type the reason for your upload.

- Alternatively, type “ATTENTION: ” and then the ticket number you are working with, or the name of your customer service representative.

- Find the small arrow in the upper right corner, click it and select “Advanced View”

- Make sure “Full internal state of the application” is checked

- Make sure “Include previous days logs and settings” is unchecked, unless the error happened on a prior day.

- Click Submit

If logs have been uploaded, please let the API Support group know by creating a webticket in the Message Center in Account Management (under Support) indicating the username of the associated TWS session. In some cases a TWS log may also be requested at the Detailed logging level. The TWS log can grow quite large and may not be uploadable by the automatic method; in this case an alternative means of upload can be found.

Exporting LogsCopy Location

Copy Location

- In TWS, navigate to Help menu >> Troubleshooting >> Diagnostics >> “API Logs” or “TWS Logs”.

- In IBG, both “API Logs” and “Gateway Logs” are accessible directly from the File menu.

- Click “Export Today Logs…” to decrypt the logs and save them in plaintext (logs are stored encrypted on your local machine)

Reading Exported LogsCopy Location

Copy Location

Each supported API language of the API contains a message file that translates a given number identifier into their corresponding request. The message identifier numbers used in the underlying wire protocol is the core of the TWS API.

The information on the right documents where each message reader file is located. The {TWS API} listed is the path to the primary TWS API or JTS folder created from the API installation.

By default, this will be saved directly on the C: drive.

Both the Incoming and Outgoing message IDs are listed in one file.

{TWS API}sourcepythonclientibapimessages.py

Incoming Message IDs:

{TWS API}sourceJavaClientcomibclientEDecoder.java

Outgoing Message IDs:

{TWS API}sourceJavaClientcomibclientEClient.java

Incoming Message IDs:

{TWS API}sourceCppClientclientEDecoder.h

Outgoing Message IDs:

{TWS API}sourceCppClientclientEClient.h

Incoming Message IDs:

{TWS API}sourceCSharpClientclientIncomingMessage.cs

Outgoing Message IDs:

{TWS API}sourceCSharpClientclientOutgoingMessages.cs

Depending on the Excel structure used, either C# or Java file path will be used.

For ActiveX and RTD, see C#

For DDE, see Java.

In our API logs, the direction of the message is indicated by the arrow at the beginning:

-> for incoming messages (TWS to client)

<- for outgoing messages (client to TWS)

Thus <- 3 (outgoing request of type 3) is a placeOrder request, and the subsequent incoming requests are:

-> 5 = openOrder response

-> 11 = executionData response

-> 59 = commissionReport response

Also note that the first openOrder response carries with it an orderStatus response in the same message. If that status were to change later, it would be delivered as a standalone message:

-> 3 = orderStatus response

Unset ValuesCopy Location

Copy Location

Developers may often find a super-massive value returned from requests like market data, P&L information, and elsewhere. These are known as Unset values. Unset values are used throughout programming systems to indicate that a value is not available. Unset values are used in place of NULL characters to prevent any unexpected error be thrown in your code. Unset values are also used in place of values like 0 to avoid confusing viewers to believe they have an account balance of 0, or that an equity is worth $0.

An unset value is the maximum value of a given data type. So the Unset Double value will appear like 1.7976931348623157E308, which contains approximately 308 digits to intentionally appear extraneous.

ArchitectureCopy Location

Copy Location

The TWS API is a BSD implementation that communicates request and response values across TCP socket using a end-line-delimited message protocol. While the underlying structure of the message will vary by request, requests typically follow a patter of indicating a message identifier, request identifier, and then directly relevant content for the request such as contract details or market data parameters.

The provided TWS API package use two distinct classes to accommodate the request / response functionality of the socket protocol, EClient and EWrapper respectively.

The EWrapper class is used to receive all messages from the host and distribute them amongst the affiliated response functions. The EReader class will retrieve the messages from the socket connection and decode them for distribution by the EWrapper class.

class TestWrapper(wrapper.EWrapper):

public class EWrapperImpl implements EWrapper {

class TestCppClient : public EWrapper

{

public class EWrapperImpl : EWrapper

{

Public Class EWrapperImpl

Implements EWrapper

EClient or EClientSocket is used to send requests to the Trader Workstation. This client class contains all the available methods to communicate with the host. Up to 32 clients can be connected to a single instance of the host Trader Workstation or IB Gateway simultaneously.

The primary distinction in EClient and EClientSocket is the involvement of the EReader Class to trigger when requests should be processed. EClient is unique to the Python implementation and utilizes the Python Queue module in place of the EReaderSignal directly. Both the EReaderSignal and Python Queue module handle the queueing process for submitting messages across the socket connection. In either scenario, the EWrapper class must be implemented first to acknowledge the EClient requests.

class TestClient(EClient):

def __init__(self, wrapper):

EClient.__init__(self, wrapper)

...

class TestApp(TestWrapper, TestClient):

def __init__(self):

TestWrapper.__init__(self)

TestClient.__init__(self, wrapper=self)Note: The EReaderSignal class is not used for Python API. The Python Queue module is used for inter-thread communication and data exchange.

private EReaderSignal readerSignal; private EClientSocket clientSocket; protected int currentOrderId = -1;

…

public EWrapperImpl() {

readerSignal = new EJavaSignal();

clientSocket = new EClientSocket(this, readerSignal);

}

EReaderOSSignal m_osSignal;

EClientSocket * const m_pClient;…

TestCppClient::TestCppClient() :

m_osSignal(2000)//2-seconds timeout

, m_pClient(new EClientSocket(this, &m_osSignal))

, m_state(ST_CONNECT)

, m_sleepDeadline(0)

, m_orderId(0)

, m_extraAuth(false)

{

}

EClientSocket clientSocket; public readonly EReaderSignal Signal;

…

public EWrapperImpl()

{

Signal = new EReaderMonitorSignal();

clientSocket = new EClientSocket(this, Signal);

}

Public eReaderSignal As EReaderSignal Public socketClient As EClientSocket

…

Sub New()

eReaderSignal = New EReaderMonitorSignal

socketClient = New EClientSocket(Me, eReaderSignal)

End Sub

The Trader WorkstationCopy Location

Copy Location

Our market maker-designed IBKR Trader Workstation (TWS) lets traders, investors, and institutions trade stocks, options, futures, forex, bonds, and funds on over 100 markets worldwide from a single account. The TWS API is a programming interface to TWS, and as such, for an application to connect to the API there must first be a running instance of TWS or IB Gateway.

The IB GatewayCopy Location

Copy Location

As an alternative to TWS for API users, IBKR also offers IB Gateway (IBGW). From the perspective of an API application, IB Gateway and TWS are identical; both represent a server to which an API client application can open a socket connection after the user has authenticated. With either application (TWS or IBGW), the user must manually enter their username and password into a login window. For security reasons, a headless session of TWS or IBGW without a GUI is not supported. From the user’s perspective, IB Gateway may be advantageous because it is a lighter application which consumes about 40% fewer resources.

Both TWS and IBGW were designed to be restarted daily. This is necessary to perform functions such as re-downloading contract definitions in cases where contracts have been changed or new contracts have been added. Beginning in version 974+ both applications offer an autorestart feature that allows the application to restart daily without user intervention. With this option enabled, TWS or IBGW can potentially run from Sunday to Sunday without re-authenticating. After the nightly server reset on Saturday night it will be necessary to again enter security credentials.

The advantages of TWS over IBGW is that it provides the end user with many tools (Risk Navigator, OptionTrader, BookTrader, etc) and a graphical user interface which can be used to monitor an account or place orders. For beginning API users, it is recommended to first become acquainted with TWS before using IBGW.

For simplicity, this guide will mostly refer to the TWS although the reader should understand that for the TWS API’s purposes, TWS and IB Gateway are synonymous.

Pacing LimitationsCopy Location

Copy Location

Pacing Limitations with regards to the TWS API are based on the number of requests submitted by a client connection. A “request” is a user-submitted query to retrieve some form of data.

An example of a request is a query to retrieve live watchlist data. While you may make a single request for market data, you will receive market data until the subscription is cancelled or your session is disconnected. Only the original request to begin the flow of data will contribute to the pacing limitation.

The maximum number of API requests that can be submitted are equivalent to your Maximum Market Data Lines divided by 2, per second.

By default, all users maintain 100 market data lines. Therefore, users have a pacing limitation of (100/2)= 50 requests per second.

Clients that have increased their market data lines to 200, by way of commission or Quote Booster Subscription, would receive (200/2)= 100 requests per second, and this would increment as your market data lines increase or decrease.

In some use cases, if you plan to send more than 50 requests per second, some orders may be queued and delayed. For this scenario, please consider switching to FIX API.

For FIX API users in IB Gateway, the limitation is 250 messages per second.

For FIX API users without using IB Gateway or TWS, there is no limitation on messages per second, but less is better.

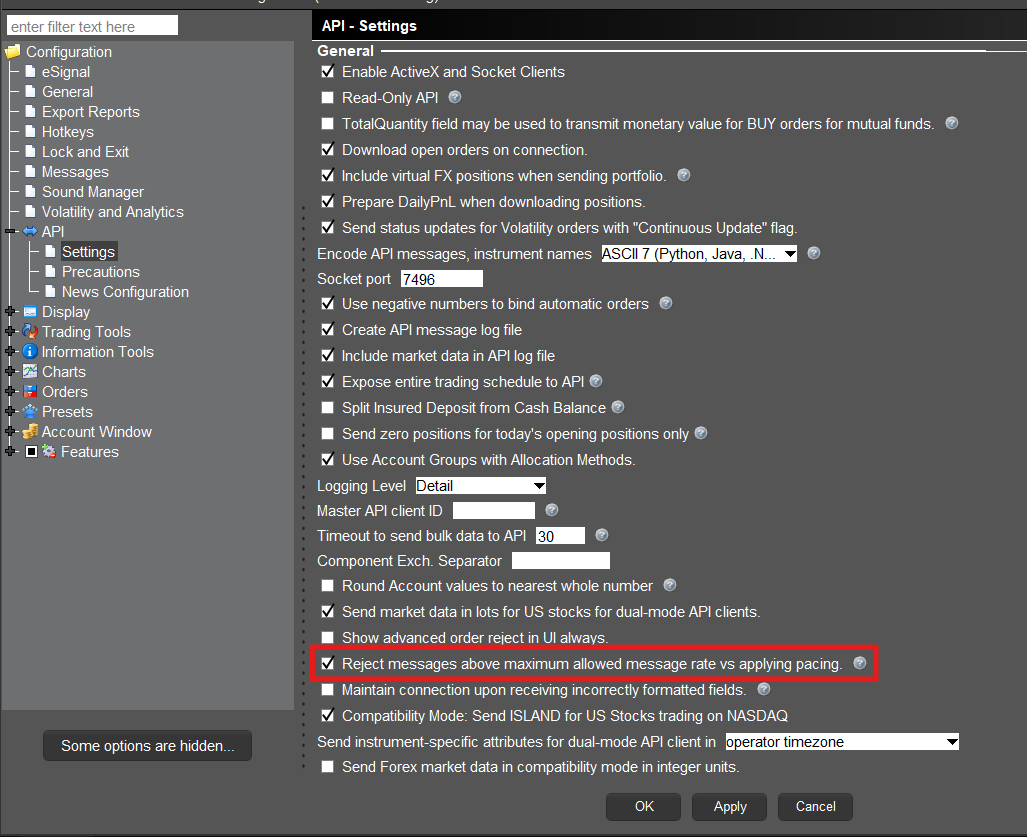

Pacing BehaviorCopy Location

Copy Location

The TWS API supports two formats for users who break the pacing limitations. This behavior is set in the Global Configuration of Trader Workstation or IB Gateway. Under “API” and then “Settings” users will see a setting for “Reject messages above maximum allowed message rate vs applying pacing.”

- If the setting is checked, TWS will notify the user they surpassed the pacing limit using error code 100. If the pacing limits are broken 3 times, the API session will terminate and the user will receive WinError 10053 on Windows or a BrokenPipe error on MacOS or Linux machines.

- If the setting is unchecked, TWS will automatically pace the requests submitted by the user. The system will wait to acknowledge requests in the EReader Thread prior to moving on to new requests.

ConnectivityCopy Location

Copy Location

A socket connection between the API client application and TWS is established with the IBApi.EClientSocket.eConnect function. TWS acts as a server to receive requests from the API application (the client) and responds by taking appropriate actions. The first step is for the API client to initiate a connection to TWS on a socket port where TWS is already listening. It is possible to have multiple TWS instances running on the same computer if each is configured with a different API socket port number. Also, each TWS session can receive up to 32 different client applications simultaneously. The client ID field specified in the API connection is used to distinguish different API clients.

Establishing an API connectionCopy Location

Copy Location

Once our two main objects have been created, EWrapper and ESocketClient, the client application can connect via the IBApi.EClientSocket object:

app.connect("127.0.0.1", args.port, clientId=0)

m_client.eConnect("127.0.0.1", 7497, 2);

bool bRes = m_pClient->eConnect( host, port, clientId, m_extraAuth);

clientSocket.eConnect("127.0.0.1", 7497, 0);

socketClient.eConnect("127.0.0.1", 7497, 0)

eConnect starts by requesting from the operating system that a TCP socket be opened to the specified IP address and socket port. If the socket cannot be opened, the operating system (not TWS) returns an error which is received by the API client as error code 502 to IBApi.EWrapper.error (Note: since this error is not generated by TWS it is not captured in TWS log files). Most commonly error 502 will indicate that TWS is not running with the API enabled, or it is listening for connections on a different socket port. If connecting across a network, the error can also occur if there is a firewall or antivirus program blocking connections, or if the router’s IP address is not listed in the “Trusted IPs” in TWS.

After the socket has been opened, there must be an initial handshake in which information is exchanged about the supported version of the TWS and API to ensure each platform can interpret received messages correctly.

- For this reason it is important that the main EReader object is not created until after a connection has been established. The initial connection results in a negotiated common version between TWS and the API client which will be needed by the EReader thread in interpreting subsequent messages.

After the highest version number which can be used for communication is established, TWS will return certain pieces of data that correspond specifically to the logged-in TWS user’s session. This includes (1) the account number(s) accessible in this TWS session, (2) the next valid order identifier (ID), and (3) the time of connection. In the most common mode of operation the EClient.AsyncEConnect field is set to false and the initial handshake is taken to completion immediately after the socket connection is established. TWS will then immediately provides the API client with this information.

- Important: The IBApi.EWrapper.nextValidID callback is commonly used to indicate that the connection is completed and other messages can be sent from the API client to TWS. There is the possibility that function calls made prior to this time could be dropped by TWS.

There is an alternative, deprecated mode of connection used in special cases in which the variable AsyncEconnect is set to true, and the call to startAPI is only called from the connectAck() function. All IB samples use the mode AsyncEconnect = False.

The ConnectAck function is called automatically once a connection has been established with the Trader Workstation or IB Gateway.

def connectAck(self):

print("API Connection Established.")

public void connectAck(){

System.out.println("API Connection Established.");

}

void TestCppClient::connectAck()

{

printf("API Connection Established.");

}

public void connectAck()

{

Console.WriteLine("API Connection Established.");

}

Verify API ConnectionCopy Location

Copy Location

A user can verify whether their API session is connected at any point with the EClient.isConnected() function.

print(app.isConnected())

System.out.println(m_client.isConnected());

printf(m_pClient->isConnected());

Console.WriteLine(clientSocket.isConnected());

socketClient.eConnect("127.0.0.1", 7497, 0)

eConnect starts by requesting from the operating system that a TCP socket be opened to the specified IP address and socket port. If the socket cannot be opened, the operating system (not TWS) returns an error which is received by the API client as error code 502 to IBApi.EWrapper.error (Note: since this error is not generated by TWS it is not captured in TWS log files). Most commonly error 502 will indicate that TWS is not running with the API enabled, or it is listening for connections on a different socket port. If connecting across a network, the error can also occur if there is a firewall or antivirus program blocking connections, or if the router’s IP address is not listed in the “Trusted IPs” in TWS.

After the socket has been opened, there must be an initial handshake in which information is exchanged about the supported version of the TWS and API to ensure each platform can interpret received messages correctly.

- For this reason it is important that the main EReader object is not created until after a connection has been established. The initial connection results in a negotiated common version between TWS and the API client which will be needed by the EReader thread in interpreting subsequent messages.

After the highest version number which can be used for communication is established, TWS will return certain pieces of data that correspond specifically to the logged-in TWS user’s session. This includes (1) the account number(s) accessible in this TWS session, (2) the next valid order identifier (ID), and (3) the time of connection. In the most common mode of operation the EClient.AsyncEConnect field is set to false and the initial handshake is taken to completion immediately after the socket connection is established. TWS will then immediately provides the API client with this information.

- Important: The IBApi.EWrapper.nextValidID callback is commonly used to indicate that the connection is completed and other messages can be sent from the API client to TWS. There is the possibility that function calls made prior to this time could be dropped by TWS.

There is an alternative, deprecated mode of connection used in special cases in which the variable AsyncEconnect is set to true, and the call to startAPI is only called from the connectAck() function. All IB samples use the mode AsyncEconnect = False.

The EReader ThreadCopy Location

Copy Location

API programs always have at least two threads of execution. One thread is used for sending messages to TWS, and another thread is used for reading returned messages. The second thread uses the API EReader class to read from the socket and add messages to a queue. Everytime a new message is added to the message queue, a notification flag is triggered to let other threads know that there is a message waiting to be processed. In the two-thread design of an API program, the message queue is also processed by the first thread. In a three-thread design, an additional thread is created to perform this task. The thread responsible for the message queue will decode messages and invoke the appropriate functions in EWrapper. The two-threaded design is used in the IB Python sample Program.py and the C++ sample TestCppClient, while the ‘Testbed’ samples in the other languages use a three-threaded design. Commonly in a Python asynchronous network application, the asyncio module will be used to create a more sequential looking code design.

The class which has functionality for reading and parsing raw messages from TWS is the IBApi.EReader class.

C++, C#, and Java ImplementationsCopy Location

Copy Location

For C#, Java, C++, and Visual Basic, we instead maintain a triple thread structure which requires the creation of a reader thread, a queue thread, and then a wrapper thread. The documentation listed here further elaborates on the structure for those languages.

final EReader reader = new EReader(m_client, m_signal);

reader.start();

//An additional thread is created in this program design to empty the messaging queue

new Thread(() -> {

while (m_client.isConnected()) {

m_signal.waitForSignal();

try {

reader.processMsgs();

} catch (Exception e) {

System.out.println("Exception: "+e.getMessage());

}

}

}).start();

m_pReader = std::unique_ptr<EReader>( new EReader(m_pClient, &m_osSignal) ); m_pReader->start();

//Create a reader to consume messages from the TWS. The EReader will consume the incoming messages and put them in a queue

var reader = new EReader(clientSocket, readerSignal);

reader.Start();

//Once the messages are in the queue, an additional thread can be created to fetch them

new Thread(() => { while (clientSocket.IsConnected()) { readerSignal.waitForSignal(); reader.processMsgs(); } }) { IsBackground = true }.Start();'Once the messages are in the queue, an additional thread need to fetch them Dim msgThread As Thread = New Thread(AddressOf messageProcessing) msgThread.IsBackground = True If (wrapperImpl.serverVersion() > 0) Then Call msgThread.Start()

Private Sub messageProcessing()

Dim reader As EReader = New EReader(wrapperImpl.socketClient, wrapperImpl.eReaderSignal)

reader.Start()

While (wrapperImpl.socketClient.IsConnected)

wrapperImpl.eReaderSignal.waitForSignal()

reader.processMsgs()

End While

End Sub

Now it is time to revisit the role of IBApi.EReaderSignal initially introduced in The EClientSocket Class. As mentioned in the previous paragraph, after the EReader thread places a message in the queue, a notification is issued to make known that a message is ready for processing. In the (C++, C#/.NET, Java) APIs, this is done via the IBApi.EReaderSignal object we initiated within the IBApi.EWrapper’s implementer.

Python ImplementationCopy Location

Copy Location

In Python IB API, the EReader logic is handled in the EClient.connect so the EReader thread is automatically started upon connection. There is no need for user to start the reader.

Once the client is connected, a reader thread will be automatically created to handle incoming messages and put the messages into a message queue for further process. User is required to trigger Client::run() below, where the message queue is processed in an infinite loop and the EWrapper call-back functions are automatically triggered.

Now it is time to revisit the role of IBApi.EReaderSignal initially introduced in The EClientSocket Class. As mentioned in the previous paragraph, after the EReader thread places a message in the queue, a notification is issued to make known that a message is ready for processing. In the Python API, this is handled automatically by the Queue class.

Remote TWS API Connections with Trader WorkstationCopy Location

Copy Location

If you want to connect TWS/ IB Gateway from a remote server, uncheck the “Allow connection from localhost only” setting. Under the “Trusted IPs” section, click “Create” and enter the IP Address detected in “Accept incoming connection attempt from <IP Address>” into “Trusted IPs”.

“Trusted IPs” does not accept subnet (e.g. /27, /28). It only accepts single IP Addresses. In the following example, there is a remote computing cluster /27 which has 32 IP Addresses and the remote computing cluster will randomly assign one of the computing nodes to connect to TWS in every connection. To make this happen, every Private IPv4 Address of the subnet are put into the “Trusted IPs” (You can also exclude the first IP Network Address and the last IP Broadcast Address of the subnet).

Accepting an API connection from TWSCopy Location

Copy Location

For security reasons, by default the API is not configured to automatically accept connection requests from API applications. After a connection attempt, a dialogue will appear in TWS asking the user to manually confirm that a connection can be made:

Untrusted IPs attempting to make a connection will be denied without prompting.

To prevent the TWS from asking the end user to accept the connection, it is possible to configure it to automatically accept the connection from a trusted IP address and/or the local machine. This can easily be done via the TWS API settings:

Logging into multiple applicationsCopy Location

Copy Location

It is not possible to login to multiple trading applications simultaneously with the same username. However, it is possible to create additional usernames for an account that can be used in different trading applications simultaneously, as long as there is not more than a single trading application logged in with a given username at a time. There are some additional cases in which it is also useful to create additional usernames:

- If TWS or IBGW is logged in with a username that is used to login to Client Portal during that session, that application will not be able to automatically reconnect to the server after the next disconnection (such as the server reset).

- A TWS or IBGW session logged into a paper trading account will not to receive market data if it is sharing data from a live user which is used to login to Client Portal.

If a different username is utilized to login to Client Portal in either of these cases, then it will not affect the TWS/IBGW session.

How to add additional usernames in Account Management

- It is important to note that market data subscriptions are setup independently for each live username.

Broken API socket connectionCopy Location

Copy Location

If there is a problem with the socket connection between TWS and the API client, for instance if TWS suddenly closes, this will trigger an exception in the EReader thread which is reading from the socket. This exception will also occur if an API client attempts to connect with a client ID that is already in use.

The socket EOF is handled slightly differently in different API languages. For instance in Java, it is caught and sent to the client application to IBApi::EWrapper::error with errorCode 507: “Bad Message”. In C# it is caught and sent to IBApi::EWrapper::error with errorCode -1. The client application needs to handle this error message and use it to indicate that an exception has been thrown in the socket connection.

Clients can validate a broken connection with the EWrapper.connectionClosed and EClient.isConnected functions.

Once a connection fails for any reason, the EWrapper.connectionClosed function will be called. This function can be used to build reconnection logic or affirm a system disconnect.

def connectClosed(self):

print("API Connection Lost.")

public void connectClosed(){

System.out.println("API Connection Lost.");

}

void TestCppClient::connectClosed()

{

printf("API Connection Lost.");

}

public void connectClosed()

{

Console.WriteLine("API Connection Lost.");

}

Account & Portfolio DataCopy Location

Copy Location

The IBApi.EClient.reqAccountSummary method creates a subscription for the account data displayed in the TWS Account Summary window. It is commonly used with multiple-account structures. Introducing broker (IBroker) accounts with more than 50 subaccounts or configured for on-demand account lookup cannot use reqAccountSummary with group=”All”. A profile name can be accepted in place of group. See Unification of Groups and Profiles.

The TWS offers a comprehensive overview of your account and portfolio through its Account and Portfolio windows. This information can be obtained via the TWS API through three different kind of requests/operations.

Account SummaryCopy Location

Copy Location

The initial invocation of reqAccountSummary will result in a list of all requested values being returned, and then every three minutes those values which have changed will be returned. The update frequency of 3 minutes is the same as the TWS Account Window and cannot be changed.

Requesting Account SummaryCopy Location

Copy Location

Requests a specific account’s summary. This method will subscribe to the account summary as presented in the TWS’ Account Summary tab. Customers can specify the data received by using a specific tags value. See the Account Summary Tags section for available options.

Alternatively, many languages offer the import of AccountSummaryTags with a method to retrieve all tag values.

EClient.reqAccountSummary (

reqId: int. The unique request identifier.

group: String. set to “All” to return account summary data for all accounts, or set to a specific Advisor Account Group name that has already been created in TWS Global Configuration.

tags: String. A comma separated list with the desired tags

)

Important: only two active summary subscriptions are allowed at a time!

self.reqAccountSummary(9001, "All", AccountSummaryTags.AllTags)

Code example:

from ibapi.client import *

from ibapi.wrapper import *

from ibapi.contract import Contract

import time

class TradeApp(EWrapper, EClient):

def __init__(self):

EClient.__init__(self, self)

def accountSummary(self, reqId: int, account: str, tag: str, value: str,currency: str):

print("AccountSummary. ReqId:", reqId, "Account:", account,"Tag: ", tag, "Value:", value, "Currency:", currency)

def accountSummaryEnd(self, reqId: int):

print("AccountSummaryEnd. ReqId:", reqId)

app = TradeApp()

app.connect("127.0.0.1", 7496, clientId=1)

time.sleep(1)

app.reqAccountSummary(9001, "All", 'NetLiquidation')

app.run()

client.reqAccountSummary(9001, "All", "AccountType,NetLiquidation,TotalCashValue,SettledCash,AccruedCash,BuyingPower,EquityWithLoanValue,PreviousEquityWithLoanValue,GrossPositionValue,ReqTEquity,ReqTMargin,SMA,InitMarginReq,MaintMarginReq,AvailableFunds,ExcessLiquidity,Cushion,FullInitMarginReq,FullMaintMarginReq,FullAvailableFunds,FullExcessLiquidity,LookAheadNextChange,LookAheadInitMarginReq ,LookAheadMaintMarginReq,LookAheadAvailableFunds,LookAheadExcessLiquidity,HighestSeverity,DayTradesRemaining,Leverage");

m_pClient->reqAccountSummary(9001, "All", AccountSummaryTags::getAllTags());

client.reqAccountSummary(9001, "All", AccountSummaryTags.GetAllTags());

client.reqAccountSummary(9001, "All", AccountSummaryTags.GetAllTags())

Receiving Account SummaryCopy Location

Copy Location

EWrapper.accountSummary (

reqId: int. the request’s unique identifier.

account: String. the account id

tag: String. the account’s attribute being received.

value: String. the account’s attribute’s value.

currency: String. the currency on which the value is expressed.

)

Receives the account information. This method will receive the account information just as it appears in the TWS’ Account Summary Window.

def accountSummary(self, reqId: int, account: str, tag: str, value: str,currency: str):

print("AccountSummary. ReqId:", reqId, "Account:", account,"Tag: ", tag, "Value:", value, "Currency:", currency)@Override

public void accountSummary(int reqId, String account, String tag, String value, String currency) {

System.out.println(EWrapperMsgGenerator.accountSummary(reqId, account, tag, value, currency));

}

void TestCppClient::accountSummary( int reqId, const std::string& account, const std::string& tag, const std::string& value, const std::string& currency) {

printf( "Acct Summary. ReqId: %d, Account: %s, Tag: %s, Value: %s, Currency: %sn", reqId, account.c_str(), tag.c_str(), value.c_str(), currency.c_str());

}public virtual void accountSummary(int reqId, string account, string tag, string value, string currency)

{

Console.WriteLine("Acct Summary. ReqId: " + reqId + ", Acct: " + account + ", Tag: " + tag + ", Value: " + value + ", Currency: " + currency);

}Public Sub accountSummary(reqId As Integer, account As String, tag As String, value As String, currency As String) Implements IBApi.EWrapper.accountSummary

Console.WriteLine("AccountSummary - ReqId [" & reqId & "] Account [" & account & "] Tag [" & tag & "] Value [" & value & "] Currency [" & currency & "]")

End SubEWrapper.accountSummaryEnd(

reqId: String. The request’s identifier.

)

Notifies when all the accounts’ information has ben received. Requires TWS 967+ to receive accountSummaryEnd in linked account structures.

def accountSummaryEnd(self, reqId: int):

print("AccountSummaryEnd. ReqId:", reqId)

@Override

public void accountSummaryEnd(int reqId) {

System.out.println("Account Summary End. Req Id: " + EWrapperMsgGenerator.accountSummaryEnd(reqId));

}void TestCppClient::accountSummaryEnd( int reqId) {

printf( "AccountSummaryEnd. Req Id: %dn", reqId);

}

public virtual void accountSummaryEnd(int reqId)

{

Console.WriteLine("AccountSummaryEnd. Req Id: "+reqId+"n");

}Public Sub accountSummaryEnd(reqId As Integer) Implements IBApi.EWrapper.accountSummaryEnd

Console.WriteLine("AccountSummaryEnd - ReqId [" & reqId & "]")

End Sub

Cancel Account SummaryCopy Location

Copy Location

Once the subscription to account summary is no longer needed, it can be cancelled via the IBApi::EClient::cancelAccountSummary method:

EClient.cancelAccountSummary (

reqId: int. The identifier of the previously performed account request

)

self.cancelAccountSummary(9001)

m_pClient->cancelAccountSummary(9001);

Account UpdatesCopy Location

Copy Location

The IBApi.EClient.reqAccountUpdates function creates a subscription to the TWS through which account and portfolio information is delivered. This information is the exact same as the one displayed within the TWS’ Account Window. Just as with the TWS’ Account Window, unless there is a position change this information is updated at a fixed interval of three minutes.

Unrealized and Realized P&L is sent to the API function IBApi.EWrapper.updateAccountValue function after a subscription request is made with IBApi.EClient.reqAccountUpdates. This information corresponds to the data in the TWS Account Window, and has a different source of information, a different update frequency, and different reset schedule than PnL data in the TWS Portfolio Window and associated API functions (below). In particular, the unrealized P&L information shown in the TWS Account Window which is sent to updatePortfolioValue will update either (1) when a trade for that particular instrument occurs or (2) every 3 minutes. The realized P&L data in the TWS Account Window is reset to 0 once per day.

It is important to keep in mind that the P&L data shown in the Account Window and Portfolio Window will sometimes differ because there is a different source of information and a different reset schedule.

See Profit & Loss for alternative PnL data

Requesting Account UpdatesCopy Location

Copy Location

Subscribes to a specific account’s information and portfolio. Through this method, a single account’s subscription can be started/stopped. As a result from the subscription, the account’s information, portfolio and last update time will be received at EWrapper.updateAccountValue, EWrapper.updatePortfolio, EWrapper.updateAccountTime respectively. All account values and positions will be returned initially, and then there will only be updates when there is a change in a position, or to an account value every 3 minutes if it has changed. Only one account can be subscribed at a time. A second subscription request for another account when the previous one is still active will cause the first one to be canceled in favor of the second one.

EClient.reqAccountUpdates (

subscribe: bool. Set to true to start the subscription and to false to stop it.

acctCode: String. The account id (i.e. U123456) for which the information is requested.

)

self.reqAccountUpdates(True, self.account)

Code example:

from ibapi.client import *

from ibapi.wrapper import *

from ibapi.contract import Contract

import time

class TradeApp(EWrapper, EClient):

def __init__(self):

EClient.__init__(self, self)

def updateAccountValue(self, key: str, val: str, currency: str,accountName: str):

print("UpdateAccountValue. Key:", key, "Value:", val, "Currency:", currency, "AccountName:", accountName)

def updatePortfolio(self, contract: Contract, position: Decimal,marketPrice: float, marketValue: float, averageCost: float, unrealizedPNL: float, realizedPNL: float, accountName: str):

print("UpdatePortfolio.", "Symbol:", contract.symbol, "SecType:", contract.secType, "Exchange:",contract.exchange, "Position:", decimalMaxString(position), "MarketPrice:", floatMaxString(marketPrice),"MarketValue:", floatMaxString(marketValue), "AverageCost:", floatMaxString(averageCost), "UnrealizedPNL:", floatMaxString(unrealizedPNL), "RealizedPNL:", floatMaxString(realizedPNL), "AccountName:", accountName)

def updateAccountTime(self, timeStamp: str):

print("UpdateAccountTime. Time:", timeStamp)

def accountDownloadEnd(self, accountName: str):

print("AccountDownloadEnd. Account:", accountName)

app = TradeApp()

app.connect("127.0.0.1", 7496, clientId=1)

time.sleep(1)

app.reqAccountUpdates(True, 'U123456')

app.run()

client.reqAccountUpdates(true, "U1234567");

m_pClient->reqAccountUpdates(true, "U150462");

client.reqAccountUpdates(true, "U1234567");

client.reqAccountUpdates(True, "U1234567")

Receiving Account UpdatesCopy Location

Copy Location

Resulting account and portfolio information will be delivered via the IBApi.EWrapper.updateAccountValue, IBApi.EWrapper.updatePortfolio, IBApi.EWrapper.updateAccountTime and IBApi.EWrapper.accountDownloadEnd

EWrapper.updateAccountValue (

key: String. The value being updated.

value: String. up-to-date value

currency: String. The currency on which the value is expressed.

accountName: String. The account identifier.

)

Receives the subscribed account’s information. Only one account can be subscribed at a time. After the initial callback to updateAccountValue, callbacks only occur for values which have changed. This occurs at the time of a position change, or every 3 minutes at most. This frequency cannot be adjusted.

Note: An important key passed back in EWrapper.updateAccountValue after a call to EClient.reqAccountUpdates is a boolean value ‘accountReady’. If an accountReady value of false is returned that means that the IB server is in the process of resetting at that moment, i.e. the account is ‘not ready’. When this occurs subsequent key values returned to EWrapper.updateAccountValue in the current update can be out of date or incorrect.

def updateAccountValue(self, key: str, val: str, currency: str,accountName: str):

print("UpdateAccountValue. Key:", key, "Value:", val, "Currency:", currency, "AccountName:", accountName)

@Override

public void updateAccountValue(String key, String value, String currency, String accountName) {

System.out.println(EWrapperMsgGenerator.updateAccountValue( key, value, currency, accountName));

}

void TestCppClient::updateAccountValue(const std::string& key, const std::string& val, const std::string& currency, const std::string& accountName) {

printf("UpdateAccountValue. Key: %s, Value: %s, Currency: %s, Account Name: %sn", key.c_str(), val.c_str(), currency.c_str(), accountName.c_str());

}

public virtual void updateAccountValue(string key, string value, string currency, string accountName)

{

Console.WriteLine("UpdateAccountValue. Key: " + key + ", Value: " + value + ", Currency: " + currency + ", AccountName: " + accountName);

}

Public Sub updateAccountValue(key As String, value As String, currency As String, accountName As String) Implements IBApi.EWrapper.updateAccountValue

Console.WriteLine("UpdateAccountValue. Key: " & key & ", Value: " & value & ", Currency: " & currency & ", AccountName: " & accountName)

End Sub

EWrapper.updatePortfolio (

contract: Contract. The Contract for which a position is held.

position: Decimal. The number of positions held.

marketPrice: Double. The instrument’s unitary price

marketValue: Double. Total market value of the instrument.

averageCost: Double. Average cost of the overall position.

unrealizedPNL: Double. Daily unrealized profit and loss on the position.

realizedPNL: Double. Daily realized profit and loss on the position.

accountName: String. Account ID for the update.

)

Receives the subscribed account’s portfolio. This function will receive only the portfolio of the subscribed account. After the initial callback to updatePortfolio, callbacks only occur for positions which have changed.

def updatePortfolio(self, contract: Contract, position: Decimal,marketPrice: float, marketValue: float, averageCost: float, unrealizedPNL: float, realizedPNL: float, accountName: str):

print("UpdatePortfolio.", "Symbol:", contract.symbol, "SecType:", contract.secType, "Exchange:",contract.exchange, "Position:", decimalMaxString(position), "MarketPrice:", floatMaxString(marketPrice),"MarketValue:", floatMaxString(marketValue), "AverageCost:", floatMaxString(averageCost), "UnrealizedPNL:", floatMaxString(unrealizedPNL), "RealizedPNL:", floatMaxString(realizedPNL), "AccountName:", accountName)

@Override

public void updatePortfolio(Contract contract, Decimal position, double marketPrice, double marketValue, double averageCost, double unrealizedPNL, double realizedPNL, String accountName) {

System.out.println(EWrapperMsgGenerator.updatePortfolio( contract, position, marketPrice, marketValue, averageCost, unrealizedPNL, realizedPNL, accountName));

}

void TestCppClient::updatePortfolio(const Contract& contract, Decimal position, double marketPrice, double marketValue, double averageCost, double unrealizedPNL, double realizedPNL, const std::string& accountName){

printf("UpdatePortfolio. %s, %s @ %s: Position: %s, MarketPrice: %s, MarketValue: %s, AverageCost: %s, UnrealizedPNL: %s, RealizedPNL: %s, AccountName: %sn", (contract.symbol).c_str(), (contract.secType).c_str(), (contract.primaryExchange).c_str(), decimalStringToDisplay(position).c_str(), Utils::doubleMaxString(marketPrice).c_str(), Utils::doubleMaxString(marketValue).c_str(), Utils::doubleMaxString(averageCost).c_str(), Utils::doubleMaxString(unrealizedPNL).c_str(), Utils::doubleMaxString(realizedPNL).c_str(), accountName.c_str());

}

public virtual void updatePortfolio(Contract contract, decimal position, double marketPrice, double marketValue, double averageCost, double unrealizedPNL, double realizedPNL, string accountName)

{

Console.WriteLine("UpdatePortfolio. " + contract.Symbol + ", " + contract.SecType + " @ " + contract.Exchange + ": Position: " + Util.DecimalMaxString(position) + ", MarketPrice: " + Util.DoubleMaxString(marketPrice) + ", MarketValue: " + Util.DoubleMaxString(marketValue) + ", AverageCost: " + Util.DoubleMaxString(averageCost) + ", UnrealizedPNL: " + Util.DoubleMaxString(unrealizedPNL) + ", RealizedPNL: " + Util.DoubleMaxString(realizedPNL) + ", AccountName: " + accountName);

}

Public Sub updatePortfolio(contract As IBApi.Contract, position As Decimal, marketPrice As Double, marketValue As Double, averageCost As Double, unrealizedPNL As Double, realizedPNL As Double, accountName As String) Implements IBApi.EWrapper.updatePortfolio