China’s announcement that it will place new restrictions on US shipping subsidiaries based in South Korea sparked heightened fears over geopolitical tensions, which pushed investors into risk-off assets in the early hours. The toughened trade stance comes shortly after the country put limits on rare earth exports to the US. The elevated angst was countering today’s solid earnings results from the big banks until Fed Chair Powell stated in the afternoon that the central bank may terminate its quantitative tightening program soon. Prospects of monetary policy accommodation via the balance sheet alongside a dovish tone bolstered a monster turnaround in stocks, which are now firmly in the green after being deep in the red. Meanwhile cross-border commerce disputes took center stage a few months ago before being sent to the backburner, but the current grapple is poised to linger, similar to the back-and-forth quarrelling during Trump 1.0. Defensive positioning was dominating trading this session after participants were offensive yesterday. The yield curve is plunging in bull-steepening fashion led by the short end, as fixed-income watchers pencil in quarter-point cuts for both this month and December with degrees of confidence north of 94% and presumably justified by the Fed responding to slowdown worries and softening labor conditions worsened by the government shutdown, which could very well be the lengthiest in history. Additionally, safe-haven silver and gold metals reached fresh records and volatility protection instruments are experiencing demand on an increase in hedging activities. Equities were facing selling pressures but are well off their lows amidst positive sector breadth and the the four major domestic benchmarks are advancing following sharp retreats this morning. Cyclical commodities are getting tossed though, especially the most economically sensitive ones, including copper and crude oil. A lack of animal spirits is sending bitcoin lower by 3%. Forecast contracts, however, are catching bids.

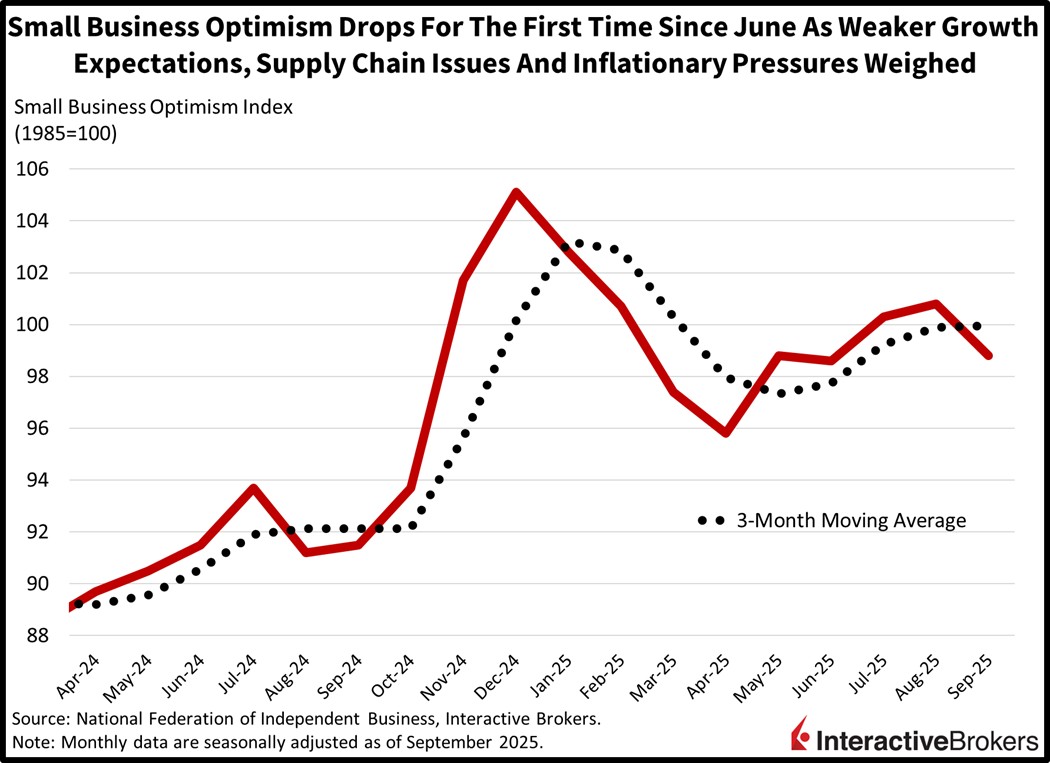

Small Business Sentiment Weakened Last Month

Small business optimism dropped last month, the first time since June, as weaker growth expectations, supply chain issues and inflation dinged sentiment. The National Federation of Independent Business’s (NFIB) headline result of 98.8 missed the median estimate of 100.5 and slipped from 100.8 in August. While firms were increasingly committed to hiring more workers and reported improving profit trends, they were less positive about the economic outlook while projecting that transaction volumes will soften. Additionally, survey respondents overall didn’t think it was a good time to expand operations. They reported that quality of labor and taxes were the most important problems. The two categories were tied at 18% of the sample size, followed by prices, payroll expenses and a lack of revenues at 14%, 11% and 10%.

Past performance is not indicative of future results.

US-China Tensions Are Here to Stay

China’s ambitious goal of becoming the world’s largest economy essentially guarantees that its tensions with Washington will persist. But these disagreements don’t mean that economic growth will suffer or that inflation will spike, which is part of the reason why investors bought the morning dip. Trump 1.0 was a perfect example, which featured GDP expanding strongly and equity prices soaring, because the headwinds from Beijing were countered by the tailwinds of deregulation, lighter taxation, subdued energy costs, an easing Fed, and a pro-business environment. Those five factors sound familiar, and traders are looking forward to déjà vu moments from the US President’s first term. There will be turbulence along the way, but this will be part of the economy navigating to clearer skies.

International Roundup

Singapore’s Economy Exceeds Estimates

Singapore’s economic growth slowed during the third quarter and the island nation’s monetary authority anticipates below trend growth in the coming months. Nevertheless, the recent gross domestic product (GDP) exceeded expectations. The economy grew 2.9% year over year (y/y) and 1.3% quarter over quarter (q/q) during the July to September period, according to preliminary estimates from the Ministry of Trade and Industry. The metrics slowed from 4.5% y/y and 1.5% q/q in the preceding quarter but significantly exceeded the consensus expectations of 2% and 0.3%. For the first nine months of 2025, GDP was up 3.9% y/y. Manufacturing, which was flat during the quarter, was the most significant driver of the decelerating growth. Construction was another headwind, with the sector’s rate of expansion slowing.

The Monetary Authority of Singapore (MAS), in a statement this morning, said it believes GDP growth will slow from its recent above trend pace as trade-related sectors normalize. Global demand for artificial intelligence, however, will help sustain the country’s manufacturing sector and infrastructure improvements will support construction activity. The MAS expects headline and core inflation, as measured by the Consumer Price Index, to average approximately 0.6% and 0.5% this year. Headline and core inflation for next year are both estimated to range from 0.5% and 1.5%.

UK Retail Sales Growth Exceeds Long-Term Trend

Retail sales in the UK during the five-week period ended Oct. 4 grew 2.3% y/y, exceeding the year-ago period’s rate of 2% and the 12-month average of 2.1%, according to the British Retail Consortium. Sales of electronics received a boost from the release of a new Apple Watch and iPhone models, which contributed to non-food sales growing 0.7% y/y. Food sales were up 4.3%, but the BRC maintains most of the increase was attributable to higher prices, with the sluggish gains in volume of purchased groceries. In another headwind, mild weather caused shoppers to hold off on buying autumn and winter clothing.

UK Payrolls Fall and Unemployment Rate Increases

UK payrolls sank by 10,000 in September relative to August and by 100,000 from the year-ago period, according to preliminary estimates from the Office of National Statistics (ONS). On a positive note, the ONS revised its August result from a m/m loss of 8,000 to a 10,000 gain, sparking hope that the labor market decline is easing. Meanwhile, the country’s unemployment rate crept up from 4.7% to 4.8%. The metric hasn’t been that high since May 2021. Average earnings growth was mixed. When excluding bonuses, compensation ascended 4.7% y/y in August, matching the economist consensus estimate but below the 4.8% gain in July. With bonuses, earnings were up 5% y/y, significantly better than the economist consensus estimate of 4.7% and July’s 4.8% print.

Australia Business Confidence Strengthens

Confidence among business leaders in Australia strengthened last month while overall conditions were unchanged, according to the National Australia Bank. The organization’s NAB Business Survey was unchanged at 8 with sales and profits strengthening and employment falling. Input costs rose, but at a marginal rate. The increase in confidence, furthermore, places the gauge above its long-term metric.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Security Futures

Security futures involve a high degree of risk and are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading security futures, please read the Security Futures Risk Disclosure Statement. For a copy visit the Warnings and Disclosures section of your local Interactive Brokers website.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account