Key takeaways

Shutdown continues

With the shutdown over a week old, parts of the government have closed, as Congress continues to disagree over how to fund it.

Limited market impact

While this shutdown has seen limited market volatility so far, many past shutdowns saw more, which tended to resolve quickly with little impact.

Think long-term

Don’t let any short-term market volatility from a government shutdown change your long-term investing plan.

The federal government’s fifth shutdown this century has entered its second week. As Congress continues to disagree over funding, large parts of the US government sit dormant. The market, so far, hasn’t seemed to care. What is a government shutdown, and when will it be resolved? How has the government shutdown affected the stock market? Should investors be concerned?

Shutdowns limit government operations

During the shutdown, essential government functions have continued. This has included, but hasn’t been limited to, air-traffic control, border patrol, federal prisons, power grid, mail delivery, disaster relief, food-safety inspections, military, and tax collection. Seniors have continued to receive Social Security and Medicare. Veteran benefits, unemployment benefits, and food stamps have been administered.

Many non-essential government activities have ceased though. Examples abound, but here are just a few. The Justice Department has suspended many civil cases. NASA has paused most projects but continues to support to the International Space Station. Certain national parks have remained open, but with limited hours and staffing. The National Zoo has continued to operate using last year’s funds, but is set to close Oct. 12 (though the animals will be fed.)

A shutdown is no laughing matter for the estimated 3 million federal employees. Non-essential workers have been furloughed. Essential workers may be paid retroactively when Congress funds the government again. In 2019, roughly 800,000 non-essential workers were furloughed, and 1.3 million essential workers received IOUs.

Government shutdowns tend to resolve quickly

Government shutdowns have precedent. This is the 22nd since modern Congressional budgeting began in 1976. The longest — 34 days — lasted from December 2018 to January 2019, during the first Trump administration.1 Most were resolved much more quickly, with an average length of eight days. Five only lasted a day.

Shutdowns typically end when one or both political parties can no longer withstand the public’s ire. During the 2013 government shutdown, Congress’s approval rating fell to a record-low 9%.2 For context, at the time, that was below approval ratings for head lice, root canals, traffic jams, and even colonoscopies. As of September 2025, 26% of Americans approved of Congress, down from a multi-year high of 36% in March 2021.3

Government shutdowns have had minimal impact on the stock market

The good news is that government shutdowns haven’t really affected the stock market historically. While there have been examples of heightened market volatility, it’s generally been benign. (And so far that’s been true of this shutdown as well.) The S&P 500 Index posted positive returns during 12 of the 21 previous government shutdowns. The average S&P 500 return during those shutdowns was 0.1%.4 (Remember, shutdowns have been resolved, on average, within eight days.)

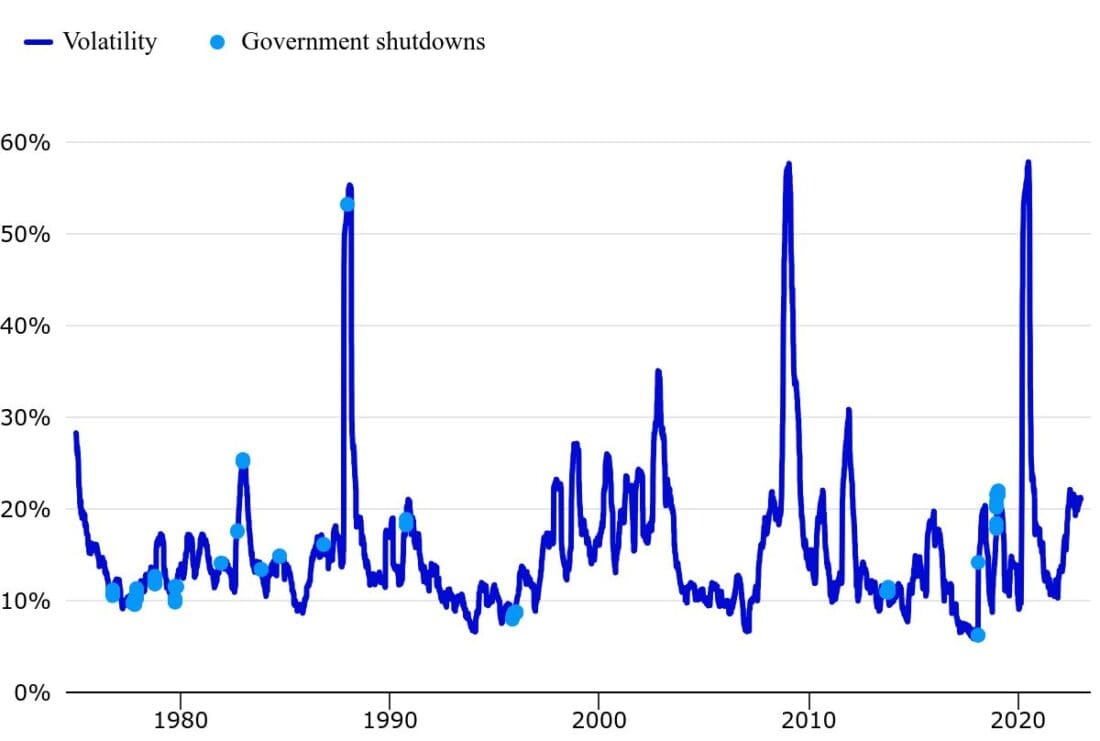

Not all government shutdowns created market volatility

Past performance is not indicative of future results.

Source: Bloomberg L.P., 12/31/22. The Dow Jones Industrial Average is a price-weighted index of the 30 largest, most widely held stocks traded on the New York Stock Exchange. Volatility is measured by the standard deviation of price moves on returns of the index. Standard deviation measures a range of total returns for a portfolio or index compared to the mean. An investment cannot be made into an index. Past performance does not guarantee future results.

In the 12 months following the December 2018 government shutdown — the most recent — the S&P 500 Index gained 26.2%. It returned 19.72% in the year following the infamous shutdown of 2013. In fact, since 1980, the average S&P 500 return in the 12 months following the government closing is 16.95%.5

Extending the timeline even further, a $100,000 investment in the S&P 500 Index in 1957 would’ve been worth $12.6 million by the end of 2024.6 That’s despite 21 government shutdowns.

Investors should consider sticking to long-term investing plans

While unnerving, concerns about shutdowns shouldn’t change investors’ long-term investment plans; sticking to the plan may be the best way forward. This isn’t the first government shutdown, and it likely won’t be the last. We expect the spending bill (or bills) to pass eventually and government operations to return to normal.

In the meantime, the political gamesmanship continues. Past shutdowns have generally been short with little noticeable impact for most people. Let’s hope history repeats itself.

—

Originally Posted October 14, 2025

Government shutdown: What investors may see in the market by Invesco US

Footnotes

- Source: US Treasury, 8/31/23

- Source: Gallup, 2/26/25. The Congressional Approval Rating fell to 5% in the Associated Press poll. It never got below 9% in the Gallup poll.

- Source: Gallup, 9/16/25

- Source: Bloomberg, L.P. 12/31/22. An investment cannot be made into an index. Past performance does not guarantee future results.

- Source: Bloomberg L.P., 2/26/25, based on the returns of the S&P 500 Index. An investment cannot be made into an index. Past performance does not guarantee future results.

- Source: Bloomberg L.P., 12/19/24. The S&P 500 Index is a market-capitalization-weighted index of the 500 largest domestic US stocks. Performance based on price returns. An investment cannot be made into an index. Past performance does not guarantee future results.

Important Information

NA4891474

Past performance is not a guarantee of future results.

Indexes are unmanaged and cannot be purchased directly by investors. Index performance is shown for illustrative purposes only and does not predict or depict the performance of any investment.

Past performance does not guarantee future results.

All investing involves risk, including the risk of loss.

In general, stock values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.

The opinions referenced above are those of the author as of Oct. 10, 2025. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

Disclosure: Invesco US

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial advisor/financial consultant before making any investment decisions. Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

All data provided by Invesco unless otherwise noted.

Invesco Distributors, Inc. is the US distributor for Invesco Ltd.’s Retail Products and Collective Trust Funds. Institutional Separate Accounts and Separately Managed Accounts are offered by affiliated investment advisers, which provide investment advisory services and do not sell securities. These firms, like Invesco Distributors, Inc., are indirect, wholly owned subsidiaries of Invesco Ltd.

©2024 Invesco Ltd. All rights reserved.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Invesco US and is being posted with its permission. The views expressed in this material are solely those of the author and/or Invesco US and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account