President Trump’s tariffs start today as the White House looks to level the playing field of global trade while seeking to propel domestic manufacturing. The Commander in Chief, furthermore, has just proposed a 100% levy on semiconductor chips, but it would exclude firms that engage in US capital expenditures. It’s a sign that he wants to build momentum following Apple’s additional $100 billion commitment to stateside goods production declared yesterday. Meanwhile, the economic calendar told a familiar tale regarding the labor market, with initial unemployment claims remaining subdued against the backdrop of elevated continuing filings, signaling that companies are keeping their existing employees but are hesitant to add new ones. Inflationary developments experienced relief though, as a monthly plunge in used automobiles prices coincided with an upside beat on productivity. Encouragingly, an increase in output per employee has cushioned cost pressures. The geopolitical front provided some positive news, too, and it’s boosting optimism of a potential truce between Moscow and Kyiv, with Trump and Putin agreeing to meet soon at an undisclosed venue. Markets are indecisive as investors digest these events. Stocks and commodities are mixed while Treasuries and the greenback are near their respective flatlines ahead of a $25 billion auction for 30-year bonds. Volatility protection instruments remain steady.

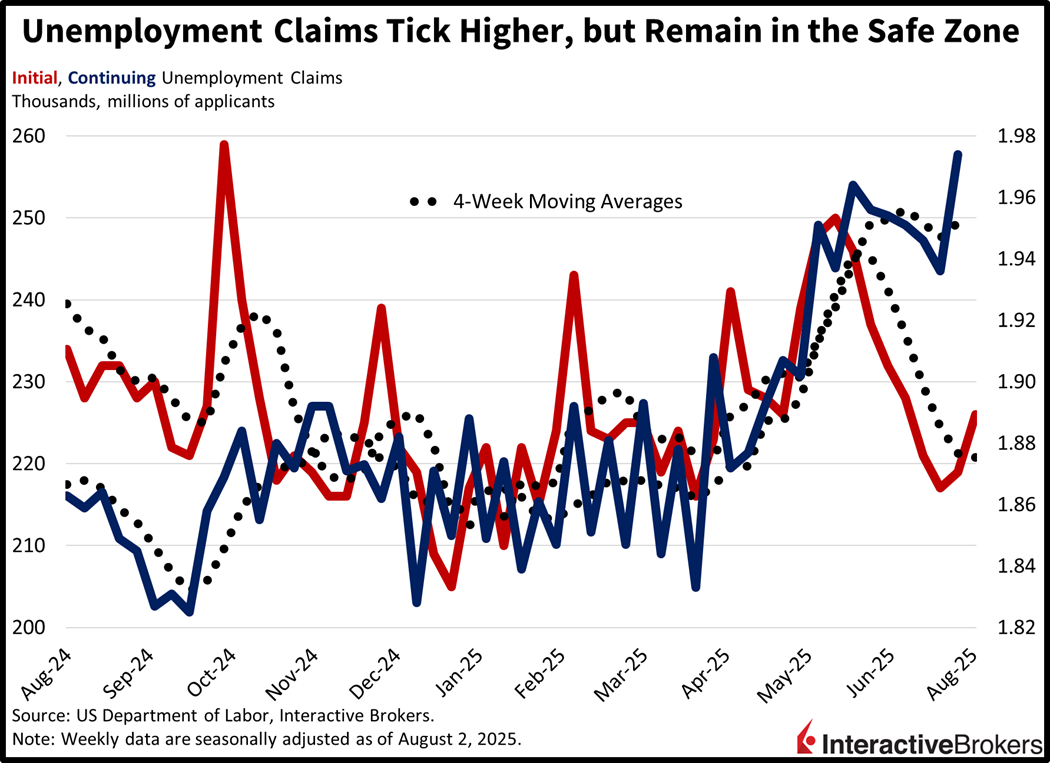

Unemployment Claims Remain in Safe Zone

Unemployment claims ticked higher in the past two weeks but remained in the safe zone. Initial filings rose to 226,000 for the week ended August 2, exceeding expectations for 221,000 as well as the prior period’s 219,000. Continuing applications jumped to the loftiest level in almost four years, since November 2021, climbing to 1.974 million. The result for the seven-day time span culminating on July 26 was also above the median estimate of 1.950 million and the previous interval’s 1.936 million. Four-week moving averages shifted in bifurcated fashion, from 221,250 and 1.947 million to 220,750 and 1.952 million.

Past performance is not indicative of future results.

Wholesale Used Car Prices Drop

Wholesale used automobile prices declined 0.5% month over month (m/m) while climbing 2.9% year over year (y/y) according to July’s Manheim Index from Cox Automotive. The results reversed significantly from June’s increases of 1.6% m/m and 6.3% y/y.

Productivity Improves

Second quarter productivity bounced back strongly following a subtraction to begin the year. Nonfarm business sector labor productivity rose 2.4% on annualized basis last quarter, beating the 2% median estimate and recovering from the 1.8% retreat in the previous interval. The result reflects a 3.7% increase in output amidst a 1.3% climb in hours worked. Unit labor costs, the ratio of hourly compensation to labor productivity or how much firms pay employees to produce one unit of output, rose 1.3% during the period.

President Trump Wants More Apple Headlines

President Trump’s recent move to threaten heavier tariffs on critical technology signals that he wants firms to follow in Apple’s footsteps by announcing additional investments that benefit domestic manufacturing activities. Overall capital expenditures have certainly been robust thus far and have helped economic growth amidst softening consumer spending, decelerating fiscal outlays and depressed residential projects. Meanwhile, today’s economic calendar offered positive signs as it relates to the current cycle, as falling automobile prices are a crucial aspect of containing non-services inflation, since they comprise a heavy share of core goods. Indeed, cars are an area in the direct crosshairs of global cross-border commerce friction. But also, strengthening productivity is a terrific development because it points to supply-side deflationary forces coinciding with an increasingly momentous economy. Finally, the labor market is stabilizing at a decent rate amidst a low level of joblessness, but immigration restrictiveness is certainly hurting here, as a lack of foreign workers limits the extent of nonfarm payroll gains and impedes the maximum potential pace of GDP advancement.

International Roundup

China’s Trade Surplus Is Smaller Than Expected

China’s trade surplus narrowed in July, falling from June’s $114.7 billion to $98.24 billion, missing the economist consensus forecast of $105.2 billion. On a y/y basis, however, July exports were up 7.2%, stronger than the forecast for 5.4% and June’s 5.8% gain. Imports were up 4.1% y/y, much better than the expectation for a 1% drop and June’s 1.1% northward movement. Export growth was driven by strong demand from the European Union, Australia, Hong Kong and Southeast Asia, which offset declining purchases from US customers as a result of higher tariffs. Imports of semiconductors were particularly strong while China’s demand for iron ore, copper, soybeans and crude oil also grew.

The Luster of Gold Boosts Australia Exports

Investor hunger for gold pushed Australia’s June trade surplus up to $5.37 billion, exceeding the economist consensus expectation of $3.2 billion and climbing significantly from May’s $1.6 billion print. After falling 3% month over month (m/m) in May, exports climbed 6% in June, according to the Australian Bureau of Statistics. Non-monetary gold was the largest contributor to the increase with investors snatching up the precious metal in response to increased uncertainty about global trade. Other commodities, such as metal ores, minerals and fuels, also supported the growth of products shipped abroad. Also in June, imports sank 3.1% m/m after having grown 3.3% in May. A slowing business environment and a return to more normal volumes of equipment purchases following a surge in May contributed to the decline.

And Building Permits Also Climb

The number of building approvals for residential projects climbed 11.9% m/m in June despite a weak showing for permits issued for private construction of homes. The June tally matched the economist consensus estimate and grew substantially from the preceding month’s 3.2% gain.

UK Central Bank Cuts Key Rate

Bank of England (BoE) policymakers voted 5-4 in favor of trimming the organization’s key interest rate from 4.25% to 4%. Following the vote, the BoE maintained that it is committed to reducing inflation and to reaching its 2% target. The vote comes shortly after data depicted a 0.1% m/m decline in gross domestic product and a slowing job market. The Consumer Price Index, however, climbed from 3.4% y/y in May to 3.6% in June.

UK Home Prices Gain More than Expected

Home prices in the UK climbed 0.4% m/m in July, as measured by the Halifax House Price Index. The result beat the economist estimate of 0.1%, which would have matched June’s level. Home prices are up 2.4% from July of 2024, slightly lower than the June’s y/y gain of 2.7%.

Leading Indicator for Japan Strengthens

Japan’s Leading Index climbed 1.3% m/m in June to 106.1, narrowly surpassing the economist forecast of 106, according to a preliminary release from the Cabinet Office. In May, the index had improved by 0.6%. Current conditions, as measured by the Coincident Index, also improved, climbing from 116 to 116.8.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bonds

As with all investments, your capital is at risk.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account