Originally Posted, 8 November 2024 – What’s Hot: Nasdaq-100 Q3 earnings — Tech strength shines amid market uncertainties

Key Takeaways

- Strong Q3 earnings from tech giants pushed the Nasdaq-100 to record highs.

- Signs of recovery in software, with improved sales growth and revenue surprises, hint at a potential turnaround.

- Macroeconomic uncertainties linger, with inflation and Fed policy likely influencing future market direction.

- Five of the “Magnificent 7” tech giants exceeded revenue expectations, though the reported revenues are gradually aligning with market estimates.

Following the conclusion of the US presidential election, the Nasdaq-100 index rallied to reach an all-time high. This was driven by the prospect of a potentially favourable regulatory environment under the new president, along with strong Q3 earnings from major tech companies. Software companies within the index also showed signs of recovery in their recent earnings reports. However, from a macroeconomic perspective, the outlook remains mixed, and the Fed’s guidance will be closely monitored for signals on the future direction of monetary policy.

Is “Higher for Longer” still in play?1

Although the Fed implemented a 50 bps rate cut in September, rising concerns over fiscal deficits and resilient nonfarm payroll figures (with 254,000 jobs added in September). Entering November, the nonfarm payroll figure for October showed an increase of only 12,000 jobs. However, this figure was impacted by hurricane disruptions, making it less indicative of underlying trends. Further employment data in the coming months will be necessary to get a clearer view of labour market conditions.

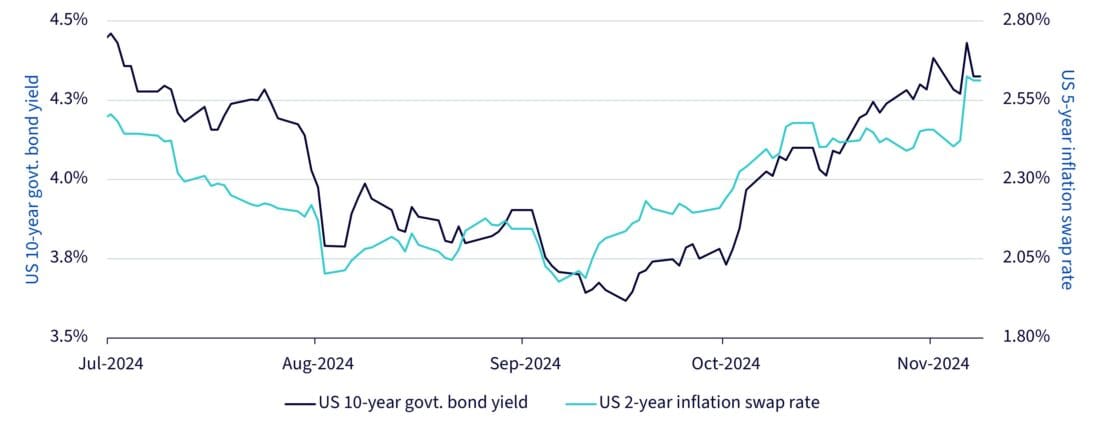

On the inflation front, September’s inflation rate, although lower than the previous month, remained steady at 2.4%—slightly above the consensus estimate of 2.3%. Following the presidential election, potential high tariffs could add upward pressure on CPI. Notably, the US 2-year inflation swap rate recently approached highest level since April, suggesting that the market is anticipating more resilient inflation ahead (Figure 1).

These pushed the US 10-year government bond yield up by over 70 bps since its mid-September low as of 07 November 2024.

While the Fed implemented a 25 bps rate cut following the election, as widely expected, the timing of further rate cuts may now need to be reassessed and could be delayed in light of these new macroeconomic dynamics.

Figure 1: US 10 year government bond yield and US 2-year inflation swap rate

Source: WisdomTree, Bloomberg, from 01 July 2024 to 07 November 2024. Historical performance is not an indication of future results and any investments may go down in value.

Index and Tech Giants’ Recent Earnings

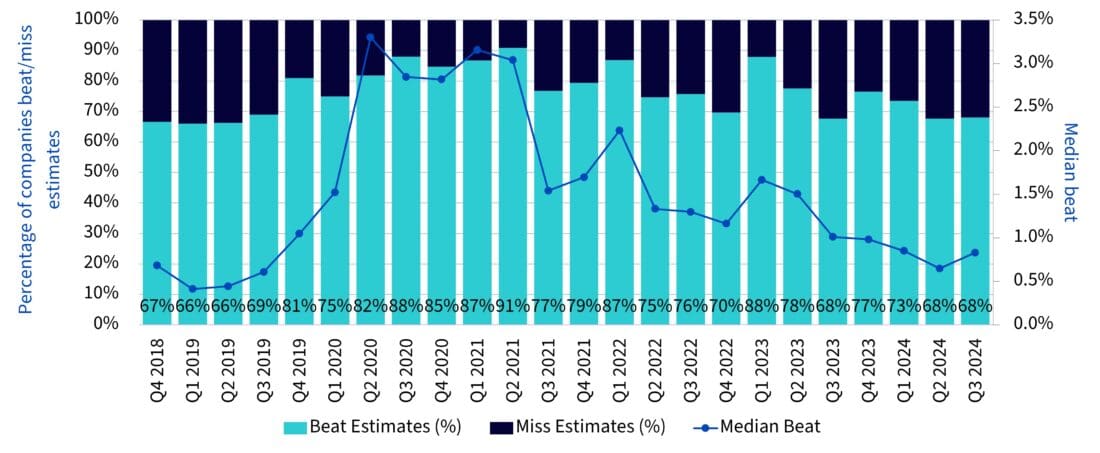

As of 7 November, 75 constituents of the Nasdaq-100 index had reported their Q3 earnings, with 68% of them delivering a positive revenue surprise against consensus estimates. The median positive surprise was 0.8%, slightly higher than Q2’s level of 0.6%, although still below the levels seen in 2022 and 2023. Among all sectors, information technology was the one with the highest percentage of companies reporting earnings above estimates in Q3 2024. Additionally, of these 75 companies, 27 provided sales guidance, and 25 reported revenue figures above their own guidance. (Figure 2a)

Figure 2a: How are companies from Nasdaq-100 index doing relative to consensus estimates (Q4 2018 to Q3 2024)

| GICS sector | Total companies | Companies reporting Q3 earnings | Companies with positive Q3 revenue surprise | % of companies with positive Q3 revenue surprise |

|---|---|---|---|---|

| Information Technology | 39 | 22 | 20 | 90.9% |

| Communication Services | 10 | 10 | 9 | 90.0% |

| Health Care | 12 | 11 | 8 | 72.7% |

| Industrials | 10 | 7 | 4 | 57.1% |

| Consumer Discretionary | 12 | 9 | 5 | 55.6% |

| Utilities | 4 | 4 | 2 | 50.0% |

| Energy | 2 | 2 | 1 | 50.0% |

| Consumer Staples | 8 | 7 | 2 | 28.6% |

| Materials | 1 | 1 | 0 | 0.0% |

| Financials | 1 | 1 | 0 | 0.0% |

| Real Estate | 1 | 1 | 0 | 0.0% |

| Total | 100 | 75 | 51 |

Source: WisdomTree, Bloomberg, as of 07 November 2024. The median beat denotes the median of volume by which reported sales exceed consensus estimates. Consensus estimates are the means of analysts’ estimated sales available on Bloomberg. The Q3 2024 data is based on the fiscal period of time that ended 30 September or 31 October 2024. Some earnings have not yet become public and typically begins to become public about one month into the future as companies report their results for the period ended 30 September or 31 October 2024. You cannot invest directly in an index. Historical performance is not an indication of future results and any investments may go down in value.

Figure 2b: How are companies from Nasdaq-100 index doing relative to consensus estimates (Q3 2024)

Source: WisdomTree, Bloomberg, as of 07 November 2024. GICS is the Global Industry Classification Standard. Consensus estimates are the means of analysts’ estimated sales available on Bloomberg. The Q3 2024 data is based on the fiscal period of time that ended 30 September or 31 October 2024. GICS Sectors represent first level classification in the Global Industry Classification Standard (GICS) hierarchy. You cannot invest directly in an index. You cannot invest directly in an index. Historical performance is not an indication of future results and any investments may go down in value.

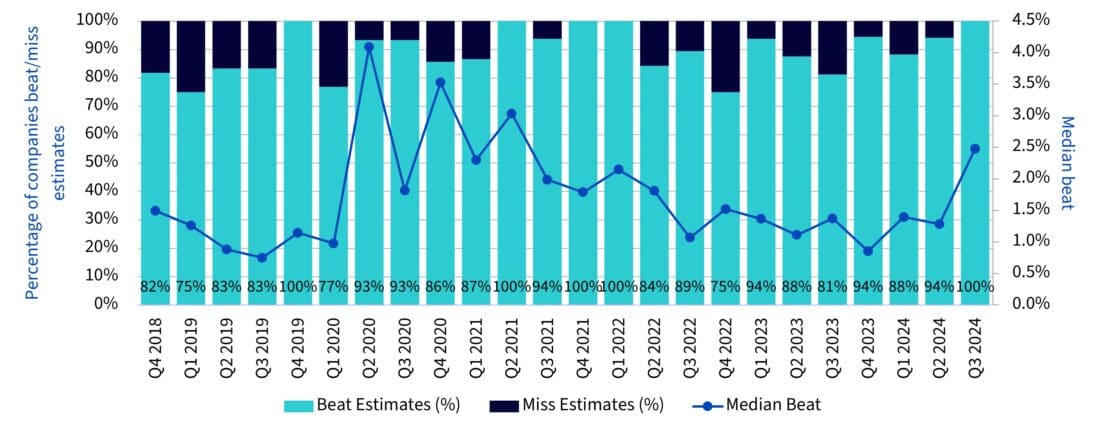

The Nasdaq-100’s performance has largely been driven by the tech giants known as the “Magnificent 72.” As of 7 November 2024, six of these companies had reported their Q3 earnings, with five exceeding consensus revenue estimates. Only Tesla’s Q3 revenue fell short of expectations. Looking back, these six companies significantly beat estimates in 2020 and 2021, when interest rates were near zero. However, as the Fed began raising rates, their revenue surprises narrowed, hovering close to zero. After Q4 2022 earnings, revenue surprises began to rebound (Figure 3a).

Nvidia’s revenue surprise tells a somewhat different story (Figure 3b). After the release of ChatGPT in November 2022, Nvidia’s revenue surprises surged, peaking with its Q2 2023 earnings before gradually decreasing to 4.2% in Q2 2024. This trend suggests that Nvidia’s sales growth is gradually aligning with market expectations, although a gap still remains. Its Q3 earnings, due to be released in November, will provide further insight into the trajectory of its revenue surprises.

Figure 3a: How are Magnificent 7 excluding Nvidia doing relative to consensus estimates (Q4 2018 to Q3 2024)

Source: WisdomTree, Bloomberg, as of 07 November 2024. Consensus estimates are the means of analysts’ estimated sales available on Bloomberg. The Q3 2024 data is based on the fiscal period of time that ended 30 September or 31 October 2024. Historical performance is not an indication of future results and any investments may go down in value.

Figure 3b: How is Nvidia doing relative to consensus estimates (Q4 2018 to Q3 2024)

Source: WisdomTree, Bloomberg, as of 07 November 2024. Consensus estimates are the means of analysts’ estimated sales available on Bloomberg. The Q3 2024 data is based on the fiscal period of time that ended 30 September or 31 October 2024. Historical performance is not an indication of future results and any investments may go down in value.

Software: Has the Recovery Begun?

Software companies enjoyed substantial sales growth during the pandemic, benefiting from low interest rates and the shift to remote work. However, they have faced challenges this year. On one hand, high interest rates have impacted their performance by increasing funding costs and compressing valuations; on the other hand, slower sales growth has weighed on the valuation of these growth-driven stocks. Additionally, concerns that AI could replace some software services have shaken investor sentiment.

Recent earnings reports, however, have provided some positive signals for software companies in the Nasdaq-100 index. Firstly, the median year-over-year sales growth has rebounded from the weak levels of the first two quarters of this year (Figure 4a), which is likely to support these growth-oriented stocks. Secondly, all software companies that have reported Q3 earnings so far have delivered a revenue surprise relative to consensus estimates, with the median revenue surprise reaching 2.1% (Figure 4b)—the highest level since Q2 2021. If this figure holds once all companies have reported, it could be a strong indicator that Q3 may represent a turning point for the software sector.

Figure 4a: Median sales YoY growth of software companies from Nasdaq-100 index (Q4 2019 to Q3 2024)

Source: WisdomTree, Bloomberg, as of 07 November 2024. Sales growth rates are based on year-over-year changes in quarterly revenue. The Q3 2024 data is based on the fiscal period of time that ended 30 September or 31 October 2024. Some earnings have not yet become public and typically begins to become public about one month into the future as companies report their results for the period ended 30 September or 31 October 2024. Software companies are classified based on GICS. You cannot invest directly in an index. Historical performance is not an indication of future results and any investments may go down in value.

Figure 4b: How are software companies from Nasdaq-100 index doing relative to consensus estimates (Q4 2018 to Q3 2024)

Source: WisdomTree, Bloomberg, as of 07 November 2024. The median beat denotes the median of volume by which reported sales exceed consensus estimates. Consensus estimates are the means of analysts’ estimated sales available on Bloomberg. The Q3 2024 data is based on the fiscal period of time that ended 30 September or 31 October 2024. Some earnings have not yet become public and typically begins to become public about one month into the future as companies report their results for the period ended 30 September or 31 October 2024. Software companies are classified based on GICS. You cannot invest directly in an index. Historical performance is not an indication of future results and any investments may go down in value.

Closing word

The Nasdaq-100’s rise to an all-time high highlights the strong earnings performance of tech giants, with potential signals of recovery emerging in the software sector. While macroeconomic uncertainties, including inflation pressures and the Fed’s future rate path, remain areas of caution, the resilience in corporate earnings provides a supportive foundation. Balancing these positive corporate signals with broader economic risks will be key to determining whether the Nasdaq-100 can build on its recent momentum in the coming quarters.

1 Returns and macro data were sourced from Bloomberg, as of 07 November 2024.

2 Magnificent 7 stocks: Apple, Alphabet, Amazon, Microsoft, Meta, Telsa, Nvidia.

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account