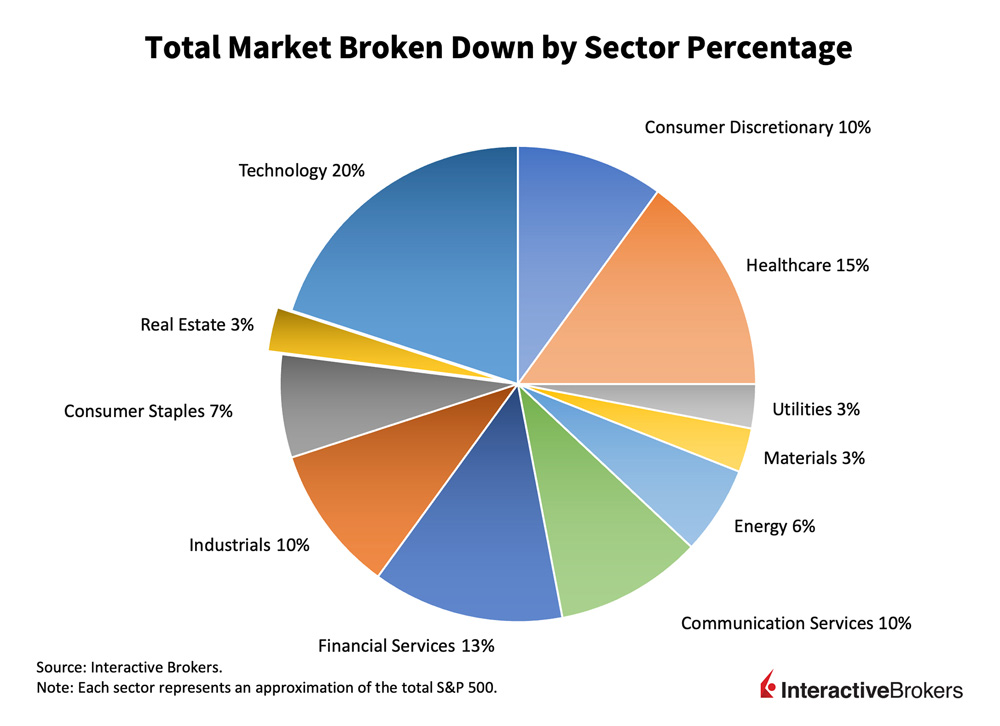

The Real Estate Sector encompasses a broad range of activities related to property ownership, development, and management. This sector is vital to the economy, providing housing, office spaces, retail outlets, and industrial facilities that support various aspects of economic activity. The Real Estate Sector is one of the smallest investable S&P sectors, comprising approximately 3% of the total market yet 15-18% of total US GDP. The GDP contribution is due to two main factors. The first is residential investment, which averages roughly 3-5% of GDP and includes construction of new single-family and multifamily structures, residential remodeling, production of manufactured homes and associated brokers’ fees. The second is consumption spending on housing services, which averages roughly 12-13% of the economy and includes gross rents and utilities by both renters and owners. Both factors include companies that can be publicly traded and attain capital gains overtime. The sector employs approximately 2.39 million people, has 257 tradeable stocks and a total market cap of $1.57 trillion. Real Estate was added as a separate Global Industry Classification Standard (GICS) sector in 2016, and most of the companies that now fall under real estate were once categorized under financials. The sector’s performance is influenced by factors such as interest rates, economic growth, and demographic trends. Despite facing challenges such as regulatory changes and market volatility, the sector remains resilient, offering investors opportunities for income generation through rental properties and capital appreciation through property value increases.

Broader Real Estate Markets:

The broader Real Estate Market is characterized by its diversity and the cyclical nature of its components. Residential real estate, including single-family homes and apartments, tends to perform well during periods of economic growth and job creation, as more individuals seek to buy or rent homes. Commercial real estate, including offices, retail spaces, and industrial properties, is closely tied to business activity and economic health, with demand fluctuating based on the strength of the economy. The sector’s performance is also influenced by the availability and cost of financing, with changes in interest rates affecting the affordability of mortgages and the attractiveness of real estate investments. However, a big part of the sector consists of Real Estate Investment Trusts (REITs), which are companies that own, operate, or finance real estate. The sector itself does not include companies that build full houses. Furthermore, the recent shift towards remote work and e-commerce has had a significant impact on the demand for certain types of commercial real estate, such as office spaces and retail outlets, while boosting demand for residential properties in suburban and rural areas.

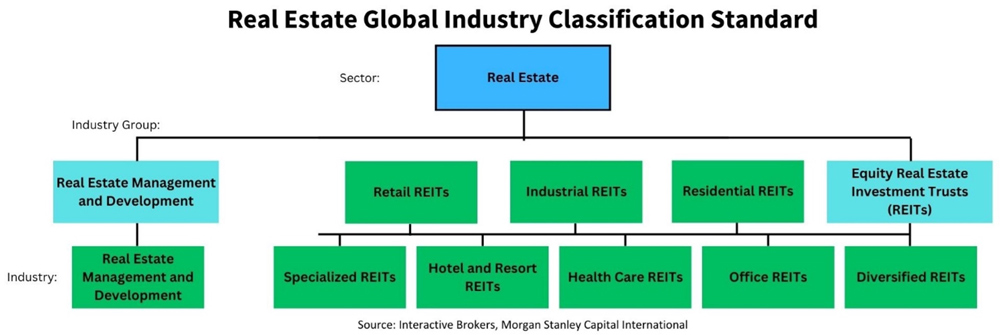

Industries Within the Real Estate Sector:

Within the umbrella of the real-estate sector, there are numerous key industry groups and industries as designated by the GICS. Under the Real Estate sector, there are two industry groups, each with industries in which the different real-estate companies operate. The Real Estate Management and Development industry group contains the industry of the same name. The companies of this industry manage and develop properties, and further include real estate services companies. These are companies that own, manage, and rent income-generating real estate properties, and distribute most of their income to shareholders and enjoy the tax advantages. As the chart shows, there are numerous different industries for the types of REITs that allow shareholders to diversify their investments within the industry group. These kinds of investments are particularly useful as they can allow one to earn income from real estate without having to buy, manage, or finance the properties themselves.

Investing in the Real Estate Sector:

The Real Estate sector is a sector of the market that can provide potential steady income for investors who are not yet ready to own and manage properties.

When investing in this sector, one can invest in traditional shares, but another popular option is to invest in REITs. Yet there are three main risks when investing in REITs. The first risk is liquidity risk; although public REITs allow investors to sell their shares on public exchanges, the investments are less liquid in comparison to bonds or stocks. There is also no secondary market for finding buyer and sellers for the property. REITs also come with leverage risk, which arises when investors decide to use borrowed money to purchase securities. This can cause the REIT to incur additional expenses and increase the fund’s losses in the case of underperformance. Lastly there is market risk, which his inherent as REITs are traded on major stock exchanges and are always subject to price movements throughout financial markets.

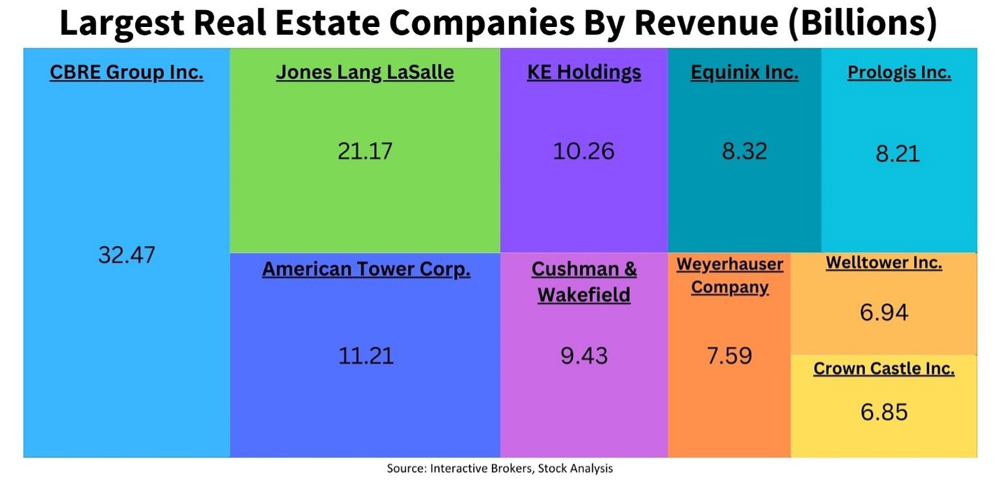

Nonetheless, investing in the Real Estate Sector can offer investors a way to diversify their portfolios and potentially generate stable income through rental properties and capital appreciation. One can invest in regular stock within the sector, yet REITs are popular because they must pay out 90% of income to investors, typically offering higher dividends than many stocks. The sector’s performance is influenced by local market conditions, economic trends, and demographic shifts, which can allow for long term growth from both stocks and REITs. Some of the largest and most popular companies that are traded within the Real Estate sector are CBRE Group Inc (CBRE), American Tower Corporation (AMT), and Cushman & Wakefield plc (CWK). If investors decide to take a more risk-averse approach, they can invest in real estate ETFs that offer more downside protection at a higher expense ratio. The Real Estate sector offers a diverse range of investment opportunities for any investor; direct ownership requires a significant upfront investment and active management, while REITs and mutual funds offer a more liquid way to invest in real estate without the need for direct property management.

Advantages and Disadvantages of Real Estate Sector Investing:

There are numerous advantages and disadvantages that one must carefully consider when deciding to invest in the Real Estate sector.

In terms of advantages, the Real Estate Sector provides investors with opportunities for stable income through rental properties and potential capital appreciation. This kind of capital appreciation can also be found through investing in REITs, which as mentioned earlier, is a slightly riskier alternative yet provides higher returns. The sector’s performance is also less correlated with the overall stock market compared to other sectors, offering a form of diversification. Real estate assets can serve as a hedge against inflation, as rents and property values tend to increase alongside economic expansion. This then translates into higher capital values, and instead passes some of the inflationary pressures onto those who rent the properties.

However, investing in real estate can be illiquid, particularly for direct property investments, and requires a significant upfront investment. The sector is also subject to local market conditions, making it more vulnerable to economic downturns in specific regions. Regulatory changes and zoning laws can impact the viability and profitability of real estate investments. Furthermore, if one were to own property instead of investing in REITs, the management of real estate properties can be time-consuming and requires expertise in property management and legal matters. Even so, there are tax consequences when investing in REITs, as investors are required to declare divided distributions received from REITs when filing taxes, and they are taxed at the investor’s top marginal tax rate.

Future Outlook and Opportunities:

The Real Estate Sector is poised forpotential growth, driven by demographic trends, urbanization, and the increasing demand for housing and commercial spaces. The sector’s future will likely be shaped by technological advancements, such as blockchain for property transactions and smart home technologies, which can enhance efficiency and security. The shift towards more sustainable living and working arrangements, such as co-working spaces and eco-friendly buildings, is also expected to influence the demand for certain types of real estate. The sector’s long-term prospects are also influenced by the need for infrastructure development and the growth of emerging markets.

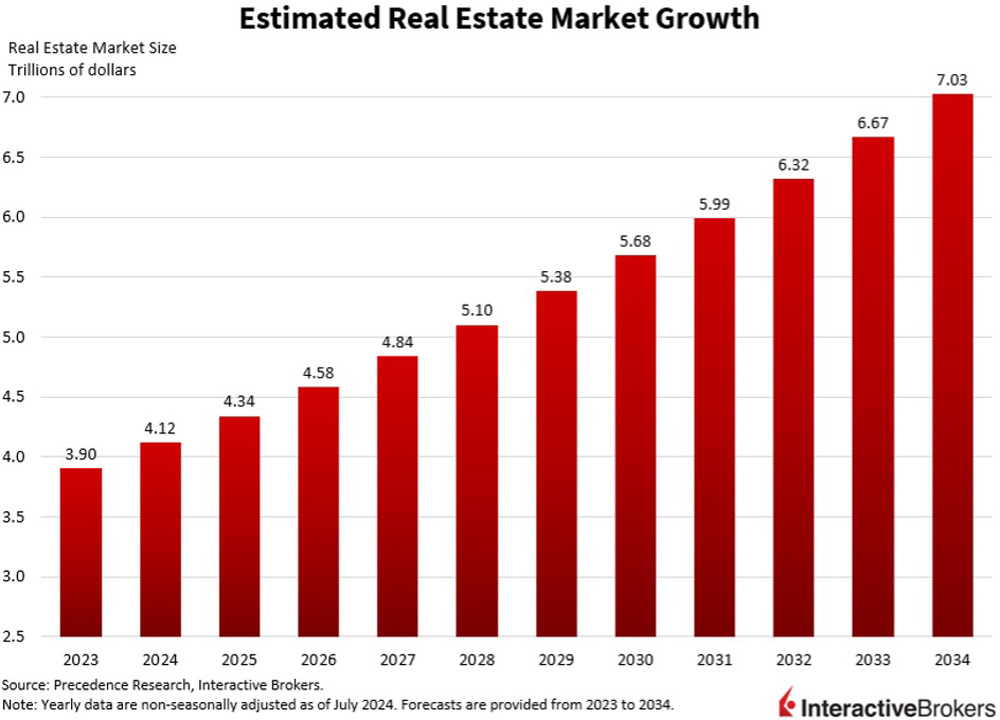

The global real estate market reached $3.9 trillion in 2023 and is aimed to reach $7.03 trillion by 2034 at a compounded annual growth rate of 5.5%. While property is highly valued in the United States and North America, Asia-Pacific markets contribute to almost 40% of the global market revenue share.

The Real Estate Sector offers a complex and rewarding investment landscape, characterized by its stability, income generation potential, and the challenges and opportunities presented by demographic and technological changes. By navigating the sector’s unique challenges and opportunities, investors can position themselves to benefit from its growth and resilience.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account