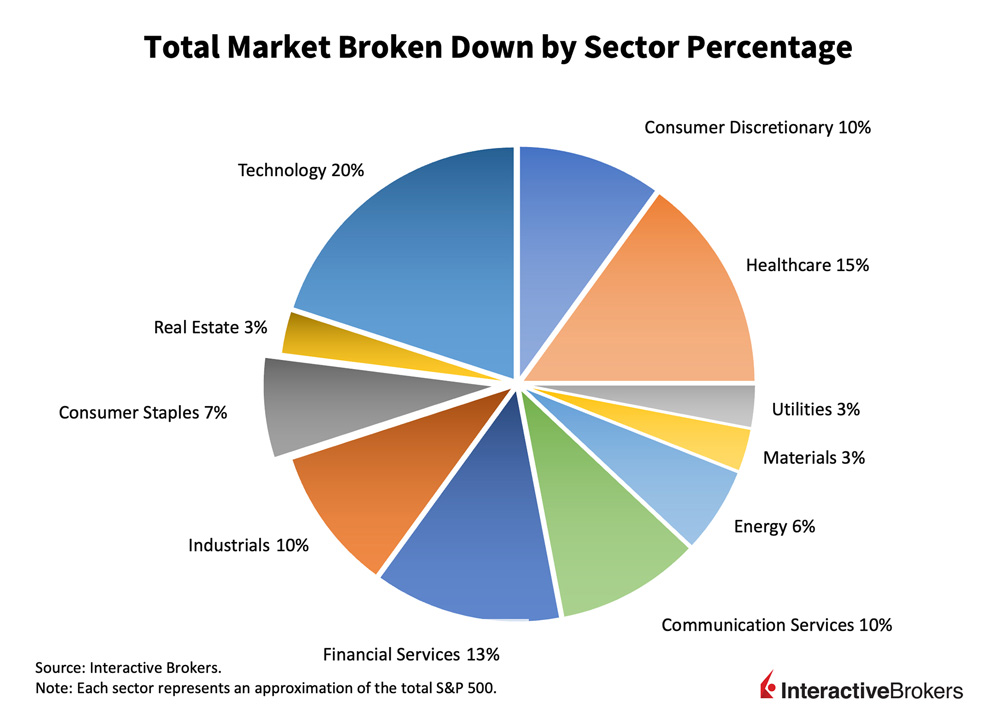

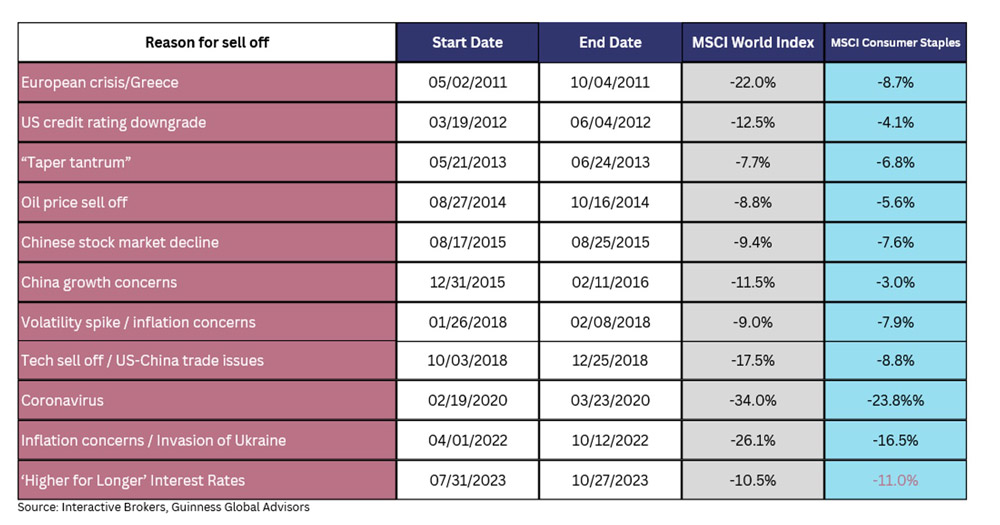

The Consumer Staples Sector consists of essential products that are used by households on a daily basis. This includes food, beverages, household goods, hygiene products, alcohol, tobacco, and more. This sector is considered defensive because its products are typically consumed regularly, regardless of economic conditions. This is exemplified through the first 8 months of 2022, while the S&P 500 was down 17%, consumer staples were only down a mere 3.98%. Out of the eleven sectors that comprise the economy, Consumer Staples is the fourth smallest. As of 2022, the sector represented 7% of the total market. According to the latest data, the Consumer Staples Sector represents approximately 10% of the total market capitalization and contributes significantly to the US GDP, reflecting its essential role in daily life and the economy. The sector’s growth in recent years has been modest, averaging around 2.5% annually, slightly below the broader market’s growth rate. This slower pace is attributed to the mature nature of the sector and the competitive landscape, which limits pricing power for many companies. However, the sector remains resilient, providing a steady stream of income and a safe haven for investors seeking stability in their portfolios.

Broader Consumer Staples Markets:

The broader Consumer Staples Market is characterized by its stability and predictability, with demand for its products being relatively insensitive to economic fluctuations. However, it underperformed in 2023 because many investors favored mega-cap growth companies (especially ones tied to artificial intelligence) over more defensive stocks. Higher interest rates also drew investors in the direction of fixed income rather than dividend-paying stocks, which contributed to the sector’s low numbers. Furthermore, companies within the sector offered more discounts in an attempt to salvage challenged consumers as a result of inflation. However, this slowed their price increases and led to decelerating revenue growth, reflecting poorly on consumer staples stocks. More broadly, the sector’s performance is influenced heavily by factors like inflation, exchange rates, and changes in consumer behavior. For instance, the tobacco industry faces challenges due to health awareness campaigns and regulatory restrictions, impacting its growth trajectory. The sector’s profitability is also affected by input costs, particularly for agricultural commodities, which can vary significantly based on weather conditions and global supply-demand dynamics.

Industries Within the Consumer Staples Sector:

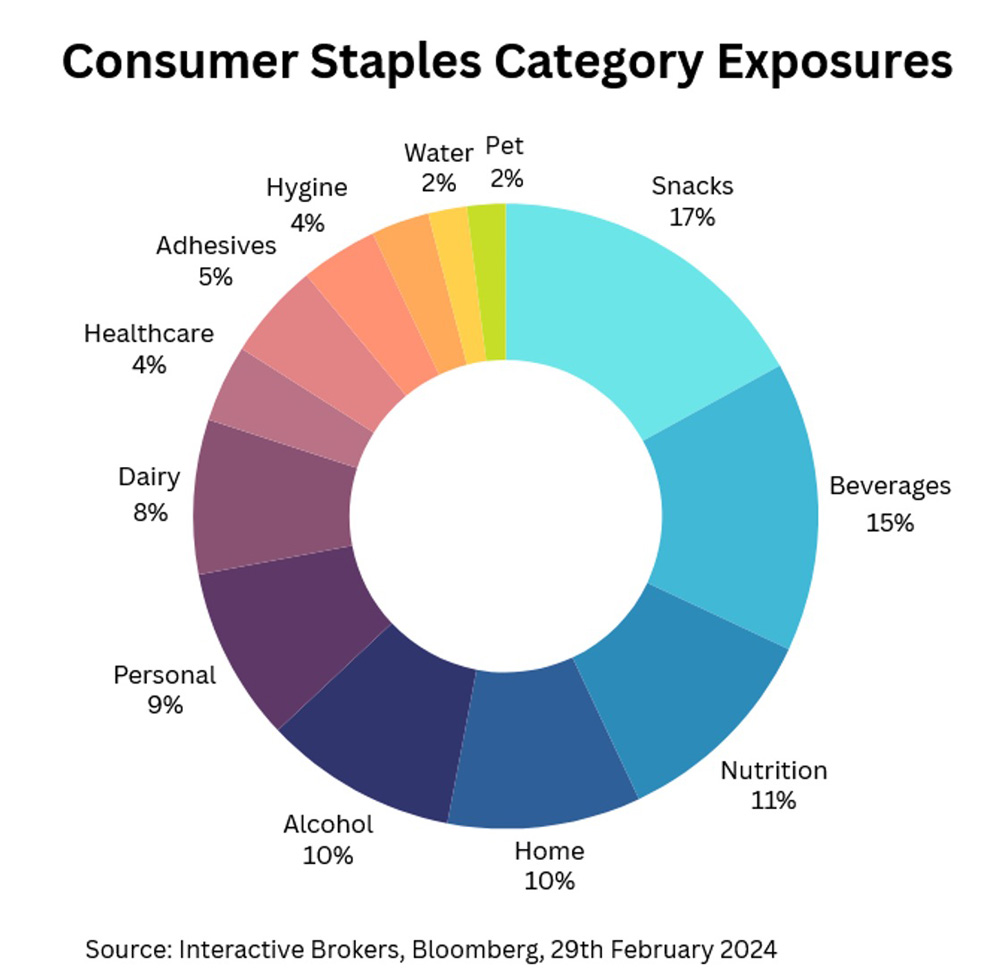

The Consumer Staples Sector is segmented into several key industries, as follows:

– Food and Beverage: This segment includes companies that produce, distribute, and sell food and beverage products. Such as packaged foods, snacks, sodas, and alcoholic beverages. It is the most well-known classification of consumer goods considering customers will always purchase food and beverage products regardless of the status of the economy. It is highly fragmented, with large multinational corporations competing alongside smaller regional brands. Innovation in product offerings and marketing strategies is crucial for gaining market share in this competitive environment.

– Personal Products: This segment encompasses companies that manufacture and sell personal care, hygiene, and cosmetic products that people use on a daily basis. Companies in this segment produce products like makeup, skincare, soap, deodorant, razors, and shaving cream. It is characterized by strong brand loyalty and includes both mass-market and premium brands. The industry is increasingly focusing on natural ingredients and sustainability in response to consumer preferences.

– Household Products: This industry involves companies that manufacture household supplies, paper products, and cleaning-related products. It is essential in that people tend to purchase toothpaste, commercial bleach, detergent, bandages, and more throughout the year. It is marked by high competition and low switching costs for consumers, necessitating continuous innovation and differentiation.

Investing in the Consumer Staples Sector:

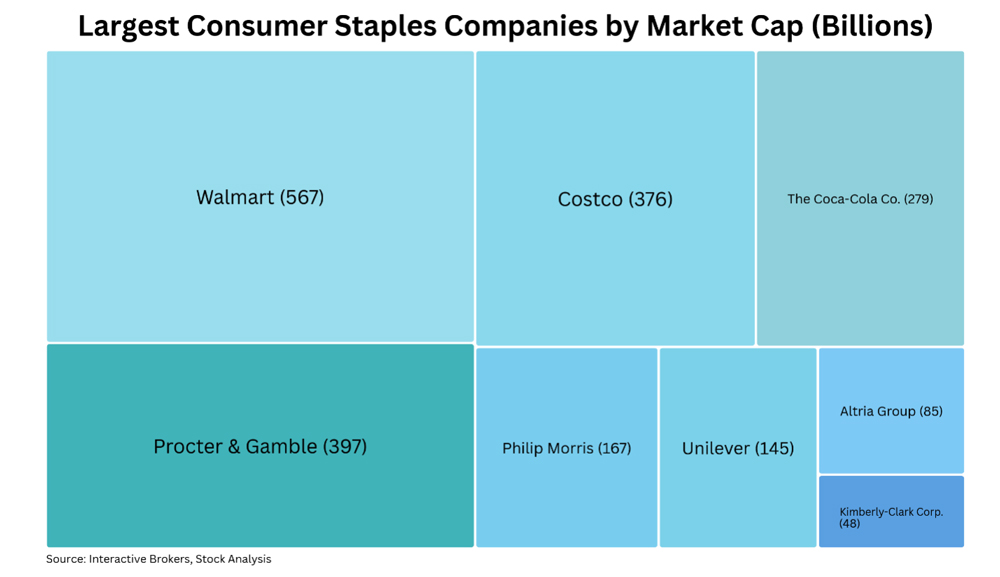

Investing in the Consumer Staples Sector can offer investors a way to generate steady income and protect against inflation. The sector’s defensive nature makes it an attractive option during uncertain economic times, as its products are essential and less susceptible to economic downturns. In fact, demand for certain Consumer Staples products like food, alcohol, and tobacco sometimes tend to increase during bear markets. One might look to redirect their investing to this sector if they think that growth is slowing materially or if the economy is heading towards a recession. However, investors must be mindful of the sector’s slow growth rate and the challenges posed by changing consumer preferences and regulatory environments. Diversification across different sub-sectors and regions can help mitigate risks and enhance returns. Key industry players within the sector include Procter & Gamble (PG), Costco (COST), Kimberly-Clark Corp. (KMB), Philip Morris International Inc (PM), Walmart Inc (WMT), Coca-Cola Co., (KO), Unilever (UL), and Nestle S.A. (NSRGY), which offer exposure to various segments of the consumer staples market.

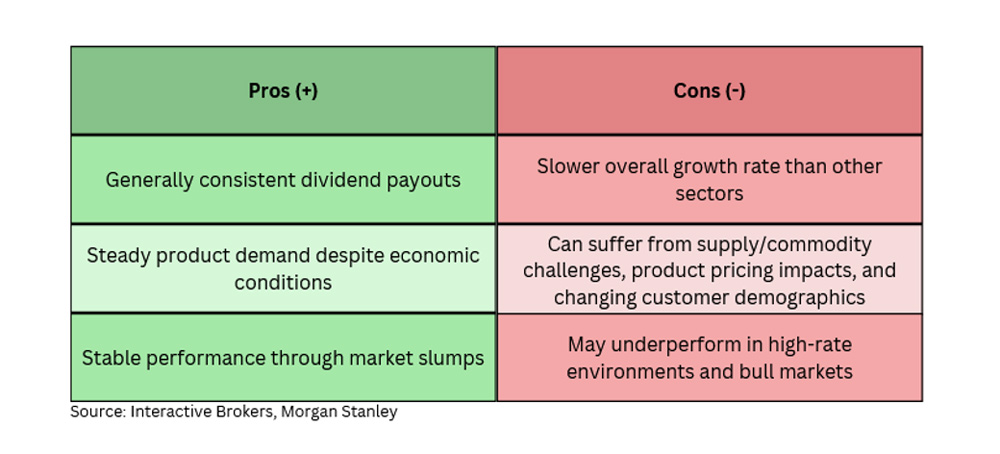

Advantages and Disadvantages of Consumer Staples Sector Investing:

On the upside, the Consumer Staples Sector provides a reliable source of income and a buffer against inflation, due to the inelastic demand for its products. They are able to bring balance to a portfolio since they tend to perform in a way that is counter to the consumer discretionary sector in market recessions. Moreover, the sector’s dividend yields are generally higher than the broader market, offering an attractive stream of income for investors. As of August 31, 2023, consumer staples offered a tidy 2.64% average dividend yield, whereas the S&P 500 had a 1.7% yield. Due to its slow and steady character, consumers staples stocks can continue to pay dividends through recessionary periods in addition to continuing to increase their payouts. Consumer Staples has also outperformed the S&P 500 during the last three recessionary periods.

However, since they are not as volatile as other investments, they also don’t return as much during periods of steady growth. Additionally, its performance can be negatively impacted by rising input costs and regulatory changes. The sector’s reliance on mature markets presents challenges in achieving significant top-line growth. Investors must balance the sector’s stability with its slower growth potential and the risks associated with changing consumer behaviors and market dynamics.

Future Outlook and Opportunities:

After a turbulent 2023, the Consumer Staples Sector is predicted to make a rebound into 2024. Valuations in the sector are predicted to look compelling against broader market and sector history, relatively speaking. Representatives from the global provider of financial news, Bloomberg, believe that consumer staples companies should be well positioned to benefit in the coming years. Driven by demographic trends, urbanization, and the increasing middle class in developing countries, food and beverage companies expect price increases to moderate and food inflation to tick down. The lower pace of price increases and a more stable macro environment will help thwart the three years of volume decreases within the sector. If volumes rise, consumer staples companies will feel less pressure to ease prices, which would in turn help profit margins. Therefore, companies that can raise prices or hold them steady are likely to meet profit margin forecasts in the future.

Balance sheet health, specifically debt reduction, is expected to be a large focus across the sector. In 2023, debt became a huge issue in America, with non-financial companies in the S&P 500 having $108 billion in debt maturing at an average interest rate of 2.8%. However, many consumer staples companies are planning to address this issue in the year ahead. PepsiCo and General Mills used much of their free cash flow in 2023 to repurchase stock and pay dividends. T

hey are both predicted to step up on their debt repayment in 2024. Likewise, many companies have been concentrating on generating cash flow and improving their EBITDA to help reach net leverage targets.

Generally, a greater emphasis on sustainability and health consciousness are expected to shape the sector’s future. The shift towards online shopping and e-commerce is also transforming the distribution channels for consumer staples, creating new opportunities for growth and efficiency improvements. While the sector faces challenges such as rising operating costs and regulatory scrutiny, its essential nature ensures its relevance and resilience in the face of economic fluctuations.

Consumer Staples Sector offers a blend of stability and income generation, making it an important component of diversified portfolios. By understanding the sector’s dynamics and keeping abreast of consumer trends and regulatory changes, investors can navigate the sector’s complexities and seize opportunities for growth and income.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account