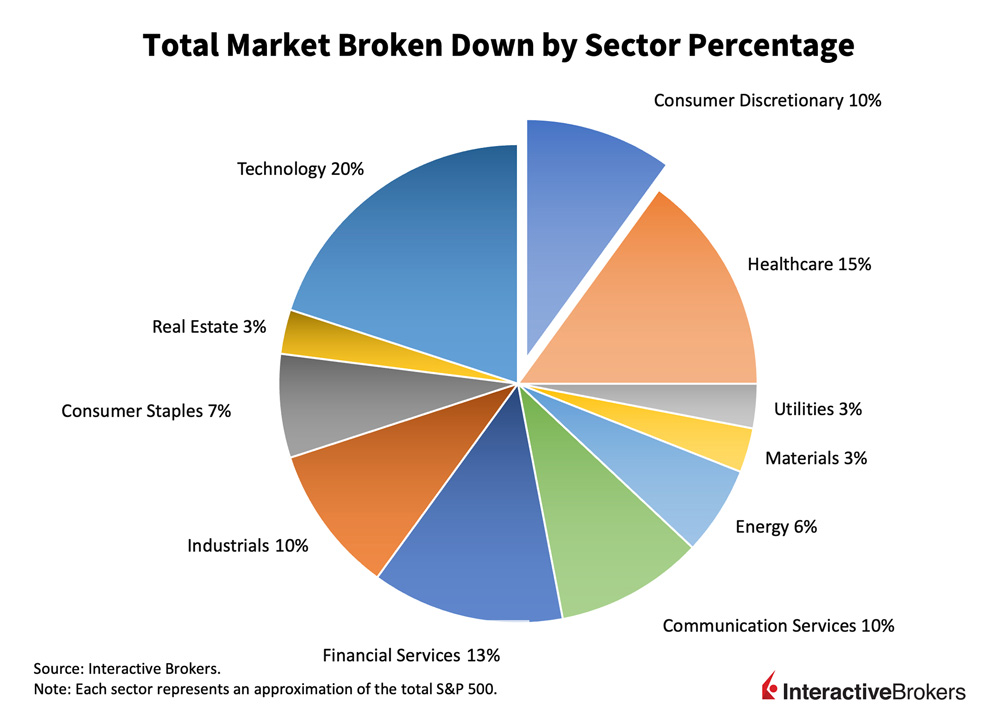

Discretionary spending is the purchase of non-essential items that consumers can survive without, as opposed to consumer staples which are items that consumers must purchase to survive, whether the economy is good or bad. The Consumer Discretionary sector is one of the eleven sectors of the US economy and represents a significant portion of consumer spending on non-essential goods and services. The sector is highly impacted by economic cycles as the purchase of items within it is directly related to disposable income and high employment, and how much people are willing to spend when economically comfortable. As of 2022, this sector accounts for approximately 10% of the total market and contributes about 11.8% to US GDP. From 2021 to 2022, the sector expanded by 5.5%, reaching a valuation of $3.5 trillion or $10,789 per capita. In 2022, 22.3 million people aged 16 and older were employed in jobs related to the consumer discretionary sector, making up 13.8% of total employment in the US. Investing in the Consumer Discretionary sector is highly appealing to investors due to its cyclical nature and inherent relationship to consumer confidence and disposable income levels. Since it is one of the largest sectors in the market, it is comprised of 578 stocks with a total market cap of $7.458 trillion. Despite global economic uncertainties, such as the impact of the COVID-19 pandemic, the sector remains resilient as the demand for discretionary items can outlast periods of economic recession.

Broader Consumer Discretionary Markets:

The broader markets within the Consumer Discretionary sector have witnessed considerable growth and dynamism over the past few years, with consumer spending surpassing $6 trillion, according to the Federal Reserve Bank of St. Louis’ latest report on consumer spending. This growth indicates a strong consumer sentiment and the ability of businesses within the sector to innovate and adapt to changing consumer preferences. The rise in consumer spending has outpaced general economic growth, highlighting the sector’s importance in driving economic activity. Notably, the consumer discretionary spending category, which encompasses items like automobiles, entertainment, and dining, saw a 6.3% year-over-year growth in Q2 2024, propelled by factors such as improved consumer confidence and the easing of pandemic-related restrictions.

Moreover, the consumer discretionary price growth reached a five-year record high, suggesting a period of inflationary pressures within the sector. This surge in prices affects both retailers and manufacturers, influencing the pricing strategies and profitability of companies in the sector. The job market within the consumer discretionary sector also reflects its vibrancy, with numerous positions available across various sub-sectors, catering to the evolving needs and preferences of consumers.

The Industries of the Consumer Discretionary Sector:

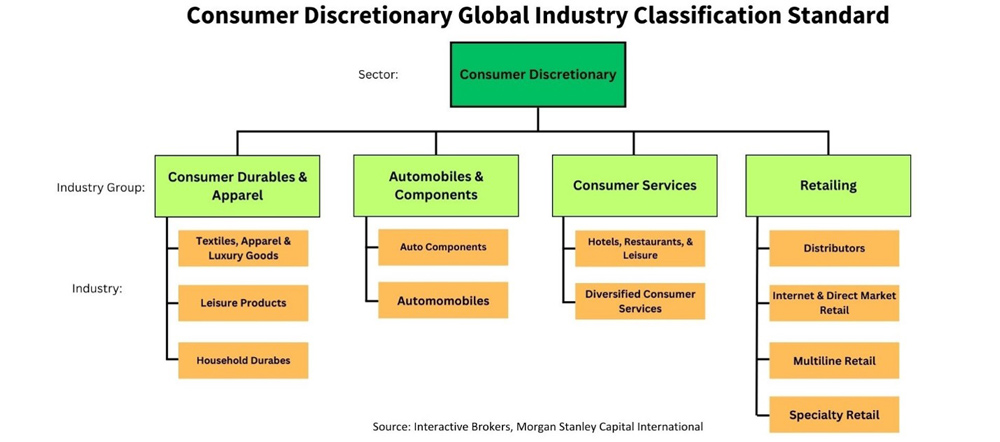

Underneath the umbrella of the Consumer Discretionary sector, there are numerous industry groups and industries that encompass hundreds of different companies. The first industry group is Consumer Goods and Apparel, under which are the industries and companies that create textiles, produce clothing and luxury items, and furnish household durables. The second industry group is Automobiles & Components, under which are the industries and companies that that produce and sell vehicles and their components, including cars, trucks, and motorcycles. The Consumer Services industry group contains the industries and companies that design, manufacture, and sell electronic devices and appliances, such as smartphones, televisions, and home appliances, and also includes hotels, restaurants, and leisure services. Lastly, the Retailing industry group encompasses businesses that sell a wide range of goods directly to consumers through physical stores, online platforms, or mail order catalogs.

Investing in the Consumer Discretionary Sector:

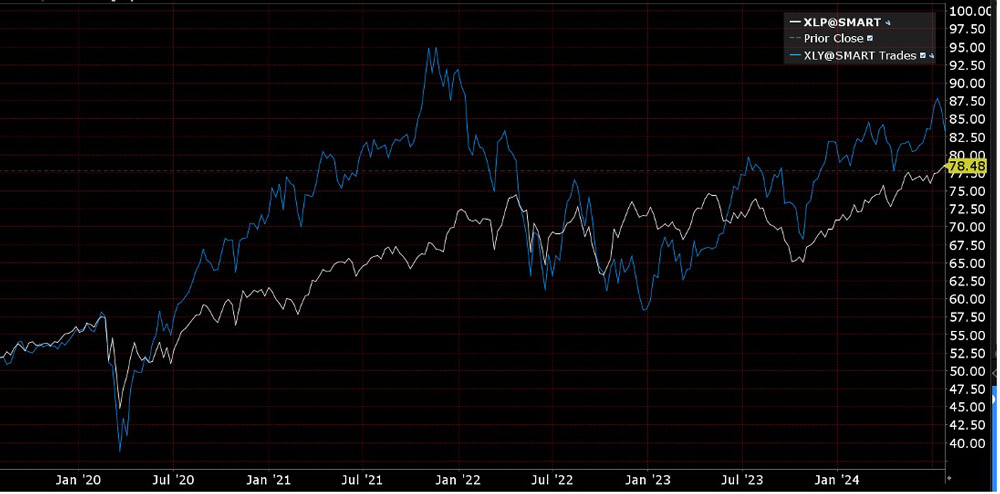

The Consumer Discretionary is widely considered a volatile sector, yet has high potential for capital gains. Since goods within the sector are elastic, which means they will be purchased when the economy is performing well and not purchased otherwise, it is important to time investments to align with positive economic performance.

It is first necessary to establish the risks when investing in this sector. The sector is closely tied to consumer spending, and thus is very cyclical. When the economy is strong, consumers are more likely to spend more or leisurely goods, but when the economy slips, consumers earn less and limit their spending. This comes with three main risks. The first is demand risk; within the sector, investors are constantly wondering whether there is enough demand for discretionary goods, and whether demand can be sustained. Lower demand equates to lower earnings and threatens investments in the sector. There are also supply chain risks within this sector, as even though supply chain shortages give retailers pricing power, it also means that companies might not have access to adequate amounts of product – this is especially concerning during the holiday season. There is also labor shortage risk within this sector, as the companies comprising it are often comprised of lower-wage jobs that have trouble attracting employees. Some companies may try offering higher wages, yet this adds to overhead costs and may affect investors. Additionally, the sector is susceptible to external shocks, such as changes in interest rates and exchange rates, which can affect consumer purchasing power and corporate earnings.

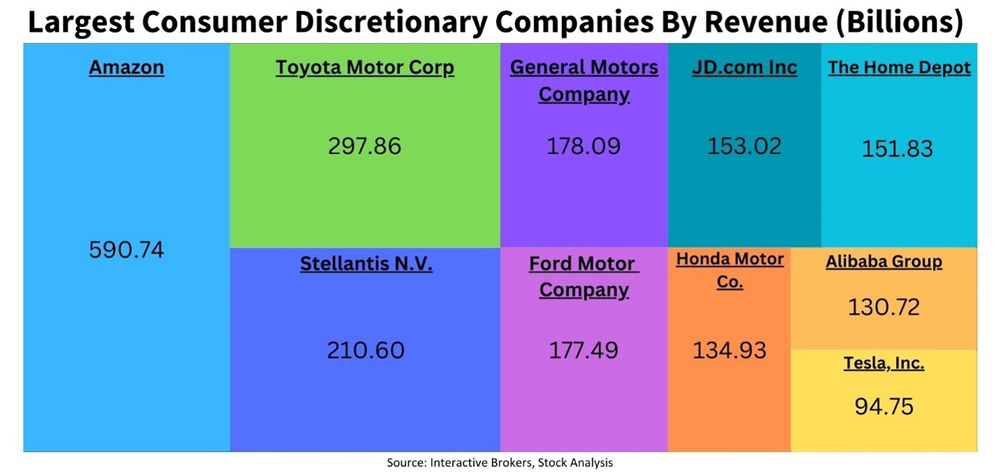

Despite the risks, the sector can be very lucrative. Investing in the Consumer Discretionary sector offers opportunities for capital appreciation and income generation, given its exposure to consumer spending patterns. The sector’s cyclical nature makes it responsive to changes in the economy, allowing investors to capitalize on periods of economic growth and downturns. Companies in the sector are also known to perform very well, some of the largest including Amazon.com Inc. (AMZN), Toyota Motor Corporation (TM), and Tesla (TSLA). These companies represent a mix of traditional automakers, tech giants, media conglomerates, and e-commerce leaders that dominate the consumer discretionary space.

Advantages and Disadvantages of Consumer Discretionary Sector Investing:

There are numerous advantages and disadvantages to investing in Consumer Discretionary companies that one must carefully consider when deciding to invest in the sector.

In terms of advantages, there is significant potential for high returns due to the sector’s sensitivity to economic cycles and consumer sentiment. The sector’s diversity ensures that there are opportunities across various sub-sectors and geographies, allowing for portfolio diversification and stable profit if investing in an ETF or mutual fund. Moreover, the sector’s growth is supported by underlying favorable demographic trends, such as rising incomes and urbanization, which enhance consumer spending power. Tesla is a famously successful stock within the sector, as the value of the shares have increased significantly during the last 5 years as the idea of electric vehicles has come to fruition.

However, the sector also faces challenges, such as the risk of oversupply in certain product categories, competition from emerging technologies, and the impact of environmental concerns on consumer behavior. Additionally, geopolitical events and trade tensions can disrupt supply chains and affect the cost of goods, posing risks to investor returns. These risks can be further heightened at certain times of the year; for example, Consumer discretionary was the highest-risk sector is Q4 2023, exacerbated by rising interest rates, supply shocks, and global shortages during the holiday season.

Future Outlook and Opportunities:

Looking ahead, the Consumer Discretionary sector is poised for growth, driven by factors such as technological advancements, changing consumer behaviors, and the rebound in travel and leisure activities post-pandemic. The sector is expected to benefit from the continued digital transformation, with e-commerce and online streaming services leading the way in consumer spending. Additionally, the shift towards sustainable and eco-friendly products is likely to influence consumer choices, creating opportunities for companies that can adapt to these trends. The sector has experienced a compounded annual growth rate of around 14% over the last 10 years and is expected to remain between 9% and 14% over the next ten.

The Consumer Discretionary sector offers compelling investment opportunities, but it’s essential for investors to understand the sector’s dynamics, including its cyclicality and the risks associated with consumer behavior and economic conditions. By doing so, investors can position themselves to take advantage of the sector’s growth prospects while managing the inherent risks and capitalizing on the potential returns.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account