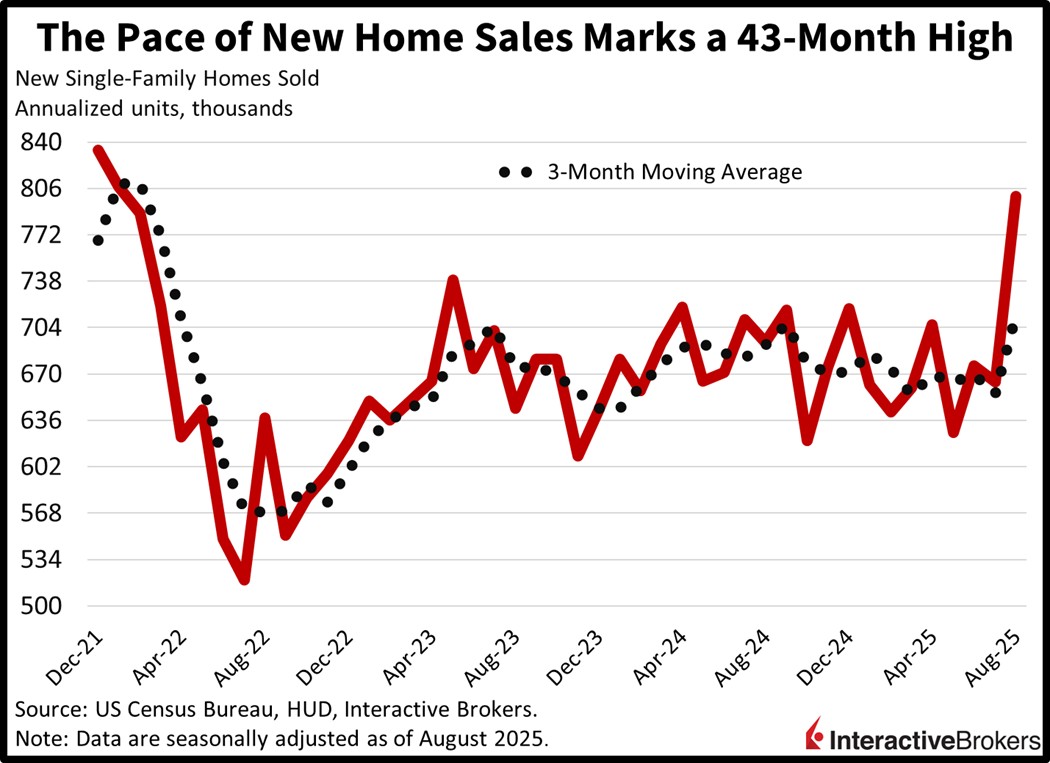

Stocks are drifting lower for the second consecutive day after yesterday’s comments from Fed Chair Powell included his opinion of overvalued equity prices, which sparked intraday volatility. Additionally, his balanced approach to inflation and employment risks was not what Treasury bulls wanted, since an increased focus on the health of payrolls would have bolstered rate cut optimism. Still, major benchmarks are only off their all-time highs by about 1% and the turbulence has been generally characterized by profit-taking rather than panic selling. Similarly, the yield curve is only ascending by a few basis points, although the move north is being led by duration in bear steepening fashion, as increases at the long end exceed those at the shorter tenors. Part of that jump was motivated by a 43-month high in new home sales, helped by plunging mortgage costs. The strong report also featured depleting inventories and loftier values, conditions that point to a potential recovery in the real estate sector and are consistent with the reacceleration theme. Elsewhere, the greenback is catching bids on heavier domestic credit, while volatility protection instruments, and the commodity complex ex gold and copper additionally experience interest.

New Home Sales Stage Ferocious Rebound

Plunging mortgage rates have finally produced the ferocious rebound in residential transactions that we’ve anticipated. Indeed, the pace of New Home Sales soared to a 43-month high last month as inventories sank and prices increased. The 800k seasonally adjusted annualized units (SAAU) were up 20.5% month over month (m/m), flying past expectations of 650k and coming in well above the 664k in July. All regions were strong, with the Northeast, South, Midwest and West gaining 72.2%, 24.7%, 12.7% and 5.6% m/m. Median and average closing values climbed from $395.1k and $478.2k to $413.5k and $534.1k and the supply ratio dropped to 7.4 months, the lowest in over two years, or since July 2023.

Past performance does not guarantee future results.

Labor Market Needs Support from the Fed

Chair Powell’s presentation yesterday was very balanced in my opinion, but it didn’t focus enough on the June loss of 13k jobs. Despite the fact that the Fed’s preferred price pressure gauge will reflect above-target inflation this Friday, monetary policymakers should be much more concerned about payrolls. The mid to high 2s on the Personal Consumption Expenditures Price Index is not a terrible place for the central bank’s dual mandate when considering softening employment conditions. The labor market needs more cuts to support the rate sensitive, cyclically oriented areas of the economy, namely real estate, manufacturing and small business. As far as Powell’s comments that stock prices are fairly highly valued, the composition of the equity market has changed significantly, making traditional valuation metrics no longer applicable. Given the consistent, stable growth of the firms driving the expansion, multiples don’t look pricey if you calculate a ratio based on the next three years of projected earnings rather than the coming 12 months.

International Roundup

Japan PMI Weakens

The September Flash Japan Composite PMI Output Index fell from a six-month high of 52 in August to 51 with manufacturing contracting at an accelerated pace while growth in the services industry slowed. The Flash Japan Manufacturing and Manufacturing Output PMIs sank from 49.7 and 49.8 to 48.4 and 47.3, slipping further below the contraction-expansion threshold of 50. The services version of the PMI stayed within the expansion territory but weakened from 53.1 to 53.

Overall growth was the slowest in four months, according to the Composite PMI, with new work expanding at only a marginal rate. Employment continued to increase, but at the slowest pace in four months. International trade was a considerable factor with new export business contracting for the sixth consecutive month. Both manufacturers and services providers reported weaker demand for foreign customers. Regarding labor, marginally bigger services-sector payrolls helped to offset a drop in factory staffing, but employment growth hit the slowest rate in two years. Also in the latest report, input costs and selling prices across manufacturing and services increased. Price pressures were driven primarily by higher labor costs, raw materials and fuel.

Australia Inflation Dampens Optimism for Rate Cut

Price pressures in Australia accelerated in August to a 13-month high, causing investors to become less optimistic that the Reserve Bank of Australia (RBA) will cut its key interest rate next week. The Weighted Mean Consumer Price Index was up 3% year over year (y/y), according to the Australian Bureau of Statistics. The print was hotter than both the economist consensus estimate of 2.9% and July’s 2.8% result. When excluding items with volatile prices, the gauge was up 3.4% y/y following the 3.2% rise in July. Within the headline, alcohol and tobacco, with a 6% gain, led price pressures. Additionally, housing costs climbed 4.5%, and the food and non-alcoholic beverages category was up 3%. Shelter costs escalated due to a 24.6% y/y hike in electricity rates due to government rebates expiring. Excluding that factor, electricity was up 5.9%. The RBA’s current key rate is 3.6% and today’s data has caused investors to lower their expectation for the central bank to ease its monetary policy next week.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account