Markets are cautious as the Fed kicks off its two-day meeting today with a decision on rates scheduled for tomorrow afternoon alongside the committee’s dot-plot and statement. Stocks did reach another fresh record in early trading before retreating into losses, however, as favorable economic data supported the view that the expansion has legs. Indeed, retail sales are trending at their strongest levels of 2025, as three consecutive months of consumer spending strength point to a second-half reacceleration against the backdrop of shoppers that are underpinned by robust asset valuations and labor conditions that remain solid despite this year’s deceleration. Industrial production also pointed to buoyancy in the manufacturing sector and that indicator is close to breaching its all-time high from June, but the real estate space was not a source of optimism. The recent plunge in mortgage yields has failed to inspire enthusiasm, as immigration restrictiveness and lofty costs keep prospective buyers at bay, evidenced by homebuilder sentiment hovering in miserable territory. Still, investors are delaying any significant investment determinations until they hear from the central bank.

Equities are declining across all major domestic benchmarks and Treasuries are near their flatlines throughout the curve. Elsewhere, the greenback is sinking on monetary policy independence concerns, volatility protection instruments are experiencing demand as well as forecast contracts and energy commodities, which are catching bids due to declining supply prospects as Washington pressures other nations to punish Moscow with tariffs for its war on Kyiv. Silver, copper, lumber and gold are descending while bitcoin is steady.

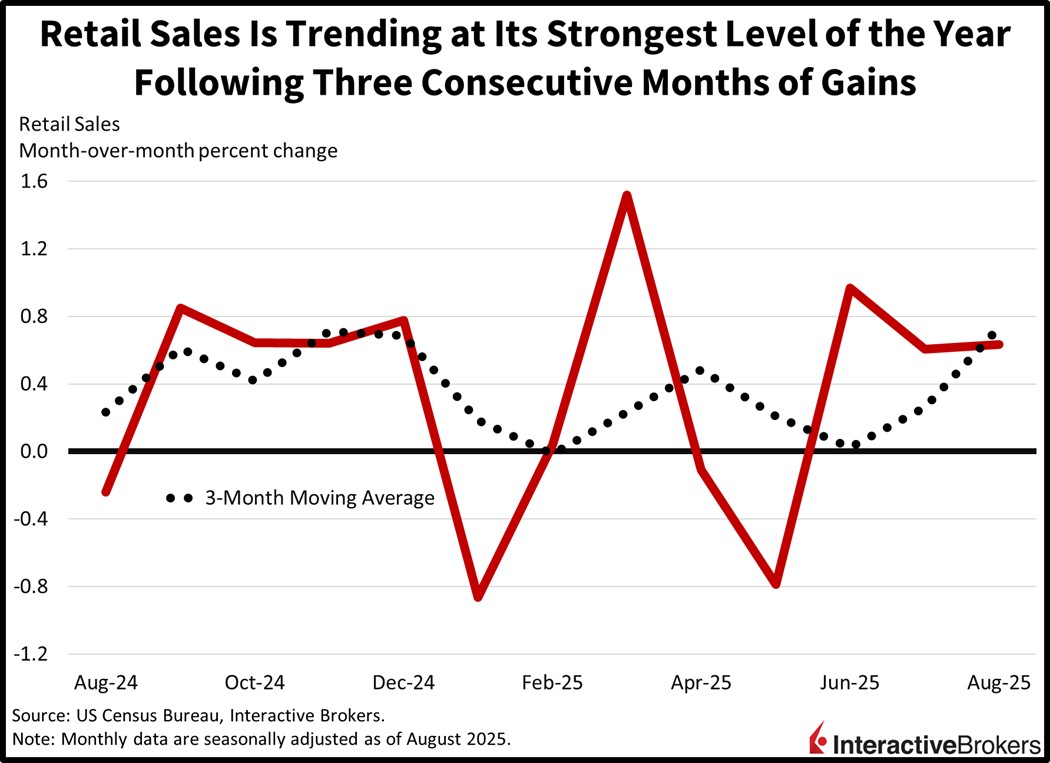

Consumer Spending Signals Reacceleration

Consumer spending remained buoyant throughout the summer with this morning’s data release representing the third consecutive month of strength. The momentum is especially impressive considering lingering inflation and decelerating labor conditions, and it is supporting confidence that robust capital markets and subdued unemployment are enough to keep the cycle on solid footing. Retail sales expanded 0.6% month over month (m/m) in August, exceeding the 0.3% median estimate while maintaining the same pace as July. The majority of categories sported m/m gains as described in the following:

- Ecommerce, 2%

- Apparel, 1%

- Sporting goods, 0.8%,

- Dining/drinking, 0.7%

- Automobiles, 0.5%

- Gasoline, 0.5% m/m.

- Electronics, 0.3%

- Groceries, 0.3%

- Building materials 0.1%

Curbing the overall gain were the miscellaneous stores, furniture showrooms, general merchandise retailers and health/personal care suppliers categories with transactions retreating 1.1%, 0.3%, 0.1% and 0.1%.

Past performance is not indicative of future results

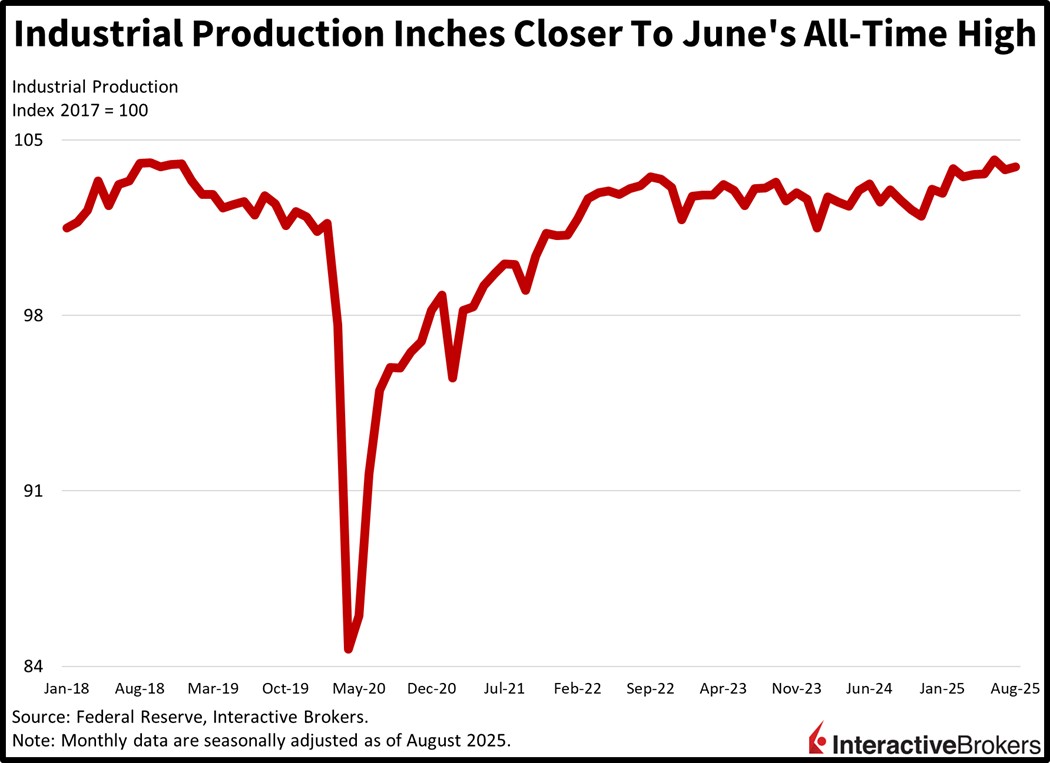

Industrial Production Reverses from July Decline

Industrial production rebounded last month, but the bounce failed to fully offset the meaningful July decline. The overall result marched north 0.1% m/m, better than the projected -0.1% and an improvement from July’s -0.4%. The mining and manufacturing categories expanded 0.9% and 0.2%, respectively, and countered the 2% m/m contraction in utilities. Across major market groups, construction supplies, consumer goods and materials advanced 0.6%, 0.4% and 0.1%, while nonindustrial materials and business equipment descended 0.1% each. This morning’s headline index value of 103.92 remains near June’s all-time high figure of 104.21.

Past performance is not indicative of future results

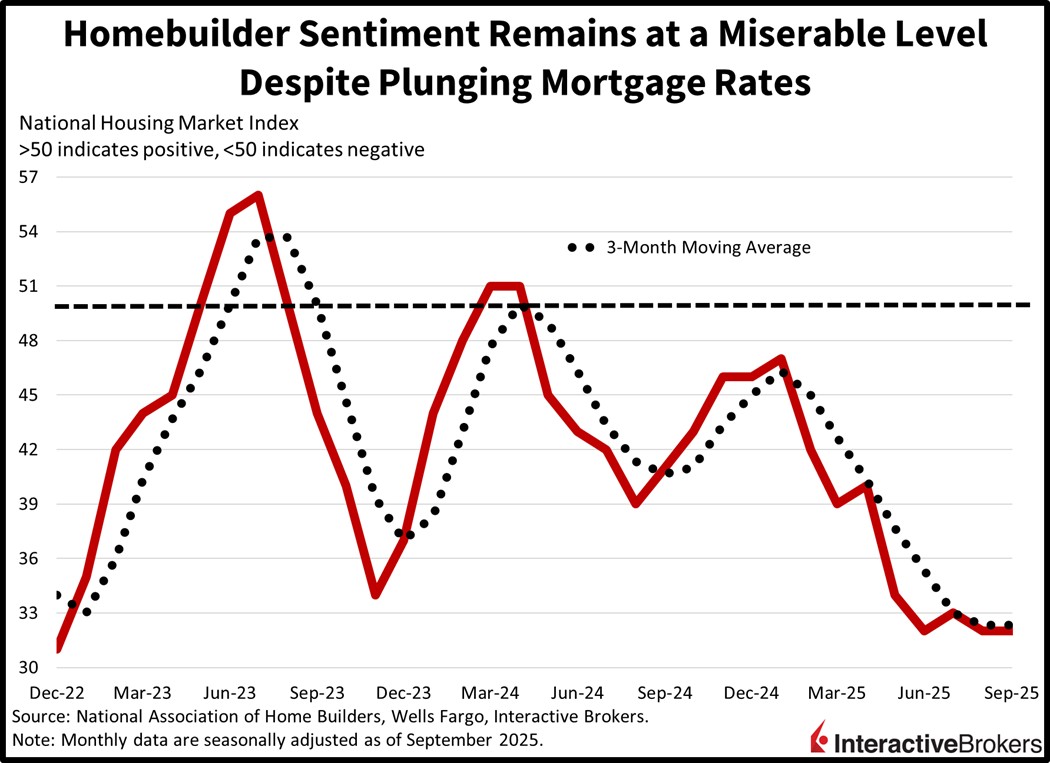

Homebuilder Pessimism Persists

Plunging mortgage rates have not helped homebuilder sentiment recently, with this morning’s print reflecting heavy pessimism in the space. The September headline of 32 missed the expectation of 33 and was unchanged from August, which are amongst the weakest figures since December 2022. Despite lighter financing costs causing the outlook for sales in the coming six months to strengthen from 43 to 45, transaction flows in the present remained at 34 while the traffic of prospective buyers declined from 22 to 21. Regional bifurcations existed, however. The West and Midwest dropped from 27 and 42 to 26 and 41 while the South was steady at 29 and the Northeast climbed from 39 to 44.

Past performance is not indicative of future results

Expecting Dissenters Tomorrow

Tomorrow afternoon’s Fed decision is probably going to feature a traditional quarter-point cut, although a wide range of arguments exist that support a steady benchmark or a jumbo 50. The significant disagreements across the economic arena are poised to produce frowns throughout the committee, with some voting members worried about inflation while others exhibit labor health nervousness. Indeed, our prediction market points to an 82% chance of at least one official formally dissenting the move at the meeting. Meanwhile, I believe the central bank has been far too tight all year and should catch up with unemployment risks by lowering by a half of a percent. For stock and Treasury bulls, however, a super-sized reduction or a dovish 25 is likely to sustain the rally’s enthusiasm, but a hawkish trim or even worse, an unexpected pause, would send equities and fixed-income assets south.

International Roundup

UK Data Depicts Continued Labor Market Weakness

UK payrolls surrendered 8,000 positions in August, bringing the 12-month loss to 127,000, according to the Office for National Statistics (ONS). It was the seventh consecutive month of declines but less than the estimate for a drop of 12,000. Today’s ONS data, furthermore, depicted July labor-market weakness with the number of individuals receiving unemployment benefits increasing by 17,400. In another development, average earnings ex bonus increased 4.8% year over year (y/y), matching the economist consensus estimate but slowing from 5% in June. When including bonuses, compensation grew 4.7% y/y, matching the forecast.

After a June Decline, Industrial Production Increases in Europe

Industrial production in the euro area climbed 0.3% m/m in July, missing the economist consensus estimate of 0.4% but reversing from the 0.6% drop in June, according to Eurostat. Relative to July of last year, production was up 1.8%, considerably better than June’s 0.7% y/y print and stronger than the economist consensus estimate of 1.7%. Non-durable goods and capital goods led the m/m increases with gains of 1.5% and 1.3%. Production of durable consumer goods and intermediate goods also strengthened, moving north by 1.1% and 0.5%. Among major sectors, energy was the only one to weaken, posting a 2.9% drop.

While Labor Costs Slowed Modestly

Labor costs in the euro area were up 3.6% y/y during the second quarter. Within this metric, the cost of hourly wages and salaries grew 3.7% while non-wage expenses ascended 3.4%.

Hong Kong Unemployment Rate Is Unchanged

Hong Kong’s unemployment rate during the June to August period, at 3.7%, was unchanged from the preceding three-month time span. The recent result was supported by declines in unemployment rates in construction, but food and beverage service and manufacturing sectors experienced higher numbers of out-of-work individuals.

Canada Prices Declined in August

Canada’s prices fell in August relative to July with the Consumer Price Index posting a -0.1% result after climbing 0.3% in the preceding month. Economists expected a goose egg. On a y/y basis, the index was 1.9% higher, accelerating from 1.7% in July but below the economist consensus expectation of 2%. The core gauge, which strips out items with volatile pricing was flat m/m following a 0.1% increase in July. It climbed 2.6% relative to August of last year, matching the July y/y print.

And Housing Starts Miss Estimates

Canada’s August housing starts total 245,800 in August, weakening from 293,500 in July and missing the economist consensus forecast of 278,000.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account