Fed Chair Powell’s Jackson Hole speech hinted at potential policy adjustments as economic conditions evolve, with markets rallying on his balanced approach.

Federal Reserve Chair Jerome Powell delivered his highly anticipated speech at the Jackson Hole Economic Symposium on August 22, 2025, outlining the Fed’s updated monetary policy framework and addressing current economic conditions.

In his remarks, Powell acknowledged that “the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance,” signaling potential changes to the federal funds rate as the central bank navigates between upside inflation risks and downside employment concerns. Markets responded positively to Powell’s measured approach, with major indices posting solid gains as investors interpreted his comments as dovish positioning ahead of the September Federal Open Market Committee meeting.

Fed Chair Speech Highlights and Policy Framework Changes

Powell’s speech marked a significant shift in the Federal Reserve’s monetary policy framework, most notably the elimination of the “makeup” inflation targeting strategy that was introduced in 2020. The Fed removed language indicating that the effective lower bound was a defining feature of the economic landscape, instead noting that monetary policy strategy is “designed to promote maximum employment and stable prices across a broad range of economic conditions.”

Powell emphasized that well-anchored inflation expectations were critical to the Fed’s success in bringing down inflation without triggering a sharp increase in unemployment.

The Chair highlighted current economic challenges, including the impact of higher tariffs across trading partners and tighter immigration policy leading to an abrupt slowdown in labor force growth. Job growth has decelerated to just 35,000 per month over the past three months, down from 168,000 monthly during 2024, while GDP growth slowed to 1.2 percent in the first half of 2025.

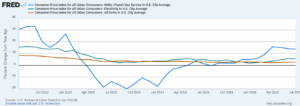

Powell noted that tariff effects are “now clearly visible” in consumer prices, with total PCE inflation at 2.6 percent and core PCE at 2.9 percent in July.

Regarding monetary policy stance, he acknowledged that “risks to inflation are tilted to the upside, and risks to employment to the downside—a challenging situation.” He emphasized that the Fed’s policy rate is now 100 basis points closer to neutral than a year ago, and that the stability of unemployment and labor market measures allows for careful consideration of policy changes.

Crucially, Powell stated that “monetary policy is not on a preset course” and decisions will be based solely on economic data and risk assessments.

Markets Snapshot: Strong Rally Across Major Indices

U.S. equity markets demonstrated a robust positive response to Powell’s Jackson Hole remarks, with all major indices posting significant gains by mid-morning trading on August 22. The Dow Jones Industrial Average surged 880.52 points or 1.97% to reach 45,666.02, while the S&P 500 climbed 103.86 points or 1.63% to 6,474.03. Technology stocks led the advance, with the Nasdaq 100 jumping 410.73 points or 1.77% to 23,553.31, and the broader Nasdaq gaining 415.35 points or 1.97% to 21,515.66.

Individual stock performance reflected broad-based optimism, with financial and industrial names leading the charge. American Express topped Dow gainers with a 3.88% increase to $320.13, followed by Caterpillar (+3.82% to $433.86) and Home Depot (+3.59% to $411.99). Among the most active stocks, major technology names posted solid gains: NVIDIA rose 1.61% to $177.79, Amazon advanced 2.00% to $226.38, and Apple climbed 1.55% to $228.39. The VIX volatility index dropped sharply by 12.23% to 14.57, indicating reduced fear in the market.

Sector performance showed broad participation in the rally, with the Dow Jones Technology index gaining 1.83% and financials advancing 1.84%. The strong market reaction suggests investors interpreted Powell’s speech as maintaining the Fed’s data-dependent approach while keeping the door open for policy accommodation if economic conditions warrant. The Dollar Index declined 0.89% to 97.635, while gold gained 1.15% to $3,420.37, reflecting expectations for a potentially less hawkish Federal Reserve stance going forward.

How Markets Reacted After Powell Signals Potential Rate Cuts

Disclaimer: The author does not hold or have a position in any securities discussed in the article. All stock prices were quoted at the time of writing.

Disclosure: The Tokenist

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult a licensed financial advisor prior to making financial decisions.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Tokenist and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Tokenist and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account