Last week, as earnings season was kicking into gear, we published an analysis of the post-earnings moves of the S&P 500 (SPX) components that had reported from July 1 through July 25th. Our conclusion at the time was that more highly weighted companies were underperforming, implying a bit more scrutiny was being placed upon the results. That seems to have abated after the solid responses to some megacap earnings last week.

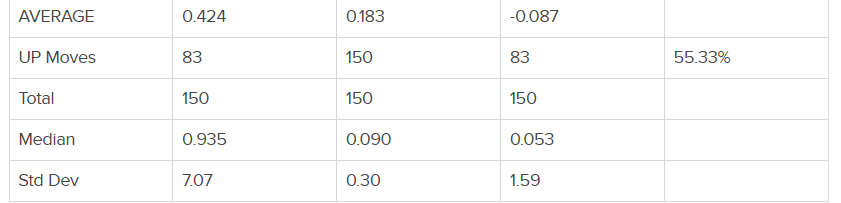

The heavily weighted mega-cap winners were of course Microsoft (MSFT, +3.95% post-earnings, 7.34% index weight), and Meta Platforms (META, +11.25% post-earnings, 3.1% index weight). Those more than offset the losses from Apple (AAPL, -2.50% post-earnings, 5.67% index weight) and Amazon (AMZN, -8.27% post-earnings, 3.78% index weight).

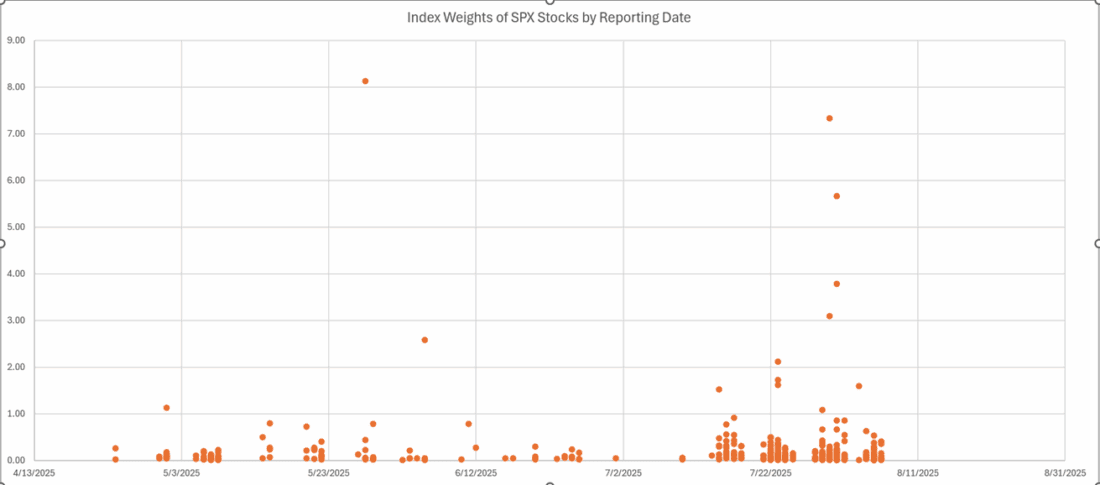

One thing that fascinated me while entering the data was just how large the most heavily weighted companies are vis-à-vis the vast majority. This scatterplot of SPX weights is one way to visualize it. Note how the vast mass of dots is just above the zero line on the y-axis:

Sources: Interactive Brokers, Bloomberg. Past performance is not indicative of future results.

Overall though, we see that some things have changed since the prior week. We had 150 companies reporting in that sample; now we have 327 through Monday. That’s about 65% of the number of stocks in the index (there are actually 503, not 500, thanks to two classes each of Alphabet, Fox, and Newscorp) and about 69% of the current index weight. Unlike before, when a 56.33% majority of post-earnings moves were higher, that is now a slight 48.62% minority. Also unlike before, we see a slight improvement when we adjust the average post-earnings move by index weight. The weighted average is now higher than the average move.

Bottom line, earnings season is going decently, and while we would like to assert that there is a strong relationship between the size of the reporting company and its post-earnings results, we can’t.

Sources: Interactive Brokers, Bloomberg. Past performance is not indicative of future results.

From the data we published through July 25:

Past performance is not indicative of future results.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Divulgación: Declaración: Interactive Brokers

El análisis presentado en este material se proporciona únicamente con fines informativos y no constituye ni deberá interpretarse como una oferta de venta ni una solicitud de oferta de compra de valores. Este material trata sobre la actividad general del mercado, las tendencias de la industria o del sector, u otras condiciones económicas o políticas de amplio espectro, y no debe interpretarse como un asesoramiento en materia de investigación o inversión. En los casos en los que se incluyan referencias específicas a valores, productos básicos, divisas u otros instrumentos, esto no constituirá una recomendación de IBKR para comprar, vender o mantener dichas inversiones. Este material no tiene en cuenta, ni está concebido para tener en cuenta, las condiciones financieras particulares, los objetivos de inversión ni los requisitos de los clientes. Antes de tomar decisiones en función del material presentado, deberá considerar si se ajusta a su situación particular. Consulte su situación con un profesional en caso de ser necesario. Las ideas y opiniones expresadas son exclusivamente las del autor y no necesariamente reflejan los puntos de vista de Interactive Brokers, sus afiliadas o sus empleados.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account