Key Takeaways

- The Federal Reserve held rates steady for the fifth consecutive meeting, with policy makers remaining in wait-and-see mode.

- Rising political pressure and tariff uncertainties have created a complex backdrop for the Fed, with risks to both inflation and unemployment now tilted higher.

- Investors should watch the Jackson Hole symposium in late August for potential policy signals, as the Fed remains data-dependent but biased toward future rate cuts.

For the fifth meeting in a row, the Federal Open Market Committee (FOMC) decided to keep rates unchanged, leaving the Fed Funds trading range at 4.25%–4.50%. While it may seem like the policy makers have not done any easing in this cycle, remember, the level for overnight money is 100 basis points below last year’s peak reading. Once again, the decision to keep the Fed Funds Rate at its current level comes as little surprise, as attention now turns to the next official FOMC gathering in September.

Obviously, the political pressure on Chair Powell to cut rates has been ratcheted up of late, but it appears that a majority of the voting members continue to feel the best monetary policy path going forward is to sit back and wait. They want to see how the economic and inflation landscape unfolds given the uncertainties that have arisen from tariff-related developments (more on that later).

Powell has consistently expressed his opinion that the uncertainties surrounding tariffs have placed a cloud of sorts over the macro outlook. In other words, the policy makers see risks ahead to both aspects of their dual mandate: employment and inflation. The increased risks of both higher unemployment and higher inflation place the Fed in a challenging environment. As we sit here in the present, a highly data-dependent Fed remains in place.

So, how are the underlying economic and inflation backdrops looking now, in the second half of the year? After posting a negative reading in Q1 due to a surge in imports, growth for the April–June period rebounded into the plus column. Labor market data has continued to show resilience. The July jobs report, due out Friday, is expected to reveal some modest slowing in new hiring, but with total nonfarm payrolls still increasing by over 100,000 and the unemployment rate remaining at a low 4.2%. And don’t forget, weekly jobless claims (one of the leading economic indicators) also remain low.

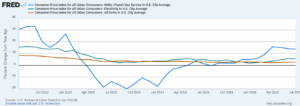

What about inflation? With respect to the Consumer Price Index (CPI), investors recently witnessed the possible end to the disinflationary trend that was prevalent from February through May of this year. Both the headline and core monthly CPI readings showed some uptick in June, the first potential signs of tariff-related effects. However, the increases were marginal, and overall inflation has remained well behaved thus far. If there is going to be any evidence of tariffs impacting price pressures, it is expected to start showing up in upcoming inflation data.

Not too surprisingly, the July FOMC meeting did see two dissenters, Fed Governors Waller and Bowman. Both these voting members had recently stated in public that they could support a rate cut at this just-concluded policy meeting, so their vote against the majority was kind of expected. However, it does underscore shifting opinions within the broader FOMC.

The Bottom Line

While September is the next scheduled month for an FOMC meeting, the Kansas City Fed’s annual Jackson Hole conference is slated for August 21–23. Powell has used this venue in the past to communicate potential shifts in policy thinking. In other words, if the FOMC could be getting closer to a rate cut (or not), investors may not have to wait another seven weeks for future guidance. For the record, Powell & Co. are still skewed toward rate cuts overall.

—

Originally Posted July 30, 2025 – Fed Watch: See You in September?

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account