1/ Improving Breadth Suggests Healthy Participation

2/ Which Way Will the Brewer Break?

3/ Alaska Faces a Confluence of Resistance

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

Improving Breadth Suggests Healthy Participation

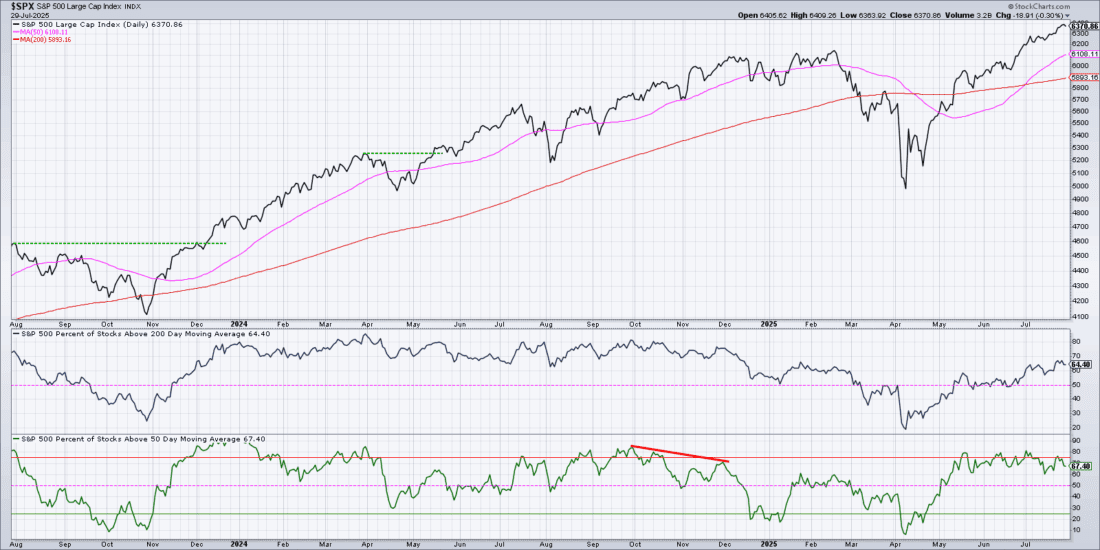

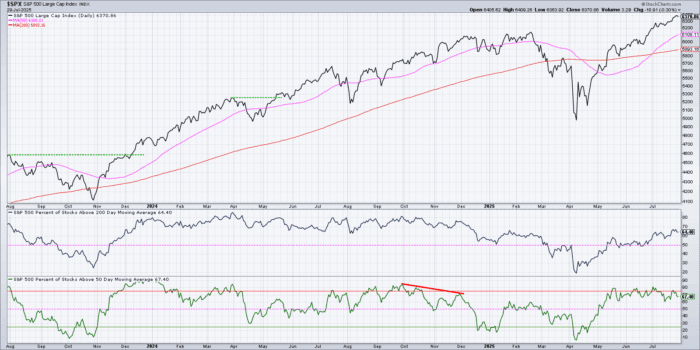

Breadth conditions have been mixed in July, with the McClellan Oscillator notably still below the zero level for the last two weeks. But with about 65% of the S&P 500 members above their 200-day moving averages, I would consider breadth fairly healthy going into August.

Past performance is not indicative of future results

About six weeks ago in mid-June, it was literally a coin flip with 50% of the S&P 500 stocks above their 200-day moving average. Over the subsequent six weeks that number has pushed up to around 65%, implying that about 15% of the index members have regained their 200-day moving average.

With well over 50% of the S&P 500 stocks above their 200-day moving average, and about two thirds of the index members above their 50-day moving average, it appears that most of the index is in decent shape using this basic measure of trend. As long as at least 50% of the index remains above their 50-day moving average, we’d consider this chart to be in a clearly bullish range.

2/

Which Way Will the Brewer Break?

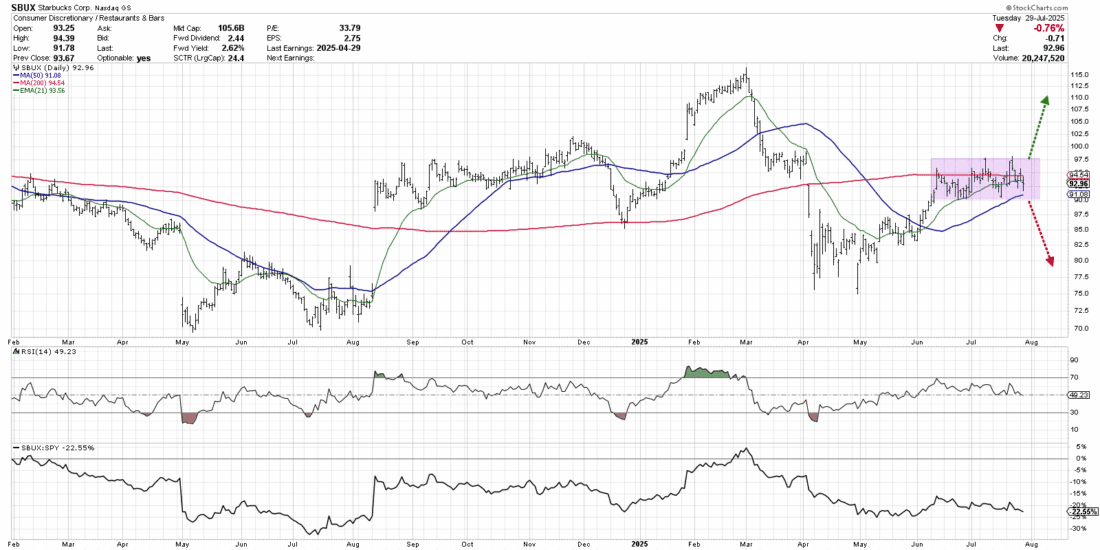

Next we’ll break down two Seattle area companies reporting earnings over the last week, with a focus on technical implications and key levels to watch. First it’s coffee conglomerate Starbucks Corp., which has been decidedly sideways since mid-June.

Past performance is not indicative of future results

I tend to define any chart as in one of three phases: an accumulation phase of higher highs and higher lows, a distribution phase of lower lows and lower highs, or a consolidation phase of consistent highs and lows. Starbucks provides a perfect illustration of a chart in a consolidation phase, with clear support around $90 and consistent resistance around $98.

Legendary trader Jesse Livermore is quoted as saying, “There is time to go long, time to go short, and time to go fishing.” In the case of SBUX, it definitely feels like “fishing time” until the price breaks out of that sideways price pattern. A break above $98 would suggest a potential retest of the February peak. A drop below $90 would also mean a failure of the 50-day moving average, implying a retest of the April lows.

3/

Alaska Faces a Confluence of Resistance

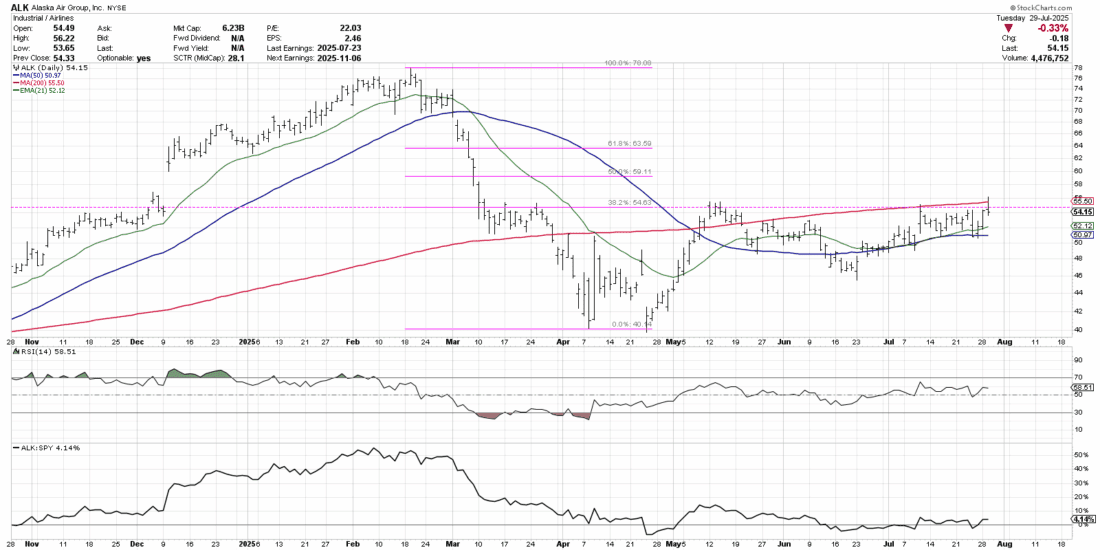

Alaska Air Group (ALK) is the largest airline operating at Seattle-Tacoma International Airport, and similar to our local coffee chain described above, the stock remains rangebound and waiting for a catalyst to break out of this consolidation phase.

Past performance is not indicative of future results

Alaska is currently sitting just below what’s called a “confluence of resistance”, where a series of technical indicators all coalesce around the same price level. We can see that the 200-day moving average, the 38.2% Fibonacci retracement level, and highs from May and July are all right around $55.

As long as ALK remains below resistance, and the Relative Strength Index (RSI) remains in a quite neutral range between 40 and 60, we’re inclined to remain on the sidelines. But a valid breakout above this $55 level, supported by stronger momentum in the form of RSI pushing above 60, would confirm a new accumulation phase for this mid-tier US airline.

Amateurs buy charts and hope that the price does what they expect it to do. Experts know that “hope” is a four-letter word for investors, and instead they set a game plan based on the established principles of technical analysis!

—

Originally posted 30th July 2025

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account