By C. Theodore Hicks II, CMT, CFP, CKA

1/ Gold Basing

2/ Ten Year Yield – Secular Trend Change

3/ 10-Year Consolidates? (Trend Pause)

4/ 10-Year and Inflation

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

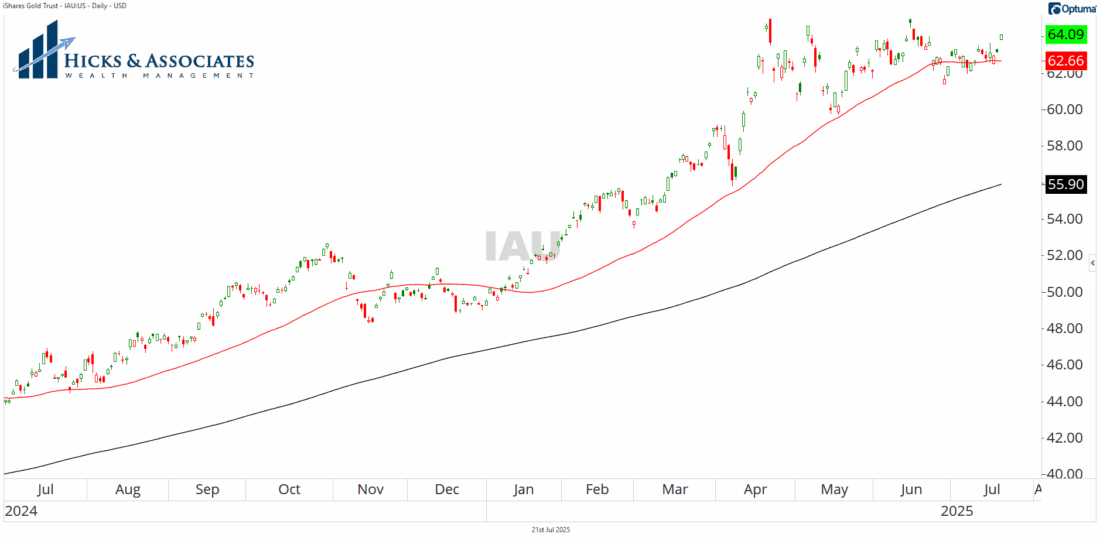

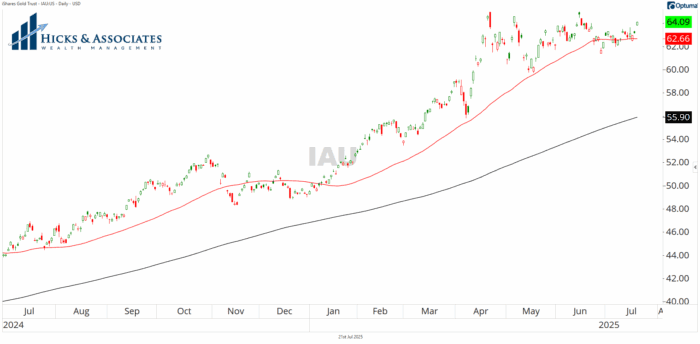

Gold Basing

Chairman Powell and the FOMC will meet next week. As they conclude their two-day meeting, they will announce whether or not President Trump will get his Fed Funds rate cut. While I’m not in the business of making forecasts, I think President Trump might be disappointed.

If we look at Gold – using IAU as a proxy – it has been building a base since April. While it has not moved higher, it cannot seem to go lower either. Using history as our guide, this suggests that the markets do not believe the battle with inflation is over. A case can also be made that yesterday’s action began a move higher out of this base.

Past performance is not indicative of future results

2/

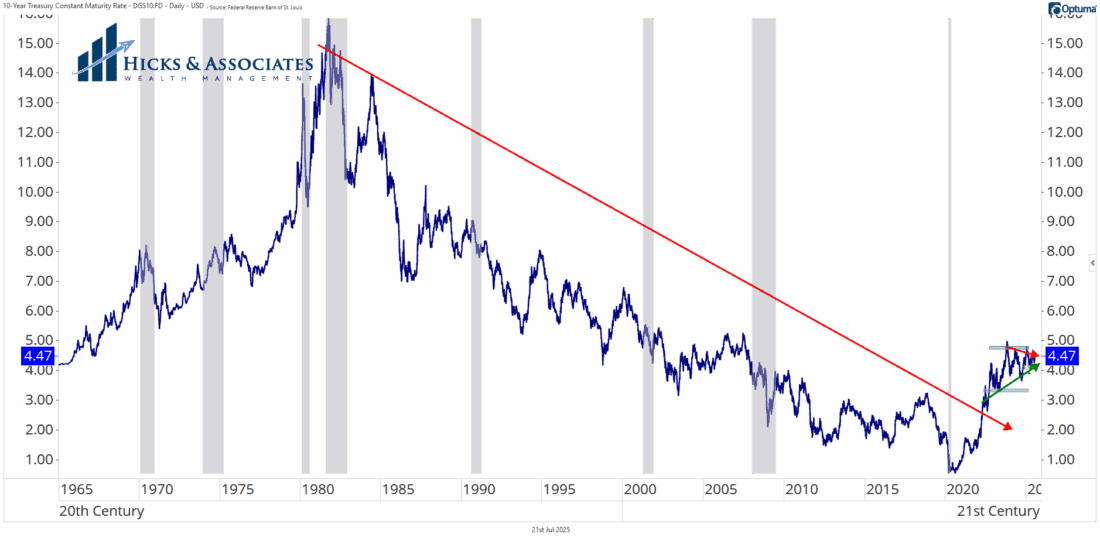

Ten Year Yield – Secular Trend Change

Chart 2 is showing the yield for the 10-year US Treasury dating back to 1965. The big red trendline is drawn just to illustrate that from 1980 to 2022 we were in a declining interest rate environment. I discuss this in my book, Evidence-Based Investing, when the 10-year yield crossed above that trendline, that was a secular trend change.

That has broad implications.

Past performance is not indicative of future results

3/

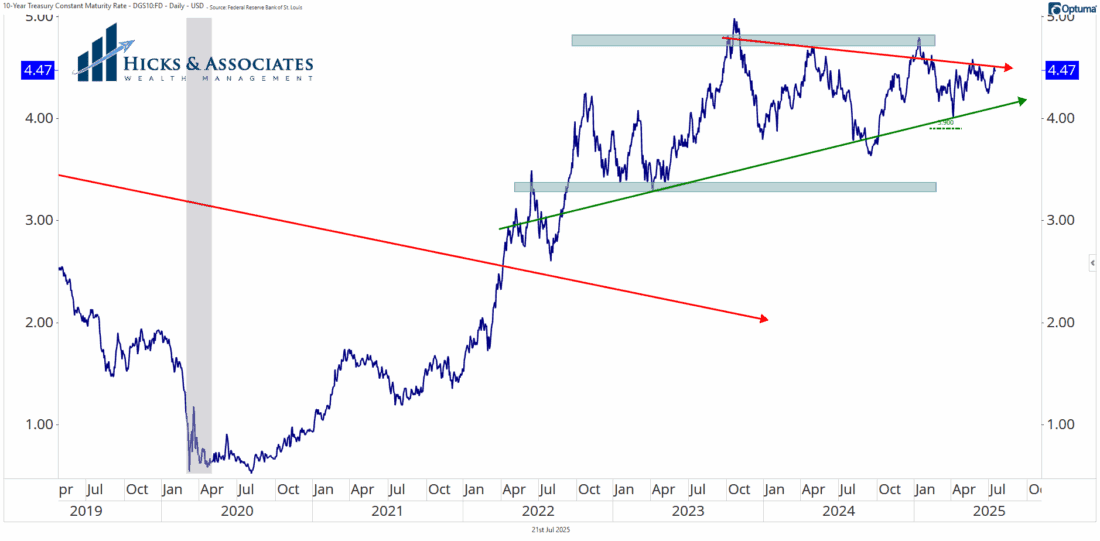

10-Year Consolidates? (Trend Pause)

While the 10-year yield has absolutely broken the secular bear-market trend for yields, I am not yet declaring that we are in a secular bull-market for yields. In other words, rates have risen but I’m not convinced that they will continue to rise. I need to see some more evidence.

Looking at our third chart for today, this is how I see it.

The bottom blue-gray rectangle illustrates what I thought could be an important support level. This is ~3.4%. But yields have not yet come down to that level. So, I no longer really think that’s a solid support area.

Past performance is not indicative of future results

The top blue-gray rectangle represents what I think could be an important resistance level.

However, the way yields have played out, I now view the green trend line as support and the red trend line as resistance. The way I’m reading this, this is a bullish pennant thereby implying that rates could very well go higher.

First a reminder that all chart patterns are suggestive, not predictive. Secondly, my team and I do not trade off patterns. However, they do help us see what could happen, so we are thinking in advance.

So, what’s the point?

4/

10-Year and Inflation

I am an avid reader. On average, I read about 40-50 books each year. At the moment, I’m finishing Ray Dalio’s latest book How Countries Go Broke: The Big Cycle. It is a good book … but you should buy mine first. 😉

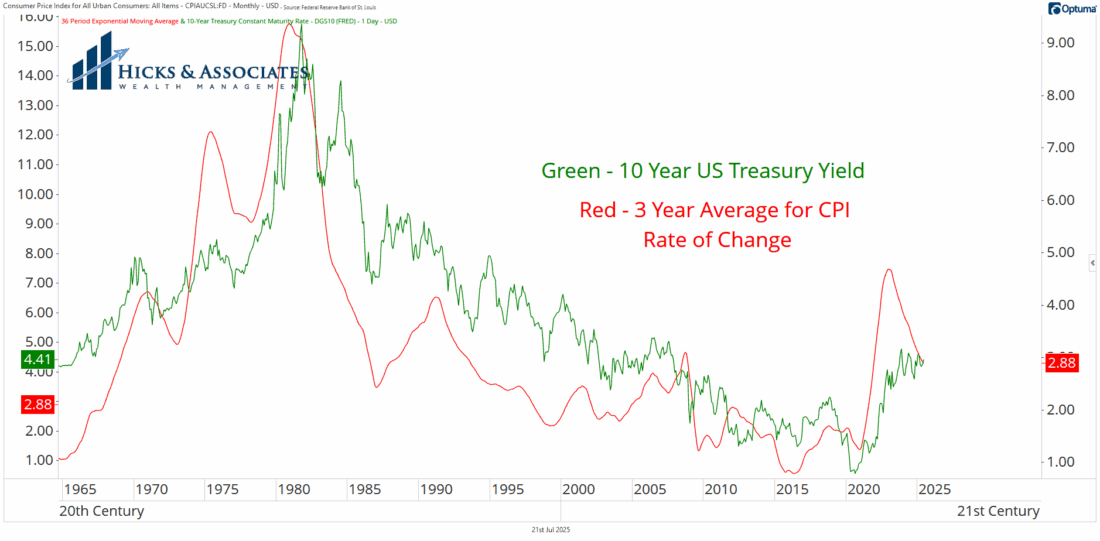

In Chapter 10 (page 200 in the hard cover) of Dalio’s book, he shows a chart that I’ve tried to recreate below.

Past performance is not indicative of future results

The green line is again showing the 10-year yield. The red line is the 3-year average for the Rate of Change in the Consumer Price Index. Notice the relatively high correlation between the two.

When I look at all of this together, it leads me to believe that Chairman Powell will not lower interest rates just yet. I read some very smart economists – mainly those who do not put a (D) or an (R) behind their name – who say Powell should cut. Maybe they are right. I’m only an armchair economist who manages money for a living. This is just how I see it and whether I’m right or wrong has no impact on the trades we enter; it’s just not a part of our investment process.

So, I make no prediction but know that Powell and the Fed seem to believe that keeping rates higher for longer will help keep inflation from moving higher. Ultimately, we want the economy to grow neither too fast nor too slow. We want that Goldilocks economy.

—

Originally posted 22nd July 2025

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account