Originally Posted 15 July 2025 – Why the Magnificent 7 are still magnificent

Key Takeaways

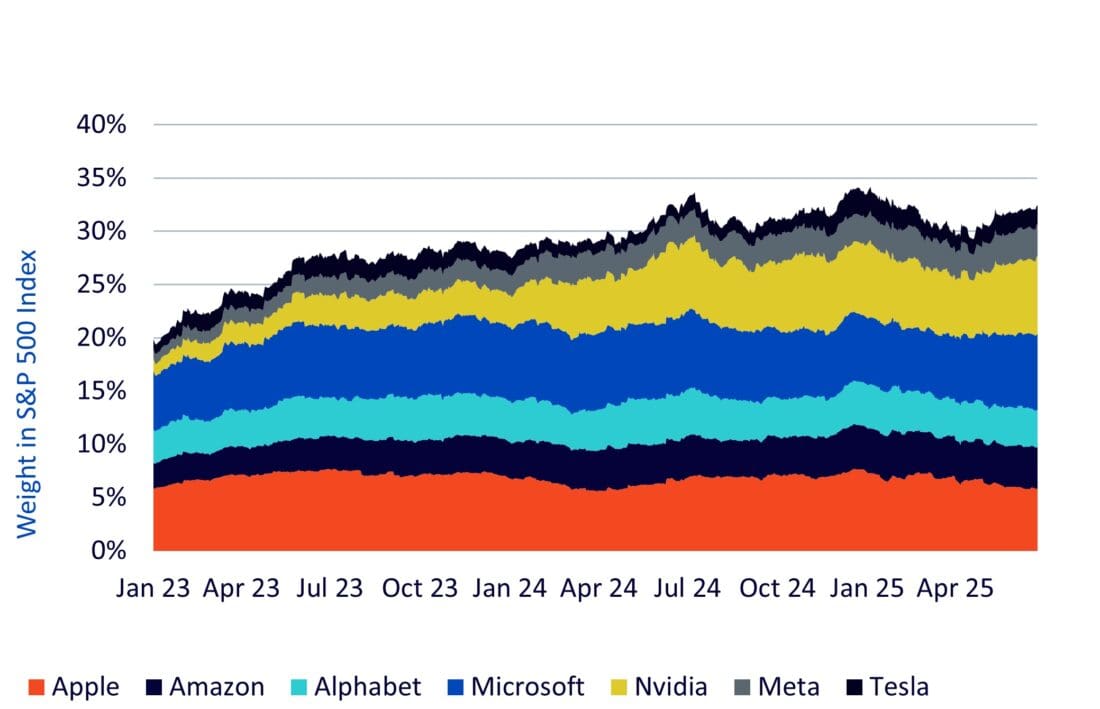

- Their weight keeps growing: The Magnificent 7 now makes up almost one-third of the S&P 500 by market cap, up from just under 20% in early 2023.

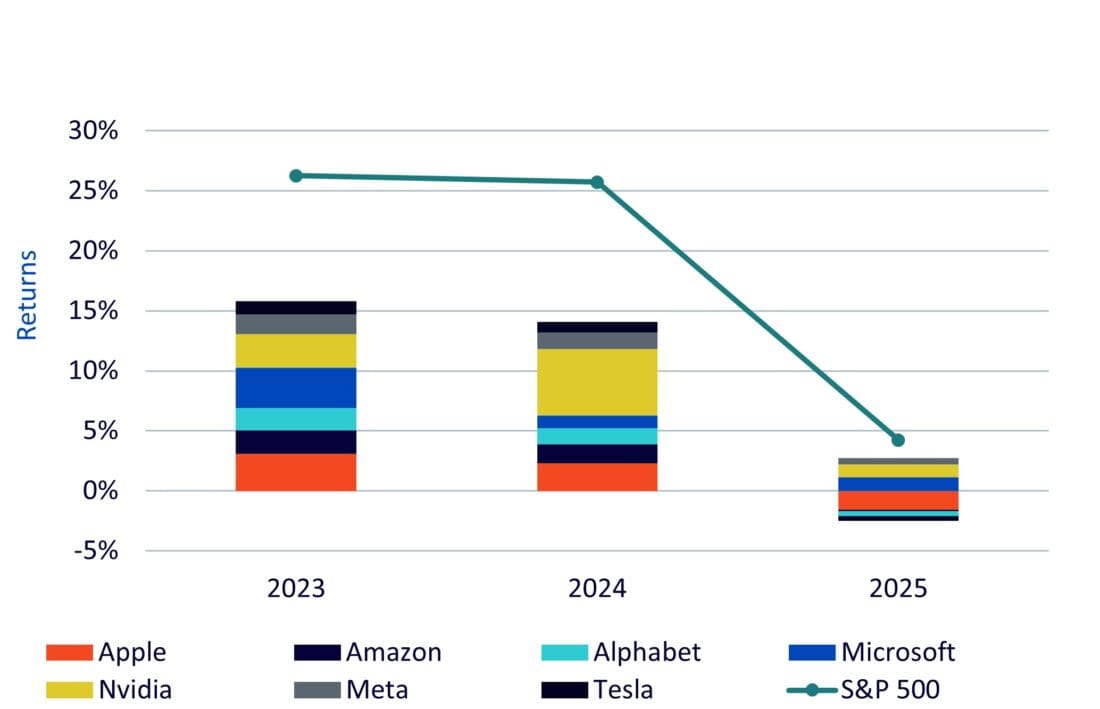

- They still drive returns: In 2023 and 2024, these seven stocks delivered more than half of the index’s total gains.

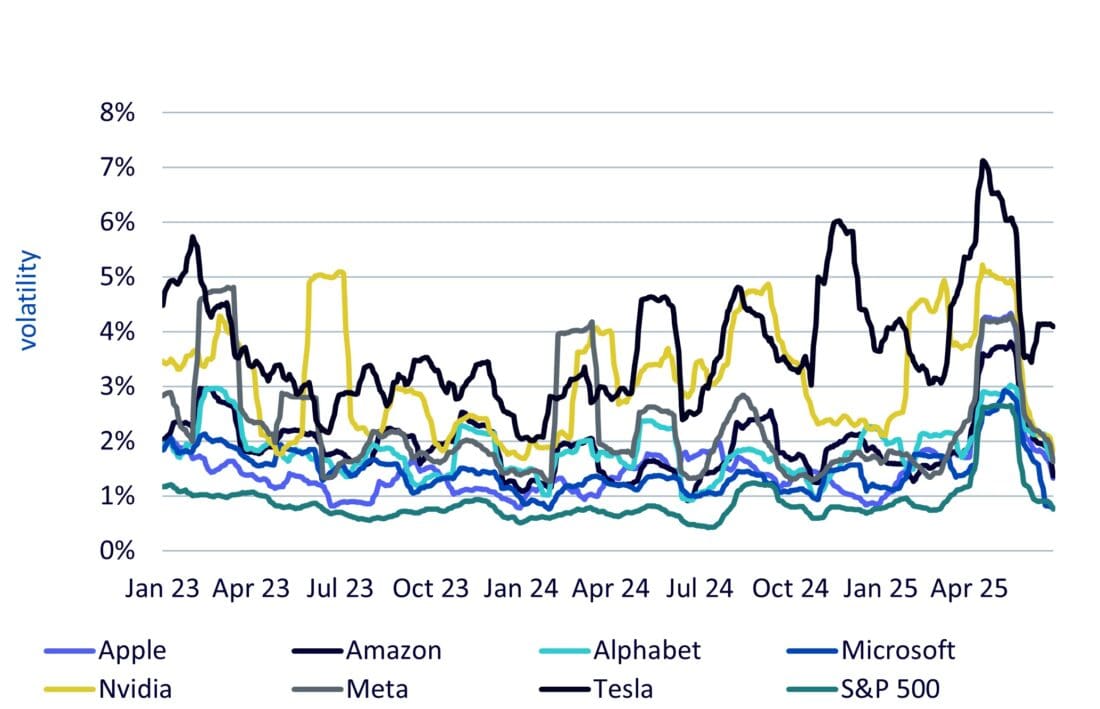

- They move more than the market: Their volatility continues to offer opportunities for tactical investors on both sides.

There is something about odd numbers that makes them appealing. They have a particular ring to them. When delivering a message, the rule of three is often referenced. The Three Musketeers might never have been so famous had they added a fourth one to their fold. Children’s author Enid Blyton’s The Secret Seven might not have solved all those mysteries if they were The Secret Six. And perhaps James Bond may never have been the world’s greatest secret agent if he were 008.

The same is true in financial markets. Fama and French built a 3-factor model, which later became a 5-factor model. Everybody talks about the S&P 500. Why 500? Why not 600? We also had FAANG – Facebook, Apple, Amazon, Netflix, and Google – tech favourites in markets. Again, five stocks. And when FAANG was superseded, Nvidia and Tesla were added to make the Magnificent 7.

The term Magnificent 7 was initially used in 2023 when markets saw the leadership of this handful of big tech companies in a market (and indeed world) that was still recovering from COVID-19. Large technology companies changing the world in a big way. What was not to like? Or hate?

At WisdomTree, we have seen how tactical investors like to trade assets that exhibit strong price movements in either direction. This is what allows them to take directional views, both long and short. The Magnificent 7 group have been ideal contenders for this over the past couple of years.

The question now is whether they are still magnificent. Do they still offer the same promise for tactical investors to potentially benefit from? At WisdomTree, we believe the answer to that question is a resounding yes. This blog gives you three reasons why we think so.

1. Their dominance has only gone up

If, in 2023, we thought the Magnificent 7 were worth talking about on their own because of their importance, well, in 2025, their importance has increased further. The weight of the Magnificent 7 in the S&P 500 was just under 20% at the start of 2023. As of June 2025, this has increased to just over 32%. Yes, seven stocks account for almost one-third of the S&P 500.

One of the biggest reasons for this notable increase is the emergence of Nvidia, which entered the big league, forcing markets to retire the term FAANG and eventually not only rub shoulders with the giants, but become a giant itself.

So, if the size of the Magnificent 7 is any indication of their relevance, it has only increased.

Figure 1: The weight of the Magnificent 7 in the S&P 500 has been on the rise

Source: WisdomTree, S&P, as of 26 June 2025. Alphabet’s weight is the sum of both classes A and C. Historical performance is not an indication of future performance, and any investments may go down in value.

2. It’s not just about the weight but also returns

With a considerable weight in the S&P 500, you’d expect the Magnificent 7 to be responsible for a sizeable portion of total returns. The chart below shows the contribution to returns from each of the 7 stocks to the S&P 500.

In 2023, the S&P 500 was up 26.3%. The contribution of the Magnificent 7 was 15.8%. Even relative to their weight, they accounted for a disproportionately large share of the index’s total return. In 2024, the S&P 500 gained 25.7%, and the Magnificent 7’s contribution was 14.1%. So, in both years, the Magnificent 7 accounted for more than half of the index’s total gain.

In 2025, things got a bit more complicated due to a significant pullback in the first half of the year. Since then, US stocks have recovered, and the S&P 500 is back in positive territory (as of 26 June). However, not all Magnificent 7 stocks have recovered from their drawdowns. Still, the movement in Magnificent 7 stocks remains noteworthy relative to the S&P 500.

Figure 2: The Magnificent 7 remain meaningful contributors to S&P 500’s returns

Source: Bloomberg, as of 26 June 2025. The return for each stock is its contribution to return in the S&P 500 Index as proxied by the SPDR S&P 500 ETF Trust. Contribution from individual stocks is compared to the total return of the S&P 500. Historical performance is not an indication of future performance, and any investments may go down in value.

3. Sometimes volatility can be a feature

At WisdomTree, we’ve seen how more volatile markets like oil attract more tactical trading than less volatile ones like aluminium. When an asset is driven by developments that can materially influence its price in either direction, traders can express their views through long and short positions.

For the Magnificent 7, factors such as earnings, interest rates, tariff policies, and new technology announcements are all highly relevant and closely watched by markets.

The chart below shows how the rolling volatility of each of the Magnificent 7 is typically much higher than that of the S&P 500 Index. Tesla appears right at the top – understandably so, given the strong swings the stock experiences. Nvidia is in a similar league. So, traders who like to trade the S&P 500 tactically because of its volatility also have the option to trade the Magnificent 7, given their relatively higher volatility levels.

Figure 3: The Magnificent 7 have consistently exhibited relatively high levels of volatility

Source: Bloomberg, as of 26 June 2025. Chart shows the 5-day moving average of the 30-day rolling standard deviation of daily returns. Historical performance is not an indication of future performance, and any investments may go down in value.

Conclusion

Markets evolve. New companies emerge. Some become more relevant over time, while others become less so. And so, maybe at some point in the future, we’ll be talking about the Mighty 9. Or we may go back down to the Fabulous 5. But until then, we have the Magnificent 7. And if they were magnificent in 2023, we believe they remain magnificent in 2025.

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account