Investor sentiment was euphoric at the start of the year. Fund inflows were white hot. Institutional and individual investor surveys were extraordinarily bullish. Annual outlooks from Wall Street’s soothsayers forecast a third straight year of solid gains for risk assets, especially US stocks.

US exceptionalism was undeniable. The US economy expanded by a better-than-anticipated 2.8% in 2024.1 The labor market was solid. Non-farm payrolls surged by 256,000 in December and the unemployment rate edged down to 4.1%.2 Gainfully employed consumers, particularly the top 20% of income earners, were in great shape. Inflation was expected to moderate, giving the Federal Reserve (Fed) ample room to continue the rate cutting cycle it began in September.

S&P 500® companies were forecast to grow their earnings by nearly 15% in 2025.3 The US was the unquestioned leader in artificial intelligence (AI), and massive capital expenditures from hyperscalers were going to press the advantage.

The incoming Trump administration was expected to accelerate the momentum with classic Republican policies to lower energy prices, cut red tape, and reduce taxes. And despite sky-high valuations, the S&P 500 managed three more all-time closing highs in the first six weeks of this year.4

Everything was going according to plan — until it wasn’t.

The S&P 500’s last all-time closing high wasn’t that long ago on February 19.5 But it’s been a far more volatile and challenging capital market environment since then.

Legendary investor Sir John Templeton famously cautioned that bull markets die on euphoria. Today, anxious investors, tired of waiting for clarity on issues from tariffs to monetary policy, may be wishing they had heeded Templeton’s warning.

What’s Foiling Investors’ Best Laid Plans?

A number of factors are responsible for at least temporarily derailing the bull market, significantly increasing market volatility, and threatening US exceptionalism.

- The Focus and Pace of the Trump Administration’s Policy Agenda

The Trump administration didn’t start with the pro-growth portions of its policy agenda as investors anticipated. Instead, the administration sought to simultaneously restructure the global trading system, reshape the global military security framework by sharing more of the burden with US allies, end illegal immigration, and eliminate wasteful and fraudulent federal government spending through the Department of Government Efficiency (DOGE).

The size, scale, and magnitude of these policy goals combined with the administration’s frenetic approach surprised market participants. And the rising policy uncertainty has paralyzed businesses, consumers, and investors to some extent. Consumer sentiment measures are plummeting, and short-term inflation expectations are increasing. - A Wait-and-See Fed Between a Rock and a Hard Place

Adding to policy stress, the dual mandate of the Fed to promote both maximum employment and stable prices may soon be at odds. Growing uncertainty about the future path of monetary policy has contributed to the difficult investing environment over the last few months. The economic, labor market, and inflation impacts from Trump administration policies are hard to predict.

In the most recent Federal Open Market Committee (FOMC) statement from May 7, the Fed acknowledged that economic activity has continued to expand at a solid pace, labor market conditions remain strong, and inflation is somewhat elevated. Fed officials claim that monetary policy is in a good place, and they prefer to wait and see what happens to the labor market and inflation over the next few months before making any changes.

But as the Fed waits, the risks of a monetary policy mistake are rising. - AI Confidence Turning to Skepticism

Investor excitement about the prospects for AI has sent US tech stocks soaring for the past couple of years. But tech stocks plummeted in late January in response to the Chinese startup DeepSeek launching a low-cost AI model. Concern that DeepSeek has created a better AI model at a lower cost with a lighter energy footprint has fractured the AI narrative that has propelled markets. And US tech stocks have not yet fully recovered.

In fact, in early April, US Treasury Secretary Scott Bessent added fuel to the fire by pinning the blame for recent market volatility on China’s DeepSeek — not on the newly introduced tariffs from the Trump administration.6 - US Economic Growth Scare

First quarter US GDP decreased by 0.3% on an annual basis.7 The decline in GDP was primarily due to a surge in imports from businesses and consumers anticipating higher costs from tariffs. But softening economic data throughout the first half of the year, especially survey data, have investors panicked.

Yet, all is not lost.

Reasons for Optimism: Fiscal and Monetary Policy

April 30 marked the first 100 days of the Trump administration, a potentially important turning point for capital markets. The Trump administration took a number of actions in April to significantly advance its deregulatory agenda. The One, Big, Beautiful Bill Act is winding its way through Congress. It will be a messy legislative process, but when passed it will likely raise the debt ceiling and extend substantial tax cuts to consumers and businesses — stimulating economic growth.

The Trump administration and US trading partners, including China, acknowledged that harsh Liberation Day tariffs would not be sustainable. Negotiations between the US and its trading partners have started.

As a result, US stocks have recouped all their losses, providing much needed relief to investors. The post-election, pro-growth policies that investors were most excited about are now firmly underway.

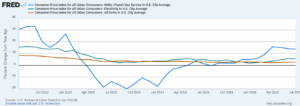

The Fed has plenty of room to revive its rate cutting cycle in the second half of the year. Recent data indicates that inflation was moderating before any potential tariff-related price increases. The Fed mistakenly assumed that tariffs were inflationary in 2018, but they weren’t. Tariffs are often described as a tax on imported goods. But higher taxes reduce consumption, which is disinflationary. How can tariffs be both a consumer tax and inflationary?

The target range for the federal funds rate of 4 ¼ to 4 ½ is already notably above the Fed’s preferred measure of inflation, the core Personal Consumption Expenditures (PCE) Index. The Fed could cut interest rates by 0.25% three or four times and still maintain a policy rate 1% above core PCE. The Fed will likely restore its rate cutting cycle in the second half, supporting the economy and bolstering risk assets.

Earnings Growth and Better Valuations Lower Recession Odds

It’s common for analysts to lower their earnings expectations throughout the year. Over the past 40 years, next-12-months earnings-per-share (EPS) growth has averaged about 2% at the start of recessions.8 According to FactSet, analysts are projecting S&P 500 companies to grow their earnings by 9% this year.9 That is significantly lower than the 15% earnings growth forecast back in January but probably still healthy enough to avoid recession. Once sky-high valuations are now better aligned with recent historical averages. More reasonable earnings growth expectations and lower valuations could create a stronger foundation for the next leg of the bull market.

After a brief April tariff-induced scare, economists and market prognosticators have been lowering their recession probabilities for this year. Most market watchers expect that the US will avoid recession in 2025.

Progress on the pro-growth Trump administration agenda, easier monetary policy, still strong earnings growth, better valuations, and lower odds of a recession create an attractive backdrop for risk assets in the second half of the year. But risks remain elevated.

No Time to Be a Hero

Investors are in the uncomfortable position of waiting and seeing across multiple dimensions over the next few quarters:

- Will the Trump administration successfully negotiate trade deals with US trading partners?

- Will Congress raise the debt ceiling and pass the One, Big, Beautiful Bill Act?

- Can all that be achieved without substantially increasing the deficit, inflation, and interest rates?

- Will ominous soft economic data transform into recessionary hard data later this year?

- Can the Fed avoid a monetary policy mistake? Cut rates too early and risk reigniting inflation. Cut too late and risk recession.

It’s become cliché to describe potential economic and capital market outcomes as wider than normal. But the economy and investing have never fit a normal distribution where events cluster around the average and extreme events are rare.

Many brilliant investors have lost fortunes trying to fit economic and investing outcomes into a normal distribution. Economic and investing outcomes have fat tails where there are far more occurrences of large gains or losses than expected in a normal distribution.

Investors must determine whether now is a good time to take bold positions by accepting more risk or if better opportunities for risk-taking will arise in the future. Valuations have improved but remain above historical averages. Credit spreads are incredibly tight. And given the heightened potential for bad outcomes, most measures of investor sentiment and capital market volatility are likely too complacent.

The uncertainty that’s roiled markets complicates decision-making. But the increased volatility in the first half of the year has created an opportunity for investors to make adjustments to better position portfolios for the remainder of the year.

Investors should consider these three themes:

- Position Toward Quality Stocks and Policy Tailwinds

- Seek Stability in Rate and Credit Markets

- Diversify Differently to Build Resilience

—

Originally Posted June 2, 2025 – ETF Market Outlook: The Unbearable Burden of Waiting and Seeing

Disclosure: State Street Global Advisors

Do not reproduce or reprint without the written permission of SSGA.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

State Street Global Advisors and its affiliates (“SSGA”) have not taken into consideration the circumstances of any particular investor in producing this material and are not making an investment recommendation or acting in fiduciary capacity in connection with the provision of the information contained herein.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns.

Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates raise, bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

Investing involves risk including the risk of loss of principal.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Investing in high yield fixed income securities, otherwise known as “junk bonds”, is considered speculative and involves greater risk of loss of principal and interest than investing in investment grade fixed income securities. These Lower-quality debt securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer.

COPYRIGHT AND OTHER RIGHTS

Other third party content is the intellectual property of the respective third party and all rights are reserved to them. All rights reserved. No organization or individual is permitted to reproduce, distribute or otherwise use the statistics and information in this report without the written agreement of the copyright owners.

Definition:

Arbitrage: the simultaneous buying and selling of securities, currency, or commodities in different markets or in derivative forms in order to take advantage of differing prices for the same asset.

Fund Objectives:

SPY: The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index. The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the index (the “Portfolio”), with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the index.

VOO: The investment seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. The fund employs an indexing investment approach designed to track the performance of the Standard & Poor’s 500 Index, a widely recognized benchmark of U.S. stock market performance that is dominated by the stocks of large U.S. companies. The advisor attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index.

IVV: The investment seeks to track the investment results of the S&P 500 (the “underlying index”), which measures the performance of the large-capitalization sector of the U.S. equity market. The fund generally invests at least 90% of its assets in securities of the underlying index and in depositary receipts representing securities of the underlying index. It may invest the remainder of its assets in certain futures, options and swap contracts, cash and cash equivalents, as well as in securities not included in the underlying index, but which the advisor believes will help the fund track the underlying index.

The funds presented herein have different investment objectives, costs and expenses. Each fund is managed by a different investment firm, and the performance of each fund will necessarily depend on the ability of their respective managers to select portfolio investments. These differences, among others, may result in significant disparity in the funds’ portfolio assets and performance. For further information on the funds, please review their respective prospectuses.

Entity Disclosures:

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

SSGA Funds Management, Inc. serves as the investment advisor to the SPDR ETFs that are registered with the United States Securities and Exchange Commission under the Investment Company Act of 1940. SSGA Funds Management, Inc. is an affiliate of State Street Global Advisors Limited.

Intellectual Property Disclosures:

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s® Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

BLOOMBERG®, a trademark and service mark of Bloomberg Finance, L.P. and its affiliates, and BARCLAYS®, a trademark and service mark of Barclays Bank Plc., have each been licensed for use in connection with the listing and trading of the SPDR Bloomberg Barclays ETFs.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs.

ALPS Distributors, Inc., member FINRA, is distributor for SPDR® S&P 500®, SPDR® S&P MidCap 400® and SPDR® Dow Jones Industrial Average, all unit investment trusts. ALPS Distributors, Inc. is not affiliated with State Street Global Advisors Funds Distributors, LLC.

Before investing, consider the funds’ investment objectives, risks, charges, and expenses. For SPDR funds, you may obtain a prospectus or summary prospectus containing this and other information by calling 1‐866‐787‐2257 or visiting www.spdrs.com. Please read the prospectus carefully before investing.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from State Street Global Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or State Street Global Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bonds

As with all investments, your capital is at risk.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account