Originally Posted, 13 Dec 2024 – Copper to benefit from China’s policy pivot

Key Takeaways

- At its Politburo meeting, China signalled a potential shift toward a more aggressive economic policy stance.

- The shift to revitalise its economy, comes after years of being constrained by a weakened real estate sector and other economic challenges.

- Copper, which has already been supported by China’s tilt towards high-tech sectors, such as EVs, batteries and solar, could get a further boost as traditional sources of demand are also bolstered.

This year, we have been anticipating China’s so-called “bazooka”—a metaphor for a large-scale economic stimulus aimed at countering an ailing real estate sector and economy. However, so far, the country has only brought out a “pistol.” Last week, at its Politburo meeting, China signalled a potential shift toward a more aggressive stance. While no new concrete measures have been announced, the policy direction from China’s leaders appears more assertive.

Politburo: Key discussions and decisions

1. Monetary Policy Adjustment

The Politburo announced a transition to a “moderately loose” monetary policy for 2025, marking the first such easing since 2010. This approach aims to enhance economic vitality by expanding credit availability and reducing borrowing costs.

2. Proactive Fiscal Measures

Leaders committed to a more proactive fiscal policy, indicating plans to increase government spending to boost domestic demand and consumption. This includes potential expansions in public investment and support for key industries.

3. Stabilising Key Markets

The Politburo emphasised the importance of stabilising the housing and stock markets, recognising their critical roles in economic stability and consumer confidence.

4. Addressing External Trade Pressures

In light of anticipated US trade policies under President-elect Donald Trump, which may include increased tariffs on Chinese imports, Chinese authorities are considering allowing the yuan to depreciate. This strategy aims to make Chinese exports more competitive and mitigate deflationary pressures.

What China eventually delivers may not match the scale of the economic stimulus seen in 2008/2009. However, we believe it will represent a significant step up compared to the past two years.

Dr. Copper what’s your prognosis?

Copper is often referred to as “Dr. Copper” because of its reputation as an accurate predictor of economic health. China consumes more than half of the world’s refined copper1, and over the past two decades, copper prices have been a reliable indicator of Chinese economic activity.

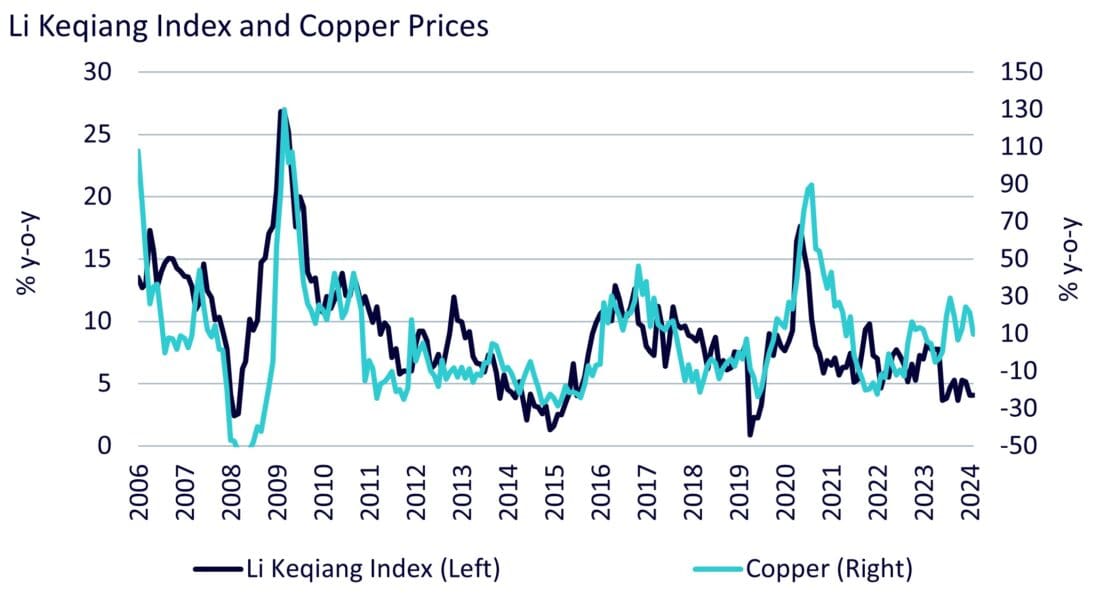

The late Chinese Premier Li Keqiang once remarked to a US diplomat that China’s GDP data was “manmade.” To track growth, he preferred to observe changes in bank lending, rail freight, and electricity consumption. The Li Keqiang Index, represented in the chart below, is a weighted average of these indicators. While the index may underrepresent China’s recent pivot to high-tech sectors such as electric vehicles, batteries, and solar cells, it still serves as a reasonable indicator of economic health.

With Chinese electric vehicle sales and electric grid spending at record highs, these two copper-intensive industries have supported copper prices at higher levels than we would have had we looked at the Li Keqiang Index alone.

Source: WisdomTree, Bloomberg. January 2005 – November 2024. Li Keqiang index: 40% outstanding bank loans, 40% electricity production, 20% rail freight volume. Copper: Bloomberg Commodity Index Total Return – Copper Subindex. Historical performance is not an indication of future performance and any investments may go down in value.

If China successfully boosts its broader economy beyond the new tech sectors, we anticipate additional support for copper prices. Targeted support for the real estate sector is an obvious avenue, given copper’s use in construction. Additionally, broad-based consumer support could spur increased consumption of durable goods, such as electronics, further driving copper demand.

1 Source: International Copper Study Group, 2024

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account