Originally Posted, 9 August 2024 – The data which can help you keep a cool investing head in a crisis

Four bite-sized pieces of data showing investors are best served not making decisions in the heat of the moment.

We have published several versions of this in recent years, usually triggered by sudden swings in financial markets. Many factors can cause markets to take fright. Sometimes the trigger is specific, such as Russia’s invasion of Ukraine in 2022; and at other times it can be a sudden loss of confidence caused by weak economic data, for example.

In this updated version – following the turbulence in markets in early August – we suggest our core arguments continue to hold true.

1. Stock market investing is very risky in the short run but less so in the long-run – unlike cash

Using almost 100 years of data on the US stock market, we found that, if you invested for a month, you would have lost money 40% of the time in inflation-adjusted terms.

Past performance is not a guide to future performance and may not be repeated.

Source: Stocks represented by Ibbotson® SBBI® US Large-Cap Stocks, Cash by Ibbotson® US (30-day) Treasury Bills. Data to December 2023. Morningstar Direct, accessed via CFA institute and Schroders.

However, if you had invested for longer, the odds would shift dramatically in your favour. On a 12-month basis, you would have lost money 30% of the time. Importantly, 12-months is still the short-run when it comes to the stock market. You’ve got to be in it for longer to benefit most.

On a five-year horizon, that figure falls to 22%. At 10 years it is 13%. And there have been no 20-year periods in our analysis when stocks lost money in inflation-adjusted terms.

Losing money over the long run can never be ruled out entirely and would clearly be very painful if it happened to you. However, it is also a very rare occurrence.

In contrast, while cash may seem safer, the chances of its value being eroded by inflation are much higher. And, as all cash savers know, recent experience has been even more painful. The last time cash beat inflation in any five-year period was February 2006 to February 2011, a distant memory. Nor is that something that’s expected to change any time soon.

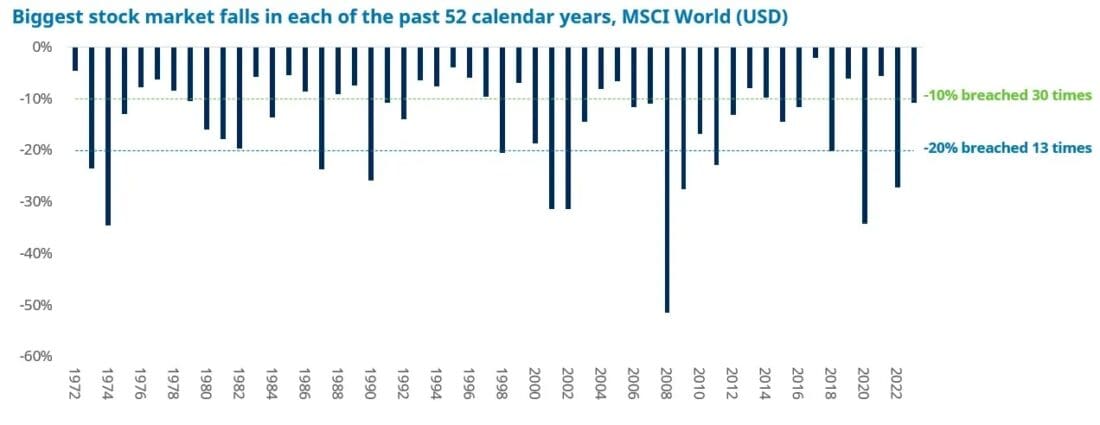

2. 10%+ falls happen in more years than they don’t – but long-term returns have been strong

Taking world stock markets (as represented by the MSCI World Index) 10% falls happened in 30 of the 52 calendar years prior to 2024. In the past decade, this includes 2015, 2016, 2018, 2020 and 2022.

More substantial falls of 20% occurred in 13 of the 52 years (that’s roughly once every six years – but if it happens this year, that will be three times in the past four years, in 2020 and 2022).

Past performance is not a guide to the future and may not be repeated

Source: Refinitiv and Schroders. Data to 31 December 2023 for MSCI World index in USD terms

Despite these regular bumps along the way, the US market has delivered strong average annual returns over this 52 year period overall.

The risk of near term loss is the price of the entry ticket for the long term gains that stock market investing can deliver.

3. Bailing out after big falls could cost you your retirement

While the market hasn’t fallen too much so far, further volatility and risk of declines cannot be ruled out. If that happens, it can become much harder to avoid being influenced by our emotions – and be tempted to ditch stocks and dash for cash.

However, our research shows that, historically, that would have been the worst financial decision an investor could have made. It pretty much guarantees that it would take a very long time to recoup losses.

For example, investors who shifted to cash in 1929, after the first 25% fall of the Great Depression, would have had to wait until 1963 to get back to breakeven. This compares with breakeven in early 1945 if they had remained invested in the stock market. And remember, the stock market ultimately fell over 80% during this crash. So, shifting to cash might have avoided the worst of those losses during the crash, but still came out as by far the worst long-term strategy.

Similarly, an investor who shifted to cash in 2008, after the first 25% of losses, would find their portfolio still underwater today.

Past performance is not a guide to the future and may not be repeated

Source: Federal Reserve Bank of St. Louis, Robert Shiller, Schroders. Monthly cash return 1934-2024 based on 3-month Treasury bill, secondary market rate; 1920-1934 based on yields on short-term United States securities; 1871-1920 based on 1-year interest rate. 1871-1920 data only available annually so a constant return on cash has been assumed for all months during this period. Other data is monthly. All analysis is based on nominal amounts.

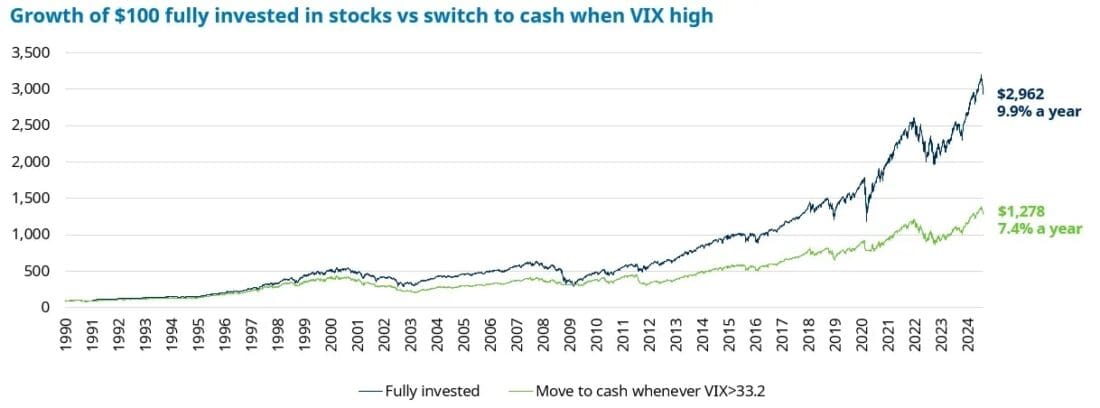

4. Periods of heightened fear have been better for stock market investing than might have been expected.

The stock market’s “fear gauge”, the Vix index, has reached new highs in recent days as investors feared a weakening US economy, among other worries. The Vix is a measure of the amount of volatility traders expect for the US S&P 500 index during the next 30 days.

It last reached a signiicant peak in May 2022, in the aftermath of the invasion of Ukraine.

However, historically, it would have been a bad idea for investors to sell out during periods of heightened fear.

We looked at a switching strategy, which sold out of stocks (S&P 500) and went into cash on a daily basis whenever the Vix was above 30, then shifted back into stocks whenever it dipped back below. This approach would have returned 7.4% a year (ignoring any costs) and underperformed a strategy which remained continually invested in stocks, which would have returned 9.9% a year, again excluding costs.

Past performance is not a guide to the future and may not be repeated.

Note: Levels in excess of 33.2 represent the top 5% of experience for the VIX. Portfolio is rebalanced on a daily basis depending on the level of the VIX at the previous close. Equity index is S&P 500, cash is 30-day cash. Data to 6 August 2024. Figures do not take account of any costs, including transaction costs. Source: CBOE, LSEG Datastream, Schroders

A $100 investment in the continually invested portfolio in January 1990 would have grown to be worth more than 2.5 times as much as $100 invested in the switching portfolio.

As with all investment, the past is not necessarily a guide to the future but history suggests that periods of heightened fear, as we are experiencing at present, have been better for stock market investing than might have been expected.

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account