As the unofficial end of summer approaches with the Labor Day weekend (August 31-September 2), markets may not be particularly attentive to the economic data calendar. There is nothing on it likely to change the outlook for a 25-basis point cut in the fed funds target rate (currently 5.25-5.50 percent) at the September 17-18 meeting, especially after Chair Jerome Powell’s Jackson Hole remarks.

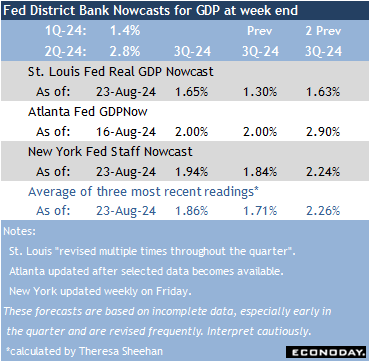

The indicators on the calendar won’t contribute to expectations for the second estimate of second quarter GDP at 8:30 ET on Thursday. There isn’t likely to be much of a revision from the advance estimate of up 2.8 percent. At the moment, the GDP Nowcasts for the third quarter look for growth below that at around perhaps just under 2 percent.

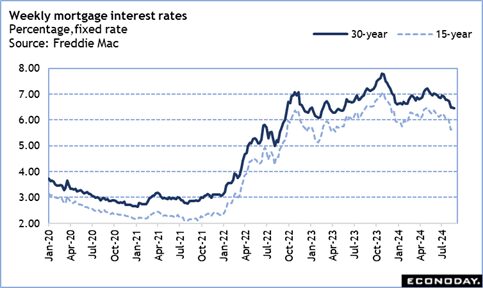

Data related to the housing market in June and July will feel out of date. Mortgage rates started to decline substantially in early August and are anticipated to contribute to greater activity in the coming months. The weekly Freddie Mac 30-year mortgage fixed rate is at 6.46 percent as of August 22, the lowest since 6.39 percent in the May 18, 2023 week. Along with increased housing stock and moderation in prices, homebuyers could re-enter the market. There is also the prospect of another miniwave of refinancing. It now makes sense to refinance newer and/or adjustable-rate mortgages to a lower fixed rate. However, some potential homebuyers who can afford to wait may hold out a bit to see if rates go even lower.

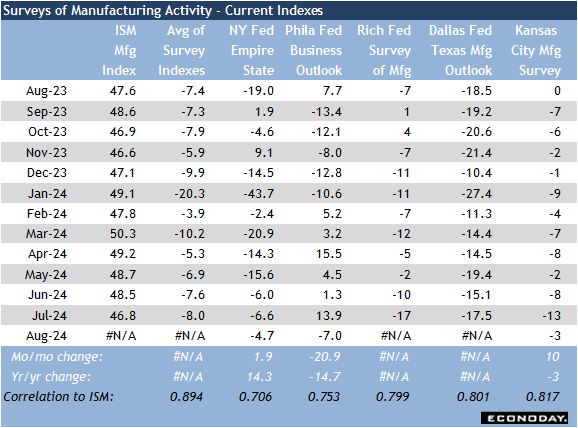

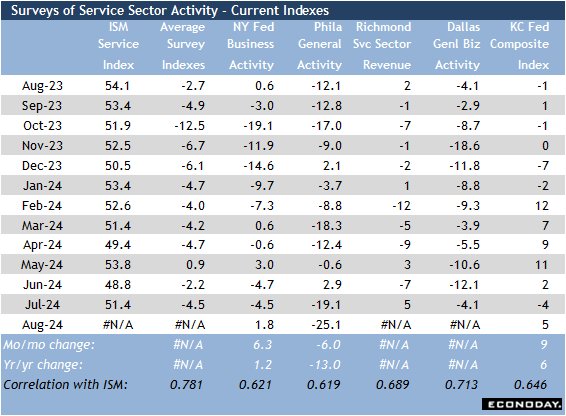

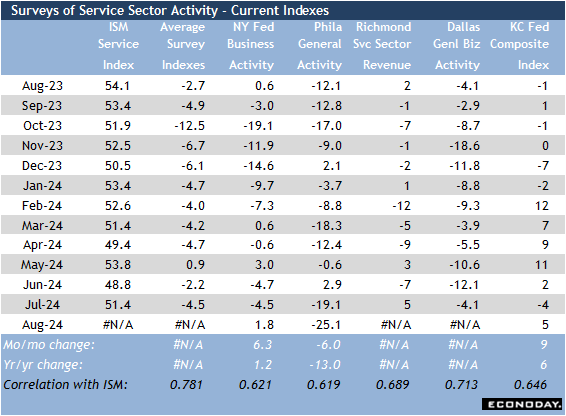

What may get more attention is the Fed distract bank surveys for manufacturing and services in August. Three of the five surveys are now available from New York, Philadelphia, and Kansas City. The Dallas Fed manufacturing survey will be released at 10:30 ET on Monday and service sector survey at 10:30 ET on Tuesday. The Richmond Fed’s surveys of manufacturing and services will be reported at 10:00 ET on Tuesday. On balance, the surveys so far seem to indicate some improvement in conditions in August. However, the picture is incomplete.

Past performance is not indicative of future results

Past performance is not indicative of future results

Past performance is not indicative of future results

–Past performance is not indicative of future results

Originally Posted August 23, 2024 – High points for US economic data scheduled for August 26 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account