1/ This is Gold!

2/ Treasury’s Next Target

3/ EM Bond Re-emerge

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

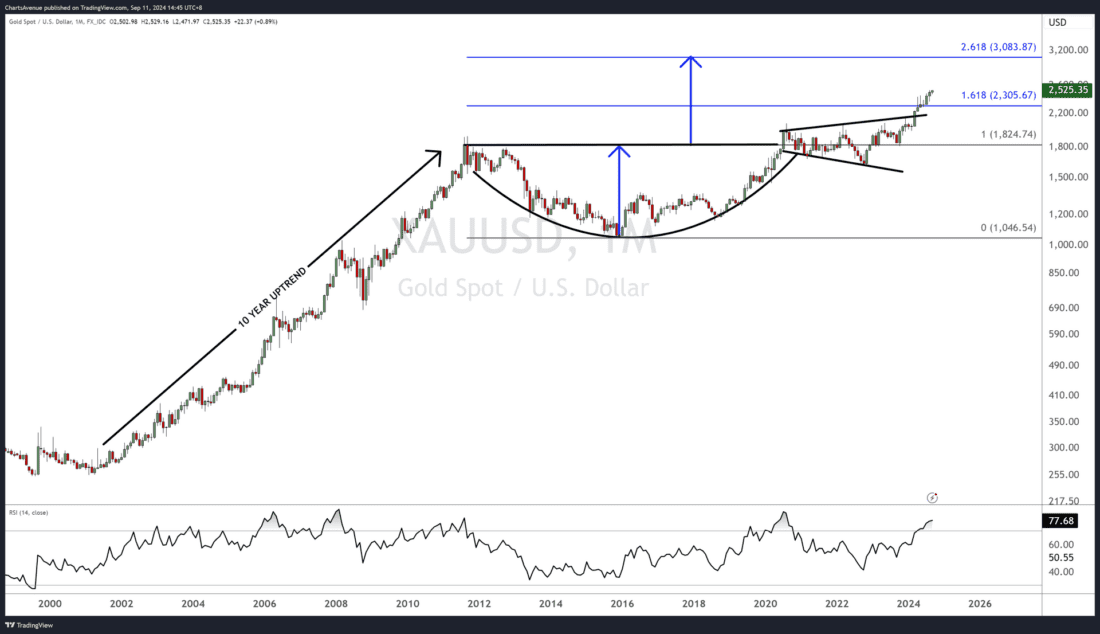

This is Gold!

After a 10-year uptrend, with interim pullbacks, Gold spent the next 9 years digesting this rise through a consolidation, creating a basing pattern. Thereafter, the price went on a sideways drift for close to 4 years, making higher highs and lower lows, producing a broadening formation also known as megaphone. Six months ago, Gold broke out, confirmed by the RSI going into overbought territory, which is evidence of strong buying interest.

Past performance is not indicative of future results

2/

Treasury’s Next Target

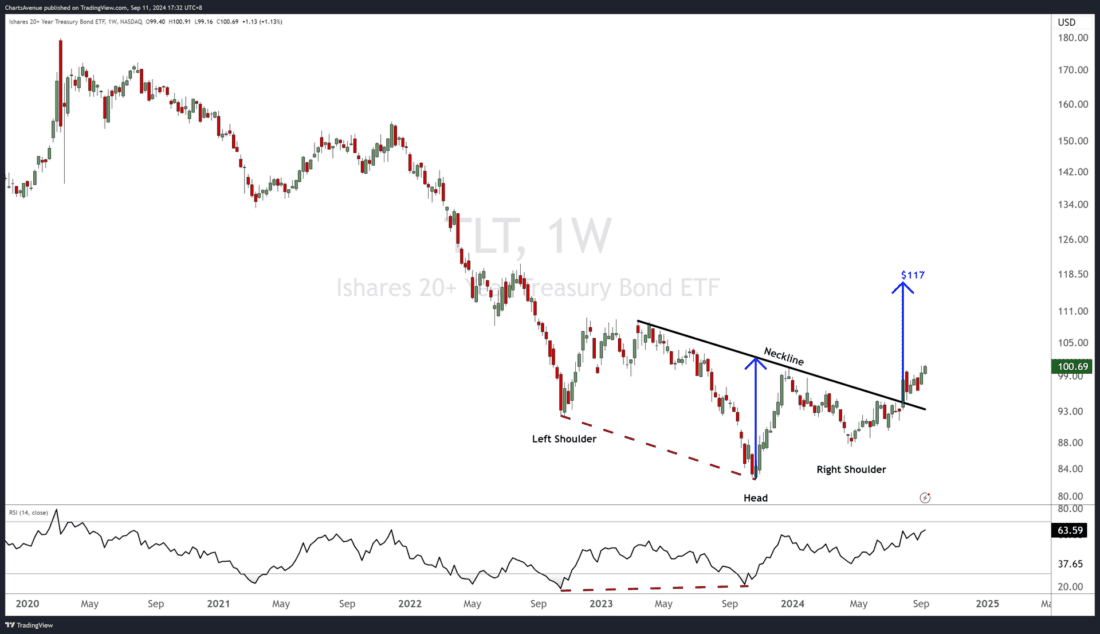

On this weekly chart, we can see how the iShares 20+ Year Treasury Bond ETF ($TLT) is in a slow process of turning around.

While the price low in October 2023 is lower than its previous low (October 2022), the RSI made a higher low, creating a bullish divergence.

The next price low, in April 2024, made a higher low compared to its previous low, the RSI alleviated from oversold levels, suggesting the selling is abating, which is technically a constructive sign for the Treasury ETF.

Past performance is not indicative of future results

$TLT’s price action since mid-2022 produced an inverted head & shoulder pattern.

3/

EM Bond Re-emerge

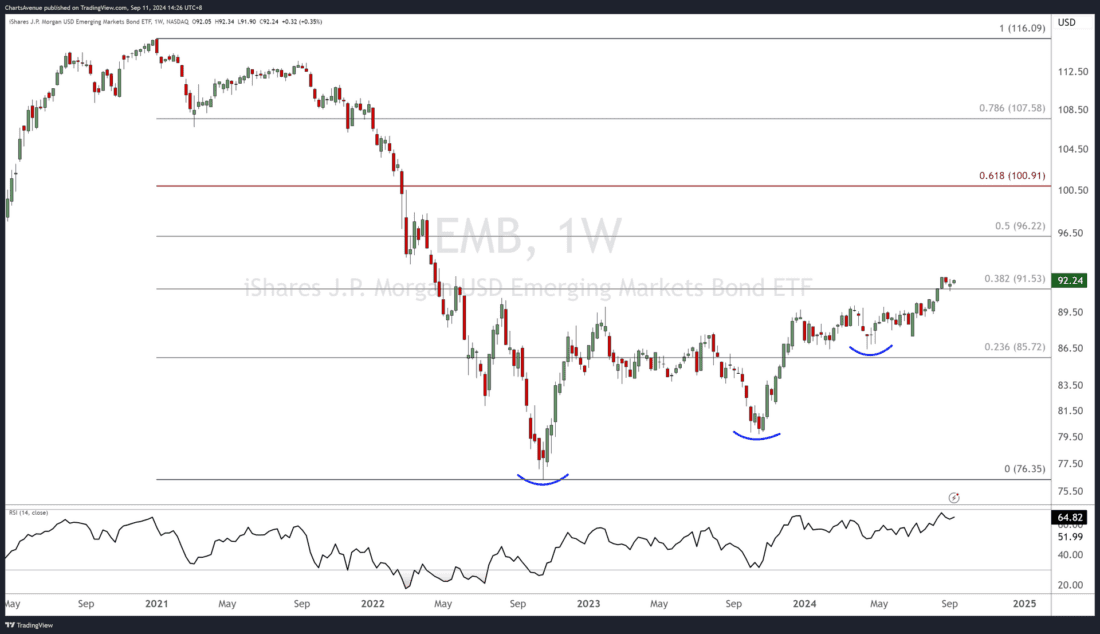

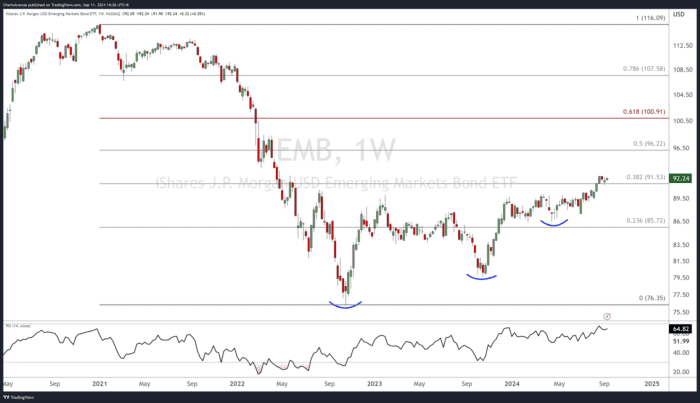

The iShares J.P.Morgan USD Emerging Markets Bond ETF ($EMB) has been in a price recovery mode since its October 2022 low. The price action making higher lows is technically constructive. To help identify important technical levels of support and resistance, Technical Analysts frequently use the Fibonacci retracements. These retracement levels are arrived at by first measuring a complete trend, in this case the January 2021 to October 2022 decline. These calculated levels then act as resistance on the way up and once the price surpasses them, they then act as support levels.

Past performance is not indicative of future results

Three weeks ago, the price was able to lift above its 38.2% retracement level, which is another positive technical input in the price chart, as the breakout suggests that the ETF could rally back to the 61.8% Fibonacci retracement, just above $100, notwithstanding interim pullbacks.

—

Originally posted 12 September 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account