Weekly Research

Names in the News: GD and XOM (report)

This week, we cover two ‘High Quality and Cheap’ U.S. large cap firms that look attractive in the PRVit framework, General Dynamics Corporation (GD, rated ‘Buy’) and Exxon Mobil Corporation (XOM, rated ‘Overweight’). GD’s stock price surged after Gulfstream Aerospace unveiled their new business jet, the Gulfstream G300. XOM announced on Tuesday plans to cut 2,000 jobs as part of their restructuring plan that will affect around 3-4% of the company’s workforce.

Financials Focus List (report)

We examine the ten Financials on our ‘Focus Names’ list: our underlying selection criteria was centered around strong performance within the PRVit model, assessing for strong Quality and attractive Valuation levels. In this report, we look at adding DBK GR and 2881 TT while removing RBI AV and WTFC.

Utilities Focus List Update (report)

The sector is typically considered a defensive play but has shown cyclical traits over the past couple of years, especially within the Electric Utilities industry. The industry has seen a strong investment cycle through the last two years, led by growth in power hungry AI data centers. The underlying selection process for the Focus List is rooted in strong PRVit performance, meaning names with strong Quality and/or favorable Valuation levels

Japan: Big Expectations for a Recovery in Value Creation (report)

In our April Japan report we stated how this was a significant time for corporate Japan, with aggregate EVA Fundamentals at a pivotal point. What we have seen since is a significant deterioration in EVA Fundamentals. This surprised the consensus, which at the time was expecting EVA Momentum to recover. The outlook is now for EVA Margin to contract further into negative territory in Q1 2026. The market, however, has reacted positively to the expected bottoming in economic growth.

Weekly Watchlist: Tracking the Top EVA Standouts (report)

Last week we started a new series in which we take a deep-dive look at select firms that have experienced at least a 5-point improvement in their PRVit Prime score over the past week and are rated as “Overweight” or “Buy” in the framework. In this report we cover U.K. JD Sports Fashion Plc (JD/LN), Hong Kong-based firm Want Want China Holdings Ltd. (151 HK), U.S. firm Concentrix Corporation (CNXC).

Quant Reports

PRVit Factor Report: U.S. (report)

Quality spreads were negative for both Large and Small Caps, driven by negative spreads in our Risk factors. In Large Cap, investors added Risk for the 6th month in a row. In Small Cap, Risk has been negative for 5 of the last 6 months. In the Large Cap universe, Profitability Trend (P2) worked as high-growth names outperformed low-growth names. Cheap Value had worked in both universes in August but that stopped in September.

Quant Corner: October 2nd, 2025 (report)

Due to the timing of the end of the month, this week, our Quant Corner covers all of September and the first of October. PRVit spreads were positive in Japan through the first of October. Quality continued to struggle in all regions. Cheap Value outperformed expensive Value in the U.S., Europe, the U.K., and Japan.

Chart of the Week

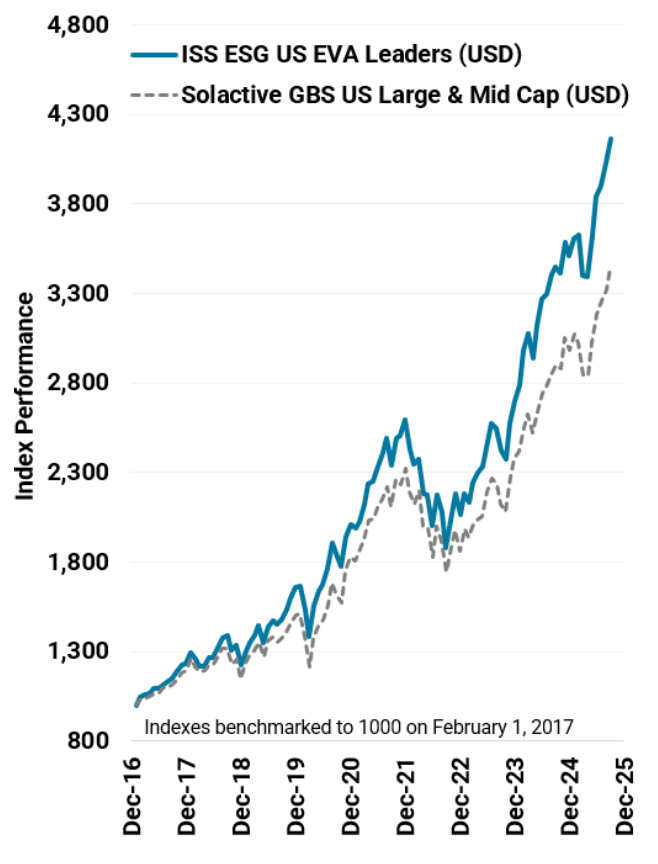

Past performance is not indicative of future results.

In our chart of the week, we look at the performance of the ISS ESG US EVA Leaders Index. The Leaders series start with an underlying regional index, removes prospective constituents with Red Norm- Based Research flags, Red Controversial Weapons flags, and those with an overall ISS ESG Corporate Rating of D-, D, and D+. Next, we apply an EVA screen to remove prospective constituents with a negative EVA Margin. Index methodologies are available on the ISS website. We currently offer three indexes covering the U.S. (ISSEVAUT), Europe (ISSEVAET), and Developed Markets (ISSEVADT) – Bloomberg tickers in parentheses. See PRVit Factor Report for more details.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from ISS EVA and is being posted with its permission. The views expressed in this material are solely those of the author and/or ISS EVA and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Research

The availability of research providers may differ depending on your location. Much of the tools, information and services accessible through research tools are prepared and offered by independent third-party providers and not by Interactive Brokers. Information about a third-party provider provided on market research pages is NOT a recommendation of that provider by Interactive Brokers. Interactive Brokers does not make any representations or warranties concerning the services provided by the third-party providers.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account