We explore why the rather vague concept of a ‘neutral policy rate’ is becoming more important to central banks – and why it is important for the outlook for bonds.

For a central bank, assessing what is the ‘neutral’ interest rate is an important – but theoretical – part of its monetary policy framework. Conceptually, it’s the balance point, where interest rates are neither ‘restricting’ nor ‘stimulating’ economic activity and can be influenced by a variety of factors, such as productivity growth or demographics.

Because it’s so hard to know what the ‘neutral’ rate is, what matters more for bond markets is how close central banks ‘think’ they are to neutrality. This is because if a central bank feels it has reached neutral, it will likely react to new data differently to one that believes itself to be in restrictive territory.

So what does this mean for bond markets? Well, the European Central Bank (ECB) already believes that it is now at a neutral policy rate setting, having halved interest rates since the start of the current cycle in mid-2024.

The market is fully pricing the US Federal Reserve (Fed) to move to neutral over coming quarters too. Similarly, for duration (interest rate risk) we also move our score to ‘neutral’. The prices of these bond markets are already reflecting our view, so it makes sense to be patient.

Have our views on the economy changed since last month?

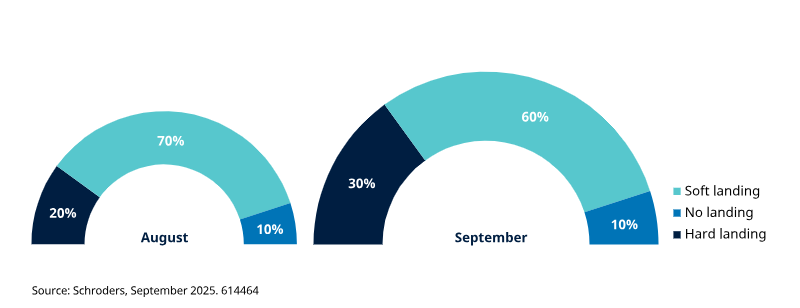

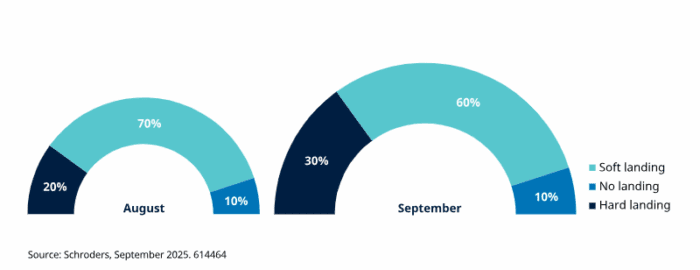

As we move towards the final quarter of 2025, we continue to see a soft landing as the most likely outcome, with a 60% probability. But the risks around that remain are skewed to the downside – a 30% chance of a hard-landing, and a 10% chance of a no-landing.

For the economy a soft landing remains our base case – but risks around this are skewed to the downside

Source: Schroders Global Unconstrained Fixed Income team, September 2025. For illustrative purposes only. % probabilities assigned to each scenario. We define a hard landing as one in which the Fed has moved rates by the end of 2026 into stimulative (e.g. below 3%) territory and a no landing as one where they have kept rates restrictive – we define it as above 4%. A soft-landing is one in which the Fed moves policy to within this band. “Soft landing” refers to a scenario where economic growth slows and inflation pressures ease, allowing modest further rate cuts; “hard landing” refers to a sharp fall in economic activity and deeper rate cuts are deemed necessary; “no landing” refers to a scenario in which inflation remains sticky and interest rates may be required to be kept higher for longer.

Past performance is not indicative of future results

Importantly though, we need to assimilate this economic outlook with what is priced into bond markets to assess the risk versus reward of our portfolio positions.

With US Treasury yields having already fallen (yields move inversely to price), we believe that about 50% of our estimation of hard landing is already in the price of bond markets. That’s why, when it comes to our overall view on interest rate (or duration), we don’t oppose rates market pricing at this stage, but neither do we seek to chase it. We wait patiently for better opportunities to arise.

Labour market slowdown, or labour market recession?

The US labour market has been in stasis over recent months. For cyclical assets, such as credit and equities, a slowdown in the labour market accompanied by easier monetary policy has so far been unproblematic, but a further, deep downturn in the labour market would be a problem.

So do we see a labour market recession from here as likely? In short, no. Our view is that the recent stall-speed reflects high uncertainty and companies have rationally held off both hiring and firing. As uncertainty eases, we expect stabilisation, but not a sharp rebound.

Why cut further? ECB back at neutral and happy there

We wrote last month that we felt the need for the ECB to ease rates further was limited and that they were moving towards agreeing with that assessment. Since then, our views on the matter are little changed and President Lagarde’s recent press conference suggested the governing council’s view continues to move in our direction.

We believe there remains room for eurozone yields to move modestly higher as the further cuts priced in for the ECB are removed, but also for curves to steepen (i.e. longer dated bond yields move comparatively higher to shorter maturities) due to worsening supply-and-demand dynamics for long-end bonds.

Waiting for better opportunities

We’ve mentioned our neutral view on interest rate risk, but how about our asset allocation views?

We continue to be wary of corporate credit in both investment grade (IG) and high yield (HY). While fundamentals like corporate profitability remain solid, valuations do not. Any weakening of the market would be an opportunity to add, but for now we are happy to wait patiently on the sidelines.

Instead, we continue to see better value in areas such as agency mortgage-backed securities (MBS), covered bonds (which are highly rates-securitised assets) and emerging market debt (both local currency and denominated in euros).

—

Originally Posted – Unconstrained fixed income views: September 2025

The views and opinions contained herein are those of Schroders’ investment teams and/or Economics Group, and do not necessarily represent Schroder Investment Management North America Inc.’s house views. These views are subject to change. This information is intended to be for information purposes only and it is not intended as promotional material in any respect.

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bonds

As with all investments, your capital is at risk.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account