The stock market bonanza shows no signs of fatigue after yesterday’s Fed decision was accompanied by predictions of one or two more cuts by Christmas amidst economic growth estimates in the dot-plot being revised upward. Today’s US calendar offered additional support to animal spirits while bolstering confidence that the cycle remains on solid footing. Indeed, investors breathed a sigh of relief following this morning’s weekly layoff report depicting plunging initial unemployment claims, just seven days after the print reached its highest level in 47 months, which had generated elevated angst about labor conditions. But Treasuries aren’t joining in the enthusiasm, however, because central banking officials collectively envision only one quarter-point reduction in 2026 followed by another trim of the same magnitude in 2027. The development is disappointing fixed-income watchers who were pricing in 150 bps of easing by the culmination of next year. SEP forecasts pointing to limited monetary policy accommodation ahead alongside heavier cost pressure expectations and reduced employment worries driven by lighter-than-anticipated jobless filings are sending the yield curve north in bear-steepening fashion led by the long end. Pricier borrowing costs are driving gains for the greenback, while a nearly united FOMC featuring just one dissenter is helping to quell concerns related to political motivations for significant reductions, actions which tend to weaken currencies due to traders perceiving that inflation mandates are being sidelined. All commodity majors are seeing weaker prices and volatility protection holdings are cheaper as well while risk-on sentiment depletes hedging demand.

Unemployment Print Helps Ease Labor Market Angst

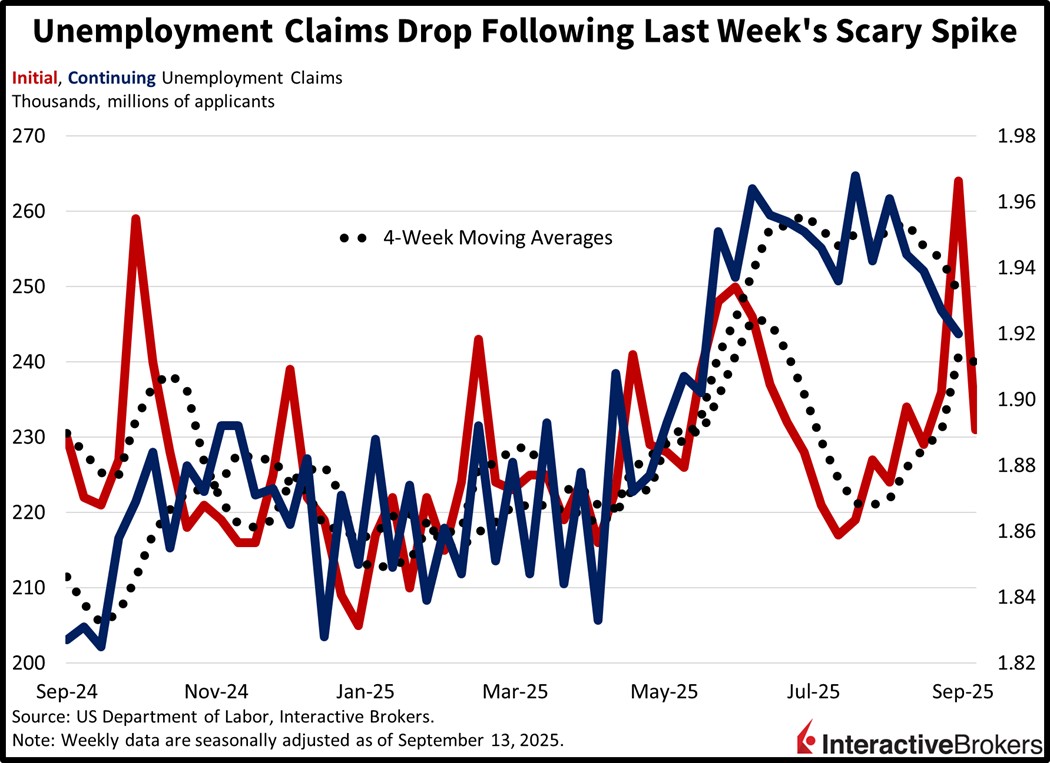

Initial unemployment claims declined last week following a scare in the previous period that was sparked by the metric hitting a 47-month high. The 231k filings reported this morning for the time span culminating on September 13 were lighter than the 240k median estimate and the preceding interval’s 264k. Continuing applications also improved, dropping from 1.927 million to 1.92 million for the seven-day term ended on Sept. 6. Additionally, it was beneath the 1.95 million projection. In an encouraging development considering that folks have been worried about the labor market, four-week moving averages, which help smooth out volatility from weekly data, declined across both indicators, slipping from 240.75k and 1.943 million to 240k and 1.933 million.

Past Performance is not indicative of future results

Reacceleration of Economy is Sustainable

The resumption of the Fed’s easing cycle supports the reacceleration theme during the second half of 2025 that we’ve been witnessing following some of the turbulence in the first six months of the year that was triggered primarily by volatile trade negotiations. Indeed, the Atlanta Fed’s GDP Now indicator is reflecting 3.3% growth in the current quarter, but I think the expansion will achieve a 4-handle when we receive the preliminary numbers before Halloween. Consumers have been rebounding ferociously and business investment has been consistently robust, while the benefits of lighter taxation and milder regulations coincide with a momentous landscape. And thanks to the Fed, financial conditions are loosening, which will help the cyclically oriented, rate-sensitive areas of the economy that have been languishing, namely small businesses, real estate and manufacturing. Emblematic of this stimulative effect is the Russell 2000 leading the major benchmarks by a wide margin once again today, because it’s the gauge most vulnerable to restrictive monetary policy. Finally, tariff revenues are arriving much stronger than many of us anticipated in the beginning of the year, helping to balance the fiscal situation by incrementally reducing deficit and sovereign debt concerns via softer term premiums and containing yields at the long-end of the curve as a result.

International Roundup

BoE Holds Key Rate, Slows Scaling Back QT

At a time when the UK is struggling with strong price pressures and a weakening job market, the Bank of England (BoE) this morning held its key interest rate unchanged at 4% and decided to slow its quantitative tightening. After five rate cuts during the past 12 months, today’s decision was supported by seven members while two policymakers pushed for a 25-bps reduction. The action implies that the central bank is more concerned about price pressures than the job market, with annualized inflation moving from 3% in January to 3.8% as of August even as labor demand has weakened. On a favorable note, policymakers believe inflation has peaked.

Weak Foreign Demand Hits Japanese Machine Orders

A significant decline in activity from foreign customers caused Japanese machinery orders to contract 4.2% month over month (m/m) in July after climbing 0.3% in June, according to the Cabinet Office. The metric also descended 1.8% year over year (y/y) following June’s 1.9% positive print. Meanwhile, the core gauge for the private sector, which excludes ships and electric utility products, sank 4.6% m/m, but was 4.9% higher relative to the year-ago period. In the preceding month, the metric was up a 3% m/m and 7.6% y/y.

Within the headline print, overseas requests sank 8.4% m/m and 20.7% y/y compared to expanding 8.8% m/m and descending 5.8% y/y in June. The weak showing from non-Japanese customers offset the 3.7% m/m and 17.2 y/y growth from the country’s private sector and government orders that climbed 21.3% m/m and 32.9% y/y. Japan’s trade with the US has been stymied by the world’s largest economy enacting a 27.5% import tax on the country’s products. The levy, however, was reduced to 15% as of Sept. 16.

Australia’s Payrolls Sink, Defying Growth Estimate

Australia’s payrolls lost 40,900 full-time employees in August after adding 63,600 workers in June. Also in August, part-time workers increased by 35,500, resulting in the total number of individuals punching the time clock falling 5,400. Economists anticipated a July addition of 21,200 following June’s 26,500 gain. At the same time, the average hourly work week shortened by 0.4%. Meanwhile, the country’s participation rate fell from 67% to 66.8%, missing the economist consensus estimate for no change. In a related matter, the unemployment rate, which is close to historical lows, remained unchanged and matched the economist consensus estimate of 4.2%.

The Reserve Bank of Australia (RBA) has dished out three interest rate cuts since February, bringing the benchmark to 3.6% and helping to support consumer spending. Inflation, furthermore, is trending within the organization’s target range of 2% to 3%. The RBA’s next rate setting meeting is at the end of this month.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account