It’s time for another musical reference, this time more obscure than usual. I was hoping to utilize the title of the 1990 album “Goodbye Jumbo”, but John Authers’ column for Bloomberg beat me to the punch. We of course learned yesterday that the FOMC opted for a 25-basis point cut despite the faint expectations for something larger. For a few minutes during Powell’s press conference yesterday, that album’s minor hit “Way Down Now” seemed to apply, but as I begin typing this morning, the recording artist’s name, World Party, was much more appropriate.

Although Chair Powell is clearly a lame duck, with his term expiring in May, his comments during his press conference were indeed quite deft. Despite acknowledging that the Fed was indeed cutting rates amidst rising prices, he was generally able to portray yesterday’s FOMC decision as a “risk management cut.” His opening speech contained the phrase, “it is also possible that the inflationary effects could instead be more persistent, and that is a risk to be assessed and managed,” but it was quite clear that the more pressing risk was deemed to be that of a weaker labor market rather than higher prices.

This was apparent in the FOMC Statement, which omitted the line “the committee judges that the risks to achieving its employment and inflation goals are roughly in balance”. If the risks are no longer in balance, then one must have increased relative to the other. It was reiterated just seconds after Powell approached the podium, when he said:

While the unemployment rate remains low, it has edged up, job gains have slowed, and downside risks to employment have risen. At the same time, inflation has risen recently and remains somewhat elevated. In support of our goals, and in light of the shift in the balance of risks, today the Federal Open Market Committee decided to lower our policy interest rate by 1/4 percentage point. We also decided to continue to reduce our securities holdings.

The consensus was remarkably tight, with only one dissent. That the newly appointed governor, Stephen Miran, was the only dissenter was hardly a surprise. It was widely assumed that he was going to advocate for a larger cut, and he did. Based on prior public statements from various voting members of the FOMC, it seemed reasonable to expect that at least one would advocate either for a more aggressive cut or even none. Instead, the pre-existing members all fell into line.

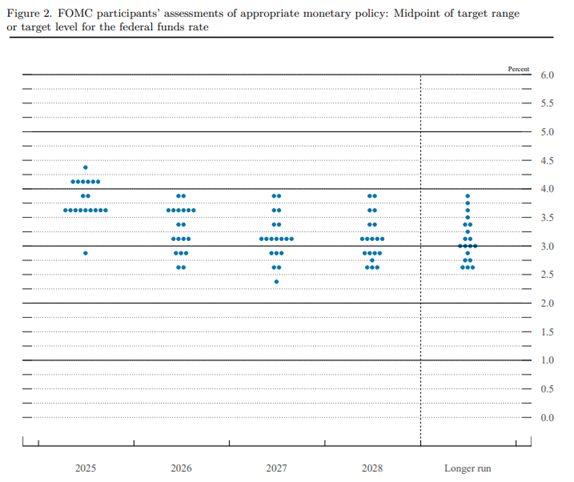

One place where there was a wider range of opinions was in the Summary of Economic Projections, or “dot plot”. There were wide spreads in the projections for future cuts, but the market enjoyed the idea that the median projection for the remainder of 2025 was for two more cuts. That ratified the market’s expectations, so traders of course took heart from that.

Federal Reserve “Dot Plot” for September 2025

Source: Federal Reserve

Of course, as the Chair reminded us, a median means that half the readings are above that level. In this case, 9 dots are clustered on the 3.625% median and only one data point is below that. Although the dots are anonymous, it seems quite obvious that the low reading belongs to Dr. Miran. Meanwhile, 9 dots are above that level, with 6 projecting that rates will be unchanged from the new 4.125% target, two projecting a single cut, and one projecting a reversion to the prior 4.375% level. Furthermore, the median for 2026 is 3.375%, which would imply only one further cut next year. That is well above the market’s expectation for rates around the 3% level. The bias is clearly toward further rate cuts, but the market might once again be more optimistic about their prospects for their arrival.

Once again, though some familiar patterns played out in the market’s post-FOMC reaction. First, the market hears what it wants. The Chair reiterated the risks to inflation, but once he declared them to be secondary, the market was glad to hear it. Second, the “half-life” of dips continues to shrink. We did have a few somewhat rocky moments yesterday afternoon, but buyers quickly emerged to buy the dip – as usual. Third, good news in the tech sector is a reliable source of lift, with today’s news of Nvidia’s (NVDA) stake in Intel (INTC) proving to be today’s catalyst.

This brings us around to this morning’s theme music. The group World Party was at best a modest success in the US and UK. Hopefully their biggest hit, “Ship of Fools”, with the refrain, “I don’t want to sail on this ship of fools” does not apply to the FOMC!

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account