Despite continued upward pressures on long-dated developed market government bond yields, emerging markets (EM) debt keeps posting strong returns. After a brief pause in July, all EM debt sub-sectors have resumed the bullish trends that have defined much of this year.

EM local currency debt, as measured by the JP Morgan Government Bond Index-Emerging Markets Global Diversified (GBI-EM GD), has now delivered a year-to-date return of +13.8% as at end of August, with all countries contributing positively to this performance. Similarly, EM hard currency debt has extended its gains, returning +8.7% year-to-date as measured by the JP Morgan Emerging Market Bond Index Global Diversified (EMBI GD) index.

The bullish positioning held by our EM debt portfolios for much of this year remains broadly unchanged. The tactical currency hedges introduced in July have been gradually unwound in August, reinforcing our long-term constructive stance, particularly towards EM local rates (i.e. local currency bonds) and currencies. We also continue to identify compelling opportunities in EM high-yield dollar denominated debt.

By contrast, the difference in yields (spreads) between investment grade emerging market bonds and US Treasury bonds fell below the 100bps mark in August, a new post-global financial crisis low. This leaves limited scope for further compression.

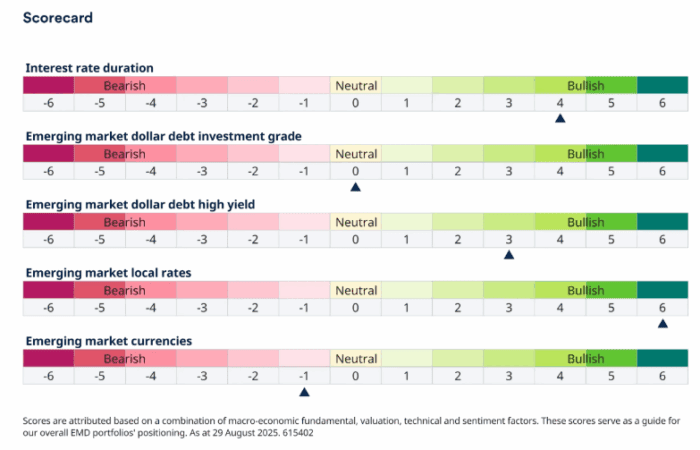

This sectoral assessment is reflected in our updated scorecard (Figure 1).

Figure 1: Sectoral Scorecard

Past performance is not indicative of future results. Note: Interest rate duration refers to US rates performance. EM dollar debt IG forecasts investment grade hard currency debt, while EM dollar debt HY forecasts non-investment grade hard currency debt. Investment grade bonds are the highest quality bonds as determined by a credit rating agency. High yield bonds are more speculative, with a credit rating below investment grade. EM local rates forecast EM local currency bond prices, and EM currencies forecast EM currencies versus the US dollar.

Figure 2: Improving sentiment towards EM debt

Source: Schroders, 31 August 2025. Past performance is not indicative of future results.

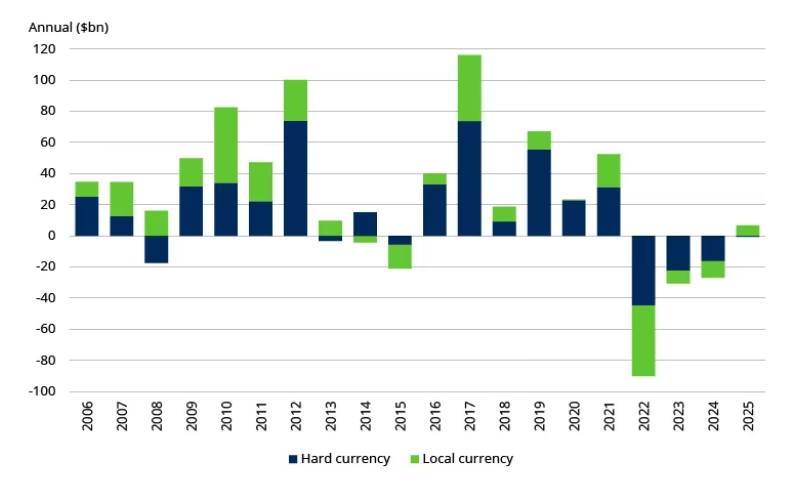

Figure 3: EM debt fund flows

Source: Schroders, JP Morgan, 31 July 2025. Past performance is not indicative of future results.

While further dislocations emanating from developed market government bonds may still require our EMD portfolios to use tactical currency and interest rate duration hedges, we expect the recent positive performance trajectory of EM debt to remain supported by the following dynamics:

(i) Global growth expectations are recovering after the dip experienced during the first half of this year. This global growth resilience is continuing despite the extreme uncertainties generated by US trade tariffs, the persistent concerns about China’s long-term growth trajectory and the historically high levels of real (inflation-adjusted) rates elsewhere in EM. With strong balance of payments, very manageable external financing needs and still reasonably stable and predictable policy frameworks in key EMs, we expect the asset class to sustain this growth resilience.

(ii) The EM disinflation cycle remains firmly in place with the recent dollar depreciation reinforcing the disinflationary forces in EM. China’s industrial overcapacity and weak domestic demand continue to drive its producer price indices into deflation, reinforcing China’s ability to export cheap goods globally. With China’s property malaise still ongoing, deflationary pressures are expected to persist. However, our Economics team highlights that these effects will not be evenly distributed around the world. Countries with high export overlap with China may shield industries through tariffs. Conversely, commodity-exporting EMs in Latin America, Africa, and the Middle East, where export overlap with China is low, stand to benefit from cheaper imports, higher real incomes, and stable trade balances. High yielding bonds in these markets should continue to benefit handsomely from these trends, especially given their still depressed valuations).

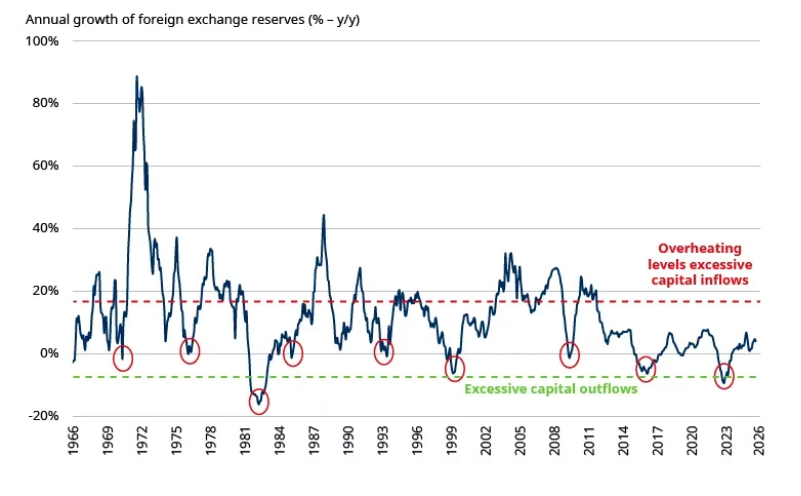

(iii) Global financial liquidity remains ample despite high levels of real rates and the ongoing withdrawal of official dollar liquidity generated by the rapid rebuild of the US Treasury General Account at the Fed (this is the government main ‘checking account’ at the Fed, which receives tax receipts and proceeds from debt sales). This ample liquidity can still be seen in the strong growth of global real monetary aggregates (which measures money in circulation across economies), the recovery in EM foreign exchange reserves (figure 4) and the apparent rebound of portfolio flows into EM.

Figure 4: EM foreign exchange reserves growth (y/y)

Source: Schroders, Bloomberg, LSEG Data & Analytics, 29 August 2025. Past performance is not indicative of future results.

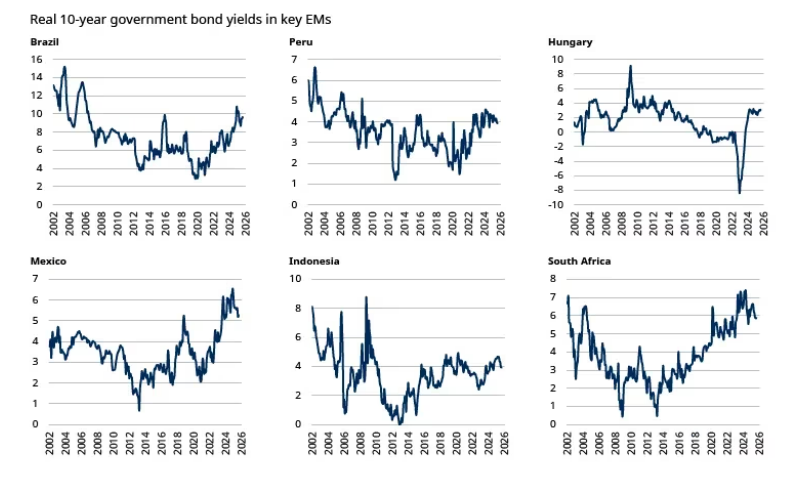

(iv) EM debt valuations remain attractive even after the strong returns of the last three years. While EM dollar debt investment grade has now reached historically tight spread levels, there are still appealing opportunities in dollar debt high yield and even more significantly in EM local rates (figure 5)

Figure 5: 10-year real bond yields in selected EM countries (%)

Source: Schroders, Bloomberg, LSEG DataStream, 29 August 2025. For illustrative purposes only and not a recommendation to buy or sell. Past performance is not indicative of future results.

(v) EM technical conditions remain favourable despite some evidence of excessive short-term positioning in EM currencies. With growing evidence of market participants being overwhelmingly negative on the US dollar, we have been recently concerned about a short-term correction in EM. We now take comfort for the fact that inflows to the asset class are recovering from extremely low levels, which has mitigated the risk of this short-term correction.

(vi) Several “frontier” economies previously at risk of crisis have also now made progress toward restoring debt and balance of payments sustainability through debt restructurings (e.g. Sri Lanka), IMF programmes (e.g. Egypt), or economic shock therapy (e.g. Argentina). In each case, markets have responded positively, rewarding these efforts with strong bond rallies over the past two years. Senegal is the most recent example of a country moving toward an IMF agreement aimed at addressing its still challenging debt burden and persistent twin deficits.

—

Originally Posted September 8, 2025 – Emerging markets debt investment views – September 2025

The views and opinions contained herein are those of Schroders’ investment teams and/or Economics Group, and do not necessarily represent Schroder Investment Management North America Inc.’s house views. These views are subject to change. This information is intended to be for information purposes only and it is not intended as promotional material in any respect.

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Bond Investments

As with all investments, your capital is at risk.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account