Key takeaways

September rate cut

A weakening labor market and anchored inflation expectations likely give the Fed the green light to cut interest rates.

Long-bond sell-off

Global long-term bonds were volatile amid political uncertainty and potential concerns over fiscal sustainability.

Gold high

Gold reached record levels,1 driven by expectations for rate cuts and increased demand among investors.

The US jobs report for non-farm payrolls was “must-see TV” last week. While employment data can shift expectations for economic growth, inflation, policy rates, and stock valuations, this report had heightened significance because markets are awaiting what the Federal Reserve (Fed) will do regarding monetary policy. It also had added weight because of concerns about the politicization of the data. Had the data exceeded expectations, skepticism about its credibility might have dominated the narrative. Instead, the report showed a slowdown in job creation, consistent with the ADP private payroll data.

Jobs data support a September rate cut

While the September 5 report showed job growth had slowed, it doesn’t appear to be signaling a recession. Demand for workers has eased, but layoffs remained limited.2 Labor supply has also declined due to retirements and reduced immigration.3 With the slower job growth in the September 5 report, it appears that the Fed is now all but guaranteed to cut rates on September 17. A 25-basis point (bps) cut is fully priced by the market,4 and we’d not be surprised to see some Federal Open Market Committee (FOMC) members, such as Christopher Waller and Michelle Bowman, vote for a 50-bps cut. But we don’t think that’s warranted at this stage. The report showed that just 22,000 jobs were created in August, and the June and July figures were revised lower by a cumulative 21,000. The unemployment rate climbed to 4.3%, broadly in line with consensus forecasts. Average weekly hours worked also fell, which can be taken as a further signal that employers need their staff to do less work.5

Good news for markets?

When inflation is elevated6 weaker job growth can be interpreted as good news for markets. It can mean that the economy isn’t overheating and that a sustained period of inflation is unlikely. It can also suggest that multiple rate cuts may be on the horizon. Lower yields across the Treasury curve can support stock valuations. Slower growth, anchored inflation expectations, falling yields, and anticipated rate cuts point to an optimistic outlook for stocks.

Long bond sell-off isn’t a reason for panic

Interest rates rallied across the U.S. Treasury yield curve on Friday, following the weaker-than-expected jobs report that shifted investor focus toward signs of economic softness. This marked a notable reversal from earlier in the week, when concerns were mounting over the rise in 30-year US Treasury yields. The initial selloff was driven by a mix of inflation worries, questions about the Fed’s independence, and growing unease over US fiscal sustainability. By week’s end, however, those concerns had eased, and attention turned to the weakening economic data, sending the 30-year yield plunging below 4.8%.7

The US wasn’t alone in experiencing upward pressure on long-term rates — France, the UK, Japan, and others also saw similar moves. In both the UK and France, the rise in yields reflects increasingly complex political environments, where policymakers may need to adjust course to address widening fiscal deficits. Despite these challenges, stock markets in the UK and France have performed well this year, supported by their structural overweight to banks and industrials, the steepening of their yield curves, and optimism surrounding European fiscal spending initiatives.

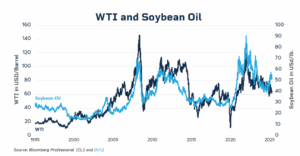

Gold rush

Driven by concerns around fiscal sustainability and central bank independence, as well as expectations for Fed rate cuts, gold experienced a meaningful rally in recent weeks. Since mid-August, the precious metal has surged more than 8% on the back of a rise in long-end sovereign bond yields, the attempted firing of Fed Governor Lisa Cook by the White House, and hints of a potential policy pivot from Fed Chair Jerome Powell at the Jackson Hole Symposium.8 Gold has now notched three consecutive weeks of gains — its longest win streak in six months — pushing prices to record highs approaching $3,600 per troy ounce.9

Despite already posting double-digit returns in both 2023 and 2024, gold is up nearly 35% year-to-date,10 and the fundamental drivers behind its performance remain firmly in place, in our opinion. These include:

- Persistent central bank buying, which has shown no signs of letting up.

- Investor demand for hedges against fiscal and geopolitical uncertainty.

- The prospects for lower interest rates may diminish the relative appeal of holding cash.

Notably, the broader investment community finally appears to be participating in gold’s rally. After years of tepid interest and weak flows, gold ETFs have seen a remarkable rebound in demand this year.11 Gold mining stocks have also attracted greater investor attention, underscored by the NYSE Arca Gold Miners Index’s 97% year-to-date return.12

The rapid rise in gold prices and renewed interest in gold funds could prove self-reinforcing. Greater investor demand can push up the price, which in turn attracts more investor attention.

What to watch this week

| Date | Region | Event | Why it matters |

|---|---|---|---|

| Sept. 10 | UK | Claimant Count Change, Average Earnings Index, and unemployment rate | Key labor market indicators, which influence Bank of England policy decisions |

| Eurozone | ZEW Economic Sentiment Index (Germany and eurozone) | Measures investor confidence and economic outlook | |

| Sept. 11 | US | Consumer Price Index (CPI), Core CPI, and 10-year bond auction | Critical inflation data; guides Fed’s interest rate decisions |

| UK | Gross domestic product (GDP) | Monthly growth indicator; reflects short-term economic momentum | |

| Sept. 12 | US | Producer Price Index (PPI), Core PPI, unemployment claims, and 30-year bond auction | Producer inflation data and labor market trends; auction impacts bond yields and Fed view |

| Eurozone | European Central Bank (ECB) interest rate decision | Central bank policy announcement; affects euro and global risk sentiment | |

| UK | Monetary policy report hearings | Offers insight into Bank of England’s economic assessments and policy outlook | |

| Sept. 13 | US | Michigan Consumer Sentiment Index: Inflation Expectations | Gauges consumer confidence and inflation outlook; closely watched by markets |

—

Originally Posted on September 8, 2025

Slower job growth likely solidifies September rate cut by Invesco US

Footnotes

- Source: Bloomberg L.P., Sept. 5, 2025, based on the gold spot price. A troy ounce is heavier than a regular ounce and is the standard unit for weighing and pricing precious metals.

- Source: US Department of Labor, Aug. 30, 2025, based on initial jobless claims.

- Source: US Department of Labor, Aug. 30, 2025, based on labor force participation rate.

- Source: Bloomberg L.P., Sept. 5, 2025, based on the fed funds implied rate.

- Source for all data in the paragraph: US Bureau of Labor Statistics, Aug. 31, 2025.

- Source: US Bureau of Labor Statistics, July 31, 2025, based on the US Consumer Price Index.

- Source: Bloomberg L.P., Sept. 5, 2025, based on the 30-year US Treasury rate.

- Source: Bloomberg L.P., Sept. 5, 2025, performance based on the gold spot price from Aug. 19, 2025–Sept. 5, 2025.

- Source: Bloomberg L.P., Sept. 5, 2025, based on the gold spot price. A troy ounce is heavier than a regular ounce and is the standard unit for weighing and pricing precious metals.

- Source: Bloomberg L.P., Sept. 5, 2025, based on the gold spot price.

- Source: Bloomberg L.P., Sept. 5, 2025, based on the total known holdings of gold by ETFs.

- Source: Bloomberg L.P., Sept. 5, 2025. The NYSE Arca Gold Miners Index is a market capitalization-weighted index designed to track the performance of publicly traded companies primarily engaged in the mining of gold and silver.

Disclosure: Invesco US

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial advisor/financial consultant before making any investment decisions. Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

All data provided by Invesco unless otherwise noted.

Invesco Distributors, Inc. is the US distributor for Invesco Ltd.’s Retail Products and Collective Trust Funds. Institutional Separate Accounts and Separately Managed Accounts are offered by affiliated investment advisers, which provide investment advisory services and do not sell securities. These firms, like Invesco Distributors, Inc., are indirect, wholly owned subsidiaries of Invesco Ltd.

©2024 Invesco Ltd. All rights reserved.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Invesco US and is being posted with its permission. The views expressed in this material are solely those of the author and/or Invesco US and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bond Investments

As with all investments, your capital is at risk.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account