Deutsche Bank analysts have raised concerns about the market cap of Nvidia Corporation

(NVDA), suggesting that it may be contributing to a potential bubble in the U.S. equities market.

Nvidia’s Surge Fuels Concerns Of A US Equity Bubble

Deutsche Bank’s research note, authored by analysts Jim Reid, Henry Allen, and Rajsekhar Bhattacharyya, raises the question of whether the U.S. equities market is in a bubble. The report highlights Nvidia’s substantial market cap as a potential contributing factor to this situation, reported Fortune.

U.S. could be considered a “bubble risk,” it said.

The report highlights that Nvidia, along with Microsoft (MSFT), Alphabet (GOOG) (GOOGL), Apple (AAPL) and Amazon (AMZN), now makes up 30% of the S&P 500’s total market value — a concentration surpassing the dotcom bubble of 2000 and raising concerns of distortion in U.S. equities.

The analysts point out that Nvidia’s market cap now exceeds that of every country’s listed stock exchange, except for the U.S., China, Japan and India, a trend that has historically not been the case.

The analysts stated, “The U.S. is now nearly five times larger than China (in second) and around 20 times larger than Europe’s larger markets.” They added that this doesn’t necessarily mean a bubble, but it does indicate we are in uncharted territory.

Over the past 5 days, the S&P 500 experienced a 0.22% drop, while Nvidia’s shares plummeted by 6.19%, as per data from Benzinga Pro. This significant decline in Nvidia’s stock value has sparked concerns about the overall stability of the U.S. equities market.

Soaring Treasury Yields Weigh on High P/E Tech Stocks

Nvidia, with its astonishing growth and a market cap of $4.2 trillion, is now worth more than the equity markets of five of the seven G7 nations—Italy, Germany, France, the U.K., and Canada.

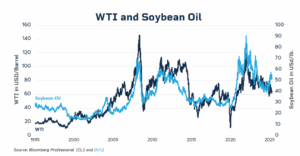

Earlier this week, Nvidia’s stock was trading lower due to a broader tech sell-off triggered by rising long-term interest rates. The rise in the 10-year Treasury yield to nearly 5% put pressure on high-growth, high P/E stocks, making future earnings seem less valuable and leading to a retreat from tech sector leaders.

Concerns about the impact of rising long-term interest rates on certain stocks were also expressed by Gary Black, Managing Director of The Future Fund LLC. He warned that high P/E stocks like Nvidia, Tesla

(TSLA) and Palantir (PLTR) could be significantly affected by the rise in 10-year Treasury yields.

—

Originally Posted September 4, 2025 – Nvidia’s Soaring Market Cap Pushing S&P 500 Towards ‘Bubble Risk,’ Warns Deutsche Bank

Disclosure: Benzinga

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Benzinga and is being posted with its permission. The views expressed in this material are solely those of the author and/or Benzinga and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account