Originally Posted 26 August 2025 – Above the Noise: Positive signs for US economy and markets

Key takeaways

US economy

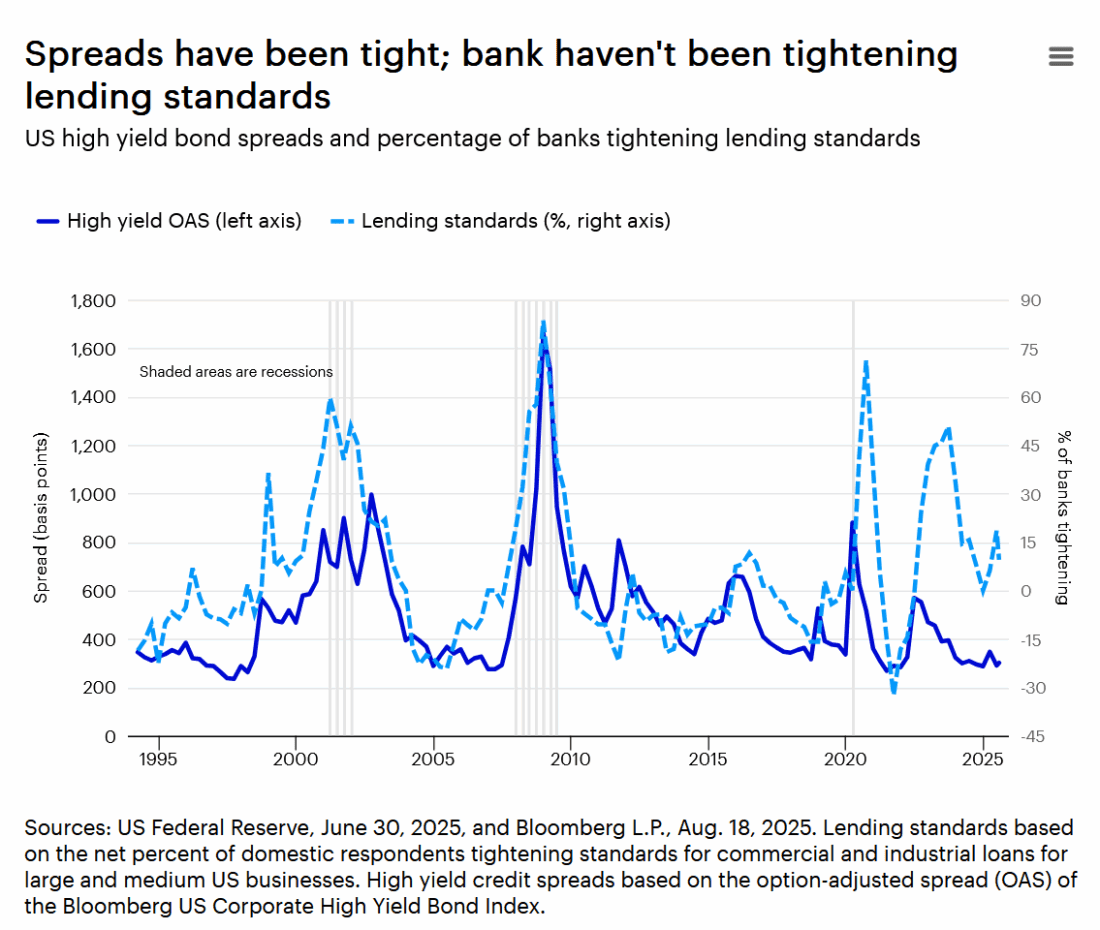

Only 9.5% of senior loan officers report tightening standards, far below the 50%-60% typical recession levels.

US markets

More than half of the NYSE companies are trading above their 200-day moving averages, just above the long-term norm.

Job reports

These are less about pinpoint precision and more about capturing the overall direction of the economy and labor market.

Why do people keep asking me whether I think 100 unarmed humans could defeat a fully grown silverback gorilla in a fight to the death? I have so many follow-up questions. First: Do I get to choose the other 99 humans? Second: Are there any rules, or is this an old-school World Wrestling Federation no-holds-barred scenario? Third: Why would I want to provoke a typically calm and gentle animal?

I’m not sure where the social media consensus has landed, but personally, I’d rather not test an animal that can lift more than 1,800 pounds and bite with a force of 1,300 PSI. Yes, gorillas rarely use their strength aggressively, but I’d prefer to keep it that way.

It’s analogous to asking whether the $30 trillion US gorilla of an economy1 can withstand policymakers armed with tariffs, “too-late” monetary policy, regressive fiscal bills, and “rigged” job numbers, to name a few. Personally, I would have preferred we left the docile early-2025 US economy alone. Growth was resilient.2 Inflation was stable.3 Let sleeping giants lie, as they say.

Instead, the contest has begun. The debate is viral.

And once again, I’m going with the gorilla.

It may be confirmation bias, but…

… the usual “canaries in the coal mine” for the US economy aren’t flapping, wheezing, or falling off their perch. (Apologies for the back-to-back animal metaphors.) A look at bank lending standards and credit spreads reveals little cause for alarm. Only 9.5% of senior loan officers report tightening standards, far below the 50%-60% levels typically seen during recessions.4 Meanwhile, high yield credit spreads are trading roughly 200 basis points below their long-term average,5 which suggests investors are confident enough in the economy to continue to lend money to businesses with below-investment grade ratings.

In short, the canaries are still singing.

Past performance does not guarantee future results.

Since you asked (part 1)

Q: Isn’t it a bad sign for the economy and financial markets that only a handful of companies are driving returns?

A: That’s so 2024! Last year, the so-called Magnificent 7 soared 67.34%, while the other 493 companies in the S&P 500 managed just 13.59%.6 It was a narrow rally, no doubt.

This year, the story’s different. The other 493 were outpacing the Magnificent 7 for much of the year and remained neck-and-neck through July 31.7 What’s more, more than half of the companies listed on the NYSE are trading above their 200-day moving averages, slightly above the long-term norm.8

It’s not the broadest advance we’ve ever seen, but it’s a far cry from last year’s top heavy market.

Q: What about small-cap stocks? Why haven’t they been participating in the market’s advance?

A: That’s correct, they’ve been largely sitting out the rally. As of mid-August, the S&P Small Cap 600 Index has returned just 0.04% year-to-date.9 Perhaps small caps will outperform when there’s a catalyst such as easier monetary policy and/or accelerating economic growth. So far, neither has materialized in 2025, but may be forthcoming.

Since you asked (part 2)

Q: What are you watching that could potentially change your optimistic outlook?

A: Every cycle, I find myself obsessively focused on a different indicator. In 2008 it was the interbank lending spread. In 2020, it was social mobility metrics, followed by back-to-work barometers, like the number of employees swiping security cards to enter office buildings. This time, it’s the 3-year US Treasury inflation breakeven, which reflects the bond market’s expectation for inflation over the next three years. Since early May 2025, it has averaged 2.50%.10 That’s price stability, at least where I come from, and it suggests the Federal Reserve (Fed) has room to lower interest rates. If the breakeven were to meaningfully break above that average, I’d be more concerned about the cycle.

It was said

“Until it is corrected, the BLS (Bureau of Labor Statistics) should suspend issuing the monthly job reports but keep publishing the more accurate, though less timely, quarterly data.”

— E.J. Antoni, Trump’s nominee to lead the BLS

That may not fly. The BLS is legally required to publish employment statistics at least once each month. This requirement is codified in 29 U.S. Code § 2, which states:

“The Bureau of Labor Statistics shall also collect, collate, report, and publish at least once each month full and complete statistics of the volume of and changes in employment, as indicated by the number of persons employed, the total wages paid, and the total hours of employment…”

As for me, I’ll be watching the ADP National Employment Report more closely than I had in the past. It’s true that the BLS report offers a broader view of employment, because it includes government hiring. ADP focuses solely on the private sector. Still, the rolling six-month correlation between the two is remarkably strong.11 The reality is that these indicators are less about pinpoint precision and more about capturing the overall direction of the economy and the labor market. What matters most is choosing an indicator that resonates with you and sticking with it. The challenge arises when investors jump between data sets in search of confirmation for preexisting biases.

Charted territory

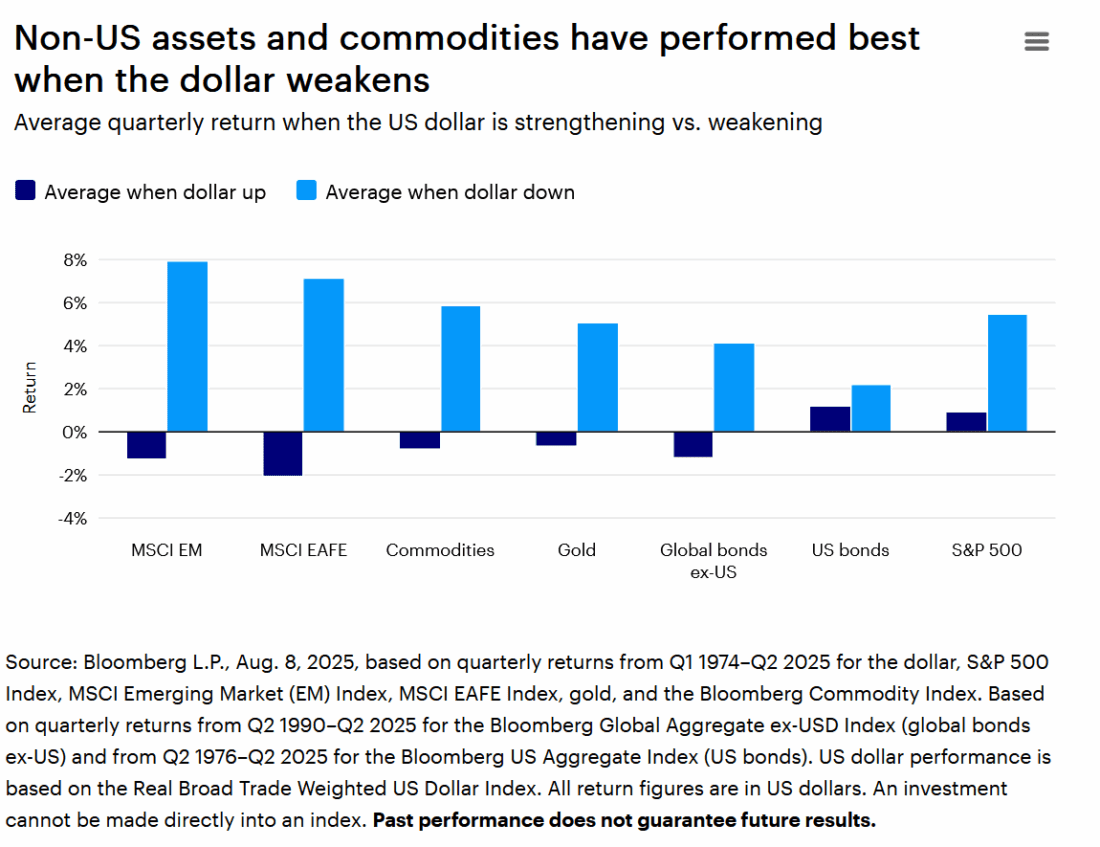

The US dollar has declined by 9.5% this year against a basket of its largest trading partners.12 The currency had been relatively range bound for much of the summer but is likely to continue to moderate given its lofty valuation13 and the likelihood that the growth and interest rate differential between the US and the rest of the world will narrow.

Among the best-performing asset classes during periods of US dollar decline are — not surprisingly — emerging market and developed market stocks as well as commodities and non-US bonds.14

Phone a friend

I reached out to Justin Livengood, Senior Portfolio Manager of Invesco’s Mid Cap Growth strategy, to assess his view of the recent pickup in initial public offerings (IPOs). Here are a couple of highlights from his response:

- The number of companies that Justin has met with recently that are considering going public has outpaced anything that he can remember in the past 10 years.

- A lot of the deals are meaningful in size. It’s not just small caps. It’s mid-cap companies, too.

- It’s industry diverse, including companies in financial services, technology, and healthcare.

- It’s geographically diverse. Asia and Europe are likely as busy as the US.

Candidly, I was excited listening to Justin’s enthusiasm over the “flurry of activity.” Listen to my full conversation with him on the Greater Possibilities podcast.

On the road again

Mercifully, the world tour tends to slow down in the summer. I just hope the coffee baristas at Newark Airport don’t miss me too much. It’s time again for my annual Grateful Dead lyric: “Summertime done come and gone, my, oh, my.” I love quoting the Dead. I hate saying goodbye to summer.

Disclosure: Invesco US

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial advisor/financial consultant before making any investment decisions. Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

All data provided by Invesco unless otherwise noted.

Invesco Distributors, Inc. is the US distributor for Invesco Ltd.’s Retail Products and Collective Trust Funds. Institutional Separate Accounts and Separately Managed Accounts are offered by affiliated investment advisers, which provide investment advisory services and do not sell securities. These firms, like Invesco Distributors, Inc., are indirect, wholly owned subsidiaries of Invesco Ltd.

©2024 Invesco Ltd. All rights reserved.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Invesco US and is being posted with its permission. The views expressed in this material are solely those of the author and/or Invesco US and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account