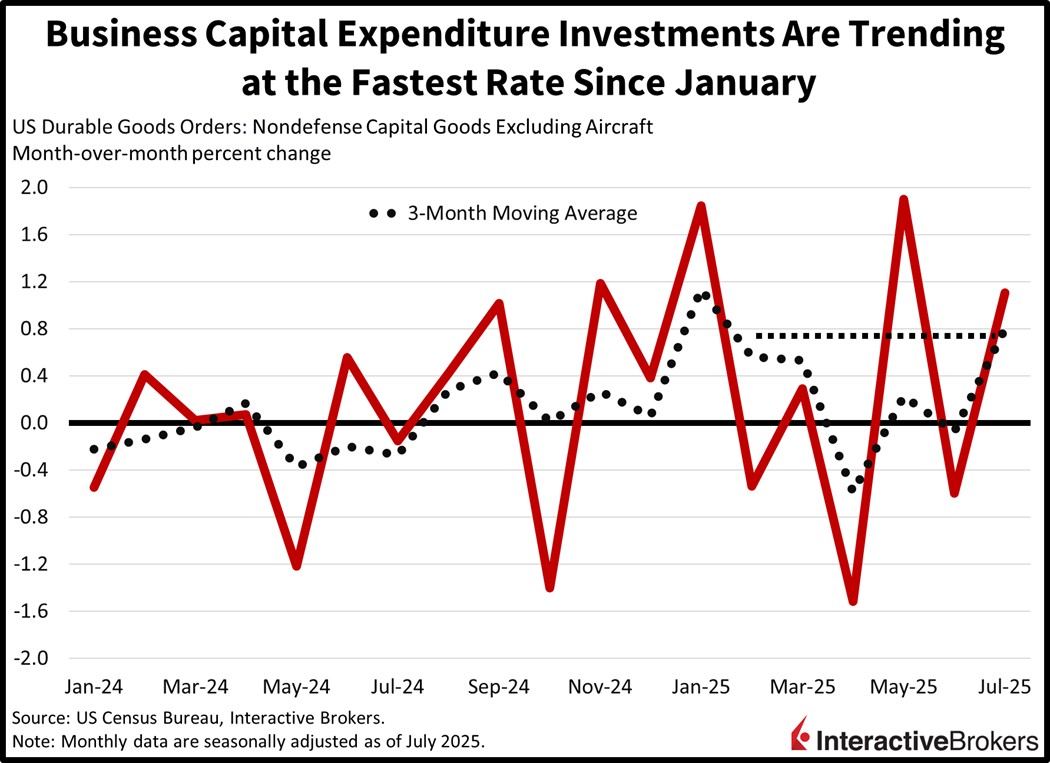

President Trump’s attempt to remove Fed Governor Cook and move toward a GOP appointed majority is emboldening rate cut bets as short-end borrowing costs plunge. Wall Street expects the committee to become increasingly dovish if the Commander in Chief is successful in ousting her. However, there is an intense legal battle brewing, as Cook refuses to go down without a fight and has filed a lawsuit to maintain her position. Markets are bullish against the backdrop, as optimistic prospects of an accommodative central bank coincide with better-than-expected economic data. Indeed, durable goods and consumer confidence arrived ahead of estimates, with the former posting a sharp progression in business investment consistent with reaccelerating growth, as corporates place first-half of 2025 uncertainty behind them and seek to benefit from the Republican party’s measures that have reduced taxation and lightened regulations. Stocks are gaining across the major indices, although small caps are leading as the group is disproportionately advantaged by a looser monetary policy authority. Treasuries are advancing along most of the curve in bull-steepening fashion, but the ultra-long dated tenors, namely the 20- and 30-year maturities, are retreating as a result of heavy White House influence on the Fed’s composition. Volatility protection instruments, the gold, silver, copper and natural gas commodities are catching bids, while conversely, crude oil, lumber and the greenback suffer losses.

Capital Expenditures Surged Last Month

The impact of a second-consecutive month of declining passenger jet purchases was partially offset by increased capital expenditures and broad-based progress in other categories in July’s durable goods report, which beat expectations. The headline retreated 2.8% month over month (m/m), much better than the -4% median estimate and June’s 9.4% plunge. The pivotal nondefense capital goods excluding aircraft component, a critical gauge of business investment, posted a staggering 1.1% m/m climb, flying past the 0.2% expectation. The following sectors along with the amount of their increases in spending, dampened the headline’s decline:

- Defense airplanes, 10.3%

- Electrical equipment, 2%

- Machinery, 1.8%

- Primary metals, 1.5%

- Fabricated metal products, 0.7%

- Computers/electronics, 0.6%

- Other, 0.5%

- Automobiles and parts categories, 0.3%

But passenger plane orders descended 32.7% m/m, which caused the weak top number. All in all, however, the corporate confidence reflected in this publication signals reaccelerating economic growth in the second half of 2025 following a sluggish beginning of the year.

Consumer Confidence Declines Marginally

Consumer confidence was pretty flat this month, according to the Conference Board. The headline number of 97.4 beat estimates of 96.2 but edged slightly lower than July’s 98.7. The sub-indices for the present and expectations retreated from 132.8 and 76 to 131.2 and 74.8. While perception of current business conditions improved modestly, views of the labor market cooled further. As for projections in the next six months, households were similarly worried about the employment landscape and income possibilities, although they were slightly more optimistic about future entrepreneurial prospects.

Acceleration of Earnings and GDP Growth is Probable

Today’s data is supportive of a bullish landscape for stocks and the economy alike throughout the back half of the year. Strong capital expenditures are coinciding with an uptick in relative certainty following a few turbulent months to start 2025. Additionally, business investment momentum is gaining ground just as the tailwinds of the Trump policy mix are poised to work their way across sectors, which will be helped by a minimum of one rate cut by Christmas. The combination bodes well for both earnings growth and a reacceleration in GDP expansion during the third and fourth quarters. Corporates would not be committing heavy dollars over the long-term if they didn’t envision a rosy road in front of them consisting of customer buoyancy, robust top-line revenues and expanding bottom-line profits.

International Roundup

Hong Kong Turns to Asian Partners to Trim Trade Deficit

Hong Kong trimmed its trade deficit in July, in part by increasing exports to its Asian trading partners. At the same time, its total shipments to foreign markets and its imports accelerated from June’s growth rates. Imports climbed 16.5% year over year (y/y), accelerating from 11.1% in June, while exports were up 14.3% compared to an 11.9% jump in the preceding month.

The special administrative region’s trade deficit, furthermore, fell from HK$58.9 billion in June to HK$34.1 billion

Exports to Asian countries grew 19.3% y/y with Taiwan’s purchases climbing 91.9%, which was followed by Malaysia and Singapore with increases of 80.7% and 42.5%. The value of shipments to China, the world’s second-largest economy, climbed 16.1%. Exports to the Netherlands and the US, however, fell 42.1% and 7.6%.

Imports from Vietnam, Thailand, Singapore and the UK grew the fastest, clocking increases of 129.3%, 33.1%, 28.7% and 24.8%. During July, Hong Kong’s imports from the US fell 8.8%, a more pronounced decline than its exports to the country.

Singapore Monthly Production Exceeds Estimates

Singapore’s industrial production jumped 8.2% in July compared to the preceding month, easily surpassing the economist consensus expectation for a 1.1% gain. The result was a reversal from the 0.8% drop in June. The y/y metric, however, matched June’s print of 7.1%.

Increases extended across five of the six categories except for the general classification, which sank 9.7%, according to the Ministry of Trade and Industry. Conversely, transportation engineering, electronics, precision engineering, chemicals and biomedical manufacturing climbed 15.8%, 13.1%, 9.6%, 4.2% and 0.2%.

Japan Price Gains Slow

Japan’s Corporate Services Price Index climbed 2.9% y/y in July, easing from the 3.2% increase in June and cooler than the economist consensus estimate for an unchanged result. The gauge is considered a leading indicator of inflation as it measures prices at which corporations sell products and services.

In a related matter, retail price gains as measured by the country’s Core Consumer Price Index also eased with the gauge up 2% y/y compared to 2.3% in June and the economist consensus estimate of 2.4%.

UK Retail Inflation Heats Up

Retail prices in the UK climbed 0.9% this month, matching the economist consensus estimate and accelerating slightly from the 0.7% northward movement in the preceding period, according to the British Retail Consortium (BRC) Shop Price Index. The August tally also exceeded the three-month average increase of 0.6% and was the highest rate since March 2024. The food and fresh food categories were the main culprits, logging hikes of 4.2% and 4.1%. Non-food items, however, sank 0.8% following a 1% drop in July.

The BRC says increased global supply costs, seasonal food inflation driven by weather conditions, the conclusion of promotional activity linked to recent sporting events, and a rise in underlying operational costs pushed prices up.

Household Sentiment Soars in South Korea

The South Korea Consumer Confidence Index posted a monthly gain of 0.6 points, climbing to 111.4, its highest level in seven years with a solid labor market and increases in equities and exports offsetting concerns about US tariffs. The gauge was expected to be unchanged from July’s level.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account