I’m as much a fan of cute market shorthand and acronyms as anyone, but as much as I enjoy a well-made taco, I was never a fan of the “TACO” acronym. Short for “Trump Always Chickens Out”, TACO implied that a key reason for the market’s recent strength was a belief that the President would not follow through with his proposed tariffs. Um… no. They’re here now and investors still don’t seem to care.

I’ve asserted that one of the key reasons for the market’s negative reaction to the original “Liberation Day” announcement was that tariffs were not on investors’ wish lists. The post-election rally was predicated upon the return of a market-friendly President who used the stock indices as a gauge of his economic performance in his first term and was expected to focus on deregulation and tax cuts. Tariffs were simply not on investors’ agenda. That disappointment was compounded first by the scope of the initial proposal, and then by the relative lack of concern shown for market concerns from the President and some of his cabinet members. Remember, it was only after a Presidential acknowledgement that markets were “yippy” did we see a reprieve.

Since then, investors have cheered a budget law that accelerates depreciation, offers tax breaks for research and development, and preserves low rates for high income earners. Considering who invests in equities and the type of stocks they favor, that can be – and implicitly was — viewed as a type of fiscal stimulus. That blunted some of the response to tariffs. For starters, tariffs revenues are being used to offset some of the increased deficits that are projected to accrue from the new budget. To some that is a huge benefit; to others it is a necessary evil, a regressive tax, and/or sand in the gears of the global economy.

Regardless of one’s opinions, the tariffs are here to stay. The question is the degree to which they will matter for the economy and for markets – which of course are not the same thing. The economic impacts are an open question. Tariffs will raise the cost of imported goods, but we don’t know to what extent they will be passed onto consumers. Some impact might be absorbed throughout the supply chain, either by the manufacturers and/or the retailers. That would blunt the effect to the public but would instead impact margins at the affected companies. There is also no consensus about whether the inflationary effects of tariffs will be ongoing, relatively temporary, or somewhat minimal. Remember, inflation is the rate of change in prices, not the price level. Thus, it is entirely possible that the inflationary impact might be front-loaded, while pushing import prices (and those of competitive US-made goods produced by opportunistic companies) to a higher plateau.

According to an analysis from The Budget Lab at Yale, a group that some will declare as partisan despite their mission as “a non-partisan policy research center dedicated to providing in-depth analysis of federal policy proposals for the American economy.”:

The 2025 tariffs imply an increase in consumer prices of 1.8% in the short-run, assuming no policy reaction from the Federal Reserve and full passthrough of tariffs to consumers. As a result, TBL [The Budget Lab] assumes the real income adjustment comes primarily through prices rather than nominal incomes. If the Federal Reserve reacted, the adjustment could in part come in the form of lower nominal incomes.

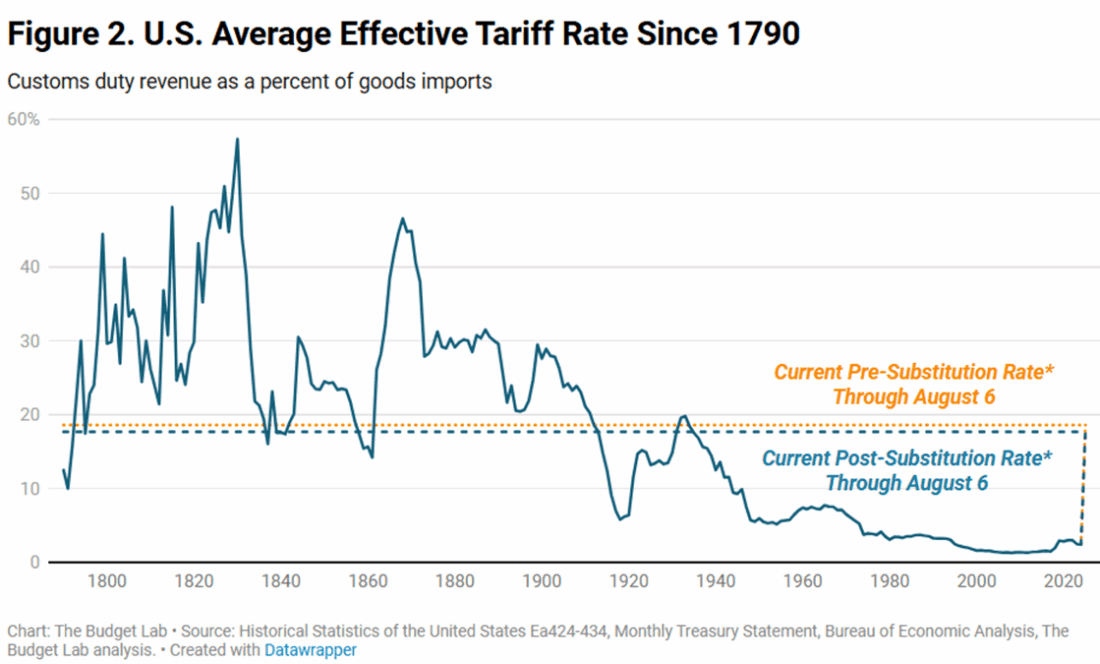

Below is a visual reminder about the magnitude of the changes that the new tariff rates will bring. Effective tariff rates will be the highest since the Smoot-Hawley Act of 1930. Our economy is far more reliant upon global supply chains these days, hence the concern about their effects upon prices and growth.

Source: The Budget Lab at Yale

No matter how we slice it, the tariffs will rejigger the economy in many ways – some expected, some undoubtedly unexpected. But the idea that the market rally was predicated on the TACO trade is at best outdated, meaning we’ve moved on to other driving factors (including the ever-present MOMO and FOMO), or never was the motivator that many had thought.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Disclosure: Bonds

As with all investments, your capital is at risk.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account