Originally posted, 23 July 2025 – From Gripens to Goshawks: The drone-driven reinvention of European defence

Key Takeaways

- Drone tech meets geopolitics: Unmanned aerial vehicles (UAVs) have moved to the forefront of Europe’s defence agenda, with European nations seeking indigenous drone capabilities.

- Saab’s autonomy advantage: Sweden’s Saab AB – now in NATO’s fold – is leveraging its tech heritage to pioneer autonomous drone systems. From software that controls 100-drone swarms to development of a “loyal wingman” unmanned combat aircraft.

- Leonardo’s expanding arsenal: Italy’s Leonardo S.p.A. is taking a broad approach – building new UAV platforms and partnering 50/50 with Turkey’s Baykar to create a Europe-based drone powerhouse, LBA Systems.

Drones and deterrence

Drones have proven their worth from Ukraine to the Middle East, where coordinated UAV swarms have emerged. Small, intelligent flying machines can spot targets, overwhelm defences, and link seamlessly with ground and air units – capabilities once confined to superpower arsenals. For Europe, which watched improvised drone tactics halt armour advances in Ukraine, investing in indigenous Unmanned Aerial Vehicles (UAV) technology is not optional; it’s imperative and comparatively cheap. Against this backdrop, two companies – Saab and Leonardo – stand out as champions of Europe’s drone evolution, each in their own style.

Saab swarming ahead

Saab AB has long been synonymous with Swedish high-tech defence – from Gripen fighter jets to sophisticated radars. Now it’s bringing that pedigree to unmanned systems. Rather than churn out large numbers of small drones, Saab’s approach is to make drones smarter, more autonomous, and better integrated. A recent milestone underscores this: in early 2025, the Swedish Armed Forces unveiled a Saab-developed drone swarm program enabling one operator to control up to 100 UAVs simultaneously. In trials scheduled during Arctic exercises, these swarms are expected to autonomously adapt to missions ranging from reconnaissance to payload delivery in complex environments.

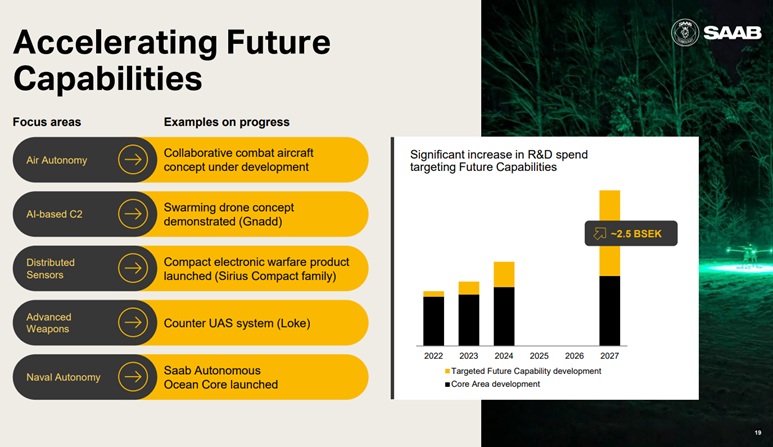

Figure 1: Saab’s R&D surge: Investing in next-gen defence capabilities

Source: Saab Capital Markets Presentation as of 28 May 2025. Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

Saab’s leadership openly emphasises this autonomy-first ethos. “It’s a lot about the autonomy,” CEO Micael Johansson noted at Saab’s Capital Markets Day, explaining that Saab is platform-agnostic about drone airframes – the real value is in the AI-driven command and control. Indeed, Saab is already working on a “collaborative combat aircraft” – effectively a loyal wingman drone to fly alongside piloted fighters. And for the smaller UAVs, Saab’s focus is on the brains: in demonstrations, young conscripts with a tablet can simply draw a patrol route and a drone swarm will execute it, self-organising and re-routing if some drones are lost. This high level of autonomy means minimal training and manpower are needed to deploy advanced drones – a key advantage for European militaries facing personnel constraints.

Leonardo: Forging the future with partnerships and firepower

In the sunny Italian skies, Leonardo S.p.A. is taking a more expansive route to drone dominance, leveraging its broad product portfolio and pan-European ties. As one of Europe’s largest aerospace and defence firms, Leonardo has its hands in everything from helicopters to cyber security. When it comes to UAVs, that means both developing drones in-house and teaming up with partners to fill capability gaps quickly. This twin-track strategy is evident in two major moves: Leonardo’s new Falco Astore armed drone launch, and a landmark joint venture with Turkey’s famed drone maker Baykar.

First, the home-grown effort. The Astore (Italian for “goshawk”) is Leonardo’s latest medium-altitude long-endurance (MALE) UAV – essentially a beefed-up, weaponised iteration of its earlier Falco EVO. With a 650 kg maximum take-off weight, 16-hour endurance, and newly added underwing pylons, the Astore can carry around 70 kg of cargo. The Astore gives Italy a measure of self-reliance in unmanned strike capability. It shows how European states are looking to their domestic industry to increase readiness now, rather than waiting years for pan-European projects. It’s a gentle reminder that Europe’s quest for strategic autonomy extends to having home-grown “eyes in the sky”. Leonardo’s Falco line, which started as unarmed surveillance drones, has now evolved into a combat UAS – a narrative of adaptation that mirrors Europe’s shift from peacekeeping posture to defence.

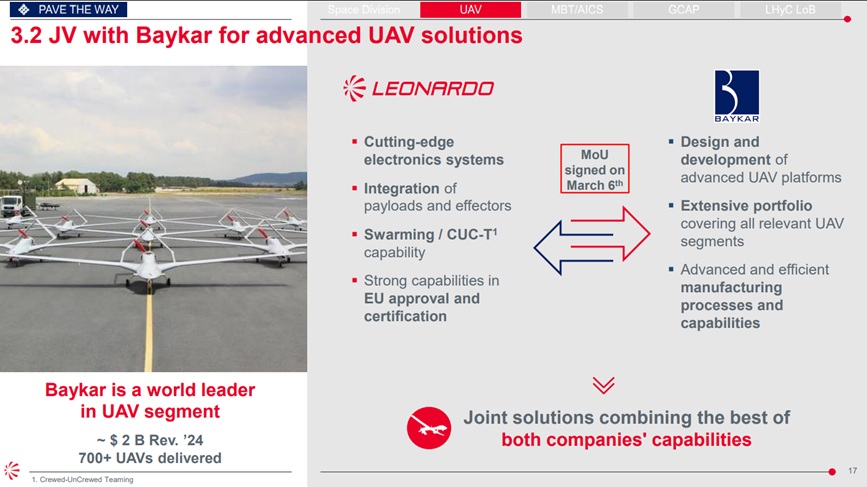

Figure 2: Leonardo–Baykar joint venture to advance European UAV capabilities

Source: Leonardo SpA Industrial Plan Update.

Leonardo’s unprecedented 50:50 joint venture for unmanned systems, named LBA Systems and based in Italy, aims to be a “key player in unmanned technologies” by combining forces: Baykar brings its world-class drone platforms (like the battle-proven TB2 and the jet-powered Kızılelma) while Leonardo contributes its expertise in sensors, electronics, and system integration. The logic is compelling. Europe’s militaries have an insatiable demand for capable drones – a market valued at over $100 billion in the next decade – and Baykar’s combat-tested UAVs are among the best. By partnering, Leonardo essentially shortcuts the R&D cycle, gaining access to a portfolio covering “all relevant UAS segments” from tactical mini drones to high-end combat drones. In return, Baykar gets a production foothold in the EU and the benefit of Leonardo’s integration and certification know-how (crucial for selling to Western militaries).

A new era of European defence: Narrative and numbers alike

It is often said that necessity breeds innovation. Europe’s present necessity – to bolster its defence amid war on its doorstep – is breeding a new wave of drone innovation, with Saab and Leonardo at the vanguard. These two firms offer a fascinating contrast in a complementary approach. Saab, hailing from a non-aligned-now-NATO nation of modest size, plays to its strengths by making systems smarter rather than larger. Its narrative is one of qualitative edge: a swarm that can re-route itself, a drone that can think like a pilot’s teammate, a network of sensors that can confound a much bigger foe. Leonardo, by contrast, comes from one of Europe’s big defence spenders and embraces a scale and scope strategy: covering every market segment through a mix of indigenous development and strategic partnerships, ensuring that Europe has ready access to the full spectrum of unmanned tech.

From a geopolitical perspective, these advancements feed into Europe’s broader strategic autonomy. Drones are eyes and ears, but they are also increasingly shields and spears. A Europe equipped with its own high-end drones can better monitor its borders, deter aggression, and operate independently when needed.

A few years ago, European defence firms were often seen as stodgy value plays reliant on slow procurement cycles. That is no longer the narrative. Now, it is one of urgency, growth, and technological leapfrogging. Drones are a critical part of the story of European defence. In a world of growing complexity, Europe’s defence industry is not just responding to change, helping drive it, one drone at a time.

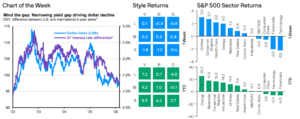

Closing the gap

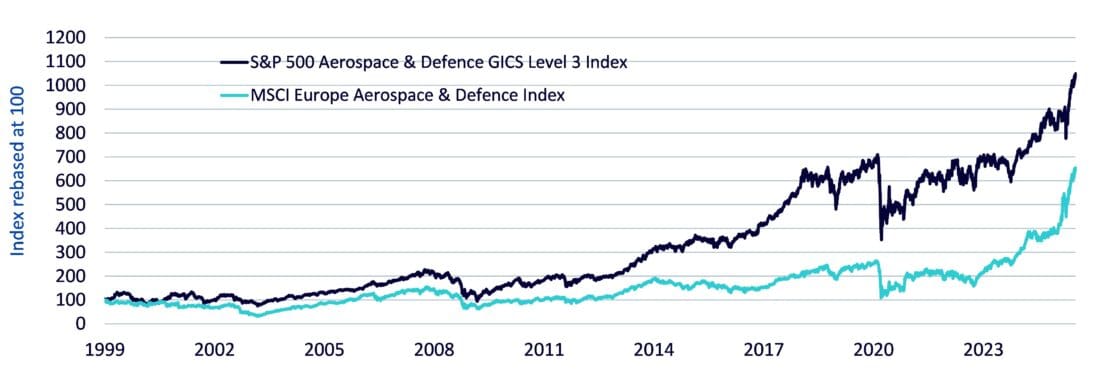

Investors have become nervous amidst the recent strong run of European defence stocks but it’s worth noting they still trail their US counterparts, a trend that has persisted since 1999. Historical performance shows plenty of room for European defence stocks to catch up to their US counterparts.

Figure 3: Historical performance US versus Europe aerospace & defence indices

Source: Bloomberg, WisdomTree from 4 January 1999 to 10 July 2025. Historical performance is not an indication of future performance and any investments may go down in value.

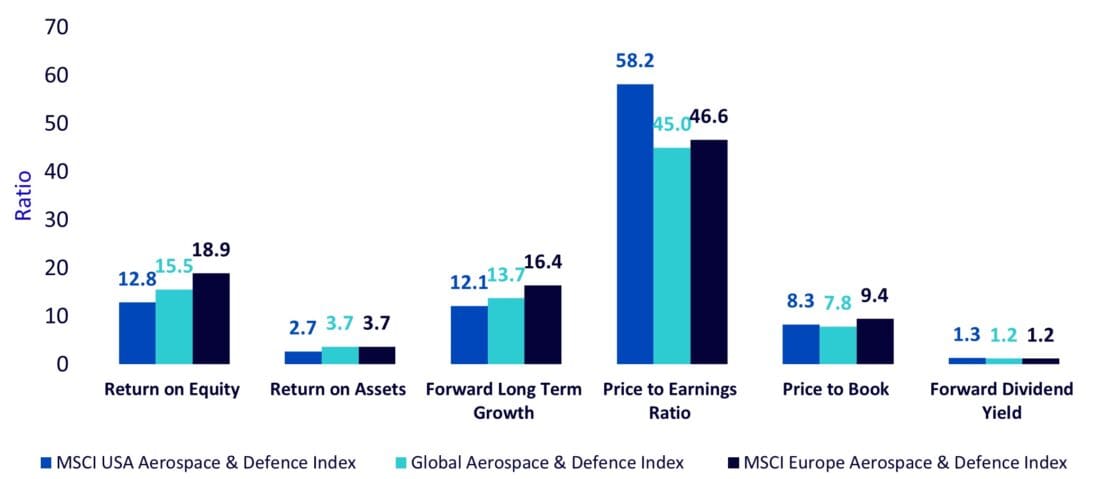

While European defence firms have seen record-high order books, multi-year government spending commitments, and growing market share, their valuation multiples remain lower than those in the US. Compared to US aerospace and defence stocks, which trade at higher historical price to earnings (P/E) ratios (at 58.2x), European aerospace and defence stocks (at 46.6x) still trade at lower price-to-earnings multiples and offer comparatively higher-quality metrics such as Return on Equity and Return on Assets, as illustrated below.

Figure 4: Comparison of fundamentals

Source: Bloomberg, WisdomTree as of 10 July 2025. Historical performance is not an indication of future performance and any investments may go down in value

Conclusion

A few years ago, European defence firms were often seen as stodgy value plays, reliant on slow procurement cycles. That is no longer the narrative. Now it is one of urgency, growth, and technological leapfrogging. Drones are a critical part of the story of European defence. In a world of growing complexity, Europe’s defence industry is not just responding to change – it’s helping drive it, one drone at a time.

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account