One thing is clear from yesterday’s “Liberation Day” tariff announcement –the market has decided that there is pretty much no way to spin it as a positive. Thus, here we are with a substantial selloff on our hands, abetted somewhat by traders whose commitment to buying every dip left them wrong-footed.

We wrote yesterday that traders seemed to be pricing in a “sell the rumor, buy the news” scenario. The probability of outcomes indicated by S&P 500 Index options expiring today and tomorrow showed peaks above at-money levels. In other words, speculators became more concerned with missing a rally than protecting against a drop. Remember, thrice this week we saw early selling abate quickly, which was seen as yet another “buy the dip” opportunity by aggressive traders. Some must have thought that a bottom was in place.

Yet we also pointed out a significant concern about a “buy the news” outcome – there was no clear consensus on what might be considered “good” or “bad”. We normally go into a “known unknown” type of event, like earnings, a Fed meeting, or an economic report, with a clear consensus for what outcomes might be considered positive or negative for asset prices. In this case, the range of potential outcomes was so wide and the administration was so tight-lipped about their plans that it was impossible to state a clear set of desired or consensus outcomes for the market.

That’s why the first move was up when “reciprocal tariffs” was mentioned. That sounded rather benign. At the time, one of my colleagues reminded me of my perpetual admonition to our trading desk after an FOMC announcement: “the first move is often the wrong move.” This time it certainly was, and as soon as the magnitude of the tariffs was visibly displayed, the reality became clear — this was not going to helpful for prices or economic output. We could see in black and white that the tariffs were quite far-reaching and combined some amount of baseline tariffs and variable rates. Again, while we didn’t have a clear delineation of good/bad, or positive/negative, there was no real way to interpret those tables in a market-friendly manner.

We then tried to learn more during an interview with Treasury Secretary Bessent on Bloomberg. His comments were spectacularly unhelpful. He admitted to being unsure about why Canada and Mexico were left off the charts (the administration did decide to honor goods and services covered by the USMCA, except autos), claimed not to care about after-hours market movements, and asserted that the selloff was “a Mag 7 problem, not a MAGA problem”. He also said that we’re “going to go to the warning track” about a potential debt ceiling breach in May or June. Nervous traders wanted to hear something to assuage them, and nothing of that nature was forthcoming. Commerce Secretary Lutnick made the rounds this morning, hitting a wide range of financial and mainstream media outlets, but his comments also failed to mollify nervous global investors.

Interestingly, the tariffs aren’t even truly reciprocal, though they are described that way. Instead, they are essentially calculated by the US trade deficit with each country, divided by total imports from that country (the math is on the USTR website), subject to a minimum of 10%. This too has not helped the market mood.

Thus, we find ourselves staring at significant dislocations across a wide range of asset classes. We have SPX -3.8% at midday, the Nasdaq 100 (NDX) -4.4% lower, and the Russell 2000 (RTY) down by -5.5%. The US Dollar has lost over 3 yen and 2 Euro cents this morning. Part of that move is caused by plunging bond yields, with the 2-year yielding 13 basis points less than yesterday and the 10-year down -8.5bp.

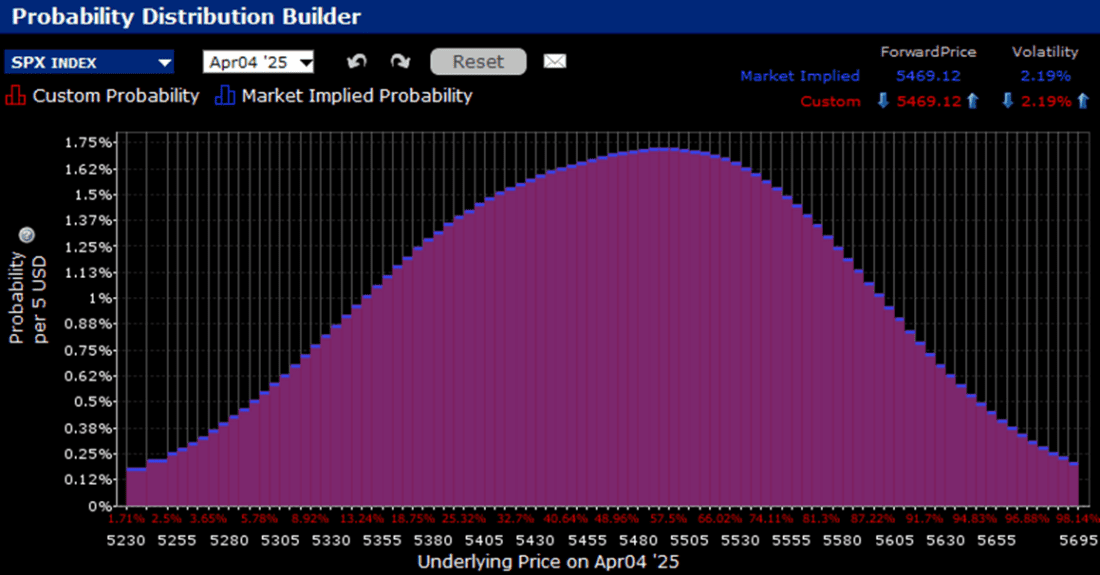

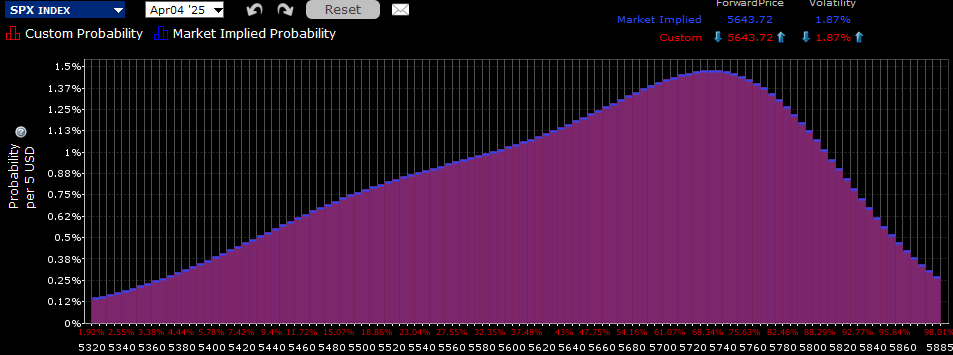

Amidst all today’s volatility, we have yet another potential market mover on tap for tomorrow morning – the March employment report. Consensus expectations – remember them? – are for an increase of 140,000 Nonfarm Payrolls, down from 151k in February, and an Unemployment Rate that will remain at 4.1%. The IBKR Probability Lab once again shows a slight bias toward a bounce, though far less pronounced than yesterday – and at far lower levels.

IBKR Probability Lab for SPX Options Expiring April 4th, 2025

Source: Interactive Brokers

Past performance is not indicative of future results

IBKR Probability Lab for SPX Options Expiring April 4th, 2025, as of April 2nd, 2025

Source: Interactive Brokers

Past performance is not indicative of future results

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD). Multiple leg strategies, including spreads, will incur multiple transaction costs.

Disclosure: Bonds

As with all investments, your capital is at risk.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account