Alibaba Q4 Earnings Overview

Alibaba (BABA US, 9988 HK) reported financial results after the Hong Kong close and before the US market opened this morning. The company beat on the big three: revenue, adjusted net income, and adjusted EPS, as the company’s core China E-Commerce, international E-Commerce, and cloud units were firing on all cylinders. This follows Jack Ma’s attendance at President Xi’s entrepreneur meeting on Monday. Could Ant Group go public? Maybe, though worth noting, it added $618 million to Alibaba’s bottom line.

The company has gotten “lighter”, selling out of its physical stores Intime and Sun Art Retail, contributing to the margin expansion. AI was the focus of analysts on the earnings call as management gave a very optimistic look at the cloud’s potential, stating, “The AI era presents a clear and massive demand for infrastructure.” That investment led to increased capex spending that crimped free cash flow -31%. It’s worth pointing out that the company still has $84.58 billion worth of cash on the books. When asked if US chip restrictions would affect the company, CEO Eddie Wu stated no, which gives some further credence to DeepSeek’s claims of utilizing low-end chips energy-efficiently.

- Revenue increased +8% YoY to RMB 280.154B ($38.381B) versus an estimated RMB 277.374B versus Q4 2023’s RMB 221.9B

- Taobao & Tmall revenue grew 9% year-over-year to RMB100,790 million (US$13,808 million)

- Alibaba International Digital Commerce Group (AIDC) grew 32% year-over-year to RMB37,756 million (US$5,173 million)

- Cloud Intelligence Group revenue +13% YoY to RMB31,742 million (US$4,349 million)

- Adjusted Net Income +6% YoY to RMB 51.066B versus estimate RMB 46.134B versus Q4 2023’s RMB 25.33B

- Adjusted EPS +13% YoY to RMB 21. 39 versus estimate RMB 19.11 versus Q4 2023’s RMB 10.14

- In the quarter, Alibaba repurchased 119 million ordinary shares (equivalent to 15 million ADSs)for US$1.3 billion.

- “The remaining amount of Board authorization for our share repurchase program, effective through March 2027, was US$20.7 billion as of December 31, 2024.”

NetEase Q4 Earnings Overview

- Revenue decreased to RMB 26.7B ($3.7B) versus an estimated RMB 27.248B versus Q4 2023’s RMB 27.2B

- Adjusted Net Income RMB 9.7B ($1.3B) versus estimate RMB 8.03B versus Q4 2023’s RMB 7.38B

- Adjusted EPS RMB 13.67 versus estimate RMB 12.56 versus Q4 2023’s RMB 11.34

Bilbili Q4 Earnings Overview

- Revenue increased +22% to RMB 7.73B ($1.059B) versus an estimated RMB 7.639B versus Q4 2023’s RMB 6.3B

- Adjusted Net Income RMB 452MM ($61.9MM )versus estimate RMB 393.818mm versus Q4 2023’s loss of RMB -555.6mm

- Adjusted EPS RMB 1.07 ($0.15) versus estimate RMB 0.97 versus Q4 2023’s loss of RMB -1.34

Key News

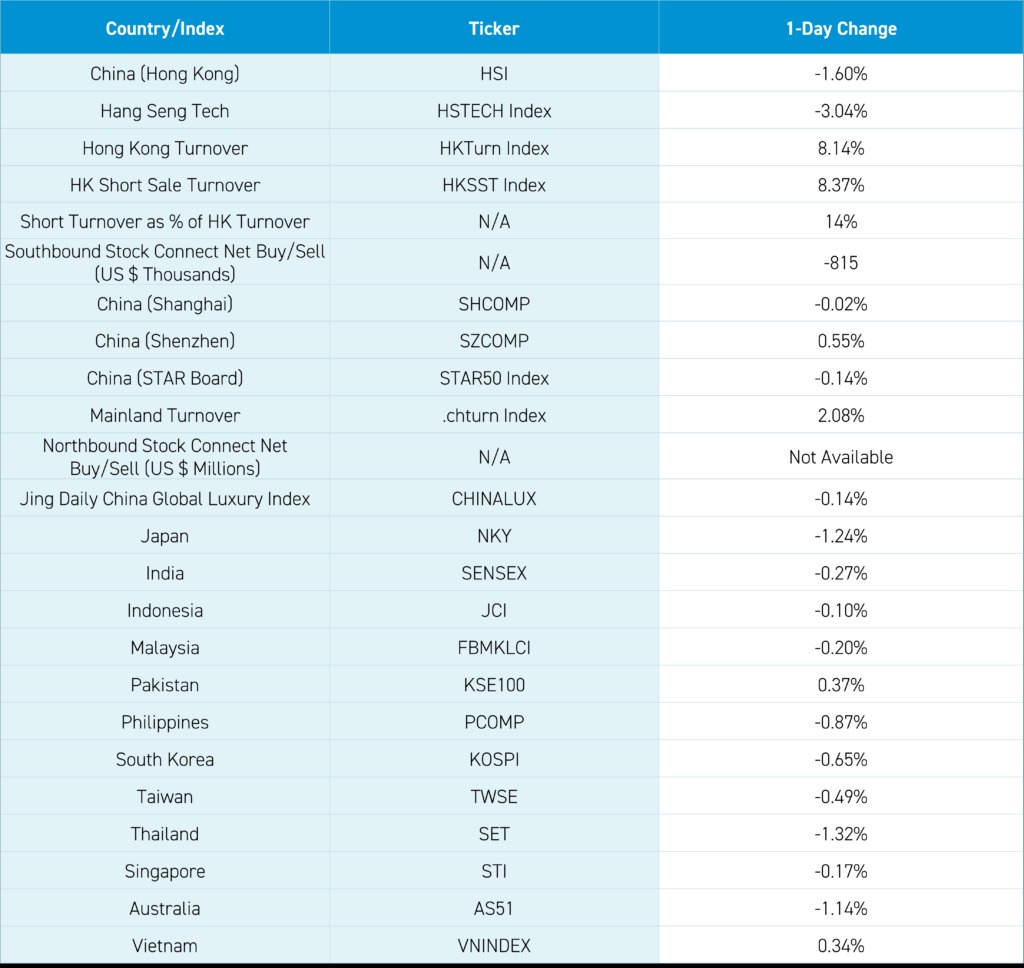

Asian equities were a sea of red despite a weak dollar overnight, as only the Shenzhen Composite, Pakistan, and Vietnam were positive.

Hong Kong-listed growth stocks, including recent strong performers in internet, software, and semiconductors, were hit with profit-taking on no news or catalysts. The downdraft, which should be expected, was despite positive remarks from President Trump stating it was “possible” that he would do another trade deal with China, saying, “There’s a little bit of competitiveness, but the relationship I have with President Xi is, I would say a great one.”

President Trump rightly stated that President Biden didn’t push China as there was no negotiation, no communication, nor any attempt to do a deal with China as his administration tried to hobble/cripple the Chinese economy and especially the tech sector. I don’t believe investors have built into the feasibility of President Trump visiting China and doing another deal with President Xi. The negative geopolitical overhang and Western media have kept many global and especially US institutions from buying low in Chinese stocks, in my opinion. That overhang can go away.

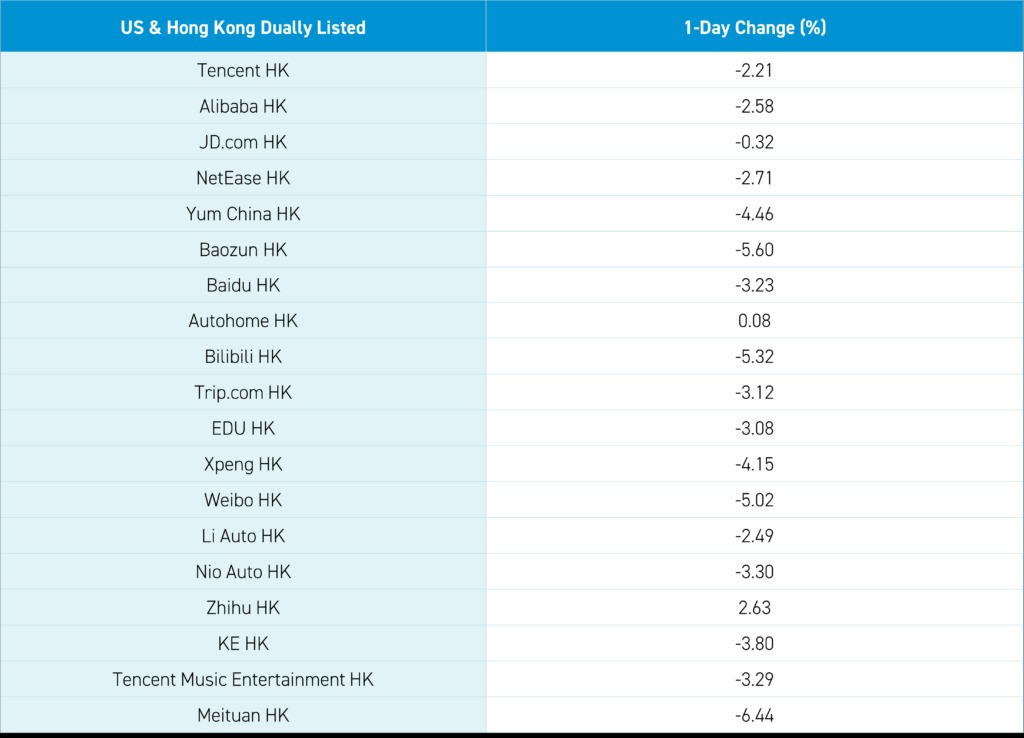

Interestingly, currency markets liked Trump’s remarks. However, Hong Kong-listed growth stocks were off on elevated volumes, as Alibaba fell -2.58% in advance of financial results after the Hong Kong close on the value of volume 4X the average, Tencent fell -2.21% on volume, nearly 4X the average, and Meituan fell -6.44% on almost 3X the average. Meituan announced it would enroll and pay for its delivery drivers in China’s social security plan while increasing injury insurance. Interesting that Meituan has seen net selling via Southbound Stock Connect, though it is hard to know if it is related to this issue.

JD.com, which fell -0.32%, also stated it would do the same when it enters the delivery space. Mainland investors were net sellers of Hong Kong stocks via Southbound Stock Connect, including the Hong Kong Tracker ETF, which was a large net sell. Healthcare was the top performer in Hong Kong, at +0.61%, and Mainland China, at +2.07%, as Wuxi Apptec gained +2.98% on a broker upgrade. The Mainland market was mixed as growth stocks were mostly higher, except for semiconductors, telecom, and CATL, which fell -1.22%. They held up a bit better on the Mainland than in Hong Kong. Meanwhile, Morgan Stanley’s well-respected strategist Jonathan Garner upgraded China to neutral from underweight.

Premier Li presided over a State Council meeting. The key point from the statement below is that it gives an indication of policies coming out of the Dual Sessions in early March. In poker, this is called a tell! This statement has the potential to have significant implications:

“Boosting consumption is an important starting point for expanding domestic demand and stabilizing growth, but also a major measure to change the medium and long term development mode. We should put consumption in a more prominent position and rely more on boosting consumption to expand domestic demand, smooth the economic cycle, and stimulate economic growth. We should make every effort to enhance consumption capacity, adopt more effective consumption promotion policies, break the barriers and constraints restricting consumption, make every effort to optimize the consumption environment, and strive to open up the chain of consumption, driving investment, industrial upgrading, and employment and income increase.”

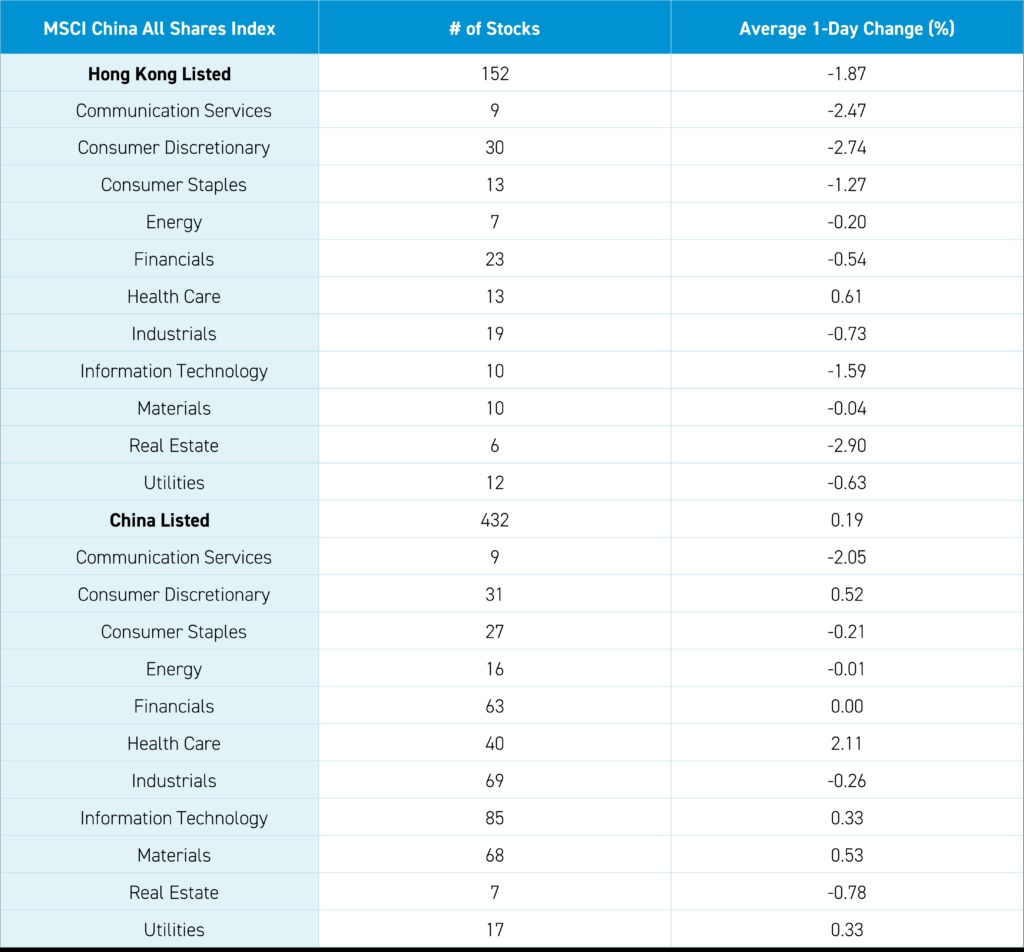

The Hang Seng and Hang Seng Tech indexes fell -1.60% and -3.04%, respectively, on volume that increased +8.14% from yesterday, which is 195% of the 1-year average. 176 stocks advanced, while 311 stocks declined. Main Board short turnover increased by +8.37% from yesterday, which is 174% of the 1-year average, as 14% of turnover was short turnover (Hong Kong short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). The value factor and large caps fell less than the growth factor and small caps. Health Care, which gained +0.61%, was the only positive sector. Meanwhile, the worst-performing sectors were Real Estate, which fell -2.90%, Consumer Discretionary, which fell -2.74%, and Communication Services, which fell -2.47%. The top-performing subsectors were consumer services, national defense, and healthcare equipment, while media, consumer durables, apparel, and semiconductors were among the worst-performing. Southbound Stock Connect volumes were 3X pre-stimulus levels as Mainland investors sold -$815 million of Hong Kong-listed stocks and ETFs led by SMIC and China Mobile were moderate net buys, UB Tech Robotics a small net buy, Hong Kong Tracker ETF a very large net sell, Tencent a large net sell, Xiaomi, Meituan and Kuaishou small net sells.

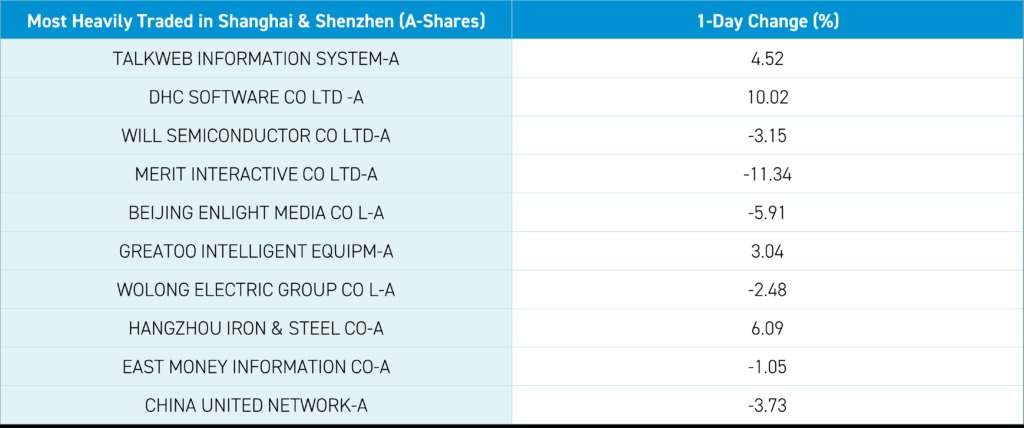

Shanghai, Shenzhen, and STAR Board diverged to close -0.02%, +0.55%, and -0.14%, respectively, on volume that increased +2.08% from yesterday, which is 156% of the 1-year average. 3,161 stocks advanced, while 1,899 declined. The growth factor and small caps outperformed the value factor and large caps. The top-performing sectors were Health Care, which gained +2.07%, Materials, which gained +0.47%, and Consumer Discretionary, which gained +0.47%. Meanwhile, the worst-performing sectors were Communication Services, which fell -2.1%, Real Estate, which fell -0.83%, and Industrials, which fell -0.31%. The top-performing subsectors were healthcare, leisure products, and retail, while telecom, insurance, and marine/shipping were the worst. Northbound Stock Connect volumes were well above average. CNY and the Asia dollar index gained versus the US dollar. Treasury bonds fell. Copper and steel rose.

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.25 versus 7.28 yesterday

- CNY per EUR 7.58 versus 7.59 yesterday

- Yield on 10-Year Government Bond 1.69% versus 1.66% yesterday

- Yield on 10-Year China Development Bank Bond 1.70% versus 1.67% yesterday

- Copper Price +0.49%

- Steel Price +0.42%

—

Originally Posted February 20, 2025 – Alibaba’s AI Bonanza, Trump China Comments & Premier Li on Raising Domestic Consumption

Author Positions as of 2/20/25 are KLIP, KBA, KALL, KCNY, KFYP, KCNY, KEMQ, BZUN, HSBC, KWEB, KHYB, LI US

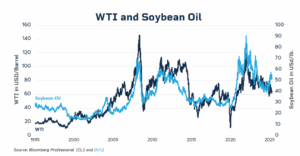

Charts Source: KraneShares

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account