Originally Posted 07 January 2025 – https://www.cboe.com/insights/posts/index-insights-december-2024/

Broad-based equity indices turned low in December 2024, with the S&P 500® Index (SPX) decreasing 2.5% and the Russell 2000® Index (RUT) dropping nearly 8.4% from year-to-date highs. Despite the pullback, the S&P 500 ended the year up 23.31% and the Russell 2000 gained 10%, marking the second consecutive year of double-digit returns for investors. Sentiment shifted toward a more defensive posture, with rising correlations and higher implied volatility into year-end. The Cboe Volatility® Index (VIX Index) closed at 17.35, its second-highest monthly close of the year. Indices focused on premium selling outperformed in December, with the S&P 500 Put-Write® Index (PUT) finishing nearly flat and the Russell 2000 Put-Write® Index (PUTR) down 3.4%.

Equity Indices

Source: Cboe Global Markets

Past performance is not indicative of future results.

The Russell 2000® Index (RUT) measures the performance of small-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 2000 securities based on a combination of their market cap and current index membership. RUT options are valuable tools for increasing yields and managing risk. The Cboe S&P 500® Index option contract (SPX), is designed to track the underlying S&P 500 Index and help investors achieve broad market protection. SPX® options offer the potential opportunity to manage large-cap U.S. equity exposure and execute risk management, hedging, asset allocation, and income generation strategies.

Volatility Indices

Source: Cboe Global Markets

Past performance is not indicative of future results.

The VIX Index is based on real-time prices of options on the S&P 500® Index (SPX) and is designed to reflect investors’ consensus view of future (30-day) expected stock market volatility. Cboe 1-Day Volatility Index® (VIX1D Index) estimates expected volatility by aggregating the weighted prices of P.M.-settled S&P 500 Index (SPX) puts and calls over a wide range of strike prices. The Cboe 3-Month Volatility IndexSM (VIX3M) is designed to be a constant measure of 3-month implied volatility of the S&P 500® (SPX) Index options.

Dispersion and Correlation Indices

Source: Cboe Global Markets

The Cboe S&P 500 Dispersion Index (DSPX) measures the expected dispersion in the S&P 500 Index over the next 30 calendar days, as calculated from the prices of S&P 500 Index options and the prices of single stock options of selected S&P 500 Index constituents, using a modified version of the VIX® methodology. The Cboe S&P 500 Implied Correlation Indices including COR1M and COR6M are the first widely disseminated market estimates of the average correlation of the stocks that comprise the S&P 500. The Cboe S&P 500 Implied Correlation Indexes offers insight into the relative cost of SPX options compared to the price of options on individual stocks that comprise the S&P 500.

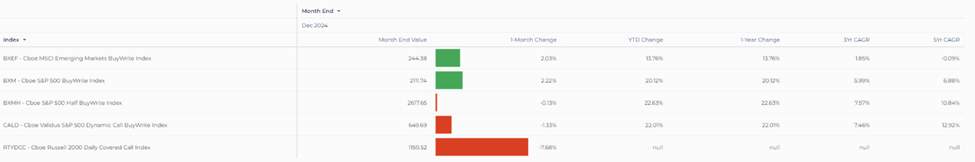

BuyWrite Indices – Equity

Source: Cboe Global Markets

Past performance is not indicative of future results.

The Cboe® MSCI Emerging Markets BuyWrite Index (BXEF) is a benchmark index designed to track the performance of a hypothetical buy-write strategy on the MXEF® index. The Cboe S&P 500 BuyWrite® Index (BXM) is a benchmark index designed to track the performance of a hypothetical buy-write strategy on the S&P 500 Index®. The Cboe S&P 500 Half BuyWrite Index (BXMH) is a benchmark index designed to track the performance of a hypothetical covered call strategy. The BXMH Index is similar in design to the Cboe S&P 500 BuyWrite Index (BXM). However, the difference in methodology is as follows: the strategy only writes half a unit of an ATM monthly SPX call option while the long SPX Index position remains unchanged. The Cboe Validus S&P 500® Dynamic Call BuyWriteSM Index (CALD) tracks the value of a hypothetical rules-based investment strategy which consists of overlaying a basket of S&P 500 a.m.-settled standard expiry short call options over a long position invested in the S&P 500 with dividends reinvested (total return).

PutWrite Indices

Source: Cboe Global Markets

Past performance is not indicative of future results.

The Cboe S&P 500 PutWrite® Index (PUT) tracks the value of a hypothetical portfolio of securities (PUT portfolio) that yields a buffered exposure to S&P 500 stock returns. The PUT portfolio is composed of one- and three-month Treasury bills and of a short position in at-the-money put options on the S&P 500 index (SPX puts). The number of puts sold is selected to ensure that the value of the portfolio does not become negative when the portfolio is rebalanced. The Cboe Validus S&P 500 Dynamic PutWrite Index (PUTD) is designed to track the value of a rule-based investment strategy which consists of overlaying a basket of S&P 500 (SPX) a.m. settled standard-expiry short put options over a money market account invested at the 4-week daily Treasury Bill rate. The Cboe Russell 2000 PutWrite Index (PUTR) tracks the value of a hypothetical portfolio of securities (PUTR portfolio) that yields a buffered exposure to Russell 2000 Index stock returns. The PUTR portfolio is composed of an investment of $K in one-month Treasury bills and of a short position in an at-the-money puts on the Russell 2000 Index (RUT put), where K is the strike price of the put option.

BuyWrite Indices – Fixed Income

Source: Cboe Global Markets

Past performance is not indicative of future results.

The Cboe HYG BuyWrite Index (BXHB) is designed to track the performance of a covered call strategy with a short iShares iBoxx $ High Yield Corporate Bond ETF (HYG) call option expiring monthly. The Cboe LQD BuyWrite Index (BXLB) is designed to track the performance of a covered call strategy with a short iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) Call option expiring monthly. The Cboe TLT 2% OTM BuyWrite Index (BXTB) is designed to track the performance of a covered call strategy with a short iShares 20+ Year Treasury Bond ETF (TLT) Call option expiring monthly.

Target Outcome Series

Source: Cboe Global Markets

Past performance is not indicative of future results.

The Cboe S&P 500 Enhanced Growth Index Series (SPEN) and Cboe S&P 500 Buffer Protect Index Series (SPRO)are part of a family of Target Outcome Indices. The Indices are designed to provide target outcome returns linked to the U.S. domestic stock market. The indices measure the performance of a portfolio of hypothetical exchange traded Flexible Exchange® Options (“FLEX® Options”) that are based on the S&P 500® Index.

Protective Put Indices

Source: Cboe Global Markets

Past performance is not indicative of future results.

The Cboe VIX Tail Hedge Index (VXTH) tracks the performance of a hypothetical portfolio that:

- Buys and holds the performance of the S&P 500 index (the total return index, with dividends reinvested), and

- Buys one-month 30-delta call options on the Cboe Volatility Index (VIX). New VIX calls are purchased monthly, a procedure known as the “roll.” The weight of the VIX calls in the portfolio varies at each roll and depends on the forward value of VIX, an indicator for the perceived probability of a “swan event.”

- The weights are determined according to this schedule and the weights applied at a particular roll date can be seen by opening the VXTH Monthly Roll Spreadsheet.

Disclosure: Cboe Global Markets

Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies are available from your broker, or at www.theocc.com. The information in this program is provided solely for general education and information purposes. No statement within the program should be construed as a recommendation to buy or sell a security or to provide investment advice. The opinions expressed in this program are solely the opinions of the participants, and do not necessarily reflect the opinions of Cboe or any of its subsidiaries or affiliates. You agree that under no circumstances will Cboe or its affiliates, or their respective directors, officers, trading permit holders, employees, and agents, be liable for any loss or damage caused by your reliance on information obtained from the program.

Copyright © 2023 Chicago Board Options Exchange, Incorporated. All rights reserved.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Cboe Global Markets and is being posted with its permission. The views expressed in this material are solely those of the author and/or Cboe Global Markets and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD). Multiple leg strategies, including spreads, will incur multiple transaction costs.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Disclosure: Bonds

As with all investments, your capital is at risk.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account