FrancisOriginally Posted 26 August 2024 – US small-caps historically shine in presidential election years

Royce Investment Partners: Co-CIO Francis Gannon looks at the confluence of volatility in politics and the stock market before examining what presidential election years have meant for small-cap stocks.

Outside of crises or other situations of great importance, politics and the stock market are usually not volatile around the same time. When they are, it’s almost always for closely related reasons. That has not been the case recently, however, as different catalysts have created nearly simultaneous spikes in each area, demonstrating this somewhat rare phenomenon.

To be sure, this election year of 2024 has already proven to be notable for its unpredictability, nearly unprecedented, and very much unprecedented events. We have seen an attempted assassination, a presidential incumbent candidate stepping down, another stepping in, and extreme reversals in the polls—and we still have almost three months to go before most of us cast our ballots.

The stock market has seen gyrations of its own that are unrelated to the peculiar political events currently dominating the headlines. First, the market began a long-awaited (at least from our perspective as small-cap specialists) reversal in leadership as mega-cap names gave way to small-cap stocks in July. This was followed in early August by the market falling with the unwinding of the globe’s largest “carry trade” in which a suddenly resurgent yen compelled speculators to shut down bets that totaled hundreds of billions of dollars around the world. (A carry trade is one in which someone borrows cash in a low-interest-rate country to pay for investments elsewhere that offer higher returns. The carry trade in the yen blew up when the Bank of Japan suddenly raised interest rates.)

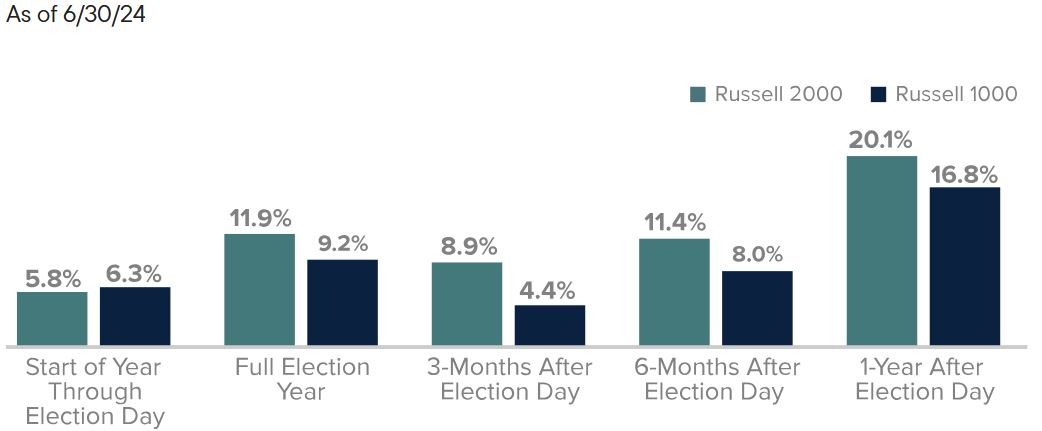

While the US markets have begun to stabilize, much remains uncertain going forward. As we often do when trying to make sense of the present and find context for what the future may hold, we looked at what has happened historically in presidential election years. The chart below has the details, which we hope are as encouraging to small-cap investors eager to see sustained leadership for the asset class as we are.

Average Total Returns for the Russell 2000 and Russell 1000 After the Last 10 Presidential Elections

Past performance is not indicative of future results

Source Russell Investments. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

History seldom repeats itself—but the persistence of the advantage for the small-cap Russell 2000 Index over its large-cap sibling, the Russell 1000 Index, is in our view quite striking. So, while recent events in both politics and the markets offer lessons in the importance of patience and caution, we are hopeful that small-cap investors will find plenty to cheer about regardless of which direction the election takes.

View more about Royce Investment Partners and the strategies they manage.

Definitions

The Russell 1000 Index is an unmanaged, capitalization-weighted index of domestic large-cap stocks. It measures the performance of the 1,000 largest publicly traded US companies in the Russell 3000 Index.

The Russell 2000 Index is an index of domestic small-cap stocks that measures the performance of the 2,000 smallest publicly traded US companies in the Russell 3000 Index.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. Past performance is no guarantee of future results. Please note that an investor cannot invest directly in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges.

Equity securities are subject to price fluctuation and possible loss of principal.

Commodities and currencies contain heightened risk that include market, political, regulatory, and natural conditions and may not be suitable for all investors.

Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks.

US Treasuries are direct debt obligations issued and backed by the “full faith and credit” of the US government. The US government guarantees the principal and interest payments on US Treasuries when the securities are held to maturity. Unlike US Treasuries, debt securities issued by the federal agencies and instrumentalities and related investments may or may not be backed by the full faith and credit of the US government. Even when the US government guarantees principal and interest payments on securities, this guarantee does not apply to losses resulting from declines in the market value of these securities.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio. Past performance does not guarantee future results.

Any data and figures quoted in this article sourced from Russell Investments, FactSet, Bloomberg and Reuters.

Important data provider notices and terms available at www.franklintempletondatasources.com. All data is subject to change.

Disclosure: Franklin Templeton

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Franklin Templeton and is being posted with its permission. The views expressed in this material are solely those of the author and/or Franklin Templeton and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account