Originally Posted 14 Jan 2025 – Strategic metals are poised for growth

Key Takeaways

- New ETF Launch: The WisdomTree Strategic Metals UCITS ETF (WENU) targets metals critical to clean technology, energy storage, and electrification using a forward-looking intensity rating for demand and supply analysis.

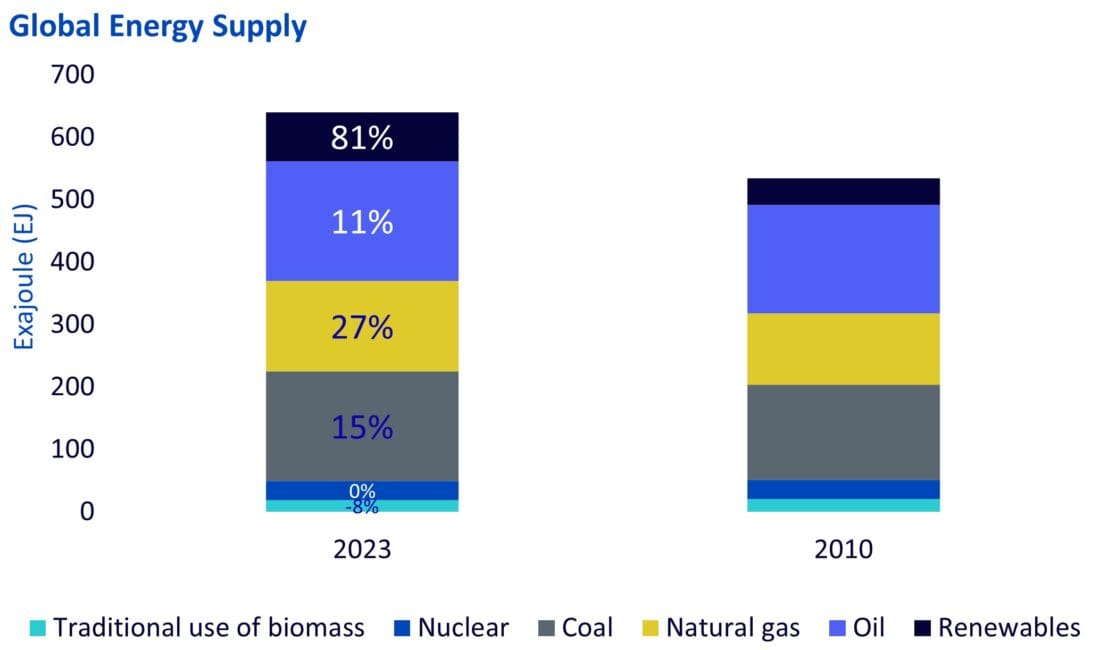

- Global Energy Demand: Energy demand rose 106 EJ (2010-2023), driven by population growth, industrial expansion, and development, especially in emerging markets.

- Energy Transition Metals: Electric vehicles (EVs) and renewables require high metal intensity, with demand for lithium, nickel, and cobalt expected to surge.

- Energy Security: Energy independence is vital; geopolitical risks highlight the need for renewables and storage solutions as Europe and China reduce reliance on hydrocarbon imports.

- The WisdomTree Strategic Metals UCITS ETF (WENU) offers targeted exposure to metals driving the energy transition, including EVs, energy storage, solar, wind, and hydrogen production, adapting to dynamic market conditions.

WisdomTree has launched the WisdomTree Strategic Metals UCITS ETF (WENU), offering investors access to the clean technology and battery metals sectors. This exchange-traded fund (ETF) utilises a rolling-futures strategy to track strategically important metals that are integral to the energy transition.

Addressing concerns about momentum

Recent shifts in the global political landscape and disappointing outcomes from COP291 have left some investors sceptical about the energy transition’s progress. Five years ago, WisdomTree introduced the WisdomTree Battery Solutions UCITS ETF (VOLT), driven by the belief that cleaner energy would displace fossil fuels. While renewable energy has grown significantly, fossil fuel demand has not diminished, and the so-called ‘transition’ remains elusive. Nonetheless, renewable energy remains the fastest-growing energy segment, and we anticipate its expansion will need to accelerate to meet surging global energy demands.

The reality of energy demand

Global energy output increased from 536 Exajoules (EJ) in 2010 to 642 EJ in 2023, a rise of 106 EJ2. During this time, renewable power generation grew by 35 EJ, an 81% increase, but not enough to offset the demand growth. This gap allowed natural gas to grow 27%, oil by 11%, and coal by 15%3. In short, electrons and molecules4 have been growing side-by-side. Our increasing energy needs promote all forms of energy production. With energy demand likely to continue rising, renewable energy supply must expand rapidly to keep pace.

Source: International Energy Agency World Energy Outlook 2024. Label shows the cumulative growth between 2010 and 2023.

Energy demand drivers

Energy demand has evolved differently across regions. Advanced economies saw a 0.5% annual decline over the past decade, while emerging markets and developing economies, home to 85% of the global population, experienced a 2.6% annual increase5. Key drivers include a population increase of over 720 million, a 50% rise in economic activity, and a 40% expansion in industrial output6. The addition of 40,000 square kilometres of building floorspace, equivalent to the size of the Netherlands, further underscores the rapid development.

Despite these gains, developing economies have not reached peak energy demand. Approximately 750 million people lack electricity, and 2.6 billion rely on polluting biomass fuels for heating and cooking. Average energy consumption per capita in regions like Africa and South Asia remains at 30 Gigajoules (GJ), far below North America’s 180 GJ and the global average of 77 GJ7. Even in advanced economies, demand could rise as data centres and artificial intelligence (AI) investments drive electricity consumption. For instance, data centre usage alone accounted for 1-1.3% of global electricity consumption in 2022, and with rapid buildout of more facilities we expect a strong gain.

Energy security and strategic independence

Energy security concerns bolster the case for reducing reliance on hydrocarbons. While the US has achieved energy independence through hydrocarbon investments, regions like Western Europe and China remain dependent on imports. The Russia-Ukraine war and Middle East instability have heightened the urgency for renewable energy and storage solutions. China has built a robust clean tech production value chain, while the European Union is pursuing initiatives like the REPowerEU and Critical Raw Materials Act to achieve similar independence.

Metals: the new energy commodity

Renewable energy sources and electric vehicles (EVs) are significantly more metal-intensive than traditional technologies. A 60-kilowatt-hour (kWh) EV battery, for example, requires 30kg of nickel, 8kg of cobalt, 10kg of lithium, and 66kg of copper—far exceeding the metal needs of internal combustion engine vehicles. As EV adoption accelerates, metal demand is expected to skyrocket. BloombergNEF projects lithium demand will increase tenfold by 2030, cobalt demand will double, and nickel demand could rise by 40-70%.

Evolving technology and investment strategies

The energy transition continues to evolve. Early battery technologies favoured nickel-heavy chemistries, but Lithium Iron Phosphate (LFP) batteries, which contain no nickel, now dominate China’s EV market. With China accounting for over 70% of global EV sales, LFP batteries are gaining traction worldwide. This shift underscores the importance of a nimble investment strategy in strategic metals. Supply can respond quickly to price signals, as seen with recent surpluses in lithium, cobalt, and nickel following price spikes.

WisdomTree Strategic Metals UCITS ETF

The WisdomTree Strategic Metals UCITS ETF (WENU) tracks the WisdomTree Energy Transition Metals Commodity UCITS Index. This index reflects the price of commodity futures linked to the energy transition, including sectors such as EVs, transmission, charging, energy storage, solar, wind, and hydrogen production. The ETF provides targeted exposure to a range of essential metals like copper, nickel, aluminium, silver, zinc, tin, platinum, lithium, and cobalt.

The selection and weighting of metals in the index are guided by a forward-looking Intensity Rating, developed with Wood Mackenzie8. This rating combines an Energy Transition Demand Rating (forecasting metal demand growth) with a Market Balance Rating (assessing supply conditions). With a two-thirds emphasis on demand and one-third on supply balance, this approach ensures a comprehensive evaluation of market dynamics.

WisdomTree’s focus remains on providing investors with adaptable, data-driven strategies to capitalise on the opportunities presented by the energy transition.

Conclusion

To meet future energy demands, growth in electrons and molecules can coexist and complement each other, each playing a crucial role in expanding energy production to satisfy our expanding needs.

The WisdomTree Strategic Metals UCITS ETF (WENU), which provides targeted exposure to the metals needed in electrification and energy storage solutions, demonstrates agility and a keen awareness of both demand and supply dynamics.

1 An annual United Nations (UN) climate change conference.

2 & 3 International Energy Agency, World Energy Outlook 2024.

4 Electricity is the flow of electrons through a conductor, which powers everything from lighting to industrial machinery. Electrons are the carriers of electrical energy in an electric circuit. Hydrocarbon fuels like oil, natural gas, and coal store energy in the chemical bonds of their molecules. When burned, these molecules react with oxygen to release energy in the form of heat, which can be used for various applications such as powering internal combustion engines, heating, and electricity generation. This distinction highlights the difference between the direct, instantaneous energy transfer of electricity and the stored, chemical energy in hydrocarbons.

5 & 6 International Energy Agency, World Energy Outlook 2024.

7 The Energy Institute Statistical Review of World Energy 2024.

8 Wood Mackenzie is a leading energy transition research and consulting firm that has been providing quality data, analytics and insights used to power the energy and natural resources industry for nearly 50 years.

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account