Earlier this week, we discussed how the options market was preparing for the robotaxi event that Tesla (TSLA) hosted last night. We noted that there was a roughly even split between bulls and skeptics, with a slight bias toward skepticism. Aftert this morning’s downbeat reaction, it occurred to me that TSLA’s history can be divided into two eras at TSLA: BT (Before Twitter) and AX (After X). The performance difference is stark.

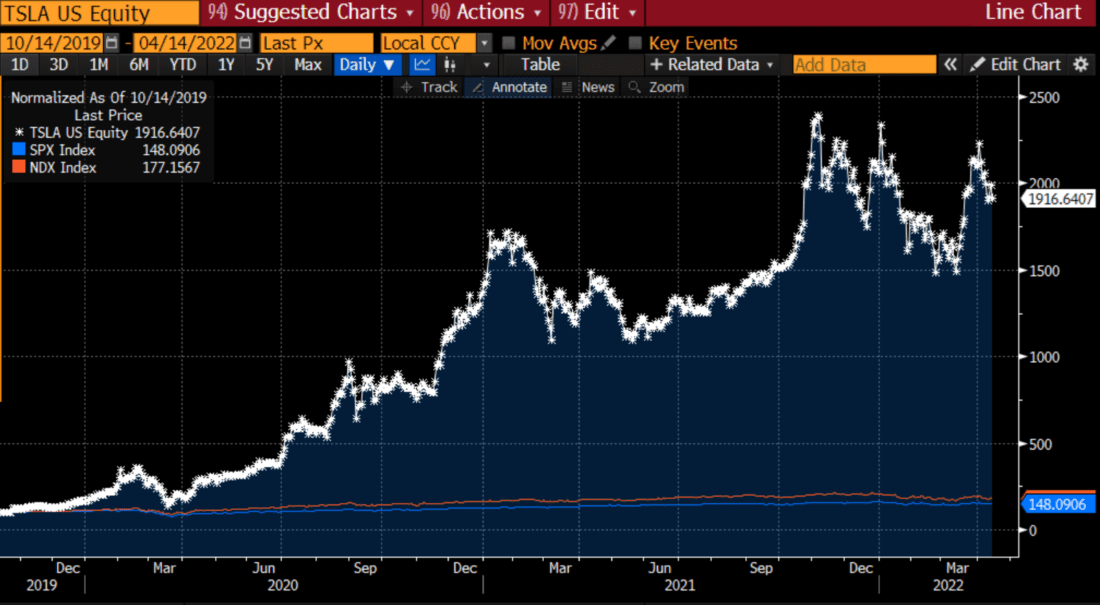

To put the dates into perspective, Elon Musk launched the acquisition of Twitter on April 14, 2022, and completed it on October 28th of that year. When the deal was announced, TSLA had just completed an absolutely astonishing run of success. The stock had increased by nearly 20-fold in the two and a half years prior to then. It was literally one of the best investments of all-time, far outpacing the Nasdaq 100 (NDX) and S&P 500 (SPX), making many of its adherents quite rich. The major benchmarks are barely visible in relation to TSLA in the chart below:

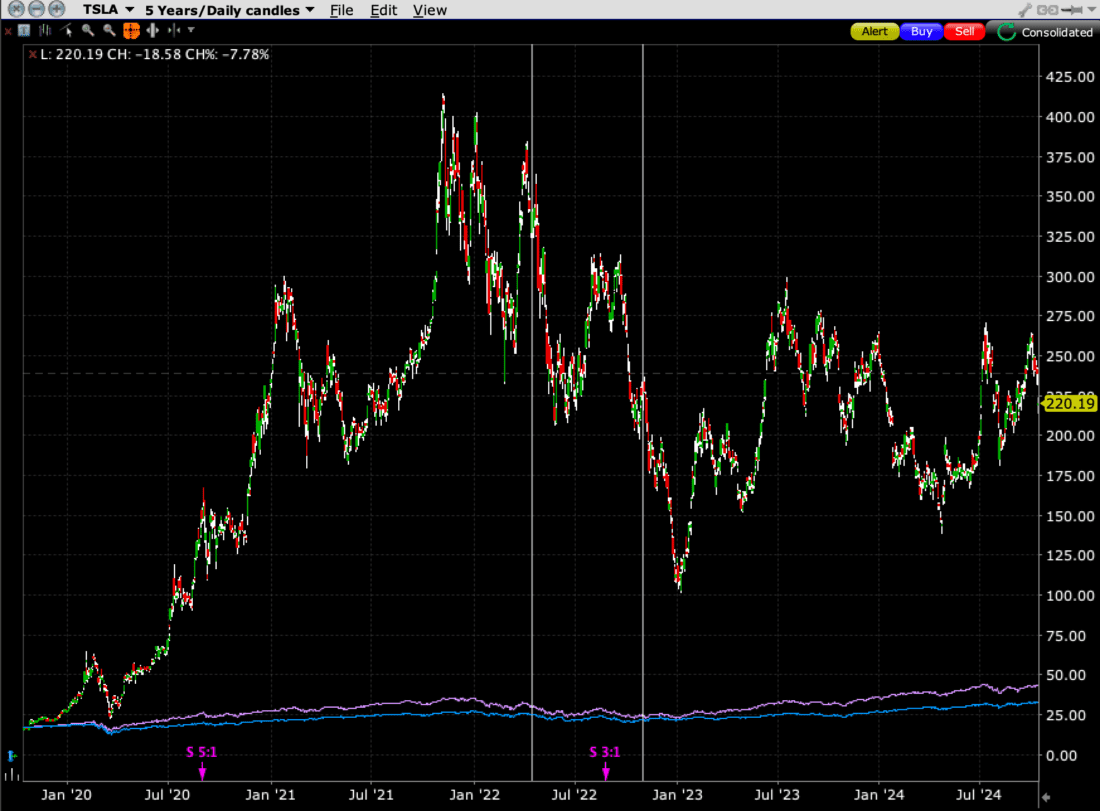

TSLA, 5-Years, Daily Candles with Vertical Lines at April 14th and October 28th, 2022; NDX (purple) SPX (blue)

Source: Interactive Brokers

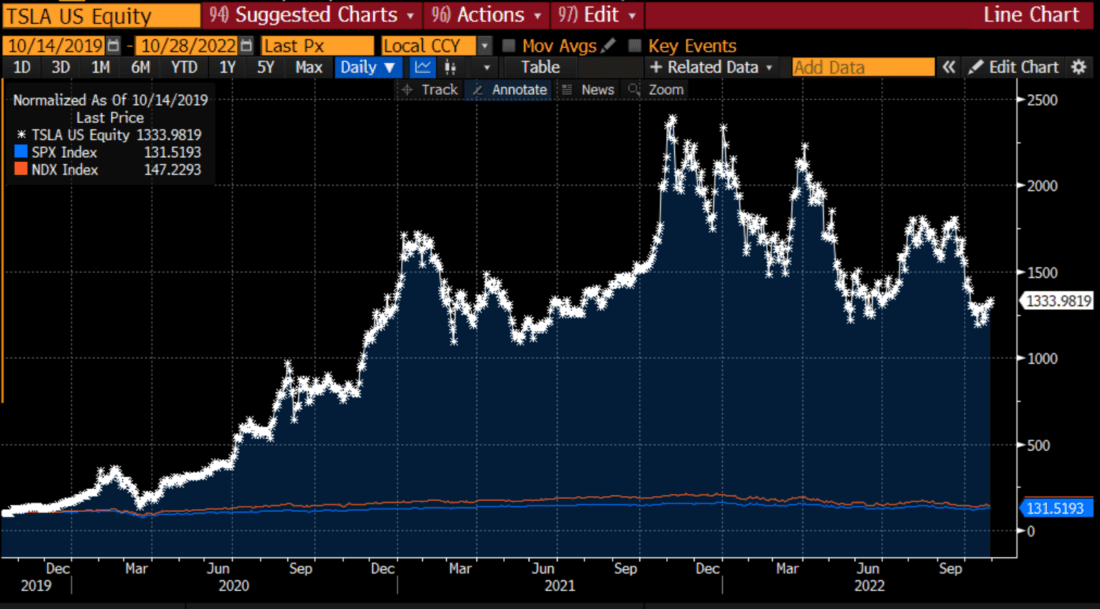

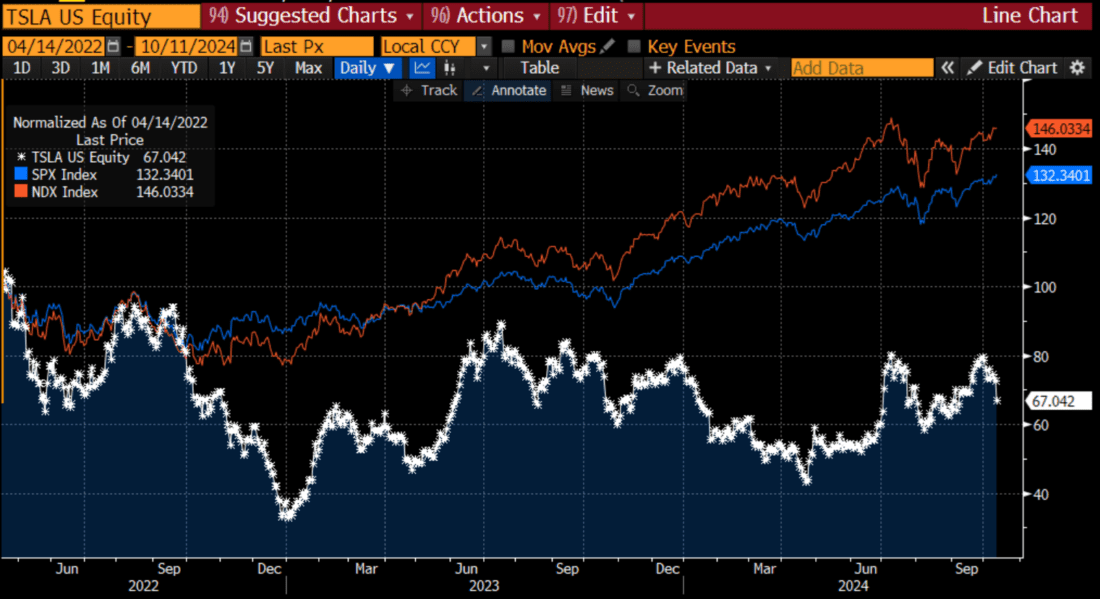

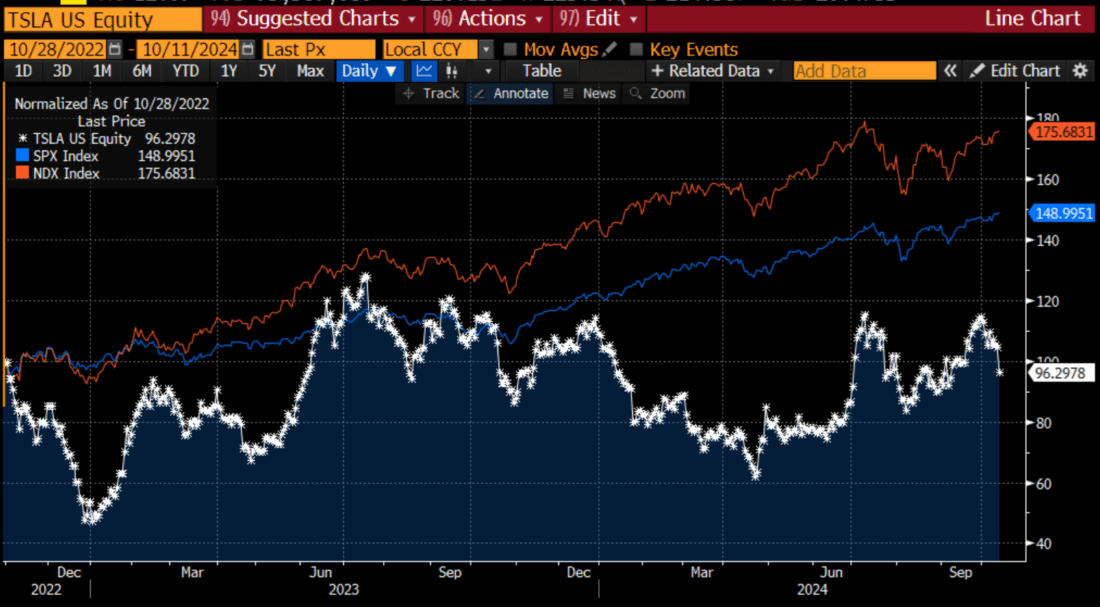

Unfortunately, the stock has been dead money since the deal was consummated, and a loser since it was announced. The following normalized graphs show the distinctions:

TSLA, SPX, and NDX Normalized from October 14, 2019 through April 14, 2022

Source: Bloomberg

TSLA, SPX, and NDX Normalized from October 14, 2019 through October 28, 2022

Source: Bloomberg

TSLA, SPX, and NDX Normalized from April 14, 2022 through October 11, 2024

Source: Bloomberg

TSLA, SPX, and NDX Normalized from October 28, 2022 through October 11, 2024

Source: Bloomberg

Everyone can come up with their own theories for why this distinction arose. Perhaps the stock’s rise was simply unsustainable, but that seems simplistic. My theory is that Twitter/X may have become one company too many for this phenomenal entrepreneur to manage.

It is extraordinarily difficult to manage any company, let alone a company that has changed transportation, and let alone other companies that have transformed spaceflight and telecommunications. But there is a common theme around transportation that binds SpaceX, Starlink, and TSLA together thematically. A social media company is a whole different animal – and a distracting one at that.

Anyone who has spent too much time on social media understands that it can be true time waster. Now imagine trying to manage a multitude of complex companies while spending increased amounts of time on social media without having it affect your performance. It seems impossible, and it very well might be.

And of course, while everyone is free to offer their personal opinions about politics and social issues, there is a real concern that Musk alienated some of his core customers. Many of the early adopters of electric cars, with TSLA being the premier manufacturer of them, did so for environmental and social reasons. Yet some of those core customers became dismayed when Musk chose to offer political opinions that differed from theirs, just as other carmakers were rolling out worthy electric competitors. I know of several who sold or traded in their Teslas for that reason.

We can debate the themes — and I’m expecting a lively debate in the comments (please keep it civil!) – but the evidence seems clear. There are clearly two eras at TSLA, at least regarding its stock performance: BT and AX.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account