There’s an adage that sticks in my head, but it’s hard to pin down. The saying is some variation of “stocks take the stairs to the roof and the elevator to the basement.” The implication is that stocks tend to grind higher when they rally but fall quickly when sentiment turns. Most market adages are rooted in fact, but when we thought about the market’s recent moves, we decided to question this one.

The basic premise does seem to have some resonance. We all can think of long periods when stocks rallied, often with low volatility and bear markets when stocks dropped sharply. Of course, the latter periods are relatively few and far between, especially during the past fifteen years or so (with the exception, of course, of early 2020). But I’ve found myself writing more frequently about sharp rallies, often fueled by short-term options traders. So, I decided to compile some evidence.

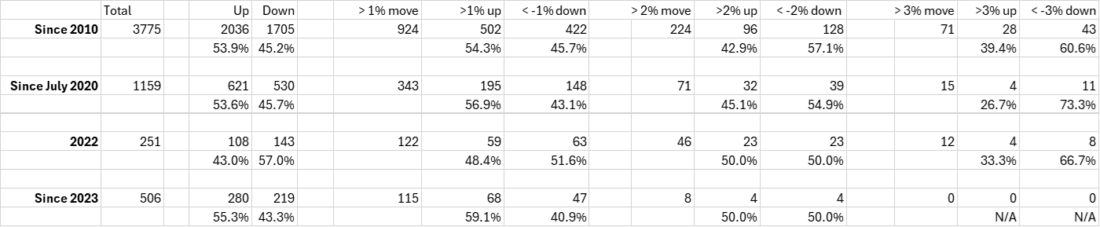

I checked the frequencies of one-day S&P 500 (SPX) moves of greater than 1%, 2% and 3% since 2010. Over that period, there appears to be some truth to the adage, though it seems to have become less accurate in recent years.

SPX 1-Day Moves in Various Timespans

Source: Interactive Brokers

Past performance is not indicative of future results.

We know that markets have gone up substantially over the past few years, so it should not be a surprise that we have seen more up days than down days over most of the past 15 years. We also see that the percentages of 1% moves, either up or down, have generally matched those of the overall level of up and down days. This is true over the whole period and the 4 ½ years since the post-Covid market recovery began in earnest.

But there are indeed some differences. For most of the longer periods, we saw that 2% and 3% moves were more likely to be to the downside. That fits with the adage. But that seems to have changed in recent years.

- During 2022, which was the most recent bear market, we saw a greater likelihood for +1% and 2% moves to be upward than we saw for up days overall. That speaks to the increased volatility that occurs during down markets, along with the propensity of bear market rallies to show outsized gains. That said, the 3% moves were definitely to the downside.

- And since 2023, when so-called 0DTE options took root among traders, things seem to have changed somewhat. 1% up days were more likely than up days overall, there was an even split between infrequent 2% moves, and no moves of more than 3%.

It is tough to draw conclusions from a relatively short timeframe – even if it has over 500 readings – but it is entirely possible that this is reflective of the potent combination of positive momentum, FOMO, and the ability to monetize them using short-dated options. Modest rallies can more easily become big rallies, and the deeply ingrained “buy the dip” mentality has allowed us to avoid relatively major drops in the past two years.

We can’t prove that the adage is passe, but it may have much less value in the current market environment.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD). Multiple leg strategies, including spreads, will incur multiple transaction costs.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account