Dividend stocks to watch this month.

The stock market offers a platform for investors to buy shares in companies. Potentially earning profits through dividends. Dividend stocks pay regular income to shareholders, usually from the company’s profits. These stocks attract investors looking for steady cash flow in addition to capital appreciation.

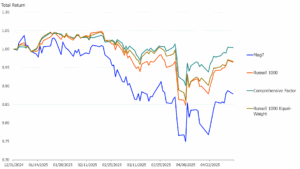

One major advantage of investing in dividend stocks is the potential for regular income, which can be especially appealing during volatile or uncertain market conditions. Many dividend-paying companies are well-established and financially stable, which might provide lower risk compared to non-dividend-paying stocks. However, these stocks might offer slower growth compared to high-growth sectors like technology, where companies often reinvest earnings rather than pay dividends.

On the downside, dividend stocks can be affected by changes in company profitability and economic conditions. If a company’s profits decrease, it might reduce or eliminate its dividend, impacting investors relying on this income. Moreover, dividend stocks can underperform the broader market during strong economic growth phases when investors seek higher returns from growth stocks. Keeping this on top of mind, here are two dividend stocks to watch in the stock market today.

Dividend Stocks To Watch Today

Church & Dwight Company (CHD Stock)

First up, Church & Dwight Company Inc. (CHD) is a producer of consumer products. In detail, the company manufactures and markets a wide range of personal care, household, and specialty products. Among its most popular brands are Arm & Hammer, which is famous for baking soda-based products, and other well-known names like OxiClean and Trojan. The company’s products cater to everyday needs, providing solutions from oral care to laundry detergents.

At the beginning of last month, Church & Dwight Company reported better-than-expected first-quarter 2024 financial results. In detail, the company posted Q1 2024 earnings of $0.96 per share, with revenue of $1.50 billion. This is compared to analysts’ consensus estimates for the quarter which were an earnings estimate of $0.86 per share, on revenue of $1.49 billion. Additionally, CHD offers it shareholders an annual dividend yield of 1.06%.

Meanwhile, year-to-date, shares of CHD stock have increased by 13.45% thus far. Moreover, during Tuesday morning’s pre-market trading session, Church & Dwight Company stock looks set to open at around $107.29 a share.

International Business Machines (IBM Stock)

Coming in next, International Business Machines Corporation (IBM) is a global technology and consulting company. The company is popular for its high-value services and software, IBM also manufactures and markets computer hardware. In addition, IBM is a player in the development of advanced information technologies, including computer systems, software, networking systems, storage devices, and microelectronics. Today, IBM has an annual dividend yield of 4.04%.

Earlier this month, IBM announced a partnership with Palo Alto Networks to enhance AI-powered cybersecurity solutions. The collaboration focuses on integrating IBM’s security consulting services with Palo Alto Networks’ platforms. Additionally, IBM will sell certain QRadar SaaS assets to Palo Alto Networks for about $500 million, pending regulatory approval. This deal also includes the transition of QRadar SaaS clients to Palo Alto’s Cortex XSIAM platform, with support continuing for on-premise QRadar clients.

In 2024 so far, shares of IBM stock are up modestly by 2.34% YTD. While, during Tuesday’s pre-market trading session, International Business Machines stock is trading slightly lower by 0.17% at $165.00 per share.

—

Originally Posted June 4, 2024 – Dividend Stocks To Consider in June 2024? 2 In Focus

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from StockMarket.com and is being posted with its permission. The views expressed in this material are solely those of the author and/or StockMarket.com and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account