Typically, options are displayed in a “Chain”, either in a tab view where each tab is an expiration or a list view in which the investor can scroll down and see each expiration. The Interactive Brokers Desktop offers both of those traditional option chain views as well as an innovative graphical view, the Option Lattice, that allows the investor to highlight four key metrics: Implied Volatility, Open Interest, Volume, and Last Price.

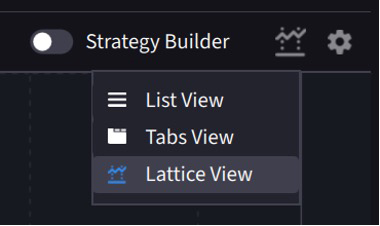

To bring up the IBKR Desktop Option Lattice the investor can click on the “Quote” icon on the left side of the screen, click on “Option Chain”, and in the right-hand corner click on the icon next to the settings gear and click on “Lattice View”

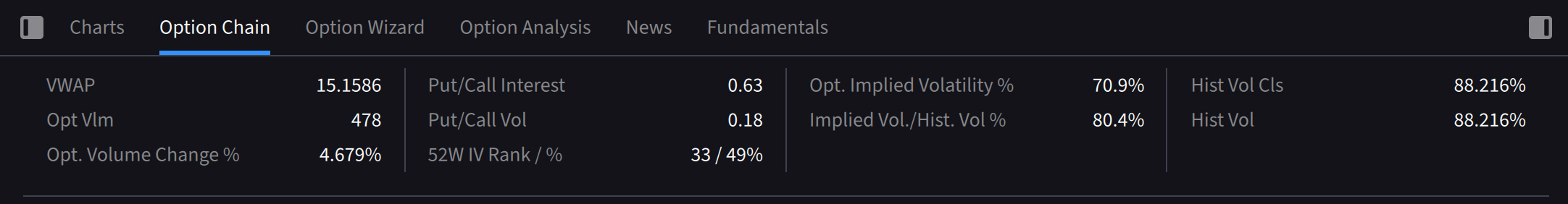

On the left-hand side of the Option Lattice is a one-month chart of the underlying and on the right is the Option Lattice display. At the top of the screen information on the underlying and options such as VWAP and Option Volume are displayed.

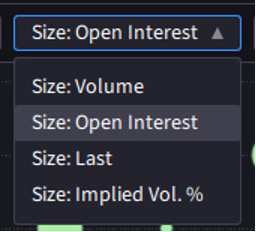

Underneath the investor can choose between displaying Calls or Puts, only one option right can be displayed at a time in the Option Lattice. Calls are displayed in green, and puts are displayed in purple. The investor can also choose the number of strikes to display, how many expirations and if they should include weeklies, and can choose between Volume, Open Interest, Last, or Implied Volatility.

The size of the circle is representative of the quantity of the category. The current price of the underlying is displayed as a dotted blue line giving a reference point to the moneyness of the options, so the investor knows quickly which options are at-the money, in-the-money, and out-of-the money.

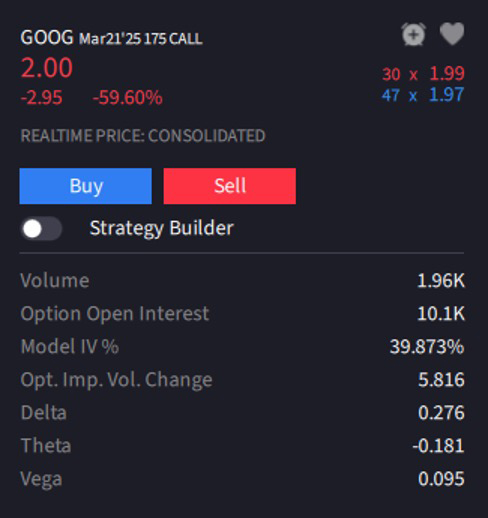

In the above screen the investor has chosen to display eight expirations the stock is currently trading at $168.44, and the bubbles represent the open interest in each contract. If the investor hovers their mouse over a bubble, they will see information for that contract as well as the ability to activate the Strategy Builder, set a market alert, add to a Watchlist, and create an order from the bubble.

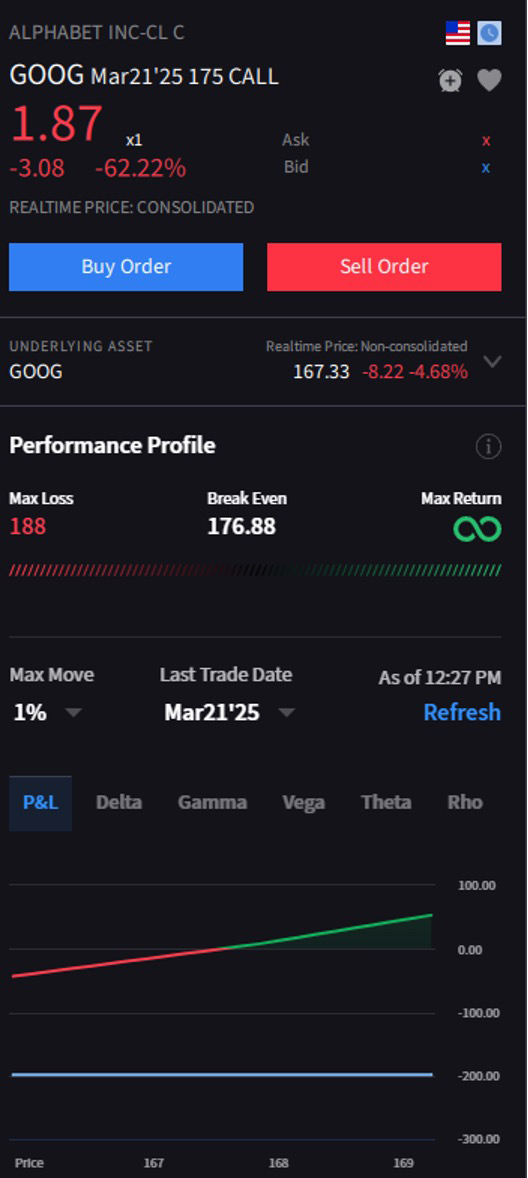

The investor would like to place an order to buy 10 of the GOOG May 21’25 175 calls. They click ”Buy” and the side panel is populated with information on the option as well as the performance profile chart. For more information on the performance profile chart please see the Traders’ Academy lesson, “Performance Profile for Options”.

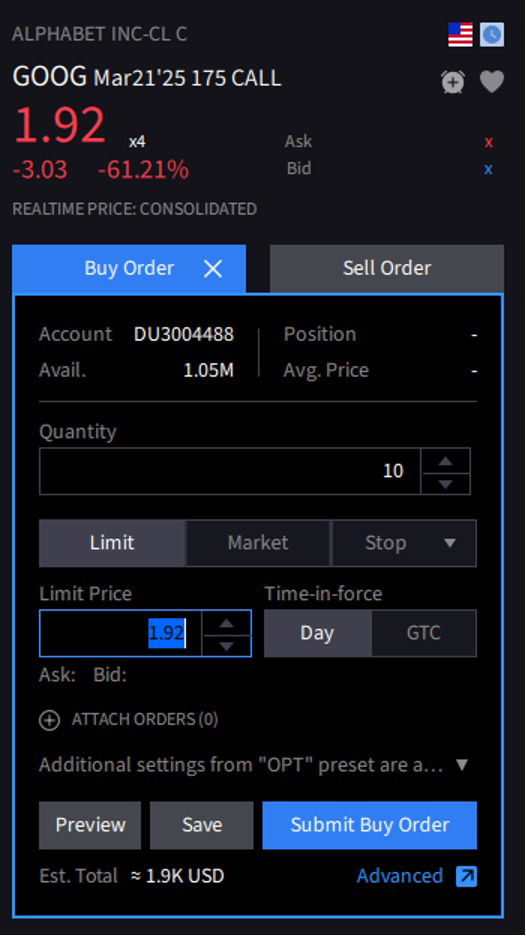

The investor clicks “Buy Order” and an order ticket is created, where the investor can enter the size, time-in-force, price, and order type. To access one of the IB algorithmic trading order types they can click on Advanced and bring up an Advanced Order Entry Window.

When the investor is ready to submit the order the click “Submit Buy Order” and the order will be submitted for trading. For more information on the Option Lattice please see the Traders’ Academy lesson, “Option Lattice View”.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account