Confidence is a fragile thing. It can be infectious – both positively and negatively – and it certainly affects our perceptions about the present and future. Despite the ever-increasing roles of algorithms and artificial intelligence in the investment process, emotions still play an important role in market behavior. Fear and greed still rule, and their constant tug-of-war has been on full display in both the market and the economy recently.

After several weeks when fear was the overriding market sentiment, leading us to one of the fastest market corrections ever, greed continues to seek opportunities to rear its head. Monday was one of those days. Indeed, as we noted, there were solid reasons for stocks to rally. Any signs of a lighter potential tariff burden should be welcomed by skittish investors, and we added that there were reasons to believe that the recent tariff commentary might have been a sign that the “Trump Put” was implemented.

Yet those don’t explain the ferocity of the bounce in a stock like Tesla (TSLA). A rally, even a substantial one, would have been quite understandable. TSLA’s 12% jump reflected something more than simply a broad market move. This was concentrated FOMO (Fear of Missing Out). As the stock fell in recent weeks, we continued to see substantial customer net buying activity. These were likely faithful investors who were buying the dip, even as the stock’s plunge worsened. In the last week, however, we saw that net buying activity shrink dramatically. It is impossible to say whether traders’ faith was shaken or their liquidity was impeded after buying on the way down (my ability to see customer data is VERY limited), but either way, once yesterday’s rally had legs, it was obvious that buyers were leaping in, unwilling to miss the rally they’d been awaiting for weeks.

In November 2023, we reminded readers of an important distinction about FOMO:

Remember, market movements hinge on the equilibrium between fear and greed. While the “F” in “FOMO” is fear, FOMO is actually a manifestation of greed. Nervousness about losing money is fear. If you’re concerned about not making enough money, that’s greed.

And FOMO never really goes away. We’ve long noted that bear market rallies are short, sharp and ferocious. This is a sign that even during long period of fear, greed always lurks. While the broad market is nowhere near bear market levels (yet?), TSLA has clearly been mired in its own bear move after a remarkable post-election rally. Thus, at least for that stock, yesterday’s move could undoubtedly be considered a bear market rally.

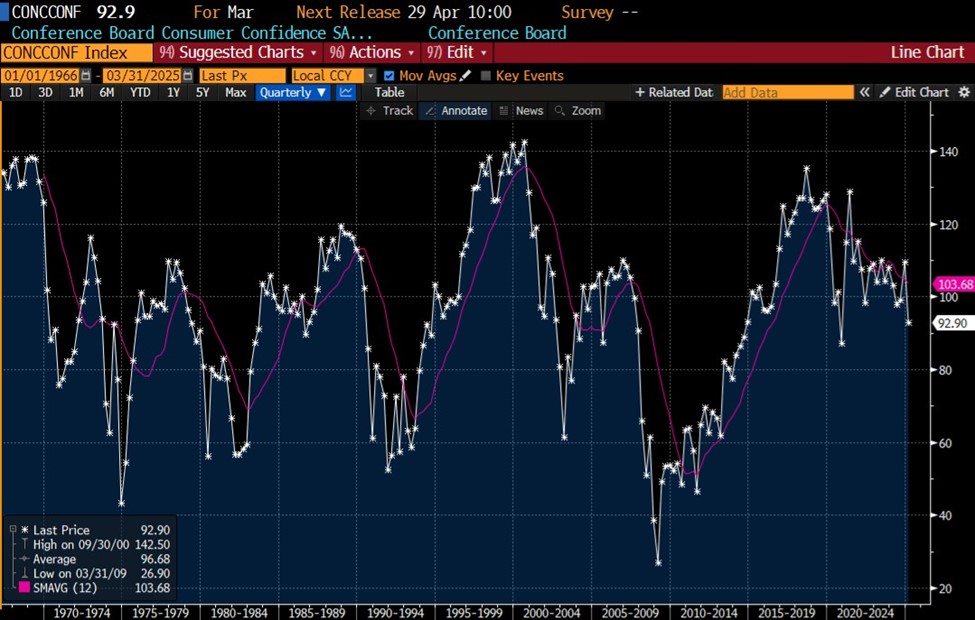

In a broader sense, however, we got another reminder that consumer confidence is fading. The Conference Board’s latest Consumer Confidence report was released this morning, and it showed another worrisome drop. The March reading was 92.9, below both the 94.0 consensus and the 100.1 prior reading (which was revised up from 98.9). This is the lowest reading since Covid, though it remains well above the lows seen during the global financial crisis:

Conference Board Consumer Confidence, Monthly Data Since 1966 (white) with 12-Month Moving Average (magenta)

Source: Bloomberg

Past performance is not indicative of future results

Despite the drop, stocks seemed to take the confidence report in stride, though bond yields have turned lower this morning. Again, if traders believe that much of the drop is related to uncertainty about tariffs, and those are assumed to be easing, then there is justification to put aside today’s report. But that is a bit of a parlay at this point.

Finally, we point to one other sign of increasing investor confidence. The demand for hedges, as evidenced by the level of the Cboe Volatility Index (VIX) has declined to relatively normal historical levels. Yet correlations, as measured by the Cboe’s COR1M index, remain elevated. We’ve explained how the level of VIX is influenced by the correlations in the underlying S&P 500 Index (SPX), and as the chart below shows, those correlations are quite high vs. VIX. Over the past year, COR1M levels were accompanied by VIX levels well above the current 17.49. It is indeed possible that the demand for volatility-based hedges has decreased because institutions have de-risked in other ways – moving to lower-beta stocks or raising cash – but this relationship indicates that traders might be more confident than they should be right now.

1-Year, VIX (red/green candles), COR1M (blue line)

Source: Interactive Brokers

Past performance is not indicative of future results

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Bonds

As with all investments, your capital is at risk.

So many realities that you and others refuse to address: 80% of Congress members cheered for mass murder. So who is running the show ? A coup d’état is happening in the USA. Now think it all over again.