The week in review

- Headline CPI rose 0.2% m/m and 2.9% y/y

- PPI rose by a softer than expected 0.1% m/m

- Retail sales rose 1.0% m/m, beating expectations

- Initial claims fell 17K to 227K

The week ahead

- FOMC Minutes

- Jackson Hole

- PMIs

- New home sales

Thought of the Week

Recent data have sent mixed signals about the U.S. economy, causing interest rate expectations to fluctuate once again. Just two weeks ago, a weak jobs report sparked recession fears, and markets swiftly priced in an additional rate cut for this year. Since then, strong retail sales and low initial jobless claims readings helped alleviate these fears, and markets are now back to pricing in only three cuts in 2024. However, while short-term rate expectations dominate headlines, it is long-term rates that matter most to long-term investors.

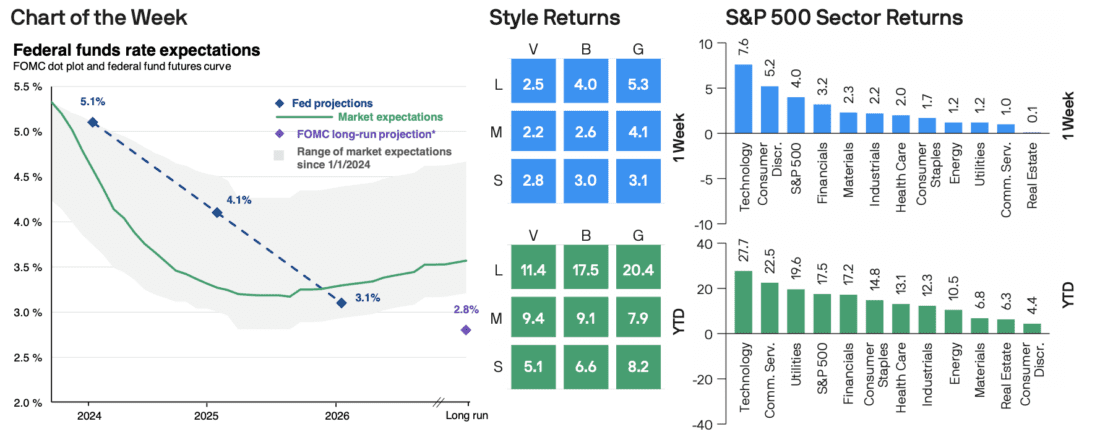

This week’s chart explores both market and Fed expectations of the longer-term, or “neutral,” federal funds rate. As of the most recent Summary of Economic Projections, the Fed’s “dot plot” projects that the overnight rate will be 3.1% by the end of 2026, and not lower than 2.8% over the long run. Moreover, this number was revised higher, first in March and again in June, signifying that the Fed thinks the economy can tolerate higher interest rates. This suggests that, barring any sort of economic collapse, the era of “free money” is likely over, and a more “normal” interest rate environment, where real yields are positive, is upon us.

Given this backdrop, investors may have to reconsider how they allocate capital. Higher bond yields could help investors achieve their income goals with less risk, while equity market quality will be more of a focus as companies combat higher borrowing costs.

Past performance is not indicative of future results

Chart of the Week: Bloomberg, CME Group, Federal Reserve, J.P. Morgan Asset Management. Market expectations reflect the federal funds rate futures curve as of 8/15/2024.

Thought of the week: Bloomberg, CME Group, Federal Reserve, J.P. Morgan Asset Management. Market expectations reflect the federal funds rate futures curve as of 8/15/2024.

—

Originally Posted August 19, 2024 – Weekly Market Recap

Past performance does not guarantee future results.

Diversification does not guarantee investment returns and does not eliminate the risk of loss.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be appropriate for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

The Market Insights program provides comprehensive data and commentary on global markets without reference to products. Designed as a tool to help clients understand the markets and support investment decision-making, the program explores the implications of current economic data and changing market conditions.

The J.P. Morgan Asset Management Market Insights and Portfolio Insights programs, as non-independent research, have not been prepared in accordance with legal requirements designed to promote the independence of investment research, nor are they subject to any prohibition on dealing ahead of the dissemination of investment research.

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment.

Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide.

Telephone calls and electronic communications may be monitored and/or recorded.

Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://www.jpmorgan.com/privacy.

This communication is issued in the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission.

If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

Copyright 2024 JPMorgan Chase & Co. All rights reserved.

©JPMorgan Chase & Co., July 2024.

Unless otherwise stated, all data is as of August 19, 2024 or as of most recently available.

Disclosure: J.P. Morgan Asset Management

Past performance does not guarantee future results.

Diversification does not guarantee investment returns and does not eliminate the risk of loss.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

The price of equity securities may rise or fall because of changes in the broad market or changes in a company’s financial condition, sometimes rapidly or unpredictably. International investing involves a greater degree of risk and increased volatility. There is no guarantee that companies that can issue dividends will declare, continue to pay, or increase dividends. Investments in commodities may have greater volatility than investments in traditional securities, particularly if the instruments involve leverage.

JPMorgan Distribution Services, Inc., member of FINRA.

J.P. Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase & Co. Those businesses include, but are not limited to, J.P. Morgan Investment Management Inc., Security Capital Research & Management Incorporated and J.P. Morgan Alternative Asset Management, Inc. and JPMorgan Asset Management (Canada) Inc.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from J.P. Morgan Asset Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or J.P. Morgan Asset Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD). Multiple leg strategies, including spreads, will incur multiple transaction costs.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account