Stocks are getting slammed today on heighted trade tensions between Washington and Beijing. The turbulence is concentrated in the semiconductor sector, following President Trump imposing restrictions on Nvidia exports to the US’s far east rival. Meanwhile, global growth expectations are being pared back as the WTO issues a pessimistic outlook concerning volumes of cross-border commerce. But domestic prospects were helped by the strongest retail sales result in 26 months, driven by a rush to automobile dealerships. Also, a better-than-expected homebuilder sentiment print coincided with only a modest miss on industrial production. Investors are active against this backdrop but are tilting toward safer haven assets. They’re picking up defensive equities, Treasuries across the curve, forecast contracts, gold and silver futures and adding exposure to cyclical commodities.

A Rush to Beat Tariffs Boosts Consumption

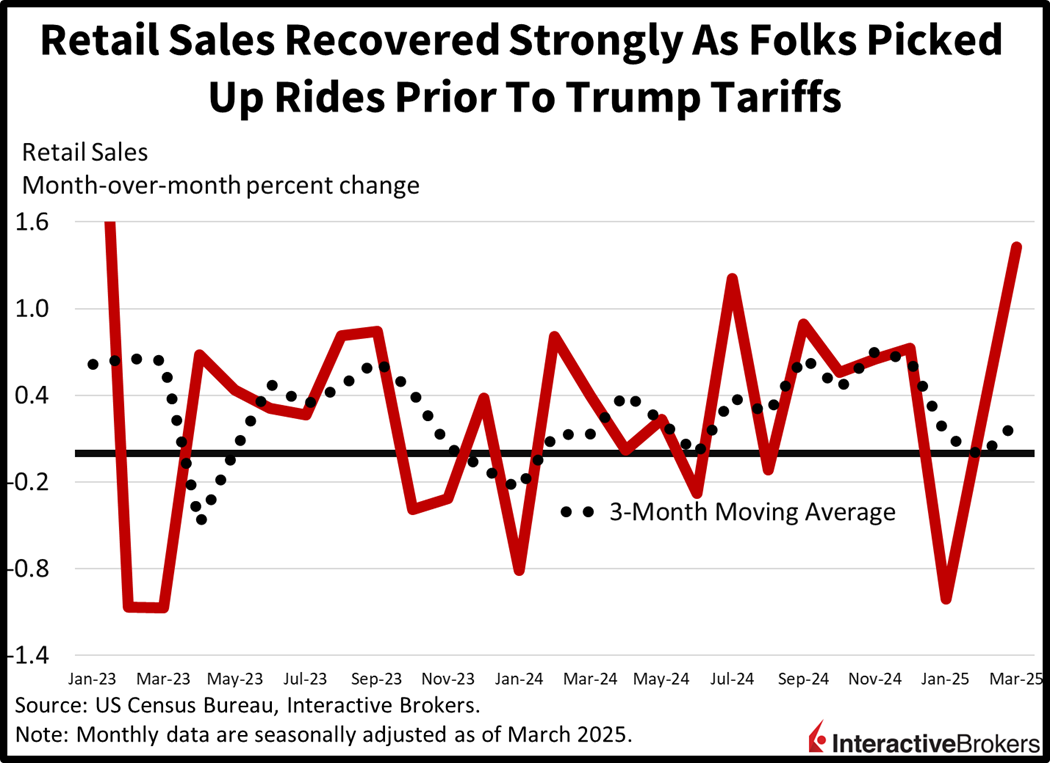

A hurry to pick up new and used rides ahead of Trump automobile tariffs sent March retail sales to its sharpest gain since January 2023 and is serving to temper consumer slowdown fears. Overall transactions rose a whopping 1.4% month over month (m/m), a 26-month high, above the 1.3% median estimate and the 0.2% increase in February. The progress was broad-based with the following segments producing the stated m/m increases:

- Car showrooms, 5.3%

- Building materials suppliers, 3.3%

- Sporting goods destinations, 2.4%

- Restaurants/drinking parlors, 1.8%

- Electronics destinations, and 0.8% m/m gains

Gains for personal care stores, miscellaneous retailers, general merchandise establishments, apparel shops, food/beverage markets and ecommerce ranged from 0.7% and 0.1%.

Furniture showrooms and gasoline stations weighed on the headline, however, slipping 0.7% and 2.5%. The control group, meanwhile, which contributes heavily to the government’s consumption calculation related to gross domestic product (GDP), grew 0.4% m/m, lighter than the 0.6% projection and 1.3% from February.

Past performance is not indicative of future results

Warm Weather Dings Industrial Activity

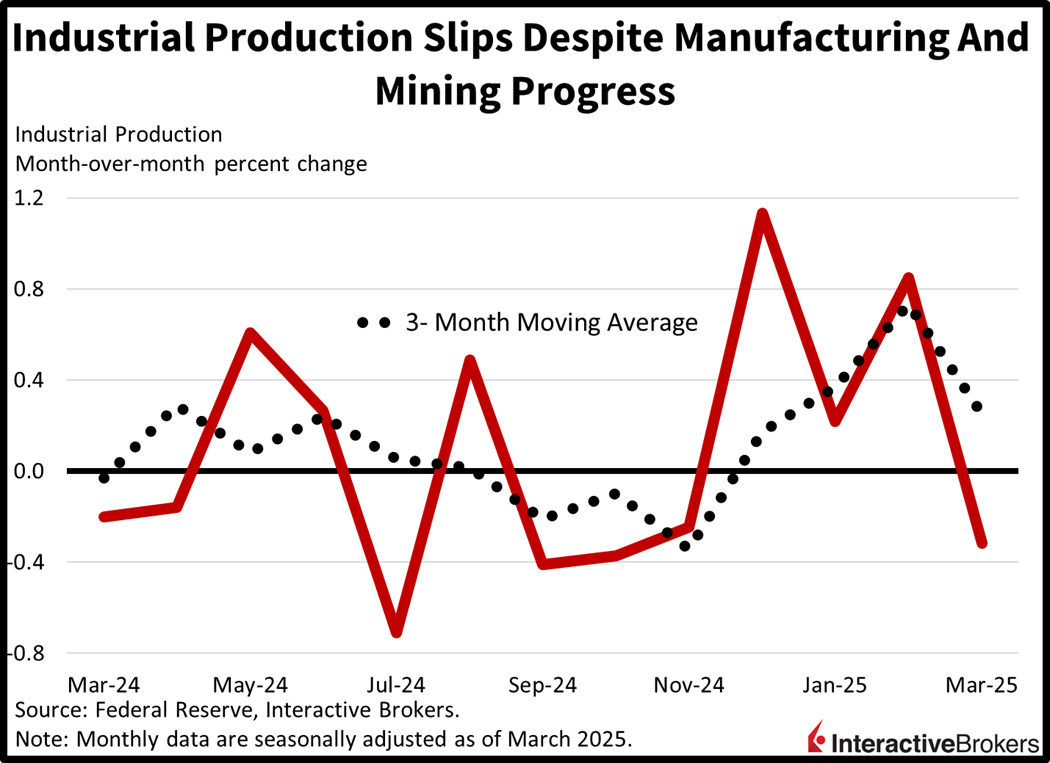

A warmer-than-expected March dented industrial production as the utilities industry offset progress in manufacturing and mining. The headline result slipped 0.3% m/m, beneath the 0.2% drop projected and February’s 0.8% advance. The 5.8% decline in utilities countered the 0.6% and 0.3% increase in manufacturing and mining. From a final product perspective, consumer goods and materials sank 1% and 0.5% while business equipment, nonindustrial supplies and construction inputs rose 1.7%, 0.2% and 0.6%.

Past performance is not indicative of future results

Dour Mood Among Homebuilders Persists

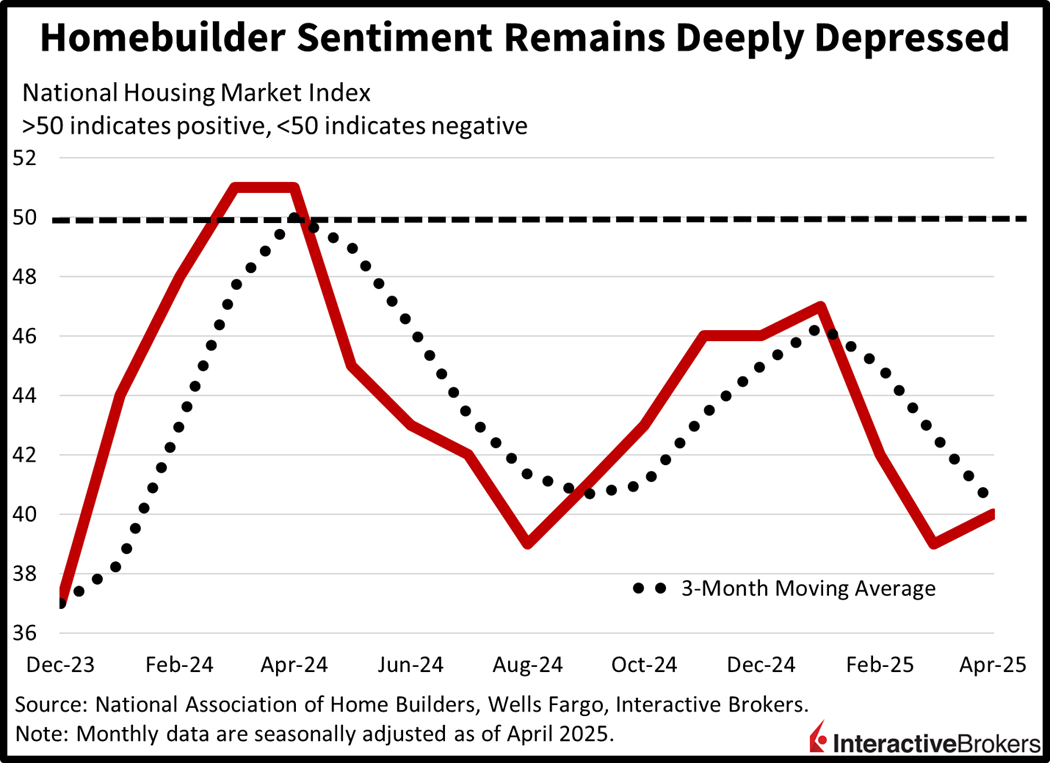

Homebuilder sentiment is less negative this month relative to March but remains near its recent lows as elevated mortgage rates, pricey properties and waning consumer confidence weigh upon transactions. The NAHB/Well Fargo Housing Market Index climbed to 40 in April, better than the 37 projected and last month’s 39. Increases in single-family sales and the traffic of prospective buyers helped to cushion a deteriorating outlook for closings over the next six months. Indeed, the present volumes and prospect components advanced from 43 and 24 to 45 and 25, but the future segment declined four points to 43. Regional performance was bifurcated with the Northeast and South dropping from 48 and 39 to 43 and 38, while the Midwest and West areas rose from 38 and 34 to 43 and 35.

Past performance is not indicative of future results

US-China Dispute Pulls Down Equities

All major domestic equity benchmarks are lower despite split sector breadth with the Nasdaq 100, S&P 500, Russell 2000 and Dow Jones Industrial indices down 2%, 1.2%, 0.5% and 0.5%. The heaviest laggards are the technology, communication services and consumer discretionary segments, which are in the red by 2.5%, 1.5% and 1%. But energy, real estate and materials are gaining the most today, with those areas up 1.9%, 0.6% and 0.2%. Treasurys are getting scooped up across the curve and the 2- and 10-year maturities are changing hands at 3.80% and 4.31%, 5 and 3 basis points (bps) lighter. But softer borrowing costs are weighing on the greenback, which is depreciating relative to all of its major counterparts, including the euro, pound sterling, franc, yen, yuan, loonie and Aussie counterpart. The Dollar Index is plunging 62 bps and is beneath its critical 100 level. Traders are boosting their commodity bets, with gold, silver, crude oil, copper and lumber higher by 3.1%, 1.8%, 1.5%, 1% and 0.2%. WTI crude is trading at $61.71 per barrel even as the EIA reported a third straight week of rising stateside inventories this morning.

Path to Positive GDP Widens

This morning’s US economic data on retail sales alongside manufacturing and mining production is incrementally widening the path toward a positive first-quarter GDP report, which our prediction market assigns 78% odds of. But since we don’t have services expenditure numbers for last month yet, there’s a chance that March outlays were driven by goods, which comprise a much smaller share of total consumption than services, at around one-third, while the latter category represents two-thirds of the pie. Still, though, cars are expensive, and the impressive showing points to the potential for a stronger-than-expected consumer in the months ahead. Meanwhile, encouraging developments from the manufacturing and mining sectors in this morning’s industrial production data reflects continued progress in onshoring initiatives and the “drill baby drill” mantra, two critical goals of Trump 2.0.

International Roundup

Bank of Canada Pauses Rate Cuts

The Bank of Canada (BoC) decided to maintain its current key interest rate of 2.75% this morning just one day after the Consumer Price Index (CPI) depicted lower-than-expected inflation. It was the first of the past eight meetings that the organization didn’t walk down. BoC Governor Tiff Macklem says the pause in monetary easing is needed to give policymakers more time to gather more information on US tariffs and the impacts of the levies. Rather than follow its practice of providing detailed economic forecasts, the bank offered two scenarios. One involves negotiating away any new tariffs. It would entail growth stalling in the second quarter before resuming and inflation slowing to less than 2% this year. The second scenario involves a prolonged trade war resulting in Canada falling into a year-long recession and inflation above 3%. In the meantime, inflation has been easing. Just yesterday, Statistics Canada reported that the CPI climbed 0.3% m/m and 2.3% y/y last month compared to consensus forecasts for 0.7% and 2.6%. Both rates were lower than February’s results.

China’s GDP Beats Expectations

China’s first-quarter GDP grew 5.4% y/y and 1.2% relative to the final quarter of last year, compared to expectations of 5.2% and 1.4%, welcome news for a country that is struggling with excess manufacturing capacity, a glut of housing stock and a trade war with the US. The y/y result matched the fourth-quarter growth rate while the quarter-over-quarter pace slowed from 1.6% in the final three months of 2024. The recent quarter ended with March industrial production and retail sales exceeding estimates, but real estate challenges persisted with home prices falling 4.5% y/y.

UK Inflation Eases

Headline inflation in the UK moderated last month, according to the CPI, but the core version of the gauge dished out mixed results. Overall prices moved northward 0.3% m/m and 2.6% y/y compared to 0.4% and 2.8% in the preceding period. Economists expected the m/m rate to remain at 0.4% and a y/y result of 2.7%. The core indicator climbed 0.5% m/m, which met expectations and increased negligibly from 0.4% in February. The y/y figure, encouragingly, fell from 3.5% to 3.4%, matching the economists’ consensus forecast.

South Korea Import Inflation Sinks

South Korea consumers and businesses experienced easing import inflation with prices for foreign items growing 3.4% y/y in March, down from 4.3% in February. Meanwhile, export cost pressures, at 6.3% y/y, were unchanged from the preceding month.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bonds

As with all investments, your capital is at risk.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account