Goldman Sachs economists have sounded the alarm on the U.S. economy, launching what they termed a “countdown to recession” as Donald Trump‘s aggressive tariff policy derails economic forecasts.

In a note shared Monday, the Goldman Sachs economic team led by Jan Hatzius downgraded its U.S. gross domestic product forecast for year-end 2025 to just 0.5% year-over-year, down from 1.7% previously.

The downgrade follows a combination of shocks, including higher tariffs announced by the Trump administration, tightening financial conditions and rising geopolitical friction, that the bank says are disproportionately affecting lower-income Americans and threatening to derail the U.S. economy.

Traders on CFTC-regulated betting platform Kalshi currently price in a 66% chance of a U.S. recession this year, up from 40% last week.

Trade War Reloaded? What’s Behind The Rising Recession Call

Goldman Sachs said its baseline scenario still assumes some moderation in tariff implementation. Still, if most of the April 9 tariffs are enacted as planned, the effective U.S. tariff rate could surge by 20 percentage points.

“Our forecast had already assumed forceful retaliation by foreign governments, but we had not accounted for the effects of a consumer-led response,” the team said, pointing to anticipated foreign consumer boycotts and reduced tourism flows to the United States, which alone could shave 0.1 to 0.2 percentage points off 2025 GDP.

Additionally, uncertainty around trade policy is compounding the issue. “Much of the very recent rise in uncertainty was related to President Trump’s ‘reciprocal’ tariff plan,” Goldman said, adding that despite having more details, ambiguity around international responses and the scope of future tariff increases remains high.

Investment And Hiring Set To Stall

Business investment, a key driver of economic growth, is now expected to flatline over the next 12 months. According to Goldman Sachs’ models, there is now a 45% probability that capital expenditures will decline during that period.

The economic team also sees looming pressure on federal, state and local government spending, especially in sectors like healthcare, education and infrastructure, which is amplifying the drag on the economy.

“We now expect roughly flat business investment over the next year,” Goldman said, noting that tightening financial conditions and tariff-driven uncertainty discourage companies from expanding or hiring.

Consumer spending, which makes up about 70% of the U.S. economy, is also under threat. As labor supply growth slows and job creation weakens, Goldman expects a meaningful deceleration in household consumption.

“Tariffs reduce real disposable income,” the bank said, implying that higher prices for imported goods will weigh on consumer purchasing power, especially among lower-income households.

The combination of weaker hiring, stagnant investment and declining consumer confidence creates a toxic mix for growth, one that might push the economy into contraction territory if shocks continue to build.

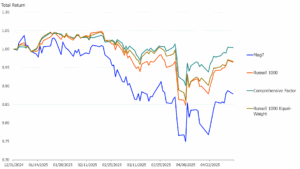

Recession Risk Spurs Hedging Shift

The rise in recession probability is not just a warning signal — it’s a tactical call to rethink their hedging strategies.

Goldman Sachs analyst Karen Reichgott Fishman said the combination of diminishing U.S. economic exceptionalism and increased risk of recession supports a strategic move into safe-haven currencies.

“The loss of U.S. exceptionalism and higher recession risk argue for a shift in hedging strategy,” Fishman said.

—

Originally April 7, 2025 – US Recession ‘Countdown’ Has Begun As Trump Tariffs Push Odds To 45%, Goldman Sachs Warns

Disclosure: Benzinga

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Benzinga and is being posted with its permission. The views expressed in this material are solely those of the author and/or Benzinga and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account