Today’s equity market rug-pull was brought to you by the friendly folks at the University of Michigan. While I’ve never understood what compound in the water in Ann Arbor makes parents suddenly bleed maize and blue when their offspring enroll at that institution[i], their economists should not be blamed for being the bi-weekly messengers of bad news about consumer sentiment. I’ll return to the same term that I last used to describe the UMich sentiment data: Frankly, it stinks.

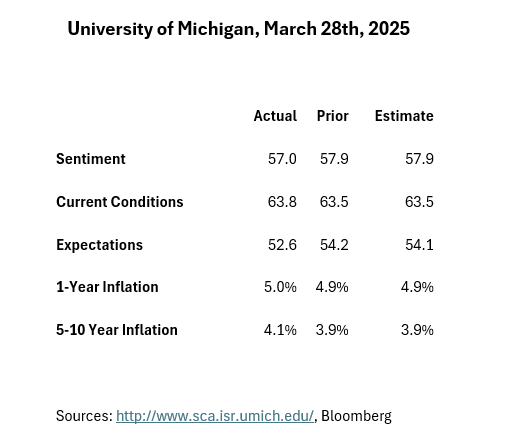

To be fair, today’s data doesn’t stink quite as badly as say, two weeks ago, or one month ago, or even as early as February 7th, when we first noted a strange uptick in 1-year inflation expectations. The magnitudes of the misses simply weren’t that substantial – and one measure actually improved:

Past performance is not indicative of future results

Coming on the back of a higher-than-expected monthly reading of the Core PCE Deflator (aka the Federal Reserve’s preferred inflation measure) of 0.4% vs. the prior 0.3% (which was also the consensus expectation), higher inflation expectations were not at all helpful to and already skittish market. My interpretation, and seemingly that of many traders, is that the Fed has and inflation concern on its hands even before the tariffs get implemented.

The early trading activity was a bit of a tug of war between the “buy the dip” crowd and those who were concerned about the higher PCE reading. Pre-market futures and the first half-hour of cash trading were only modestly lower, with some attempts to claw back to unchanged levels. Those efforts were abandoned after the UMich report, though, and stocks sank precipitously. The modest declines became a -1.5% rout in the S&P 500 (SPX) and -2% in the Nasdaq 100 (NDX) by midday.

Yet bond yields have been lower across the curve all morning, implying either that the PCE report was not all that meaningful to bond traders or that there is a “flight to safety” going on. My vote is of course for the latter. The 10-Year Treasury yield was about 3bp lower before the PCE data, about 6bp lower just before the UMich data, and about 9bp at midday. It is hard to reconcile the prospect of higher inflation with lower long-term yields unless there is either a flight to safety or concerns about future economic woes. Neither is a particularly welcome topic.

Regarding the sentiment numbers, I had been of the belief that the Fed was less concerned with “soft data”, like consumer surveys, than with “hard data” from official government sources. I happened to attend a discussion with Richard Clarida, a former Fed Vice Chair, and he assured the audience that it was not the case. He asserted that at least during his time at the Fed (2018-2022), they considered all data somewhat equally and did indeed pay close attention to survey data.

Dr. Clarida’s talk led me to the question that I am wrestling most with right now: if the two parts of the Fed’s dual mandate move in opposition (higher prices AND higher unemployment), which part does the Fed tackle first? During Paul Volcker’s time at the Fed, which coincided with a major bout of stagflation (much more inflation and unemployment than we face now), the focus was on fixing inflation as a prerequisite to reducing unemployment. Chair Powell seems to be respectful of Volcker’s handling of that inflationary shock, so my gut says that he would also advocate for focusing on higher prices, despite his comment about the “transitory” effects of tariffs on inflation.

Regarding that “transitory” comment, it is important to remember the distinction between price levels and inflation. CPI – the Consumer Price Index – is like the S&P 500. It measures the level of prices in the economy (unlike SPX, it rarely goes down). Inflation measures the change in CPI. Thus, even if inflation slows, it doesn’t mean that prices come down — disinflation refers to a slowing rate of price increases, not lower prices. So, while tariff-induced inflation might indeed be “transitory”, its effect on price levels will not be.

Let’s think of it this way: suppose the price of a stock rose 2% every year, from say, $96 to $98 to $100. It gets more costly each year. Then let’s say it jumps 10% to $110 one year, but then resumes its usual $2 path. The inflation in the stock price might have been transitory, but it never got cheaper to buy. That’s the same as the “transitory” effect from tariffs. Yes, the bump might be transitory, but its effect on price levels is not.

As I finish typing this, traders don’t seem to care particularly much about these types of subtleties. They worried about the prospect of auto tariffs on Wednesday, were only mildly perturbed yesterday after the details were released, and resumed their angst apace today. Maybe this is setting us up for a big bout of “sell the rumor, buy the news” next week, but this month’s -6% and -7.4% drops in SPX and NDX, respectively, tell us that sentiment is likely to remain challenged for some time.

And I’d also imagine that many of those angsty traders will be rooting for Auburn to beat Michigan in tonight’s NCAA matchup…

[i] I’m looking at you, Cousin Karen!

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Disclosure: Bonds

As with all investments, your capital is at risk.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account