Animal spirits are catching tailwinds to start the week as traders step up to the plate and swing hard at risk assets. The enthusiasm is motivated by anecdotal evidence suggesting that President Trump’s tariffs will be lighter than feared, characterized by targeted levies rather than widespread duties. Adding additional fuel to the fire was a much better-than-expected flash PMI report, depicting a sharp acceleration in consumer spending this month. The developments are helping investors view the glass as half full, since the potential for draconian trade policies and softening consumption trends were principal drivers of the first quarter correction in equities. Market participants are responding to the circumstances by aggressively scooping up stocks, cyclical commodities, and the greenback while trimming Treasurys, gold bars and equity volatility protection.

Services Offset Manufacturing Malaise

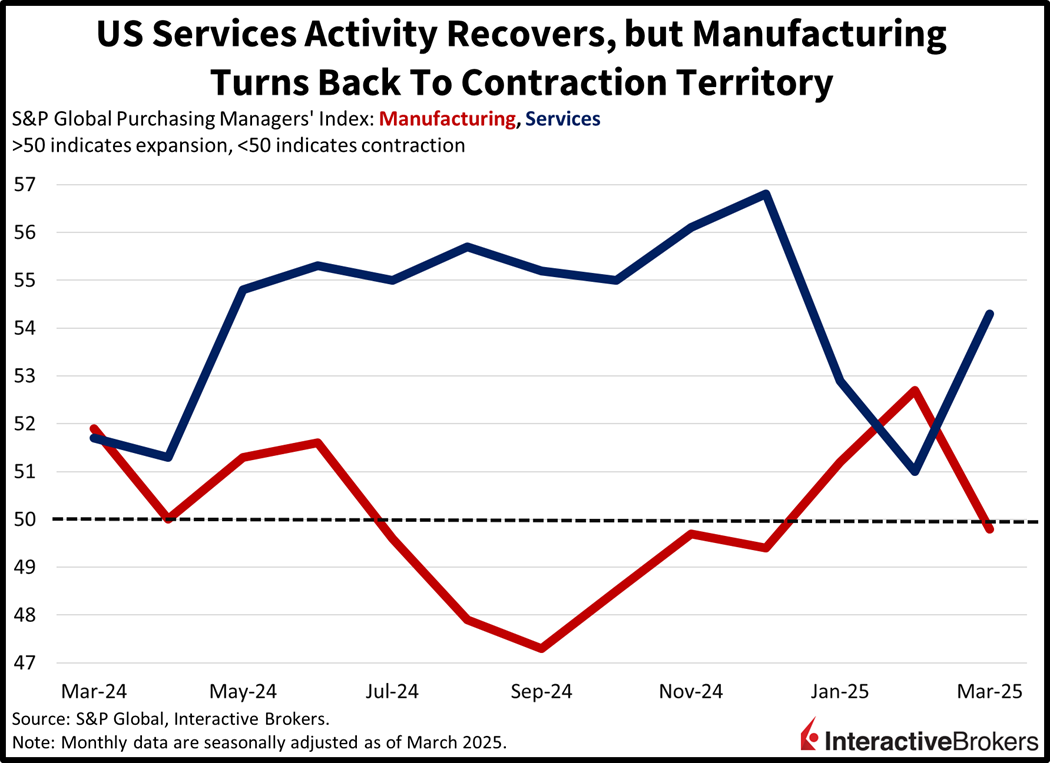

This morning’s flash Purchasing Managers’ Index (PMI) from S&P Global noted accelerating economic conditions to finalize the quarter. And while the manufacturing sector dove back into contraction territory, momentum in the much larger services component fully offset the weakness. The Services PMI leaped to 54.3 this month, much stronger than the 50.8 anticipated and the 51 from February. The segment reported strength in new orders, prices and employment amidst declining confidence. Servicers did have to acquiesce to customer constraints by accepting narrower margins, however, as establishments reported weaker demand conditions amidst rising costs for materials and labor. Sentiment, meanwhile, was mainly hurt by uncertainty regarding tariffs and government spending cuts.

Past performance is not indicative of future results

Frontrunning Momentum Softens

In manufacturing, momentum sank in March as much of the activity credited to January and February were derived from tariff frontrunning. Weak orders, faster delivery times and shorter rosters weighed on this month’s headline result of 49.8, which was softer than the 50.8 projected as well as the 51 from February. Furthermore, the sharpest increase in goods costs in 25 months, driven by higher commodity charges and wages, disincentivized purchasing trends. In contrast to the services sector though, sentiment in manufacturing remained buoyant as factories look forward to the potential for a boost in onshoring activities, stronger demand and lighter taxation.

Small Caps Lead the Rally

Investors are embracing risk-on positioning today with stocks surging amidst a neglect of risk-haven instruments such as Treasurys and gold bars. All major, domestic equity benchmarks are advancing with the Russell 2000, Nasdaq 100, S&P 500 and Dow Jones Industrial gauges up 2.3%, 1.9%, 1.6% and 1.3%. Sectoral breadth is strongly positive. Indeed, every segment is gaining, led higher by consumer discretionary, technology and industrials; they’re up 2.7%, 1.8% and 1.4%. Treasurys are getting sold, however, as firmer growth projections and taller inflation expectations send yields north. The 2- and 10-year maturities are changing hands at 4.03% and 4.33%, 7 and 8 basis points (bps) heavier on the session. In currency markets, pricier borrowing costs are helping the dollar and its index has climbed 20 bps, driven by the greenback appreciating against most of its major counterparts, including the euro, pound sterling, franc, yen and yuan. It is depreciating relative to the loonie and Aussie tender, however. Among commodities, cyclical crude oil, lumber and copper are performing well; they’re rising 1.2%, 0.9% and 0.3%, but a lack of safe-haven demand is weighing on gold, which is down 0.4% while silver is unchanged. WTI is trading at $69.15 per barrel as supply prospects decline marginally following President Trump announcing a 25% tariff on any country that purchases oil from Caracas.

A Full Week of Econ Data

Today’s developments indicating that trade policy may be softer than feared alongside stronger activity is music to the ears of equity bulls. But the news flow concerning tariffs and consumer spending has been quite volatile, as President Trump countlessly turns from unwavering to understanding on the tariff front. Meanwhile, most economic data publications have missed projections in recent weeks, so it makes sense that today’s upside beat was well received by investors. As we progress through this week, however, bullish traders hope that messaging on trade remains tempered while additional strong prints dial down recession odds and keep earnings expectations buoyant. Finally, the rest of the week’s stateside calendar offers consumer confidence and new home sales tomorrow, durable goods on Wednesday, unemployment claims on Thursday, personal income and outlays and pending home transactions on Friday as well as plenty of Fed speak and a few regional surveys from the central bank’s specific districts.

International Roundup

Singapore Inflation Eases

Singapore’s Consumer Price Index climbed only 0.9% year over year (y/y) last month but reversed a negative trend on a month over month (m/m) basis, according to the country’s Department of Statistics. The y/y result, the lowest in four years, met below the consensus expectation and eased from 1.2% in January, validating the Monetary Authority of Singapore’s decision two months ago to start easing its policy. On a m/m basis, the CPI climbed 0.8% after having declined by 0.7% in the preceding month. Singapore’s core CPI, which excludes accommodation and private transportation, climbed 0.60% y/y, descending from 0.80% in January and lower than the forecast for 0.7%.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account