The Santa Rally is gaining steam, thanks to weaker-than-expected economic data that is pointing to decelerating but still solid employment conditions. This morning’s one-two punch featured a modest miss on ADP’s job figures amidst an ISM-Services report that arrived well below projections. The results are weighing on interest rates while serving to increasingly cement another 25-bp cut at the Fed’s meeting in just two weeks–IBKR Forecast Traders assign a 73% probability of a December reduction. Investors are reacting to the economic reports favorably, as the readings support corporate earnings growth alongside a favorable monetary policy environment. Meanwhile in Paris, odds of a new prime minister taking over are surging just as left- and right-leaning members of the Parliament join forces to cast votes of no-confidence regarding the current administration. Similarly, in Seoul, President Yoon Suk Yeoul is facing backlash across party lines and is due for an impeachment consideration in light of his martial law announcement yesterday, which is being perceived as inappropriate by a vast majority of the nation’s National Assembly.

Source: ForecastEx

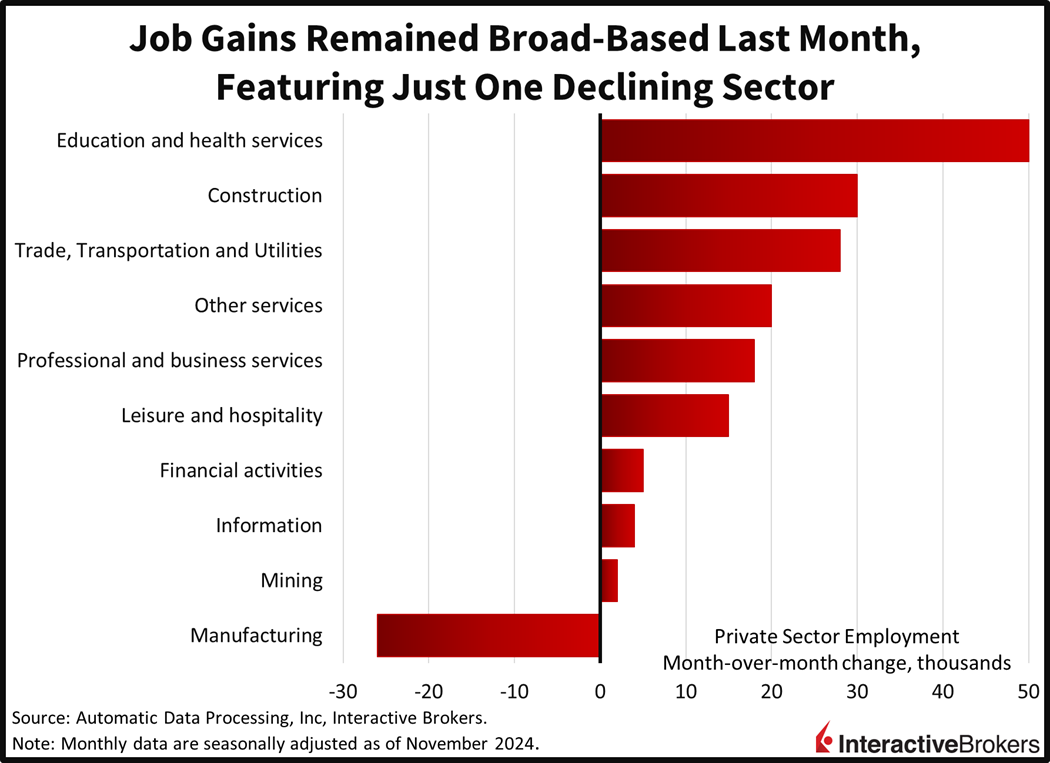

Hiring Moderates in Aftermath of Severe Weather

Serving as a contrast to yesterday’s stronger-than-expected Job Turnover and Labor Survey report, ADP reported this morning that private sector employers added 146,000 workers in November, missing expectations for 166,000 and declining from the preceding month’s downwardly revised 184,000. October’s pace, however, was negatively influenced by hurricanes Milton and Helene as well as the Boeing labor dispute. November’s hiring gains were somewhat mixed by sector, but similar to last month, manufacturing was the only category to contract, having lost 26,000 positions.

Among industries, the education and health services classification and the construction group led with 50,000 and 30,000 additions. Other gainers and the number of net new employees were as follows:

- Trade, transportation and utilities, 28,000

- Other services, 20,000

- Professional and business services, 18,000

- Leisure and hospitality, 15,000

- Financial activities, 5,000

- Information, 4,000

- Natural resources and mining, 2,000

While hiring moderated month-over-month (m/m), paycheck increases accelerated on a year-over-year (y/y) basis, moving from 6.7% and 4.7% for job changers and job stayers to 7.2% and 4.8%, respectively. It was the first time in over two years that the pace of pay raises accelerated for job stayers.

Small firms bucked the trend of expanding payroll, trimming 17,000 positions while medium-sized firms and large enterprises added 42,000 and 120,000 positions, respectively.

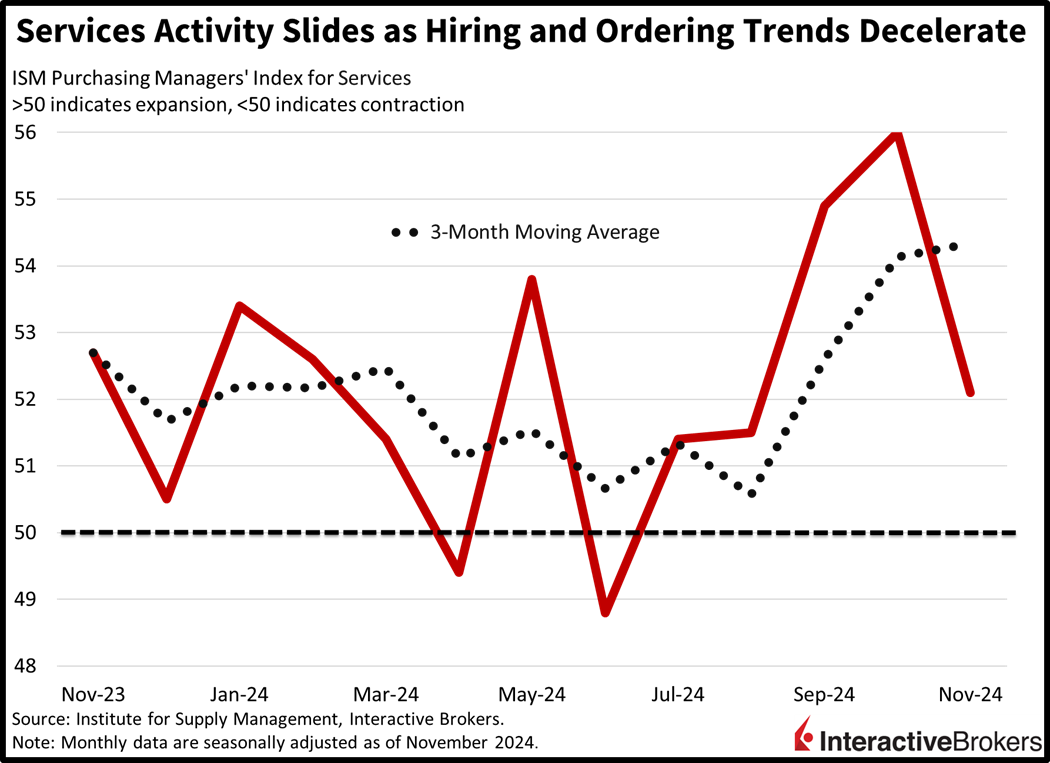

Services Sector Decelerates

While employers are continuing to hire in the non-goods producing industries, services sector activity, while still expansionary, has hit a three-month low, according to the Institute for Supply Management (ISM) services PMI Index. The benchmark last month fell to 52.1, a 3.9-point decline from October and below the analyst consensus expectation of 55.5. A result above 50 indicates expansion. The organization’s gauge of new orders fell to 53.7, a 3.7-point decline, which was also a three-month low. Employers also slowed the pace of hiring with the Employment Index descending 1.5 points to 51.5. Pricing was virtually unchanged, climbing 0.1 of a point to 58.2.

Survey respondents commented that lead times for acquiring items domestically are still long, causing them to seek providers in China for electrical equipment. Prices for items from the country are still lower despite tariffs. Other respondents said they are waiting to assess President-elect Donald Trump’s cabinet appointments and his proposed protectionist policies.

AI Shines as Retailers Struggle

Salesforce’s (CRM) third-quarter sales and profits exceeded expectations and the upper range of its fourth-quarter revenue guidance announced today is higher than Wall Street forecasts. CEO Marc Benioff said growth was driven by the company’s Agentforce, which is an artificial intelligence product that includes chatbots for assisting customers. Salesforce shares jumped more than 9% following the earnings announcement. In the retail sector, Foot Locker’s (FL) top- and bottom-line results missed expectations and the company lowered its full-year guidance, explaining that back-to-school shopping was disappointing, and it had to increase its promotions. Chewy (CHWY) reported a revenue beat, but earnings missed expectations. The company said it has increased its active customers m/m. On a positive note, Dollar Tree’s (DLTR) quarter exceeded expectations with the company explaining that lower freight costs and a decrease in shrink helped results. Additionally, the company experienced a 1.6% y/y increase in customer traffic and produced a 1.8% y/y same-store sales increase.

Santa Rally Thrives

Markets are soaring today with two of the four major stateside benchmarks nailing fresh all-time highs. Financial conditions are also loosening following this morning’s economic data misses, with the greenback and rates providing relief for risk assets. The Nasdaq 100 and S&P 500 indices are up 1% and 0.4% as the pair achieve new records, but the cyclically tilted Dow Jones Industrial and Russell 2000 are also higher by 0.4%, despite those two failing to reach new peaks, for now. But sector breadth is offering an alternative perspective, with just 5 out of 11 segments gaining on the session. Representing the leaders are technology, consumer discretionary and health care, which are higher by 1.5%, 0.6% and 0.2%. Energy, materials and real estate, on the other hand, are losing 1.9%, 0.9% and 0.7%. Treasurys are getting scooped up with the 2- and 10-year maturities changing hands at 4.15% and 4.21%, 4 and 2 basis points (bps) lighter on the session. The Dollar Index is down 11 bps as the greenback depreciates relative to the euro, franc, pound sterling and yuan but appreciates versus the yen and Aussie and Canadian currencies. Commodities are mixed, however, with silver and gold higher by 1.2% and 0.4%, copper and crude oil near their respective flatlines and lumber down 1%. WTI crude is trading at $69.80 per barrel as energy traders weigh a probable postponement to supply increases from OPEC+ at its virtual meeting tomorrow, an uptick in Middle Eastern tensions and a depletion in stateside energy supplies, according to this morning’s report from the US Energy Information Administration.

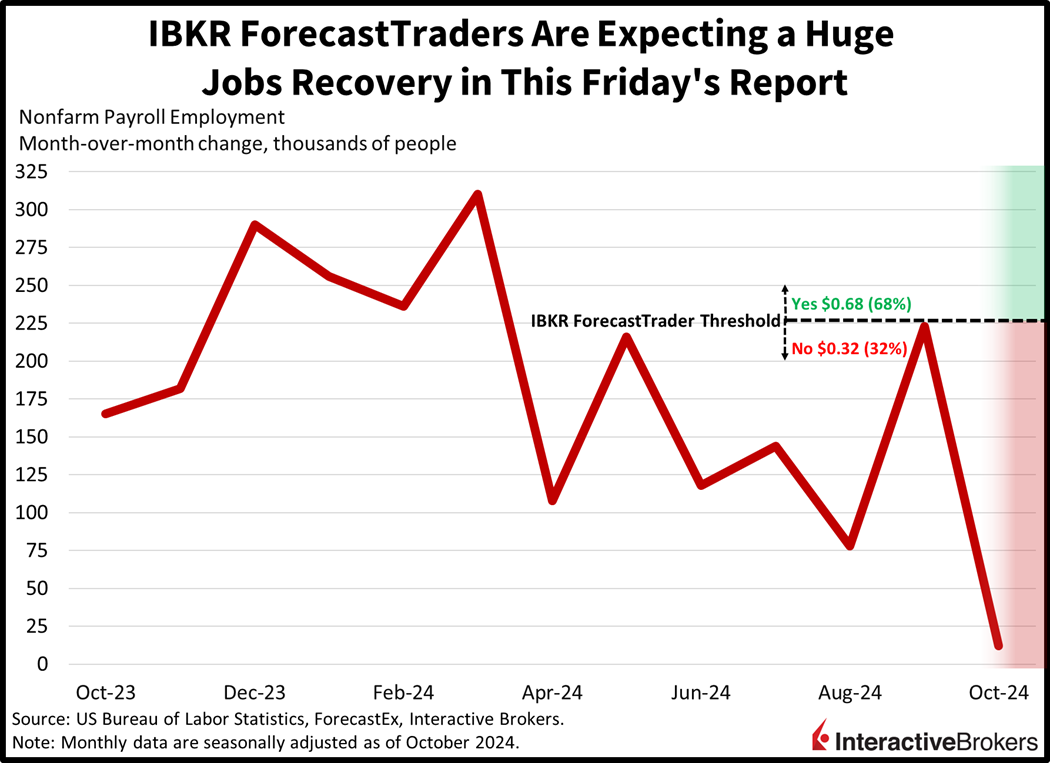

ForecastEx Pick: Nonfarm Payrolls

While tomorrow’s economic calendar is quiet as EU retail sales and unemployment claims take center stage, this Jobs Friday is a different story. Estimates for the headline figure are all over the place, but the current median on Wall Street stands at 214,000, which the consensus believes will be accompanied by a 4.2% unemployment rate and monthly wage pressures running at 0.3%. My projection is beneath current anticipations at 190,000, while my joblessness and compensation growth figures are in-line with forecasts. On the other hand, folks, IBKR ForecastTraders are pricing in a huge beat, with participants assigning a 68% probability of a figure above 225,400. Considering my prognosis of a lighter number while our marketplace projects a much stronger one, this week’s ForecastEx Pick lands on Jobs Friday. Nonetheless an important factor is that October’s nonfarm payrolls was derailed by two major hurricanes and the Boeing labor dispute, coming in at just 12,000, which means that a lot of those jobs can be added back to November, producing an upside surprise. But ladies and gentlemen, the IBKR No contract is just $0.32 and pays out a dollar on a number north of 225,400. The dynamic offers investors an attractive value play in my opinion, with a good chance of a triple for Team No this Friday.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account