Markets are mixed today as investors await big-tech earnings after the bell and enthusiastically scoop up popular Trump trades ahead of election day, which is only six sunsets away.

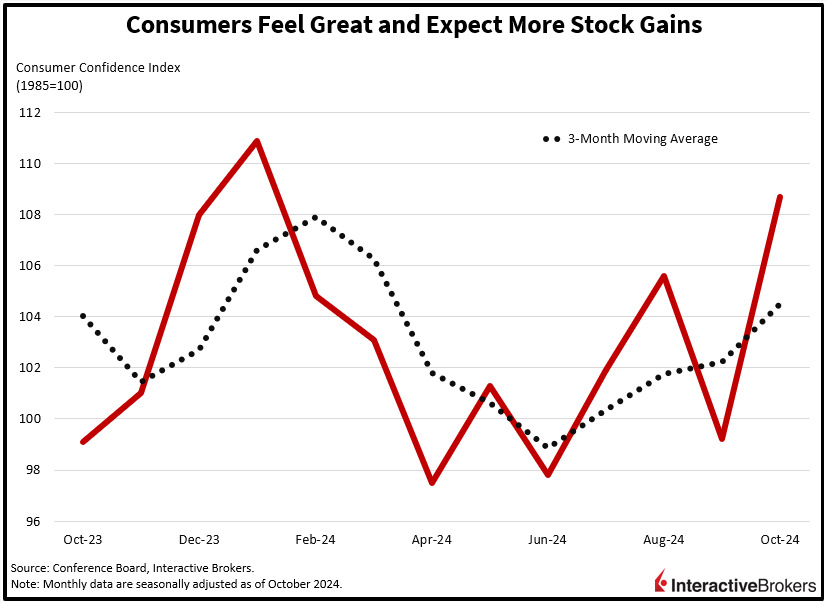

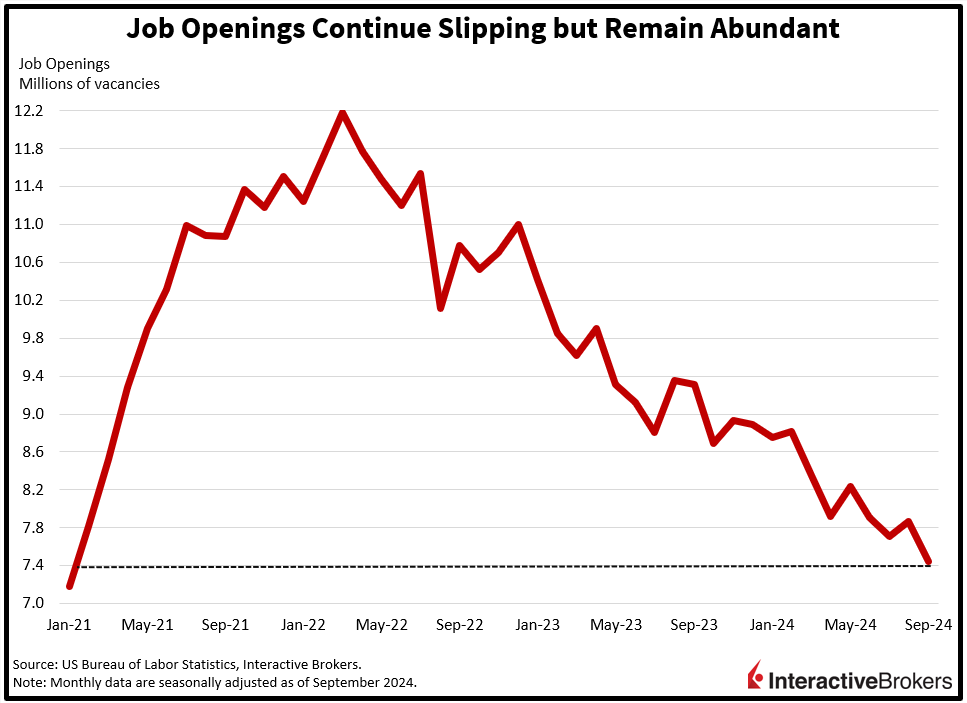

Traders are dialing up economic growth projections ahead of the announced winners, igniting a painful rise in long-term interest rates. Yields have certainly not been cooperating, but they did receive an intraday assist from this morning’s much cooler-than-expected JOLTS report. Fixed-income players focused on the hard data rather than the soft, as the Conference Board’s Consumer Confidence Index jumped to its tallest level since January. Tech stocks are a big reason for Americans’ optimism, with equity performance expectations rising significantly against this backdrop. All in all, this week features 5 of the magnificent 7’s earnings results, and investors are gearing up to examine whether AI capital expenditures are contributing to the top and bottom lines.

Stocks to Party On

Unseasonably warm weather this month isn’t the only thing to lift Americans’ spirits with the Conference Board’s Consumer Confidence Index jumping from 99.2 to 108.7 and exceeding the median analyst forecast of 99.5. While the October score is the highest level since January, it is considerably below results that ranged from 120 to nearly 140 during the three years leading to the Covid-19 pandemic. On a positive note, both the Present Situation and Expectations components moved upward, climbing from 123.8 and 82.8 to 138.0 and 89.1. Other results included the following:

- Among survey respondents, 51.4% expect the stock market to advance during the year ahead, the strongest result since the organization began tracking the topic in 1987.

- Expectations for the average inflation rate during the next 12 months climbed from 5.2% in September to 5.3%.

- Regarding employment, 17.8% of individuals expect more jobs to be available compared to 17.1% in September.

Past performance is not indicative of future results

Job Openings Miss Expectations

This morning’s Job Openings and Labor Turnover Survey (JOLTS) pointed to a labor market that is easing but still fairly healthy. While for-hire signs of 7.443 million for September missed expectations of 7.990 million and fell from the preceding month’s read of 7.861 million, the result is still strong. The number of quits, however, eased from 3.178 million to 3.071 million, implying that workers may be less confident in their ability to find new jobs.

Past performance is not indicative of future results

Inflation Hits Ford While Value Drives Growth at McDonald’s

Inflation, pricing pressures, the need to improve the quality of earnings and a slowdown in global spending were dominant themes in recent earnings reports. Ford Motor Co (F) posted third-quarter earnings and revenue that exceeded expectations, but it said results for the current year are likely to be toward the bottom of its previous guidance range. While the company has succeeded in trimming costs, inflation and warranty expenses are likely to prevent it from having a record year for earnings, says Ford CFO and Vice Chair John Lawler. McDonald’s (MCD) posted a 0.3% quarterly increase in US sales and attributed the growth to its introduction of low-cost value meals at a time when consumers are pushing back against price increases. International sales, however, weakened, with the Middle East conflict and the sluggish Chinese economy weighing upon results. McDonald’s also said it will no longer offer onions with its quarter pound hamburgers at certain locations because the item was determined to be the source of a recent outbreak of E. coli. In the digital finance world, both PayPal (PYPL) and SoFi (SOFI) posted earnings and revenue growth. PayPal said its quarterly earnings advanced 6% but provided guidance for the metric to head north by only the low-single-digits range. The company says the slow growth will result from it focusing on improving the quality of its profits. SoFi, a fintech firm that provides a variety of products, including student loans, home improvement financing, investments and financial planning, posted earnings and revenue that grew 35% and 30%, respectively, exceeding analyst expectations. The company said its personal loan charge-offs and delinquencies on personal loans both declined during the quarter. In the travel industry, JetBlue Airways (JBLU) said election uncertainty could result in the company experiencing a bigger-than-anticipated decline in sales and that Hurricane Milton is providing a considerable headwind. With increased industry capacity, JetBlue has trimmed its capital expenditures for the next four years by deferring the deliveries of Airbus jets. It expects revenue this year to decline by as much as 5%, while analysts anticipated guidance of a 3.6% contraction.

Interest Rates Spook Equity Investors

Equities are mostly lower on the session in response to towering interest rates, which have softened slightly following the 10:00 am economic reports. Tech stocks are much higher, however, ahead of important earnings, with the Nasdaq 100 leading the benchmarks by climbing 0.9%. Meanwhile, the S&P 500 is up 0.2%, but the Dow Jones Industrial and Russell 2000 baskets are down 0.2% and 0.4%. Sectoral breadth is deeply negative with 9 out of 11 segments suffering losses with the utilities, energy and real estate lower by 1.7%, 1.6% and 0.7%. Technology and communication services are bucking the trend though; they’re up 1.3% and 1%. Yields and the dollar were up sharply but are now near their respective flatlines. The 2- and 10-year Treasury maturities are changing hands at 4.14% and 4.29%. The greenback is nonetheless appreciating relative to most of its major counterparts, including the euro, franc, yen, yuan and Aussie and Canadian currencies, but it’s depreciating versus the pound sterling. Commodity performance is varied as crude oil and copper lose 1.3% and 0.7%. Conversely, silver, gold and lumber are up 2%, 1% and 0.7%.

Seasonal Strength Approaches

As we inch closer to turning the calendar page to November, equity investors are approaching some of the best periods of the year. But with stocks up 23% year to date, how much room is left for more upside? These ten months have been terrific, but they are still behind the pace of many recent years, with 2023, 2021, 2019 and 2013 delivering 24%, 27%, 29% and 30% for investors. Furthermore, a 30% year would land the S&P 500 at 6200, but for that case to manifest, we’d need a red sweep in Washington, favorable AI comments on earnings calls, tempered economic data and calmer interest rates.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account